Dollar rebounds broadly today following receding risk appetite. Investors are apparently paring their gains in stocks. Swiss Franc and Euro are the next strongest, followed by Yen. On the other hand, Australian Dollar and Sterling are the worst performing. In particular, the Pound was weighed down by sharp deterioration in manufacturing data. Over the week, Dollar is still the worst performing but Aussie has the potential to overtake it before close. Euro is still the strongest one, followed by Swiss Franc.

In Europe, currently, FTSE is down -0.75%. DAX is down -0.64%. CAC is down -1.12%. Germany 10-year yield is down -0.0185 at -0.512. Earlier in Asia, Nikkei dropped -0.44%. Hong Kong HSI dropped -1.60%. China Shanghai SSE dropped -0.40%. Singapore Strait Times dropped -0.85%. Japan 10-year JGB yield is up 0.0066 at 0.043.

Canada retail sales rose 1.3% in Nov, up in 7 of 11 subsectors

Canada retail sales rose 1.3% mom to CAD 55.2B in November, well above expectation of 0.0% mom/ That’s the seventh consecutive monthly gain, led by sales at food and beverage stores, along with an uptick in e-commerce sales. Ex-auto sales rose 2.1% mom, above expectation of 0.3% mom.

Sales were up in 7 of 11 subsectors, representing 53.4% of retail trade. In volume terms, retail sales rose 1.2% in November.

UK PMI composite dropped to 40.6 in Jan, sharp contraction in Q1

UK PMI manufacturing dropped sharply to 52.9 in January, down from 57, missed expectation of 53.0, a 7-month low. PMI Services dropped to 38.8, down from 49.4, missed expectation of 45.3, an 8-month low. PMI Composite dropped to 40.6, down from 50.4, an 8-month low.

Chris Williamson, Chief Business Economist at IHS Markit, said:

“A steep slump in business activity in January puts the locked-down UK economy on course to contract sharply in the first quarter of 2021, meaning a double-dip recession is on the cards. Services have once again been especially hard hit, but manufacturing has seen growth almost stall, blamed on a cocktail of COVID-19 and Brexit, which has led to increasingly widespread supply delays, rising costs and falling exports.

“Worryingly, January also saw companies reduce headcounts at an increased rate again – albeit less so than seen between March and November. The steepest loss of jobs was recorded in the hotels, restaurants, travel and leisure sectors, reflecting the new lockdown measures.

“Encouragingly, the current downturn looks far less severe than that seen during the first national lockdown, and businesses have become increasingly optimistic about the outlook, thanks mainly to progress in rolling out COVID-19 vaccines. Business hopes for the year ahead have risen the highest for over six-and-a-half years, boding well for the economy to return to solid growth once virus restrictions ease.”

Also released, retail sales rose 0.3% mom, 2.9% yoy in December, versus expectation of 1.0% mom, 4.0% yoy. Retail sales ex-fuel rose 0.4% mom, 6.4% yoy versus expectation of 0.3% mom, 6.5% yoy.

Eurozone PMI composite dropped to 47.5, double-dip recession increasingly inevitable

Eurozone PMI Manufacturing dropped to 54.7 in January, down from 55.2, missed expectation of 55.0. PMI Services dropped to 45.0, down from 46.4, above expectation of 44.8. PMI Composite dropped to 47.5, down from 49.1.

Chris Williamson, Chief Business Economist at IHS Markit said: “A double-dip recession for the eurozone economy is looking increasingly inevitable as tighter COVID- 19 restrictions took a further toll on businesses in January…. Some encouragement comes from the downturn being less severe than in the spring of last year, reflecting the ongoing relative resilience of manufacturing, rising demand for exported goods and the lockdown measures having been less stringent on average than last year…

“The roll out of vaccines has meanwhile helped sustain a strong degree of confidence about prospects for the year ahead, though the recent rise in virus case numbers has caused some pull-back in optimism. The survey data therefore add to the view that t he eurozone will see a soft start to 2021, but that the economy should pick up momentum again as the vaccine roll out gathers pace.”

Germany PMI manufacturing dropped to 57.0, services down to 46.8

Germany PMI Manufacturing dropped to 57.0 in December, down from 58.3, missed expectation of 58.0. PMI services dropped to 46.8, down from 47.0, above expectation of 46.8. PMI Composite dropped to 50.8, down form 52.0, hitting a 7-month low.

Phil Smith, Associate Director at IHS Markit said: “There were few surprises from January’s flash Germany PMI release, with the manufacturing data remaining strong but showing a slight loss of momentum, while services activity was further depressed by the lockdown measures introduced in the middle of December. All in all, the German economy has made a slow start to the year, and the extension of the current containment measures until at least mid-February means this looks like being the picture for several more weeks to come.”

France PMI composite dropped to 47 in Jan, but return of employment growth a big positive

France PMI Manufacturing rose to 51.5 in January, up from 51.5, a 6-month high and beat expectation of 50.8. PMI services. on the other hand, dropped to 46.5, down from 49.1, missed expectation of 48.3. PMI Composite dropped to 47.0, down from 49.5.

Eliot Kerr, Economist at IHS Markit said: “The French private sector started the new year as it ended the last, with COVID-19 restrictions driving a further decline in business activity. However, there were one big positive to be gleaned from the latest PMI data, and that was the return of employment growth. The fact that firms have returned to recruitment activity points to some confidence in an economic recovery in the second half of this year. That confidence was also evident in the broader expectations figures, which were only slightly off December’s 11-month high.

Japan PMI manufacturing dropped to 49.7 in Jan, short-term activity undoubtedly hampered by rising coronavirus cases

Japan PMI Manufacturing dropped to 49.7 in January, down from 50.0, back in contraction. PMI Services dropped to 45.7, down from 47.7. PMI Composite dropped to 46.7, down from 48.5.

Usamah Bhatti, Economist at IHS Markit, said: “Short-term activity will undoubtedly be hampered by rising coronavirus disease 2019 (COVID-19) cases, as the government declared a state of emergency in Tokyo and introduced further measures to curb rising infection rates. As a result, positive sentiment weakened across the private sector. Firms are still predicting growth over the coming 12 months, although concern remains that the impact of the pandemic will be prolonged.”

Japan CPI core dropped to -1% yoy in Dec, worst since 2010

Japan CPI core (all item ex-fresh food) dropped further to -1.0% yoy in December, down from -0.2% yoy, but was above expectation of -1.1% yoy. That’s still the biggest annual decline in core inflation since September 2010. Headline CPI (all items) dropped to -1.2% yoy, down from -0.9% yoy. CPI core-core (all item ex-fresh food and energy) dropped to -0.4% yoy, down from -0.3% yoy.

“I don’t think the risk of Japan sliding back into deflation is high,” BOJ Governor Haruhiko Kuroda insisted yesterday. “But potential growth may be falling so we need to look at the impact (on prices) carefully.”

Australia CBA PMI manufacturing rose to 57.2, 49-month high

Australia CBA PMI manufacturing rose to 57.2 in January, up from 55.7. That;s also the highest level in 49 months. PMI Services dropped to 55.8, down from 57.0. PMI Composite dropped slightly to 56.0, down from 56.6.

Pollyanna De Lima, Economics Associate Director at IHS Markit, said: “The Australian private sector remained resilient at the start of the year, despite the COVID-19 pandemic, with the flash PMI showing sustained growth of new orders, output and employment… While this boost in demand is welcome, inflationary pressures seem to be mounting….

“Material shortages and restricted freight capacity remained key themes of the survey…. Businesses were upbeat towards the year-ahead outlook for output, with hopes pinned on vaccine developments and the eventual lifting of restrictions globally. However, optimism weakened in January, dampened by concerns over the long-term effects of the COVID-19 pandemic on the economy.”

Australia retail sales dropped -4.2% mom in Dec, Victoria down -7%

Australia retail sales dropped -4.2% mom in December, much worse than expectation of -1.5% mom. Over than year, sales rose 9.4% yoy. Victoria led the falls by state, down -7% following a 22% rise in November, while New South Wales fell -5% as localized restrictions in Sydney impacted turnover. All states and territories, except for the Northern Territory, fell this month.

New Zealand BusinessNZ manufacturing dropped to 48.7, caution heading into the New Year

New Zealand BusinessNZ Manufacturing index dropped to 48.7 in December, down from 54.7. The manufacturing was back in contraction after staying in expansion territory for six straight months. Looking at some details, production dropped from 55.0 to 51.5. Employment dropped from 51.3 to 49.9. New orders dropped from 56.5 to 49.9. Finished stocks dropped from 59.2 to 45.9. Deliveries also dropped from 51.5 to 44.5.

BNZ Senior Economist, Doug Steel said that “the PMI’s three-month moving average sits at an expansionary 51.8, albeit below its long-term average of 53.0. This all suggests some expansion in the final quarter of last year, but the softer December month suggests some caution heading into the New Year.”

New Zealand CPI unchanged at 1.4% yoy in Q4, underlying inflation higher

New Zealand CPI rose 0.5% qoq in Q4, above expectation of 0.2% qoq. Annually, CPI was unchanged at 1.4% yoy, above expectation of 1.0% yoy.

The trimmed means CPI, which exclude extreme price movements, ranged from 1.7% to 2.1% yoy, indicating that underlying inflation is higher than the 1.4% overall increase in CPI.

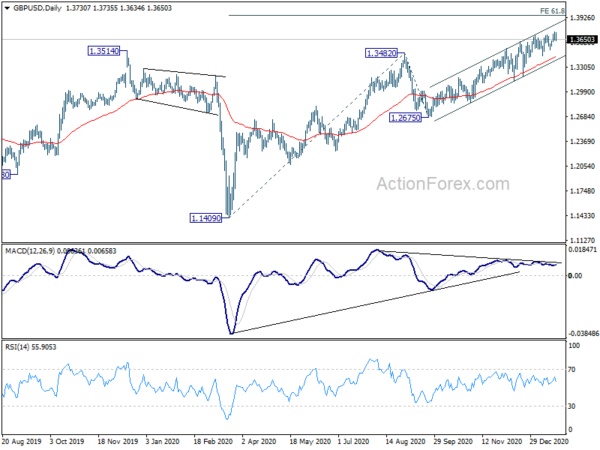

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.3676; (P) 1.3711; (R1) 1.3771; More…

Intraday bias in GBP/USD is turned neutral with today’s retreat. Though, further rally is expected as long as 1.3518 support intact. Break of 1.3745 will extend the up trend from 1.1409, to 61.8% projection of 1.1409 to 1.3482 from 1.2675 at 1.3956. On the downside, however, firm break of 1.3518 will confirm short term topping, and turn intraday bias back to the downside for channel support (now at 1.3398) first.

In the bigger picture, rise from 1.1409 medium term bottom is in progress. Further rally would be seen to 1.4376 resistance and above. On the downside, break of 1.2675 support is needed to indicate completion of the rise. Otherwise, outlook will stays cautiously bullish in case of pullback.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | CPI Q/Q Q4 | 0.50% | 0.20% | 0.70% | |

| 21:45 | NZD | CPI Y/Y Q4 | 1.40% | 1.00% | 1.40% | |

| 22:00 | AUD | CBA Manufacturing PMI Jan P | 57.2 | 55.7 | ||

| 22:00 | AUD | CBA Services PMI Jan P | 55.8 | 57 | ||

| 23:30 | JPY | National CPI Core Y/Y Dec | -1.00% | -1.10% | -0.90% | |

| 00:01 | GBP | GfK Consumer Confidence Jan | -28 | -29 | -26 | |

| 00:30 | AUD | Retail Sales M/M Dec P | -4.20% | -1.50% | 7.10% | |

| 00:30 | JPY | Manufacturing PMI Jan P | 49.7 | 50.1 | 50 | |

| 07:00 | GBP | Retail Sales M/M Dec | 0.30% | 1.00% | -3.80% | -4.10% |

| 07:00 | GBP | Retail Sales Y/Y Dec | 2.90% | 4.00% | 2.40% | 2.10% |

| 07:00 | GBP | Retail Sales ex-Fuel M/M Dec | 0.40% | 0.30% | -2.60% | -3.00% |

| 07:00 | GBP | Retail Sales ex-Fuel Y/Y Dec | 6.40% | 6.50% | 5.60% | 5.30% |

| 07:00 | GBP | Public Sector Net Borrowing (GBP) Dec | 33.4B | 31.5B | 30.8B | 25.4B |

| 08:15 | EUR | France Manufacturing PMI Jan P | 51.5 | 50.8 | 51.1 | |

| 08:15 | EUR | France Services PMI Jan P | 46.5 | 48.3 | 49.1 | |

| 08:30 | EUR | Germany Manufacturing PMI Jan P | 57 | 58 | 58.3 | |

| 08:30 | EUR | Germany Services PMI Jan P | 46.8 | 45.5 | 47 | |

| 09:00 | EUR | Eurozone Manufacturing PMI Jan P | 54.7 | 55 | 55.2 | |

| 09:00 | EUR | Eurozone Services PMI Jan P | 45 | 44.8 | 46.4 | |

| 09:30 | GBP | Manufacturing PMI Jan P | 52.9 | 53 | 57.5 | |

| 09:30 | GBP | Services PMI Jan P | 38.8 | 45.3 | 49.4 | |

| 13:30 | CAD | Retail Sales M/M Nov | 1.30% | 0.00% | 0.40% | |

| 13:30 | CAD | Retail Sales ex Autos M/M Nov | 2.10% | 0.30% | 0.00% | |

| 14:45 | USD | Manufacturing PMI Jan P | 56.5 | 57.1 | ||

| 14:45 | USD | Services PMI Jan P | 54 | 54.8 | ||

| 15:00 | USD | Existing Home Sales Dec | 6.46M | 6.69M | ||

| 15:30 | USD | Natural Gas Storage | -162B | -134B | ||

| 16:00 | USD | Crude Oil Inventories | -1.2M | -3.2M |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals