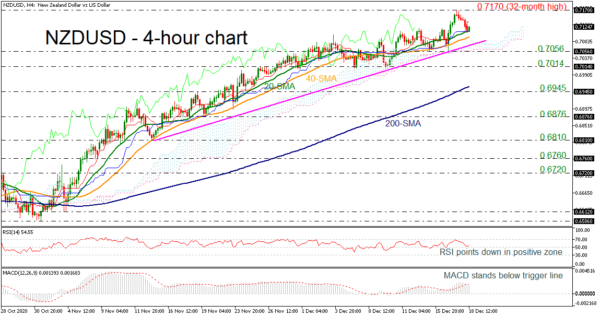

NZDUSD is rising after the downside pullback off the 32-month high of 0.7170, which hit the 20-period simple moving average (SMA) at 0.7110. The RSI is pointing marginally up after the falling move from the overbought territory, while the MACD is dropping below its trigger line in the positive region, confirming the latest decline.

Further losses may meet support around the 40-period SMA at 0.7095 ahead of the rising trend line at 0.7075, overlapping the upper surface of the Ichimoku cloud. Not far below, support could occur around the 0.7056 area and the 0.7014 obstacle. Even lower, the 200-period SMA currently at 0.6960 could attract attention.

On the upside, resistance could occur around the 32-month peak of 0.7170, registered on December 17. Higher still, the 0.7390 barrier would increasingly come into scope, taken from the high in April of 2018.

The medium-term picture continues to look predominantly bullish, with trading activity taking place above the uptrend line.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals