Canadian Dollar strengthens against most major currencies in early US session as boosted by stronger than expected job data. That comes in the back ground of this week’s strong rally in oil price too. On the other hand, Dollar is under broad based pressure as global stock markets are back on risk on mode.

As for the week, the Loonie is set to end as the strongest one followed by Swiss Franc and Euro. Yen is still the worst performing, followed by Dollar, but their place could swap before close.

In Europe, currently, FTSE is up 0.97%. DAX is up 0.19%. CAC is up 0.81%. German 10-year yield is down -0.0128 at -0.533. Earlier in Asia, Nikkei dropped -0.12%. Hong Kong HSI dropped -0.31%. China Shanghai SSE rose 1.68%. Singapore Strait Times dropped -0.40%. Japan 10-year JGB yield dropped -0.0044 to 0.034.

Canada employment grew 378k, unemployment rate dropped to 9%

Canada employment grew 378k in September, well above expectation of 230k. The majority came from full-time jobs which grew 334k. Services producing jobs grew 2.1% while good-producing jobs rose 2.0%. Unemployment rate dropped for the fourth straight month to 9.0%, also better than expectation of 10.1%. 1.8m people Canadians were unemployed, down -214k from August.

UK GDP grew 2.1% mom in August, still -9.2% below pre-pandemic level

UK GDP grew only 2.1% mom in August, well below expectation of 5.7% mom. While that was the fourth consecutive month of increase, GDP remains -9.2% below pre-pandemic level in February. Looking at some details, services grew 2.4% mom (-9.6% below Feb. level), production grew 0.3% mom (-6.0% below Feb level), manufacturing grew 0.7% mom (-8.5% Feb level), construction rose 3.0% mom (-10.8% below Feb level).

Rolling three months growth in GDP from June to August was at 8.0% 3mo3m. Services rose 7.1% 3mo3m. Production rose 9.3% 3mo3m. Manufacturing rose 11.3% 3mo3m. Construction rose 18.5% 3mo3m.

Also from UK, trade deficit widened to GBP -9.0B in August, slightly better than expectation of GBP -9.1B.

From France, industrial output rose 1.3% mom in August, above expectation of 2.3% mom. Italy industrial output rose 7.7% mom in August, above expectation of 1.3% mom.

NIESR expects UK GDP growth to stall in Sep, slow to 1.3% in Q4

NIESR expects UK GDP growth to “stop” in September, bringing total Q3 growth to 15%. For Q4, with the background of a likely widening of lockdown restrictions, a winding down of government support schemes, and return of extensive Brexit related uncertainty, pace of recovery will be even slower, forecast to be at just 1.3%.

“Today’s ONS estimates suggest that GDP grew by 8 per cent in the three months to August. Although the latest estimates also signal a fourth consecutive monthly increase, with growth of 2.1 per cent in August itself, output is still about 9 per cent below the levels seen in February. These numbers would suggest that the UK could grow by about 15 per cent in the third quarter of 2020. However, there is further cause for concern ahead with the likely re-imposition of lockdown measures, the winding down of government support measures, and Brexit uncertainty. We expect the economy at the end of this year to be some 8.5 per cent below its level at the end of 2019.” Dr Kemar Whyte Senior Economist – Macroeconomic Modelling and Forecasting.

China Caixin PMI composite dropped to 54.5, economy remained in recovery phase

China Caixin PMI Services rose to 54.8 in September, up fro August’s 54.0, above expectation of 54.5. PMI Composite dropped to 54.5, down from 55.1.

Wang Zhe, Senior Economist at Caixin Insight Group said: “Overall, the economy remained in a post-epidemic recovery phase and improved at a faster pace. Supply and demand both expanded in the manufacturing and services sectors…. In the near term, there will still be uncertainties from Covid-19 overseas and the U.S. election, and the development of “dual circulation” in the domestic and international markets will continue to face challenges.”

From Japan, labor cash earnings dropped -1.3% yoy in August, better than expectation of -1.5% yoy. Household spending dropped -6.9% yoy, below expectation of -6.6% yoy.

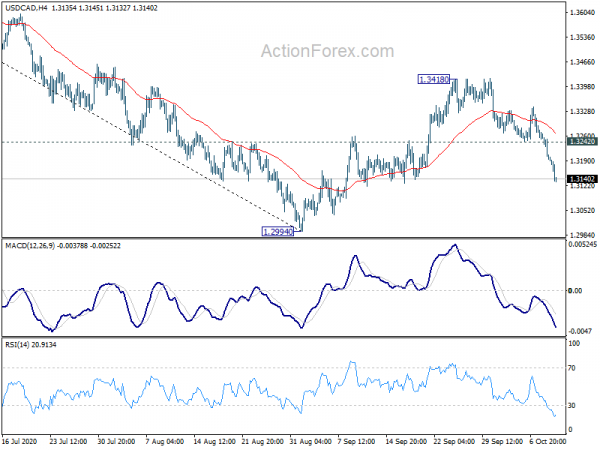

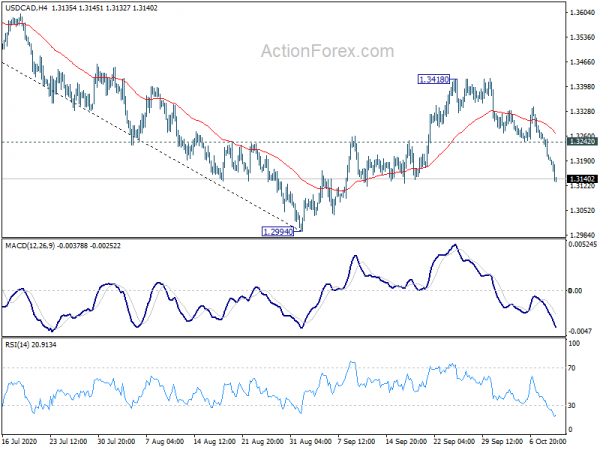

USD/CAD Mid-Day Outlook

Daily Pivots: (S1) 1.3172; (P) 1.3219; (R1) 1.3244; More….

USD/CAD’s decline continues today and reaches as low as 1.3132 so far. Intraday bias remains on the downside for 1.2994 low first. Firm break there will confirm resumption of whole down trend from 1.4667. On the upside, break of 1.3242 support turned resistance is needed to indicate completion of the fall. Otherwise, outlook will remain mildly bearish in case of recovery.

In the bigger picture, fall from 1.4667 is seen as the third leg of the corrective pattern from 1.4689 (2016 high). Sustained break of 61.8% retracement of 1.2061 to 1.4667 at 1.3056 will target a test on 1.2061 (2017 low). But we’d expect loss of downside momentum as it approaches this key support. On the upside, firm break of 1.3715 resistance will argue that this falling leg has completed and turn focus back to 1.4667/89 resistance zone.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Labor Cash Earnings Y/Y Aug | -1.30% | -1.50% | -1.50% | |

| 23:30 | JPY | Overall Household Spending Y/Y Aug | -6.90% | -6.60% | -7.60% | |

| 06:00 | GBP | GDP M/M Aug | 2.10% | 5.70% | 6.60% | 6.40% |

| 06:00 | GBP | Index of Services 3M/3M Aug | 7.10% | -4.00% | -8.10% | -7.10% |

| 06:00 | GBP | Manufacturing Production M/M Aug | 0.70% | 3.20% | 6.30% | 6.90% |

| 06:00 | GBP | Manufacturing Production Y/Y Aug | -8.40% | -10.50% | -9.40% | -10.10% |

| 06:00 | GBP | Industrial Production M/M Aug | 0.30% | 2.60% | 5.20% | |

| 06:00 | GBP | Industrial Production Y/Y Aug | -6.40% | -7.80% | -7.40% | |

| 06:00 | GBP | Goods Trade Balance (GBP) Aug | -9.0B | -9.1B | -8.6B | |

| 06:45 | EUR | France Industrial Output M/M Aug | 1.30% | 2.30% | 3.80% | |

| 08:00 | EUR | Italy Industrial Output M/M Aug | 7.70% | 1.30% | 7.40% | 7.00% |

| 12:30 | CAD | Net Change in Employment Sep | 378.2K | 230.2K | 245.8K | |

| 12:30 | CAD | Unemployment Rate Sep | 9.00% | 10.10% | 10.20% | |

| 14:00 | USD | Wholesale Inventories Aug F | 0.50% | 0.50% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals