Dollar’s selloff intensifies further today, after worse than expected job data. Also, markets are generally on risk-on mode, as traders are optimistic that stimulus deal could be reached in the Congress soon. Swiss France is currently the next weakest, having little reactions to SNB rate decision. Australian and New Zealand Dollars are taking turns to be the strongest. Both are boosted by solid economic data. Sterling is following as next strongest, with Brexit trade negotiations making some progresses.

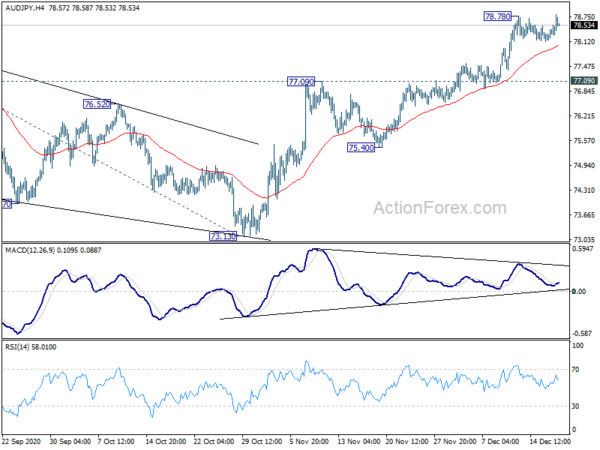

Technically, Dollar’s broad based down trend resumption is taking shape, with GBP/USD breaking away from 1.3539 resistance. USD/JPY has also broken 103.17 low. A focus in on when USD/CAD would break through 1.2688 temporary low. As for Aussie, EUR/AUD’s breach of 1.6033 low suggests down trend resumption, but there is no follow through selling yet. AUD/JPY’s breach of 78.78 temporary top also suggests rise resumption. Again, there is no follow through buying. In addition to Dollar’s decline, whether Aussie could solidify momentum is an interesting point before weekend too.

In Europe, currently FTSE is down -0.02%. DAX is up 0.76%. CAC is up 0.37%. Germany 10-year yield is down -0.0202 at -0.587. Earlier in Asia, Nikkei rose 0.18%. Hong Kong HSI rose 0.82%. China Shanghai SSE rose 1.13%. Singapore Strait Times dropped -0.51%. Japan 10-year JGB yield dropped -0.0009 to 0.009.

US initial jobless claims rose to 885k, continuing claims dropped to 5.5m

US initial jobless claims rose 23k to 885k in the week ending December 12, well above expectation of a fall to780k. Four-week moving average of initial claims rose 34.3k to 812.5k.

Continuing claims dropped -273k to 5508k in the week ending December 5. Four-week moving average of continuing claims dropped -215.5k to 5726k.

Also released, housing starts rose to 1.55m annualized rate in November. Building permits rose to 1.64m. Philly Fed manufacturing index dropped sharply to 11.1, down from 26.3, missed expectation of 20.0.

BoE stands pat, Q4 a little weaker than expected due to coronavirus

BoE judged that “the existing stance of monetary policy remains appropriate”. Bank Rate was held unchanged at 0.10%. Total target stock of asset purchase were also kept at GBP 895B. Both decisions were unanimous.

It also pledged to “stands ready to take whatever additional action” if inflation outlook weakens. Also, it maintained “the Committee does not intend to tighten monetary policy at least until there is clear evidence that significant progress is being made in eliminating spare capacity and achieving the 2% inflation target sustainably.”

The central bank noted that the roll out of coronavirus vaccines is “likely to reduce the downside risks to the economic outlook from Covid”. But Q4 GDP is likely to be a “little weaker than expected” due to increase in Covid cases and associated re-imposition of restrictions

Outlook remains “unusually uncertain”, depending of “revolution of the pandemic and measures taken to protect public health, as well as the nature of, and transition to, the new trading arrangements between the European Union and the United Kingdom”.

SNB keeps sight deposit rate at -0.75%, pandemic to be back under control in foreseeable future

SNB kept sight deposits rate unchanged at -0.75%. Also, “in light of the highly valued Swiss franc, the SNB remains willing to intervene more strongly in the foreign exchange market”.

In the baseline scenario, SNB expects the pandemic to be “brought back under control in the foreseeable future”. Global recovery should therefore “regain momentum in the course of next year”. But production capacity will be “unfertilized for some time” and inflation will remain modest in most countries.

For Swiss, SNB expects GDP to contract by around -3% this year. GDP will then grow 2.5% to 3.0% for 2021, but recovery remains “incomplete”. Conditional inflation forecast through the end of 2021 is revised slightly lower, “primarily due to the renewed deterioration in the economic situation as a result of the second wave of the pandemic”. Overall inflation would be at -0.7% in 2020, 0.0% in 2021, and 0.2% in 2022.

Also released, Swiss trade surplus widened to CHF 4.46B in November, above expectation of CHF 4.12B.

Eurozone CPI finalized at -0.3% in Nov, EU at 0.2%

Eurozone CPI was finalized at -0.3% yoy in November, core CPI at 0.2% yoy. The highest contribution to the annual euro area inflation rate came from food, alcohol & tobacco (+0.36%), followed by services (+0.25 pp), non-energy industrial goods (-0.07 pp) and energy (-0.82 pp).

EU CPI was finalized at 0.2% yoy. The lowest annual rates were registered in Greece (-2.1%), Estonia (-1.2%), Slovenia and Cyprus (both -1.1%). The highest annual rates were recorded in Poland (3.7%), Hungary and Czechia (both 2.8%). Compared with October, annual inflation fell in fourteen Member States, remained stable in four and rose in nine.

Australia employment grew 90k in Nov, unemployment rate dropped to 6.8%

Australia employment grew 90k in November, to 12.86m, much better than expectation of 50.0k. Over, the year, though, employment was still down -0.6% or -83.1k. Looking at some details, Full-time jobs rose 84.2k to 8.73m. Part-time jobs rose 5.8k to 4.14m.

Unemployment rate dropped -0.2% to 6.8%, better than expectation of 7.0%. Participation rate rose 0.3% to 66.1%. Hours worked rose 2.5% mom.

New Zealand GDP grew record 13% qoq in Q3

New Zealand GDP grew 14.0% qoq in Q3, stronger than expectation of 12.8% qoq. That’s also the largest quarterly rise on record. However, on an annual bases, GDP dropped -2.2% over the year. Growth in Q3 was not enough to fully makeup for the economic impact of the coronavirus pandemic and the responding measures.

Looking at some more details, Services industries rose 11.1% qoq. Goods-producing industries rose 26.0% qoq. Primary industries rose 4.6% qoq.

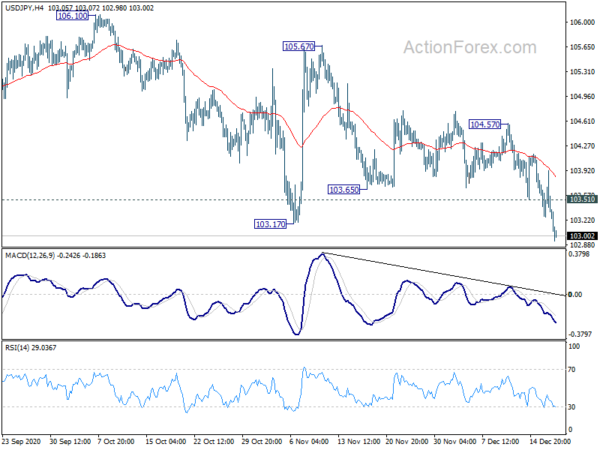

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 103.15; (P) 103.53; (R1) 103.81; More..

USD/JPY drops to as low as 102.93 so far today. The break of 103.17 support confirms resumption of whole down trend from 111.71. Intraday bias remains on the downside. Deeper decline would be seen to retest 101.18 low. On the upside, above 103.51 minor resistance will turn intraday bias neutral first. But break of 104.57 resistance is needed to indicate short term bottoming. Otherwise, outlook will stay bearish in case of recovery.

In the bigger picture, USD/JPY is still staying in long term falling channel that started back in 118.65 (Dec. 2016). Hence, there is no clear indication of trend reversal yet. The down trend could still extend through 101.18 low. On the upside, break of 106.10 resistance is needed to be the first signal of medium term reversal. Otherwise, outlook will remain bearish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | GDP Q/Q Q3 | 14.00% | 12.80% | -12.20% | -11.00% |

| 00:30 | AUD | Employment Change Nov | 90.0K | 50.0K | 178.8K | |

| 00:30 | AUD | Unemployment Rate s.a. Nov | 6.80% | 7.00% | 7.00% | |

| 07:00 | CHF | Trade Balance (CHF) Nov | 4.46B | 4.12B | 3.86B | |

| 08:30 | CHF | SNB Interest Rate Decision | -0.75% | -0.75% | -0.75% | |

| 09:00 | CHF | SNB Press Conference | ||||

| 10:00 | EUR | Eurozone CPI Y/Y Nov F | -0.30% | -0.30% | -0.30% | |

| 10:00 | EUR | Eurozone CPI – Core Y/Y Nov F | 0.20% | 0.20% | 0.20% | |

| 12:00 | GBP | BoE Interest Rate Decision | 0.10% | 0.10% | 0.10% | |

| 12:00 | GBP | BoE Asset Purchase Facility | 895B | 895B | 895B | |

| 12:00 | GBP | MPC Official Bank Rate Votes | 0–0–9 | 0–0–9 | 0–0–9 | |

| 12:00 | GBP | MPC Asset Purchase Facility Votes | 0–0–9 | 0–0–9 | 0–0–9 | |

| 13:30 | CAD | ADP Employment Change Nov | 40.8K | -79.5K | ||

| 13:30 | USD | Housing Starts Nov | 1.55M | 1.53M | 1.53M | |

| 13:30 | USD | Building Permits Nov | 1.64M | 1.55M | 1.54M | |

| 13:30 | USD | Initial Jobless Claims (Dec 11) | 885K | 780K | 853K | 862K |

| 13:30 | USD | Philadelphia Fed Manufacturing Survey Dec | 11.1 | 20 | 26.3 | |

| 15:30 | USD | Natural Gas Storage | -120B | -91B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals