Canadian Dollar is currently trading as the strongest one for today, following the upside breakout in oil price. The resilient Sterling is following as second strongest, awaiting BoE to rule out negative interest rates later in the week. On the other hand, Australian Dollar is the worst performing, after RBA pulled ahead of announcement of QE extension. Euro is the second worst, as selloff gathers pace after GDP release. Dollar and Yen are mixed for now, awaiting some more guidance from over risk sentiments.

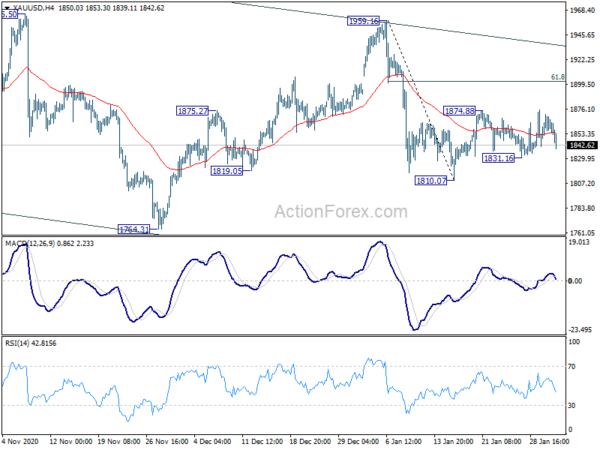

Technically, EUR/USD’s break of 1.2052 support finally indicates resumption of fall from 1.1230. For Dollar to solidify buying, GBP/USD would need to break through 1.3608 support while USD/CAD should break 1.2880 resistance. Or, Gold would need to break 1831.16 to target a 1810.07 support and below. For Euro to solidify selloff, EUR/JPY will need to break through 126.26 minor support. EUR/CHF will need to break 1.0788 minor support.

In Europe, currently, FTSE is up 0.44%. DAX is up 1.18%, CAC is up 1.67%. Germany 10-year yield is up 0.028 at -0.485. Earlier in Asia, Nikkei rose 0.97%. Hong Kong HSI rose 1.23%. China Shanghai SSE rose 0.81%. Singapore Strait Times rose 0.72%. Japan 10-year JGB yield dropped -0.005 to 0.056.

WTI oil upside breakout, targets 55.70 first, 58.26 next

WTI crude oil breaks through 53.92 resistance to resume near term up trend today. Further rise should be seen to 61.8% projection of 47.24 to 53.92 from 51.58 at 55.70 first, and then 100% projection at 58.26.

In any case, near term outlook will now stay bullish as long as 51.58 support holds. As for the chance of taking on 65.43 medium term structural resistance, we’ll see if WTI could accelerate upwards with the current move.

Eurozone GDP contracted -0.7% qoq in Q4, EU down -0.5%

Eurozone GDP contracted -0.7% qoq in Q4, smaller than expectation of -1.8% qoq. Over the year, GDP contracted -6.8% yoy. EU GDP contracted -0.5% qoq. Over the year, EU GDP contracted -6.4% yoy.

Among the Member States, for which data are available for the Q4, Austria (-4.3%) recorded the highest decrease compared to the previous quarter, followed by Italy (-2.0%) and France (-1.3%) while Lithuania (+1.2%) and Latvia (+1.1%) recorded the highest increases. The year on year growth rates were still negative for all countries.

Also released, Italy GDP dropped -2.0% qoq in Q4, versus expectation of -2.3% qoq. France CPI came in at 0.3% mom, 0.8% yoy in January, versus expectation of -0.3% mom, 0.8% yoy.

RBA kept cash rate at 0.1%, expands asset purchase by AUD 100B

RBA kept cash rate target and 3-year AGB target unchanged at 0.10%. It announced to buy an additional AUD 100B of government bonds, including states and territories, after the current program completes in mid-April. The additional purchases will be held at current rate of AUD 5B per week. On forward guidance, RBA maintained the pledge that it ” will not increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range”. It doesn’t expect the conditions to be met “until 2024 at earliest”.

In the central scenario of economic outlook, RBA expects GDP to grow 3.5% in both 2021 and 2022. GDP will reach end-2019 level by the middle of this year. Unemployment rate will be around 6% by the end of 2021, and 5.5% by the end of 2022. CPI is projected to be at 1.25% over 2021 and 1.50% over 2022.

Suggested readings on RBA:

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2032; (P) 1.2084; (R1) 1.2113; More…

EUR/USD’s break of 1.2052 support suggests resumption of fall from 1.2348. Intraday bias is back on the downside for channel support (now at 1.1972). Sustained break there would argue that it’s correcting whole up trend from 1.0635 to 1.2348. Next near term target will be 100% projection of 1.2348 to 1.2052 from 1.2188 at 1.1892 first. On the upside, break of 1.2188 resistance, through, will suggest that the correction has completed and bring retest of 1.2348 high.

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. We’d be alerted to topping sign around 1.2516/55. But sustained break there will carry long term bullish implications.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Monetary Base Y/Y Jan | 18.90% | 19.00% | 18.30% | |

| 3:30 | AUD | RBA Interest Rate Decision | 0.10% | 0.10% | 0.10% | |

| 7:45 | EUR | France CPI M/M Jan P | 0.30% | -0.30% | 0.20% | |

| 7:45 | EUR | France CPI Y/Y Jan P | 0.80% | 0.20% | 0.00% | |

| 9:00 | EUR | Italy GDP Q/Q Q4 P | -2.00% | -2.30% | 15.90% | |

| 10:00 | EUR | Eurozone GDP Q/Q Q4 P | -0.70% | -1.80% | 12.50% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals