Commodity currencies turn softer today, following pull back in stocks. On the other hand, Yen, Swiss Franc and Dollar are gaining some grounds. Euro and Sterling are mixed on the sideline. Over the week, Kiwi remains the strongest one, followed by Dollar and then Sterling. Swiss Franc and Yen are the weakest. Fed Chair Jerome Powell reminded investors that while the vaccine news are welcome, the path ahead is still uncertain. While the extra boost on sentiment from coronavirus vaccine faded quickly, overall sentiments remain positive for now.

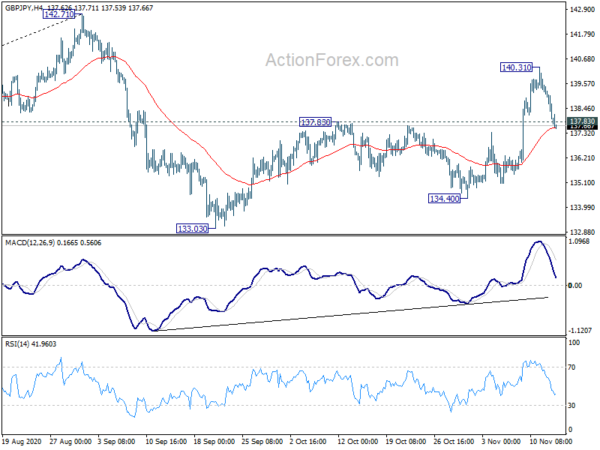

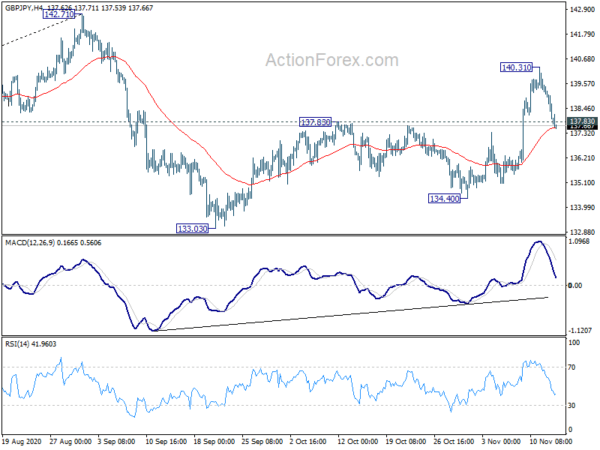

Technically, GBP/JPY’s break of 137.83 support argues that rebound from 133.03 might have completed with three waves up to 140.31. The question is whether that corresponds to bullish reversal in Yen or bearish reversal in Sterling, or both. The levels to watch include 1.3118 support in GBP/USD, 0.9068 resistance in EUR/GBP, 123.18 support in EUR/JPY and 104.73 minor support in USD/JPY. We might find out before weekly close.

In Asia, currently, Nikkei is down -0.99%. Hong Kong HSI is down -0.55%. China Shanghai SSE is down -0.75%. Singapore Strait Times is down -0.49%. 10-year JGB yield is down -0.0095 at 0.022. Overnight, DOW dropped -1.08%. S&P 500 dropped -1.00%. NASDAQ dropped -0.65%. 10-year yield dropped notably by -0.073 to close at 0.885.

RBNZ Orr: Be careful, be prepared and don’t run around on predictions

RBNZ Governor Adrian Orr said the improved growth and inflation projections in the latest Monetary Policy Statement released this week “is a very bod assumption”. The central bank has been “at pains to explain to people that we are creating scenarios, not projections of certainty,” he said.

“If the economy continued to grow and do what it’s doing, well that’s a beautiful world, but that’s a big if,” Orr added. “So today’s news around Covid just puts it back into perspective. Be careful out there, be prepared, don’t run around on predictions.”

Orr has the new FLP is “such an invasive way into the banking sector to provide very low cost of funding”. He’ll be on watch to make sure that’s passed on to borrowers and investors.” As for the further easing, Orr said purchases of foreign assets is “not a preferred option” that would not have a significant impact “really in the long term”.

“We are very comfortable where we are with the funding for lending and the quantitative easing program we’re doing at present.”

New Zealand BusinessNZ PMI dropped to 51.7, not getting too carried away with recovery

New Zealand BusinessNZ Performance of Manufacturing Index dropped from 54.0 to 51.7 in October. Production dropped from 56.7 to 51.1. New orders dropped from 58.1 to 52.4. But employment rose from 51.7 to 52.6.

BusinessNZ’s executive director for manufacturing Catherine Beard said that the sector remains in a state of flux, although still managing to keep in positive territory.

BNZ Senior Economist, Craig Ebert said that “October’s PMI serves as a gentle reminder of not getting too carried away with the sense of recovery, even if the worst of COVID’s impacts can be assumed to be behind us”.

Fed Powell: Too soon to assess implications of vaccines to path of economy

Fed Chair Jerome Powell said yesterday that recent development in coronavirus vaccine is “certainly good and welcome news for the medium term.” However, “significant challenges and uncertainty remain about timing, production, distribution and the efficacy for different groups” of a vaccine.

“From our standpoint it is too soon to assess with any confidence the implications of the news for the path of the economy especially for the near term,” he added. “The next few months could be challenging.”

“We’ve got new cases at a record level. We’ve seen a number of states begin to reimpose limited activity restrictions, and people may lose confidence that it’s safe to go out,” Powell acknowledged. “We’ve said from the beginning that the economy will not fully recover until people are confident that it’s safe to resume activities involving crowds and people.”

ECB Lagarde: We’re not racing to be first on digital currency

ECB President Christine Lagarde said her “hunch” was that digital currency” will come”. Nevertheless, “We’re not racing to be first… We are moving ahead diligently, not incautiously. We will be prudent.”

“If it’s cheaper, faster, more secure for the users then we should explore it. If it’s going to contribute to a better monetary sovereignty, a better autonomy for the euro area, I think we should explore it,” she added.

ECB launched a public consultation on digital currencies last month. Policy makers would decide around mid-2021 on whether to initiate a full-fledged project. Lagarde added that it might take two to four years before digital currency could be launched.

Looking ahead

Eurozone GDP is a major focus in European session while trade balance will be released too. Swiss will release PPI. Later in the day, US will release PPI and U of Michigan consumer sentiment.

GBP/JPY Daily Outlook

Daily Pivots: (S1) 137.30; (P) 138.37; (R1) 138.99; More…

The break of 137.83 resistance turned support suggests that GBP/JPY’s rebound from 133.03 might have completed with three waves up to 140.31. Intraday bias i now back on the downside for 134.40 support first. Break there will likely resume the pattern from 142.71 through 133.03 support. On the upside, though, break of 140.31 resistance will resume the rebound to retest 142.71 high instead.

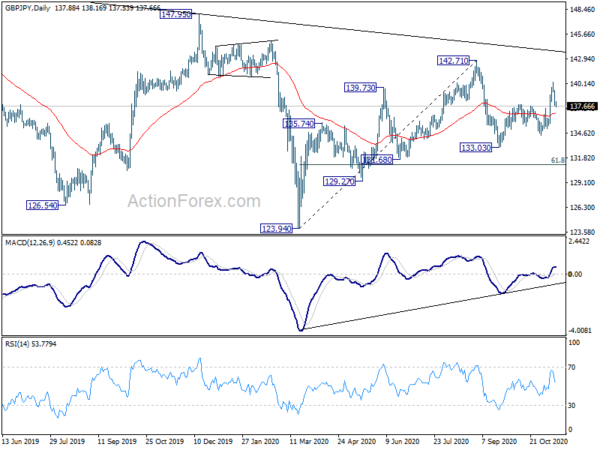

In the bigger picture, rise from 123.94 is seen only as a rising leg of the sideway consolidation pattern from 122.75 (2016 low). As long as 147.95 resistance holds, an eventual downside breakout remains in favor. However, firm break of 147.95 will raise the chance of long term bullish reversal. Focus will then be turned to 156.59 resistance for confirmation.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | NZD | BusinessNZ Manufacturing Index Oct | 51.7 | 54 | ||

| 07:30 | CHF | Producer and Import Prices M/M Oct | 0.10% | 0.10% | ||

| 07:30 | CHF | Producer and Import Prices Y/Y Oct | -3.10% | |||

| 10:00 | EUR | Eurozone Trade Balance (EUR) Sep | 22.3B | 21.9B | ||

| 10:00 | EUR | Eurozone GDP Q/Q Q3 P | 12.70% | 12.70% | ||

| 10:00 | EUR | Eurozone Employment Change Q/Q Q3 P | 0.70% | -2.90% | ||

| 13:30 | USD | PPI M/M Oct | 0.20% | 0.40% | ||

| 13:30 | USD | PPI Y/Y Oct | 0.30% | 0.40% | ||

| 13:30 | USD | PPI Core M/M Oct | 0.30% | 0.40% | ||

| 13:30 | USD | PPI Core Y/Y Oct | 0.90% | 1.20% | ||

| 15:00 | USD | Michigan Consumer Sentiment Index Nov P | 82 | 81.8 | ||

| 15:30 | USD | Natural Gas Storage | -3B | -36B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals