Markets continue to be dominated by strength of Euro and Swiss Franc today. That comes in spite of surging coronavirus infections in Europe. Meanwhile, the deadlock of Brexit negotiations remain. Traders are apparently adding to bet that more global central banks, like RBA and BoE, are joining the negative interest rate club soon. For now, Aussie and Kiwi are the weakest ones. Dollar and Sterling are mixed.

Technically, 1.1830 resistance in EUR/USD and 125.08 resistance in EUR/JPY will catch some attentions in the US session. Break will pave the way to 1.2011 and 127.07 high. 0.9162 resistance in EUR/GBP is also important and break will indicate completion of pull back from 0.9291, and bring retest of this high. Finally, while it’s still far from 1.5738 resistance, break there will confirm that EUR/CAD has completed the corrective pattern from 1.5978. We might indeed see EUR/CAD then surges through 1.4991 high to resume whole rally from 1.4263 later.

In Europe, currently, FTSE is up 0.13%. DAX is down -0.85%. CAC is down -0.12%. German 10-year yield is up 0.0145 at -0.609, still below -0.6 handle. Earlier in Asia, Nikkei dropped -0.44%. Hong Kong HSI rose 0.11%. China Shanghai SSE rose 0.47%. Singapore Strait Times dropped -0.59%. Japan 10-year JGB yield dropped -0.001 to 0.024.

US building permits rose to 1.55m, housing starts rose to 1.42m

US building permits rose 5.2% mom to 1.55m annualized rate in September, above expectation of 1.52m. Housing starts rose 1.9% mom to 1.42m, below expectation of 1.45m.

Released in European session, Eurozone current account surplus widened to EUR 19.9B in August, versus expectation of EUR 17.2B. Germany PPI came in at 0.4% mom, -1.0% yoy, versus expectation of -0.1% mom, -1.4% yoy. Swiss trade surplus narrowed to CHF 3.28B in September, below expectation of CHF 4.32B. New Zealand NZIER business confidence rose to -40 in Q3.

BoE Vlieghe: Risk to monetary policy skew towards additional stimulus

BoE External MPC member Gertjan Vlieghe said in speech, even though “policy rates and long-term interest rates are very low… investment is weak, vacancies are low”. Risks to economic outlook are “skewed towards a longer period of labour market slack with weak inflationary pressure”. Risks to monetary policy stance are therefore “skewed towards additional monetary stimulus.” Addition QE remain an “available policy tool”. But it’s “less potent now than in March, at the height of market disruption and uncertainty.”

Vlieghe said the MPC has also been discussing of the use of negative interest rates. “Growing empirical literature finds that the effect has generally been positive,” he added. “Negative rates have not been counterproductive to the aims of monetary policy. The question for the MPC is “whether there is any reason to think that the UK experience might be different”.

But his own view is “risk that negative rates end up being counterproductive to the aims of monetary policy is low.” Nevertheless, BoE is “not at a point yet when it can reach a conclusion on this issue.”

EU ready to negotiate, but UK said made a fundamental change first

European Commission spokesman Eric Mamer said today “we stay ready to negotiate” with the UK on post Brexit trade deal. He added, “in order to come to an agreement, both sides need to meet and this is also obviously the case in this negotiation.”

On the other hand, UK Prime Minister Boris Johnson’s spokesman said, “what the UK’s chief negotiator needs to see is a clear assurance from the EU that it has made a fundamental change in approach to the talks and that this is going to be a genuine negotiation rather than one side being expected to make all of the moves.”

Separately, UK Trade Minister Liz Truss said, “We’re intensifying negotiations so we are in a good position to move forward after the (U.S.) election… We want a deal that delivers for all parts of (Britain) and is forward-leaning in modern areas like tech & services.”

RBA minutes confirm imminent easing

Minutes of RBA’s October meeting indicated that the board was already ready to push forward new easing measures. The announcement was delayed to November, partly for allowing the market to digest the Government’s budget, and partly for Governor Philip Lowe to outline the changes first.

In short, the minutes noted that members continued to “consider how additional monetary easing could support jobs as the economy opens up further”. They “discussed the options of reducing the targets for the cash rate and the 3-year yield towards zero, without going negative, and buying government bonds further along the yield curve”. They believed that “these options would have the effect of further easing financial conditions in Australia”.

Suggested readings on RBA:

RBA Kent: Interest rates could all go a little lower

RBA Assistant Governor Christopher Kent’s comment in a webinar reinforced the case for further monetary easing at November 3 meeting. He noted that monetary easing could gain a bit more traction now as the economy was reopening, echoing previous comments by Governor Philip Low. Interest rates “could all go a little lower than they currently are”, referring to both the cash rate as well as the three-year yield target. While he declined to comment on whether RBA would extend the purchases of securities of longer maturity, he acknowledged that such a move could lower funding costs for both the governments and businesses.

Regarding fiscal position, Kent said that “debt of course will rise with deficits but that’s part of the very crucial fiscal support that we are seeing.” “The key is not to focus on the potential change in the ratings that come from rising debt. Instead focus on the fact that the rising debt is very manageable,” he added.

USD/CHF Mid-Day Outlook

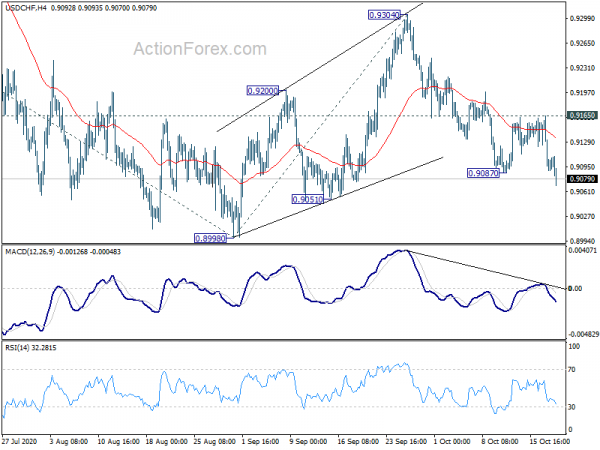

Daily Pivots: (S1) 0.9071; (P) 0.9119; (R1) 0.9147; More…

USD/CHF drops through 0.9087 temporary today and intraday bias is back on the downside for 0.8998 support. Break there will resume larger down trend. Next target is 61.8% projection of 0.9901 to 0.8998 from 0.9304 at 0.8746. On the upside, break of 0.9165 resistance will dampen this bearish view and turn intraday bias neutral first.

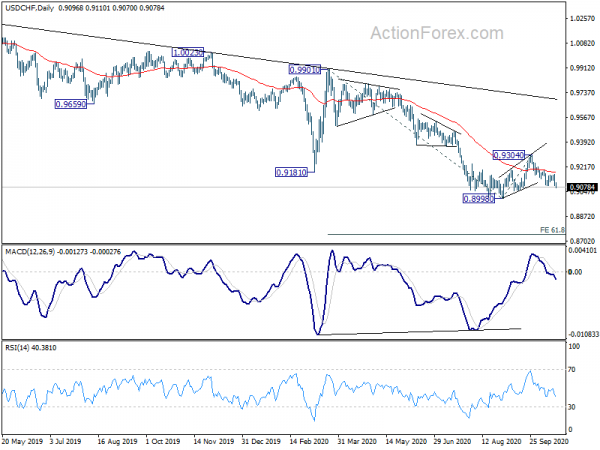

In the bigger picture, decline from 1.0237 is seen as the third leg of the pattern from 1.0342 (2016 high). There is no clear sign of completion yet. On resumption, next target will be 138.2% projection of 1.0342 to 0.9186 from 1.0237 at 0.8639. Nevertheless, strong break of 0.9304 resistance will be an early sign of trend reversal and turn focus back to 0.9901 key resistance for confirmation.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:00 | NZD | NZIER Business Confidence Q3 | -40 | -63 | ||

| 00:30 | AUD | RBA Minutes | ||||

| 06:00 | CHF | Trade Balance (CHF) Sep | 3.28B | 4.32B | 3.58B | 3.54B |

| 06:00 | EUR | Germany PPI M/M Sep | 0.40% | -0.10% | 0.00% | |

| 06:00 | EUR | Germany PPI Y/Y Sep | -1.00% | -1.40% | -1.20% | |

| 08:00 | EUR | Eurozone Current Account (EUR) Aug | 19.9B | 17.2B | 16.6B | 17.0B |

| 12:30 | USD | Building Permits Sep | 1.55M | 1.52M | 1.48M | |

| 12:30 | USD | Housing Starts Sep | 1.42M | 1.45M | 1.39M |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals