Sterling had a roller coaster ride today, dropped notably on concerns over the deadlock in Brexit negotiations. Though, it then rebounded on talks that UK is still going to engage in talks after its self imposed mid-October deadline. Additional the country avoided a national coronavirus lockdown. The Pound is indeed the strongest one for today so far, followed by Aussie. Dollar, on the other hand, is the weakest one as it seems that the recovery attempt has already exhausted itself.

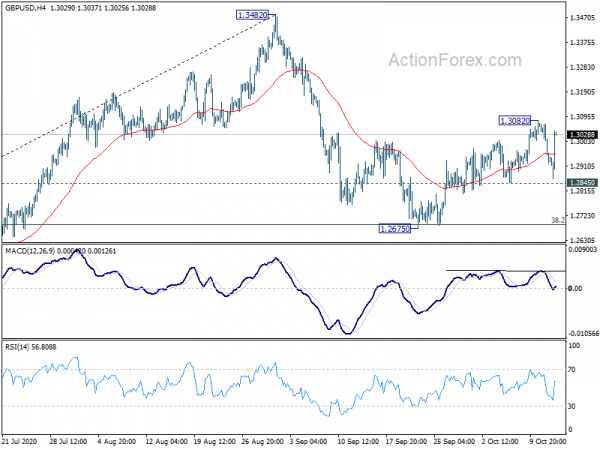

Technically, despite a brief breach of 135.87 minor support in GBP/JPY, GBP/USD holds well above 1.2845 support. EUR/GBP also held well below 0.9162 resistance. The Pound is still leading Dollar, Euro and Yen for the near term. Focus will indeed turns to 1.3082 temporary top in GBP/USD and 0.9019 temporary low in EUR/GBP to confirm resumption of Sterling’s rebound.

In Europe, currently, FTSE is down -0.49%. DAX is down -0.01%. CAC is down -0.14%. German 10-year yield is down -0.0215 at -0.576, moving towards -0.6 handle. Earlier in Asia, Nikkei rose 0.11%. Hong Kong HSI rose 0.07%. China Shanghai SSE dropped -0.56%. Singapore Strait Times dropped -0.47%. Japan 10-year JGB yield rose 0.0006 to 0.031.

US PPI picked up to 0.4% yoy in Sep, core PPI up to 1.2% yoy

US PPI for final demand rose 0.4% mom in September, above expectation of 0.2% mom. PPI core rose 0.4% mom, also above expectation of 0.2% mom. Annually. PPI turned positive to 0.4% yoy versus expectation of -0.3% yoy. PPI core surged to 1.2% yoy versus expectation of 0.3% yoy.

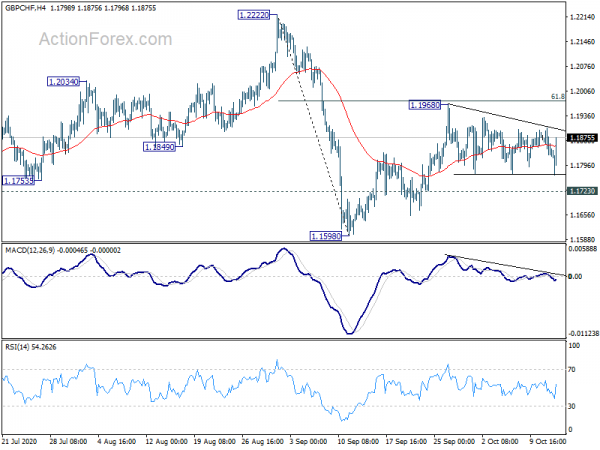

GBP/CHF rebounds as UK avoids national circuit breaker

Sterling rebounds, after initial dips, on talks that UK Prime Minister Boris would continue negotiations with EU even after the self-imposed October 15 deadline. An unnamed official was quoted saying UK still believe a deal is possible with intense negotiations in the coming days.

Separately, the UK government also resisted a “circuit breaker” national lockdown. Instead, Johnson told parliament, “the advice that I have today is that if we do the regional approach … we can bring down the R (reproduction rate) and we can bring down the virus… the whole point is to seize this moment now to avoid the misery of another national lockdown.”

Finance Minister Rishi Sunak said “We cannot allow the virus to take hold. We must prevent the strain on our NHS becoming unbearable. But we must also acknowledge the stark reality of the economic and social impacts of another national lockdown,” he told parliament…. The costs of doing so are not abstract, they are real. They can be counted in jobs lost, businesses closed and children’s education harmed,”

GBP/CHF rebounds notably after initial dips today and it’s staying in consolidation from 1.1968 temporary top. Rise from 1.1598 is still in favor to continue as long as 1.1723 minor support holds. Break of 1.1968 should pave the way to retest 1.2222 near term resistance.

Eurozone industrial production rose 0.7% mom in Aug, EU up 1.0% mom

Eurozone industrial production rose 0.7% mom in August, below expectation of 0.8% mom. Looking at some details, production of durable consumer goods rose by 6.8% mom, intermediate goods by 3.1% mom and energy by 2.3% mom, while production of both capital goods and non-durable consumer goods fell by -1.6% mom.

EU industrial production rose 1.0% mom. Among Member States for which data are available, the highest increases in industrial production were registered in Portugal (+10.0% mom), Italy (+7.7% mom), Hungary and Sweden (both +6.7% mom). The largest decreases were observed in Ireland (-13.4% mom), Estonia (-2.1% mom) and Luxembourg (-1.2% mom).

Australia consumer sentiment surged to 105.0, highest since Jul 2018

Australia Westpac Consumer Sentiment rose 11.9% to 105.0 in October, up from 93.8. The Index has now lifted by 32% over the last two months. It’s also stands at the highest level since July 2018, 10% above the six-month average prior to the coronavirus pandemic. Confidence was also lifted in all states, including even Victoria (up 13.7%) which is still in lockdown. Confidence in New South Wales surged 17.5%, Queensland up 7.1%, Western Australia up 2.4%, South Australia up 9.3%.

Westpac also noted that one of the “likely factors” for the surge in sentiment was an expectation of RBA rate cut from 0.25% to 0.10% in November. Communications from RBA over the last few weeks “points to this outcome” too. And, “there seems to be no reason for the Board to delay its decision”.

RBNZ Hawkesby: Negative rate is not a game of bluff

RBNZ Assistant Governor Christian Hawkesby said the central bank is still “very much in the mindset of ‘have we provided enough stimulus, and if we need to provide more what is the best way to do that?’” And that is what “motivated our work around active preparation of a package of further tools.”

He emphasized that negative interest rate is “not a game of bluff” to talk down the New Zealand Dollar exchange rate. Though, “the biggest challenge about having a negative policy rate is the communication challenge,” he said. “How to explain it to the general public, how to explain it as a policy, how to win the argument, how to retain hearts and minds that you’re doing the right thing for the right reasons.”

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2883; (P) 1.2977; (R1) 1.3031; More…

GBP/USD rebounds ahead of 1.2845 minor support but stays below 1.3082 temporary top so far. Intraday bias remains neutral first and further rise is in favor. On the upside, above 1.3082 will resume the rebound from 1.2675 for 1.3482 resistance. Nevertheless, break of 1.2845 will indicate that fall from 1.3482 is not over. Intraday bias will be turned back to the downside for 38.2% retracement of 1.1409 to 1.3482 at 1.2690.

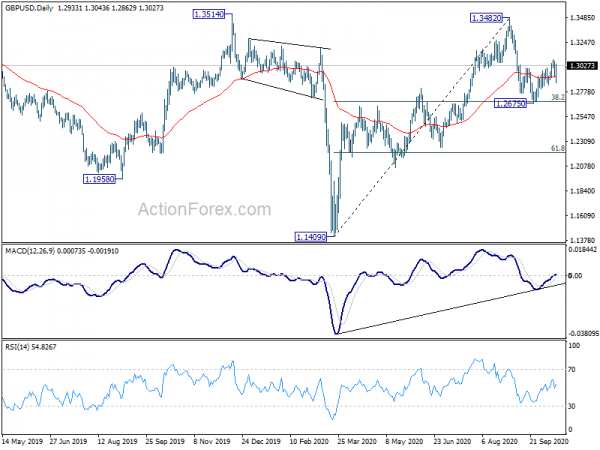

In the bigger picture, focus is back on 1.3415 key resistance now. Decisive break there should also come with sustained trading above 55 month EMA (now at 1.3312). That should confirm medium term bottoming at 1.1409. Outlook will be turned bullish for 1.4376 resistance and above. Nevertheless, rejection by 1.3514 will maintain medium term bearishness for another lower below 1.1409 at a later stage.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Consumer Confidence Oct | 11.90% | 18.00% | ||

| 04:30 | JPY | Industrial Production M/M Aug F | 1.00% | 1.70% | 1.70% | |

| 09:00 | EUR | Eurozone Industrial Production M/M Aug | 0.70% | 0.80% | 4.10% | 5.00% |

| 12:30 | USD | PPI M/M Sep | 0.40% | 0.20% | 0.30% | |

| 12:30 | USD | PPI Y/Y Sep | 0.40% | -0.30% | -0.20% | |

| 12:30 | USD | PPI Core M/M Sep | 0.40% | 0.20% | 0.40% | |

| 12:30 | USD | PPI Core Y/Y Sep | 1.20% | 0.30% | 0.60% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals