SINGAPORE — A Biden administration will likely maintain a tough stance on China, but the U.S. rhetoric could soften — and that may help soothe market jitters, chief executive of a major Asian bank said on Thursday.

The race to the White House remains too close to call but Democratic candidate Joe Biden appears closer to the 270-mark needed to win. According to NBC projections, Biden has 253 electoral votes while President Donald Trump has 214 electoral votes in the bag.

If Biden wins, a major question for investors would be whether his China agenda will differ substantively from Trump’s, said Piyush Gupta, chief executive of DBS Group Holdings, Southeast Asia’s largest bank by assets.

“My view on that is in substance, it is unlikely to change very much. I think the issues relative to China have bipartisan support in the U.S., so you’ll likely continue to see a swath of policies which focus on the same things: Trying to get China to open up its markets and a more level playing field,” he told CNBC’s “Capital Connection.”

“However, I think what will change is the rhetoric,” said Gupta, adding that Trump’s tweets and actions “keep people on edge” which lead to markets getting antsy.

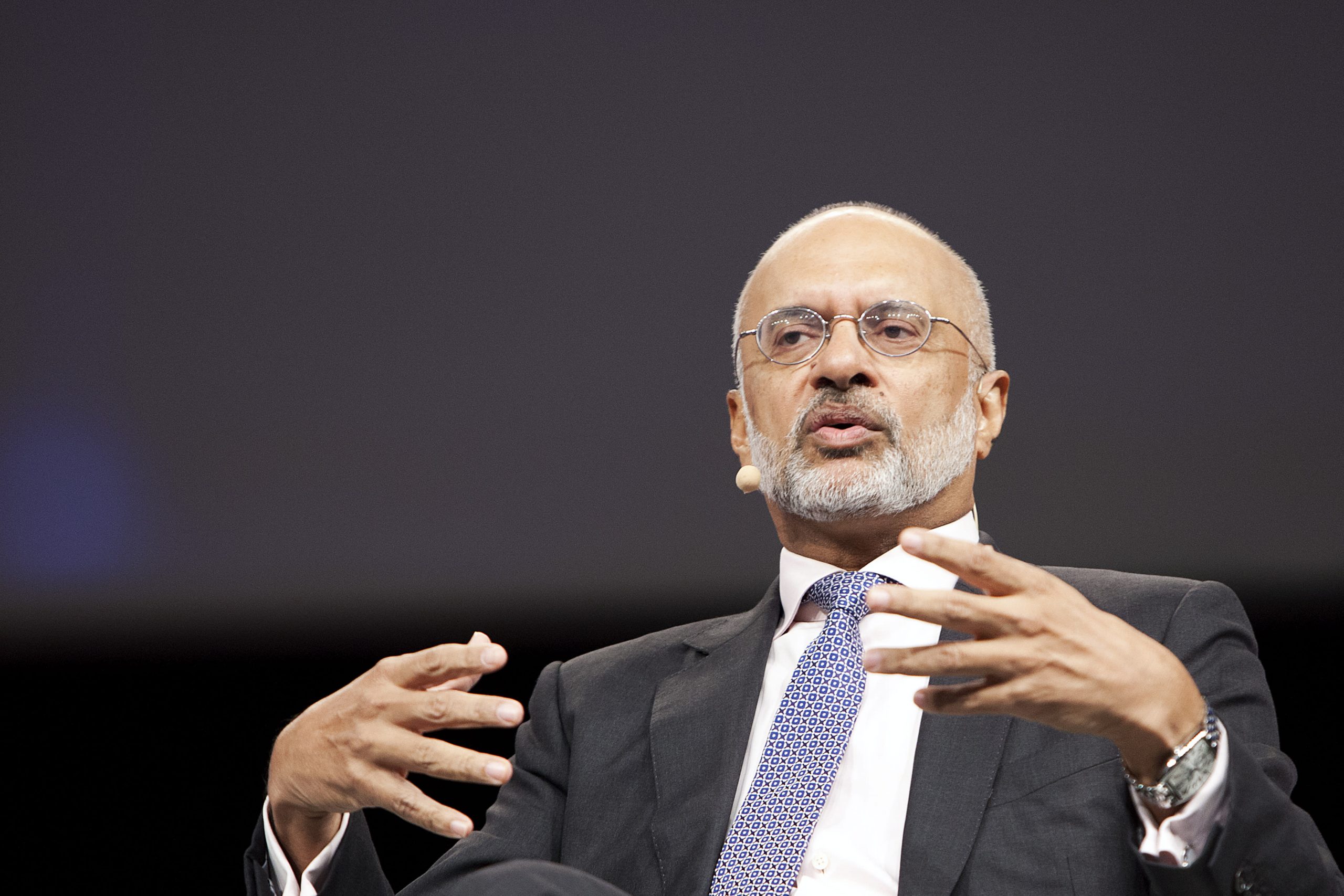

Piyush Gupta, CEO of DBS Group Holdings, speaks at the Singapore Fintech Conference on Nov. 16, 2016.

Ore Huiying | Bloomberg | Getty Images

But a Biden administration would bring back some normalcy in how messages are communicated and actions are taken, said the CEO. At the same time, Biden is also more likely to work with trading partners, such as those in Europe, he added.

“So, net-net, while it’s not clear to me you’d see a reduction in tariffs or a major shift in the China stance, I think the softening of the rhetoric and the way of engagement will soothe the markets’ nerves,” he said.

Singapore bank earnings

Even as the U.S. is struggling to contain the spread of Covid-19, several East Asian economies have managed to keep their outbreaks under control — and that’s allowed some economic activity to resume, said Gupta.

That helped DBS to beat expectations on its third-quarter earnings. The bank’s net profit for the quarter fell 20% year-on-year to 1.3 billion Singapore dollars ($957.3 million) — better than an average of 1.17 billion Singapore dollars ($861.5 million) estimated by Refinitiv.

Here are other highlights from the bank’s financial report:

- An additional 554 million Singapore dollars ($407.9 million) were set aside for potential losses, bringing DBS’ total allowances for the first nice months of 2020 to 2.49 billion Singapore dollars ($1.83 billion).

- Fee income of 798 million Singapore dollars ($585.6 million) marked a rebound to pre-Covid levels, helped by a jump in wealth management activity and credit card fees.

- Net interest margin, a measure of lending profitability, narrowed to 1.53% from the second quarter’s 1.62%.

The other two Singapore banks, Oversea-Chinese Banking Corp and United Overseas Bank, also released their third-quarter earnings this week. OCBC reported a 12% year-on-year fall in net profit to 1.03 billion Singapore dollars ($758.4 million), while that of UOB dived 40% to 668 million Singapore dollars ($491.9 million) during the same period — both beating expectations.

Shares of the three banks jumped on Thursday afternoon: DBS and OCBC rose by more than 3%, while UOB inched up around 2.9%. All three outperformed the benchmark Straits Times Index, which climbed 2.7%.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals