Selloff in Swiss Franc and Yen is the main focus today. But the forex markets are mixed elsewhere. Commodity currencies are mildly firmer as led by Aussie, but major pairs are just bounded in very tight range at the time of writing. Euro, Sterling and Dollar are mixed for the moment. But the picture could be changed drastically in the US session. Renewed selloff in US stocks could prompt some downside acceleration. Meanwhile, Fed Chair Jerome Powell’s comments on recent developments in yields would be scrutinized.

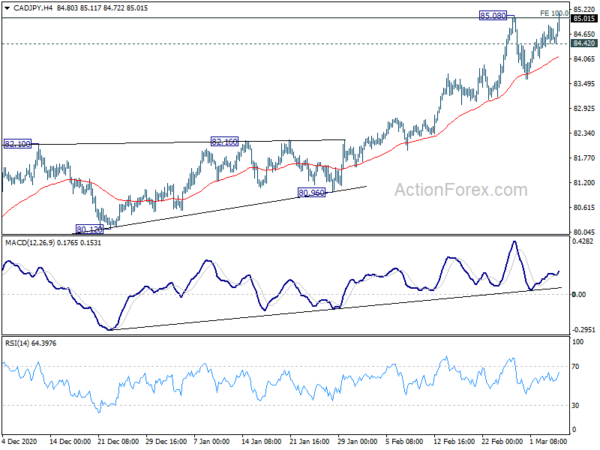

Technically, Canadian Dollar would worth a watch as WTI appears to have defended 58.57 near term support well. Sustained break of 85.08 temporary top in CAD/JPY would confirm up trend resumption. But break of 84.42 minor support will extend the consolidation from 85.08 with another falling leg. EUR/CAD is also under pressure again and sustained break of 1.5208 would finally confirm resumption of fall from 1.5783.

In Europe, currently, FTSE is down -0.40%. DAX is down -0.13%. CAC is down -0.05%. Germany 10-year yield is down -0.017 at -0.303. Earlier in Asia, Nikkei dropped -2.13%. Hong Kong HSI dropped -2.15%. China Shanghai SSE dropped -2.05%. Singapore Strait Times rose 0.48%. Japan 10-year JGB yield rose 0.0164 to 0.140.

US initial jobless claims rose to 745k, slightly below expectations

US initial jobless claims rose 9k to 745k in the week ending February 27, slightly below expectation of 755k. Four-week moving average of initial claims dropped -16.75k to 790.75k. Continuing claims dropped -124k to 4295k in the week ending February 20. Four-week moving average of continuing claims dropped -99k to 4448k.

Also from the US, non-farm productivity dropped -4.2% in Q4. Unit labor costs rose 6.7%. Challenger job cuts dropped -39.1% yoy in February.

From Canada, labor productivity dropped -2.0% qoq in Q4.

Eurozone retail sales dropped -5.9% mom in Jan, EU down -5.1% mom

Eurozone retail sales dropped sharply by -5.9% mom in January, worse than expectation of -1.1% mom. Volume of retail trade decreased by -12.0% mom for non-food products and by -1.1% mom for automotive fuels, while it increased by 1.1% mom for food, drinks and tobacco.

EU retail sales dropped -5.1% mom. Among Member States for which data are available, the largest decreases in total retail trade were registered in Austria (-16.6% mom), Ireland (-15.7% mom) and Slovakia (-11.1% mom). The highest increases were observed in Sweden (+3.5% mom), Bulgaria (+1.8% mom) and Estonia (+1.7% mom).

Eurozone unemployment rate unchanged at 8.1% in Jan, EU at 7.4%

Eurozone unemployment rate was unchanged at 8.1% in January, better than expectation of 8.3%. 13.282 million people in the Eurozone were unemployed, up 8000 from December.

EU unemployment rate was also unchanged at 7.4%. 15.663 million people were unemployed, up 29000 from December.

UK PMI construction rose to 53.3, fastest rise in cost burdens for 12 yrs

UK PMI Construction rose to 53.3 in February, up from 49.2, above expectation of 51.5. Markit said the recovery in total output restarted during the month. Increase in commercial activity helped offset housing slowdown. However, there was fastest rise in cost burdens for more than 12 years.

Tim Moore, Economics Director at IHS Markit: “Construction work regained its position as the fastest growing major category of UK private sector output in February. The rebound was supported by the largest rise in commercial development activity since last September as the successful vaccine rollout spurred contract awards on projects that had been delayed at an earlier stage of the pandemic….

“Stretched supply chains and sharply rising transport costs were the main areas of concern for construction companies in February. Reports of delivery delays remain more widespread than at any time in the 20 years prior to the pandemic, reflecting a mixture of strong global demand for raw materials and shortages of international shipping availability. Subsequently, an imbalance of demand and supply contributed to the fastest increase in purchasing costs across the construction sector since August 2008.”

Australia retail sales rose 0.5% in Jan, trade surplus widened to AUD 10.1B

Australia retail sales rose 0.5% mom in January, slightly below expectation of 0.6% mom. Comparing to a year ago, sales turnover rose 10.6% yoy. All state and territories reported growth, except Queensland with -1.5% mom decline. Western Australia reported strongest sales growth by 2.1% mom, followed by Victoria and Tasmania at 1.0%.

Exports of goods and services rose 6% mom to AUD 39.8B in January. Imports of goods and services dropped -2% mom to AUD 29.7B. Trade surplus widened to AUD 10.1B, above expectation of AUD 6.3B.

RBNZ Orr: We will not be resuming business as previous in its entirety any time soon

RBNZ Governor Adrian Orr said in a speech, the current pic up in economic activity is “sector and event specific”, and “we will not be ‘resuming business as previous’ in its entirety any time soon”.

While the initiation of global vaccination program is positive, “there remains a significant period before widespread immunity is achieved”. In the meantime, “economic uncertainty will remain heightened and international mobility restrictions will continue”.

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9161; (P) 0.9180; (R1) 0.9220; More….

USD/CHF rises to as high as 0.9252 so far today and intraday bias stays on the upside. Next target is 0.9295 resistance and break will carry larger bullish implications. Rise from 0.8756 should then target 61.8% retracement of 0.9901 to 0.8756 at 0.9464. On the downside, break of 0.9135 minor support will turn intraday bias neutral again. But further rally is expected as long as 0.9044 resistance turned support holds.

In the bigger picture, decline from 1.0237 is seen as the third leg of the pattern from 1.0342 (2016 high). Firm break of 0.9295 resistance, and sustained trading above 55 week EMA (now at 0.9227), will suggest that the pattern has completed. In this case, further rise could be seen back to 1.0237/0342 resistance zone in the medium term. Though, rejection by 0.9295 will retain medium term bearishness for 138.2% projection of 1.0342 to 0.9186 from 1.0237 at 0.8639.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | Retail Sales M/M Jan | 0.50% | 0.60% | 0.60% | |

| 00:30 | AUD | Trade Balance (AUD) Jan | 10.14B | 6.30B | 6.79B | 7.13B |

| 05:00 | JPY | Consumer Confidence Index Feb | 33.8 | 30.6 | 29.6 | |

| 09:30 | GBP | Construction PMI Feb | 53.3 | 51.5 | 49.2 | |

| 10:00 | EUR | Eurozone Unemployment Rate Jan | 8.10% | 8.30% | 8.30% | 8.10% |

| 10:00 | EUR | Eurozone Retail Sales M/M Jan | -5.90% | -1.10% | 2.00% | 1.80% |

| 12:30 | USD | Challenger Job Cuts Y/Y Feb | -39.10% | 17.40% | ||

| 13:30 | CAD | Labor Productivity Q/Q Q4 | -2.00% | -2.00% | -10.30% | -10.60% |

| 13:30 | USD | Initial Jobless Claims (Feb 26) | 745K | 755K | 730K | 736K |

| 13:30 | USD | Nonfarm Productivity Q4 | -4.20% | -4.70% | -4.80% | |

| 13:30 | USD | Unit Labor Costs Q4 | 6.00% | 6.70% | 6.80% | |

| 15:00 | USD | Factory Orders M/M Jan | 1.90% | 1.10% | ||

| 15:30 | USD | Natural Gas Storage | -149B | -338B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals