The forex markets are relatively mixed today. Sterling is generally higher but it’s capped by conflicting messages regarding Brexit trade negotiations. Canadian Dollar is currently second strongest, with help from mild strength in oil price. On the other hand, New Zealand Dollar is the worst performing, followed by Euro and Swiss France. Dollar is mixed, awaiting more guidance from US stimulus stocks and FOMC policy announcement tomorrow.

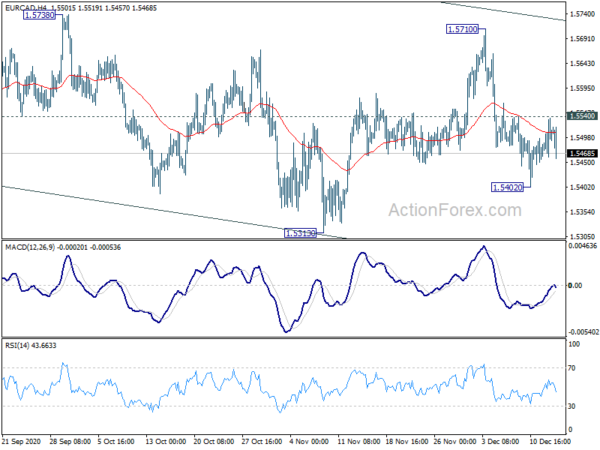

Technically, EUR/JPY is trading back below 126 handle at the time of writing, suggesting that retreat from 126.74 is extending lower. We’ll firstly see if that would come with a pull back in EUR/USD through 1.21 handle. Or USD/JPY would break through 103.51 support to extend larger down trend. At the same time, EUR/CAD appears to be rejected by 1.5540 minor resistance. Break of 1.5402 temporary low would resume the fall from 1.5710 to 1.5313 low. That could be an indication of more weakness in Euro instead.

In Europe, currently, FTSE is down -0.38%. DAX is up 0.94%. CAC is up 0.34%. Germany 10-year yield is down -0.0037 at -0.621. Earlier in Asia, Nikkei dropped -0.17%. Hong Kong HSI dropped -0.69%. China Shanghai SSE dropped -0.06%. Singapore Strait Times dropped -0.05%. Japan 10-year JGB yield dropped -0.0105 to 0.003.

US Empire State manufacturing dropped to 4.9, but employment posted strongest gains in months

US Empire State manufacturing index dropped to 4.9 in December, down from 6.3. New orders increased marginally, and shipments were modestly higher. Inventories continued to move lower, and delivery times edged up. Employment posted its strongest gain in months, and the average workweek lengthened somewhat. Input prices increased at the fastest pace in two years, while selling prices increased at about the same pace as last month.

Import price index rose 0.1% mom in November, below expectation of 0.3% mom.

From Canada, manufacturing sales rose 0.3% mom in October, below expectation of 0.5% mom. Housing starts rose to 246k in November.

ECB Rehn: New PEPP envelop is a ceiling, not a target

ECB Governing Council member Olli Rehn said that the new EUR 1.86T “envelop” of the central bank’s Pandemic Emergency Purchase Programme is not a target but a ceiling for now”. He added, “we will implement the programme so that we can ensure favorable financing conditions and that means we are taking market conditions, market developments into implementation.”

He also said ECB will monitor FX “very closely”, and will take market conditions into implementation”. Though, he reiterated that exchange rate is not a policy target.

SECO downgrades 2021 Swiss GDP growth for coronavirus second wave

State Secretariat for Economic Affairs SECO downgrade 2021 growth forecast as “the second wave of the coronavirus will have an adverse effect on the Swiss economy”. Also, “rising case numbers and the measures to combat the coronavirus will slow international economic development considerably in the winter half-year of 2020/2021, especially in Europe. ” Though, “less dramatic containment measures have been taken than last spring and the overall economic impact is likely to be less severe.”

For 2020 as a whole, GDP is projected to contract -3.3%, worst since 1975. 2021 GDP growth forecast was revised down from -3.8% to 3.0%. The Swiss economy should return to pre-crisis levels towards the end of 2021. For 2022, GDP is projected to grow 3.1%.

Swiss PPI came in at -0.1% mom, -2.7% yoy.

UK Johnson: No deal Brexit remained the most likely outcome

UK Prime Minister Boris Johnson spokesman told reporters today, “the prime minister made clear that not being able to reach an agreement and ending the transition period on Australia-style terms remained the most likely outcome but committed to continuing to negotiate on the remaining areas of disagreement.”

On the other hand, Germany’s ambassador to EU Michael Clauss said, the negotiations are “not over yet” and “there are still a few days ahead of us”. “There is still a chance for a deal by the end of the week.”

UK claimant count rose 64.3k in Nov, unemployment rate ticked up to 4.9% in Oct

UK claimant count rose 64.3k in November, above expectation of 10.5k. That represents a 2.5% monthly increase. The total count, at 2.7m, was 114.8% above March’s level.

Unemployment rate rose 0.1% to 4.9% in the three months to October, below expectation of 5.1%. Average earnings including bonus rose 2.7% 3moy, above expectation of 2.3%. Average earnings excluding bonus rose 2.8% 3moy, above expectation of 2.6%.

RBA Minutes: Recovery is underway but uneven and protracted

In the minutes of December 1 monetary policy meeting, RBA said economic recovery in Australia was “under way” and and recent data had “generally been better than expected”. Employment rate was “likely to peak lower than the 8 per cent rate expected”. Though, recovery was still expected to be “uneven and protracted”, dependent on “significant policy support and favorable health outcomes”. High unemployment rate and excess capacity were expected to result in “subdued wages growth in inflation over coming years”.

RBA reiterated, “the Bank remained prepared to purchase bonds in whatever quantity required to achieve the 3-year yield target”. The size of bond purchases is kept “under review” and it’s “prepared to do more if necessary. Also, RBA ” remains committed to not increasing the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range”. No increase in cash rate is expected for “at least 3 years”. Also, ” it would be appropriate to remove the yield target before the cash rate itself were increased.”

China data suggests recovery gained momentum

China’s industrial production rose 7.0% yoy in November, up from October’s 6.9% yoy, matched expectations. Retail sales rose 5.0% yoy, up from October’s 4.3% yoy, but missed expectation of 5.1% yoy. Auto sales rose 11.8% yoy while household appliances sales rose 5.1% yoy. Communications equipment sales even jumped 43.6% yoy. Fixed asset investment rose 2.6% ytd yoy, up from October’s 1.8% ytd yoy, beat expectation of 2.6%. Private sector fixed-asset investment rose 0.2% ytd yoy, turned positive from October -0.7%.

Suggested reading: China’s November Data Signals Recovery Continues. PBOC to Keep Powder Dry

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 103.65; (P) 103.87; (R1) 104.24; More..

Intraday bias in USD/JPY stays neutral first and further decline is expected. Overall, the pair is staying inside the falling channel from 111.71. Break of 103.51 will target 103.17 first. Break there will resume the whole decline to 101.18 low. For now, break of 104.57 resistance is needed to indicate short term bottoming. Otherwise, outlook will stay bearish in case of stronger recovery.

In the bigger picture, USD/JPY is still staying in long term falling channel that started back in 118.65 (Dec. 2016). Hence, there is no clear indication of trend reversal yet. The down trend could still extend through 101.18 low. On the upside, break of 106.10 resistance is needed to be the first signal of medium term reversal. Otherwise, outlook will remain bearish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:00 | NZD | Westpac Consumer Survey Q4 | 106 | 95.1 | ||

| 00:30 | AUD | RBA Meeting Minutes | ||||

| 02:00 | CNY | Retail Sales Y/Y Nov | 5.00% | 5.10% | 4.30% | |

| 02:00 | CNY | Industrial Production Y/Y Nov | 7.00% | 7.00% | 6.90% | |

| 02:00 | CNY | Fixed Asset Investment YTD Y/Y Nov | 2.60% | 2.60% | 1.80% | |

| 06:45 | CHF | SECO Economic Forecasts | ||||

| 07:00 | GBP | Claimant Count Change Nov | 64.3K | 10.5K | -29.8K | |

| 07:00 | GBP | Average Earnings Including Bonus 3M/Y Oct | 2.70% | 2.30% | 1.30% | |

| 07:00 | GBP | Average Earnings Excluding Bonus 3M/Y Oct | 2.80% | 2.60% | 1.90% | |

| 07:00 | GBP | ILO Unemployment Rate (3M) Oct | 4.90% | 5.10% | 4.80% | |

| 07:30 | CHF | Producer and Import Prices M/M Nov | -0.10% | 0.00% | ||

| 07:30 | CHF | Producer and Import Prices Y/Y Nov | -2.70% | -2.90% | ||

| 09:00 | EUR | Italy Trade Balance (EUR) Oct | 7.57B | 5.40B | 5.85B | |

| 13:15 | CAD | Housing Starts Nov | 246K | 215K | ||

| 13:30 | CAD | Manufacturing Sales M/M Oct | 0.30% | 0.50% | 1.50% | |

| 13:30 | USD | Import Price Index M/M Nov | 0.10% | 0.30% | -0.10% | |

| 13:30 | USD | Empire State Manufacturing Index Nov | 4.9 | 6.3 | 6.3 | |

| 14:15 | USD | Industrial Production M/M Nov | 0.30% | 1.10% | ||

| 14:15 | USD | Capacity Utilization Nov | 73.00% | 72.80% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals