Overall, the markets are relative quite today, in month end trading. Stocks are struggling in tight range, indifferent to news of Modern’s plan to see US and EU clearance for their vaccine. In the currency markets, Sterling is currently the strongest one, awaiting news on Brexit trade talks. Canadian is the next strongest, then Kiwi. Australian Dollar, on the other hand, is the worst performing, followed by Yen and then Dollar. Gold broke 1800 handle earlier today to resume down trend and stays weak too.

Technically, Euro could be interesting to watch today. EUR/USD is still heading towards 1.2011high while EUR/JPY is heading to 123.13 resistance. Meanwhile, EUR/GBP struggles to rise through 0.9004 resistance to confirm short term bottoming yet. We could find out soon, whether Euro would power through these levels, or be rejected by them.

In Europe, currently, FTSE is down -0.08%> DAX is up 0.71%. CAC is down -0.13%. German 10-year yield is up 0.014 at -0.571. Earlier in Asia, Nikkei dropped -0.79%. Hong Kong HSI dropped -2.06%. China Shanghai SSE dropped -0.49%. Singapore Strait Times dropped -1.75%. Japan 10-year JGB yield rose 0.0005 to 0.030.

Mixed data from Canada

A batch of mixed economic data is released from from Canada today, IPPI dropped -0.4% mom in October versus expectation of 0.0% mom. RMPI rose 0.5% mom versus expectation of -2.0% mom. Building permits dropped -14.6% mom versus expectation of-3.8% mom. Current account deficit narrowed slightly to CAD -7.5B in Q3, smaller than expectation of CAD -8.6B.

Swiss KOF dropped to 103.5, retail sales rose 3.1% yoy

Swiss KOF Economic Barometer dropped to 103.5 in November, down from 106.6, above expectation of 101.0. The barometer is thus moving towards its long-term average, which means that the outlook for the Swiss economy remains subdued also in view of the current pandemic situation. Also from Swiss, retail sales rose 3.1% yoy in October.

From UK, mortgage approvals rose to 98k in October, above expectatoin of 85k. M4 money supply rose 0.6% mom in October, below expectation of 1.0% mom. Germany CPI dropped -0.8% mom, -0.3% yoy in November, below expectation of -0.7% mom, -0.2% yoy.

Japan industrial production rose 3.8% mom in Oct, 5th straight month of growth

Japan industrial production rose 3.8% mom in October, well above expectation of 2.3% mom, and not much slower than September’s 3.9% mom. It’s also the fifth straight month of increase. The Ministry of Economy, Trade and Industry also said manufacturers expected growth to continue with another 2.7% mom in November, but a decline of -2.4% mom in December.

Retail sales rose 6.4% yoy in October, matched expectations. That’s the first annual rise in eight months., following a -8.7% yoy decline in September. Housing starts dropped -8.3% yoy, slightly better than expectation of -8.6% yoy.

China PMI manufacturing rose to 52.1 in Nov, highest in three years

The official China PMI Manufacturing rose to 52.1 in November, up from 51.4, above expectation of 51.5. That’s the highest reading in more than three years. It’s also the ninth straight month of growth reading. PMI Services rose to 56.4, up from 56.2, above expectation of 56.0.

According the Zhao Qinghe, the bureau’s senior statistician. Four factors grove manufacturing activity. Both supply and demand of Chinese manufactured goods continued to improve. Imports and exports steadily recovered. Prices of both raw materials and output rose. Prospect of manufacturers of all sizes also improved.

New Zealand ANZ business confidence jumped to -6.9 in Nov, surge in manufacturing

New Zealand ANZ Business Confidence jumped to -6.9 in November, well above preliminary reading of -15.6 and October’s final of -15.7. Manufacturing confidence surged 14.5 pts and turned positive to 6.7. Retail confidence and services confidence also rose 17.9 pts and 10.2 pts to -3.8 and -6.6 respectively. Agriculture and construction dropped by -2.4 and -15.8 to -52.4 and -3.3.

Activity Outlook rose to 9.1, versus preliminary reading of 4.6 and October’s 4.7. Manufacturing outlook rose 13.4 to 15.0. Construction rose 14.5 to 23.3. Services rose 3.2 to 9.2. But retail dropped -2.2 to 0 while agriculture dropped -5.1 to -9.1.

From Australia, TD securities inflation rose 0.3% mom in November. Private sector credit rose 0.0% mom in October. Company gross operating profits rose 3.2% qoq in Q3.

USD/CAD Mid-Day Outlook

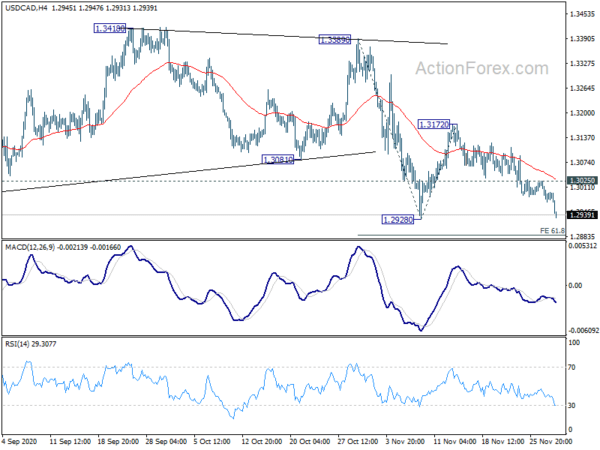

Daily Pivots: (S1) 1.2968; (P) 1.2997; (R1) 1.3021; More….

USD/CAD’s fall continues today and intraday bias stays on the downside for 1.2928 support. Decisive break there will confirm resumption of whole down trend from 1.4667. Next near term target will be 61.8% projection of 1.3389 to 1.2928 from 1.3172 at 1.2887, and then 100% projection at 1.2711. On the upside, above 1.3025 minor resistance will delay the bearish case, and extend the consolidation from 1.2928 with another rising leg first.

In the bigger picture, fall from 1.4667 is seen as the third leg of the corrective pattern from 1.4689 (2016 high). Rejection by 55 week EMA is keeping outlook bearish. Sustained break of 61.8% retracement of 1.2061 to 1.4667 at 1.3056 will target a test on 1.2061 (2017 low). But we’d expect loss of downside momentum as it approaches this key support. On the upside, firm break of 1.3389 resistance is needed to indicate medium term bottoming. Otherwise, outlook will remain bearish in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Industrial Production M/M Oct P | 3.80% | 2.30% | 3.90% | |

| 23:50 | JPY | Retail Trade Y/Y Oct | 6.40% | 6.40% | -8.70% | |

| 00:00 | NZD | ANZ Business Confidence Nov | -6.9 | -15.6 | ||

| 00:00 | AUD | TD Securities Inflation M/M Nov | 0.30% | -0.10% | ||

| 00:30 | AUD | Private Sector Credit M/M Oct | 0.00% | 0.10% | 0.00% | |

| 00:30 | AUD | Company Gross Operating Profits Q/Q Q3 | 3.20% | 4.50% | 15.00% | 15.80% |

| 01:00 | CNY | NBS Manufacturing PMI Nov | 52.1 | 51.5 | 51.4 | |

| 01:00 | CNY | Non-Manufacturing PMI Nov | 56.4 | 56 | 56.2 | |

| 05:00 | JPY | Housing Starts Y/Y Oct | -8.30% | -8.60% | -9.90% | |

| 07:30 | CHF | Real Retail Sales Y/Y Oct | 3.10% | 0.30% | 0.40% | |

| 08:00 | CHF | KOF Leading Indicator Nov | 103.5 | 101 | 106.6 | |

| 09:30 | GBP | Mortgage Approvals Oct | 98K | 85K | 91K | 92K |

| 09:30 | GBP | M4 Money Supply M/M Oct | 0.60% | 1.00% | 0.90% | 0.80% |

| 13:00 | EUR | Germany CPI M/M Nov P | -0.80% | -0.70% | 0.10% | |

| 13:00 | EUR | Germany CPI Y/Y Nov P | -0.30% | -0.20% | -0.20% | |

| 13:30 | CAD | Industrial Product Price M/M Oct | -0.40% | 0.00% | -0.10% | |

| 13:30 | CAD | Raw Material Price Index Oct | 0.50% | -2.00% | -2.20% | |

| 13:30 | CAD | Current Account (CAD) Q3 | -7.5B | -8.9B | -8.6B | |

| 13:30 | CAD | Building Permits M/M Oct | -14.60% | -3.80% | 17.00% | |

| 14:45 | USD | Chicago PMI Nov | 59.2 | 61.1 | ||

| 15:00 | USD | Pending Home Sales M/M Oct | 1.00% | -2.20% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals