Trading in the financial markets are rather subdued today, pretty much in pre-holiday mood. Dollar is still in recovery mode but upside momentum has been very weak. The greenback is set to end as the worst performing one, followed by Canadian and then Swiss Franc. On the other hand, Sterling is also paring some gains, with eyes in the final hours of Brexit trade talks. It’s still the strongest one for the week. But it’s hard to say with certainty that the Pound could hold on to its position.

Technically, EUR/JPY tried to resume recent rally by and broke 126.74 temporary top. Yet, strong resistance is see from 127.07 key resistance level, as the cross then retreated notably in early US session. GBP/JPY is also dragged down. We might indeed see Yen crosses turning slightly lower before weekly close. But overall, we’ll have to wait for next week for any tradeable developments.

In Europe, currently, FTSE is up 0.09%. DAX is up 0.32%. CAC is down -0.18%. German 10-year yield is down -0.0049 at -0.574. Earlier in Asia, Nikkei dropped -0.16%. Hong Kong HSI dropped -0.67%. China Shanghai SSE dropped -0.29%. Singapore Strait Times dropped -0.32%. Japan 10-year JGB yield rose 0.0039 to 0.013.

Canada retail sales rose 0.4% in Oct, up in 6 of 11 subsectors

Canada retail sales rose 0.4% mom to CAD 54.6B in October, above expectation of 0.1% mom. That’s the sixth consecutive monthly increase since the record decline in April. Core retail sales, excluding gasoline stations and motor vehicle and parts dealers, edged up 0.3% mom.

EU Barnier: Path to Brexit trade agreement is very narrow

EU chief Brexit negotiation Michel Barnier told the European Parliament, “It’s the moment of truth. There is a chance of getting an agreement but the path to such an agreement is very narrow.”

“We find ourselves in a very serious and sombre situation,” he added. “We have very little time remaining, just a few hours to work through these negotiations in a useful fashion if we want this agreement to enter into force on the first of January.”

“That is where we get to one of the most difficult issues at the moment. Fisheries being part and parcel of the trade relationship,” said Barnier. “We have to be prepared for all eventualities.”

Separately, UK Prime Minister Boris Johnson said, “obviously the UK’s position is always that we want to keeping talking if there’s any chance of a deal… But we’ve also got to recognise that the UK’s got to be able to control its own laws, it’s what people voted for, and we’ve also got to be able to control our waters and fishing rights.”

He added: “our door is open, we’ll keep talking but I have to say things are looking difficult. There’s a gap that needs to be bridged.”

UK retail sales dropped -3.8% mom in Nov, ex-fuel sales dropped -2.6% mom

UK retail sales dropped -3.8% mom in November, worse than expectation of -3.3% mom. Ex-fuel sales dropped -2.6% mom, also below expectation of -2.3% mom. Over the year, headline retail sales rose 2.8% yoy versus expectation of 2.8% yoy. Ex-fuel sales rose 5.6% yoy versus expectation of 6.2% yoy.

Germany Ifo business climate rose to 92.1, overall economy showing resilience

Germany Ifo Business Climate rose to 92.1 in December, up from 90.7, above expectation of 90.5. Current Assessment index rose to 91.3, up from 90.0, above expectation of 89.3. Expectations index rose to 92.8, up from 91.5, matched expectations. By sector, manufacturing rose markedly from 4.0 to 8.9. Services rose from -3.1 to -0.3. Trade rose from -4.0 to 0.3. Construction was unchanged at -0.5.

Ifo said: “Companies were more satisfied with their current business situation. They were also less skeptical about the coming six months. While the lockdown is hitting certain sectors hard, overall the German economy is showing resilience.

Germany PPI came in at 0.2% mom, -0.5% yoy in November, versus expectation of 0.1% mom, -0.6% yoy. Eurozone current account surplus widened to EUR 26.6B in October.

BoJ stands pat, to conduct assessment on monetary easing

BoJ announced to extend the during of the Special Program to Support Financing in Response to the Novel Coronavirus (COVID-19) by 6 months. Other than that, monetary policy was kept unchanged. Under the yield curve control framework, short term interest rate target was held at -0.1%. 10-year JGB yield target is held at around 0%, with unlimited purchase of government bonds.

Also, BoJ will “conduct an assessment for further effective and sustainable monetary easing, with a view to supporting the economy and thereby achieving the price stability target of 2 percent”. Nevertheless, the framework of QQE with YCC has been “working well to date” and thus there is “no need to change it. The results of the review will likely be be published in March.

The central bank said Japan’s economy is “likely to follow an improving trend” with gradual waning of COVID-19 impact. But pace of improvement is expected to be “only moderate”. Year-on-year rate of core CPI is “likely to be negative for the time being”. But it’s expected to turn positive and then increase gradually.

Released from Japan, national CPI core dropped to -0.0% yoy in November, matched expectations. That’s the worst reading since September 2010.

New Zealand ANZ business confidence rose to 9.4, first positive since 2017

New Zealand ANZ Business Confidence jumped to 9.4 in December, up form -6.9. That’s the first positive reading since August 2017. Own Activity index rose to 21.7, up from 9.1, highest since March 2018.

New Zealand goods exports dropped -0.2% yoy to NZD 5.2B in November. Goods imports dropped -17% yoy in NZD 5.0B. Monthly trade balance was a surplus of NZD 252m, slightly above expectation of NZD 250m. That’s the first November surplus since 2013. There were contrasting movements in exports to top destinations. Exports to China, US and EU were up. Exports to Australia and Japan were down. Imports were down from all top trading partners, including China, EU, Australia, US and Japan.

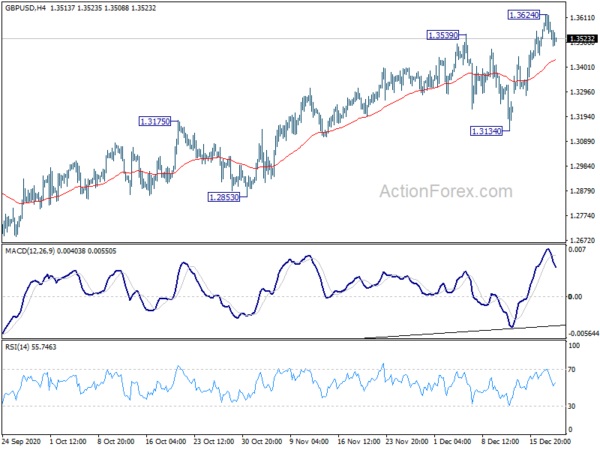

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.3510; (P) 1.3567; (R1) 1.3638; More…

GBP/USD is staying in consolidation form 1.3624 temporary top. Intraday bias remains neutral first. Further rise is expected as long as 1.3134 support holds. Break of 1.3624 will target 61.8% projection of 1.1409 to 1.3482 from 1.2675 at 1.3956 next.

In the bigger picture, focus stays on 1.3514 key resistance. Decisive break there should also come with sustained trading above 55 month EMA (now at 1.3308). That should confirm medium term bottoming at 1.1409. Outlook will be turned bullish for 1.4376 resistance and above. Nevertheless, rejection by 1.3514 will maintain medium term bearishness for another lower below 1.1409 at a later stage.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance (NZD) Nov | 252M | 250M | -501M | -427M |

| 23:30 | JPY | National CPI Core Y/Y Nov | -0.90% | -0.90% | -0.70% | |

| 00:01 | GBP | GfK Consumer Confidence Dec | -26 | -30 | -33 | |

| 03:00 | JPY | BoJ Interest Rate Decision | -0.10% | -0.10% | -0.10% | |

| 07:00 | GBP | Retail Sales M/M Nov | -3.80% | -3.30% | 1.20% | 1.30% |

| 07:00 | GBP | Retail Sales Y/Y Nov | 2.40% | 2.80% | 5.80% | |

| 07:00 | GBP | Retail Sales ex-Fuel M/M Nov | -2.60% | -2.30% | 1.30% | 1.40% |

| 07:00 | GBP | Retail Sales ex-Fuel Y/Y Nov | 5.60% | 6.20% | 7.80% | |

| 07:00 | EUR | Germany PPI M/M Nov | 0.20% | 0.10% | 0.10% | |

| 07:00 | EUR | Germany PPI Y/Y Nov | -0.50% | -0.60% | -0.70% | |

| 09:00 | EUR | Eurozone Current Account (EUR) Oct | 26.6B | 25.2B | ||

| 09:00 | EUR | Germany IFO Business Climate Dec | 92.1 | 90.5 | 90.7 | |

| 09:00 | EUR | Germany IFO Current Assessment Dec | 91.3 | 89.3 | 90 | |

| 09:00 | EUR | Germany IFO Expectations Dec | 92.8 | 92.8 | 91.5 | |

| 13:30 | CAD | Retail Sales M/M Oct | 0.40% | 0.10% | 1.10% | |

| 13:30 | CAD | Retail Sales ex Autos M/M Oct | 0.00% | 0.10% | 1.00% | |

| 13:30 | USD | Current Account (USD) Q3 | -178.5B | -190B | -171B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals