Dollar dropped broadly overnight as markets turned into mild risk-mode following FOMC rate decision. A better economic outlook was painted by the new economic projections. Yet, Fed is clear that it’s not even considering tapering the asset purchases for now. DOW and S&P 500 rose to new record while 10-year yield also closed higher. Commodity currencies are currently the strongest ones for the week. Extra strength is seen in Aussie today after much stronger than expected job numbers. Focus will now turn to BoE rate decision.

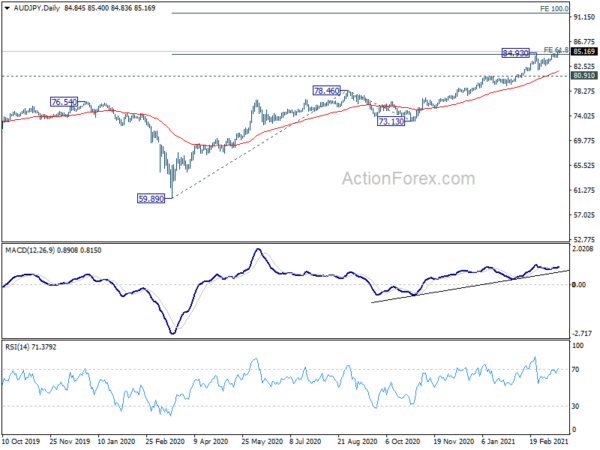

Technically, Australian Dollar could be a focus today. AUD/JPY’s break of 84.93 resistance suggests resumption of up trend from 59.89. Next target is 100% projection of 59.89 to 78.46 from 73.13 at 91.70. Break of 0.7387 minor resistance in AUD/USD will indicate completion of the correction from 0.8006 and bring retest of this high. Break of 1.5250 in EUR/AUD will resume larger down trend from 1.9799. The development in AUD/USD and EUR/AUD could help solidify another round of up trend in Aussie.

In Asia, currently, Nikkei is up 1.07%. Hong Kong HSI is up 1.46%. China Shanghai SSE is up 0.58%. Singapore Strait Times is up 1.14%. Japan 10-year JGB yield is up 0.0128 at 0.106. Overnight, DOW rose 0.58%. S&P 500 rose 0.29%. NASDAQ rose 0.40%. 10-year yield rose 0.020 to 1.641.

FOMC stood pat, projects better outlook

The FOMC rate decision, new economic projections and Chair Jerome Powell’s press conference were generally taken well by investors. Federal funds rate was kept at 0-0.25%. Purchase of treasury securities will continue by at least USD 80B per month, and ABS by at least USD 50B per month. 2021 GDP and inflation forecasts were upgraded, while Fed also expects lower unemployment rate.

Powell said in the post meeting conference that “substantial progress” is needed before policymakers consider dialing back the asset purchases. “Until we give a signal, you can assume we’re not there yet,” he emphasized. “As we approach it, well in advance, well in advance, we will give a signal that yes, we’re on a path to possibly achieve that, to consider tapering.”

On the topic of of rising treasury yields, Powell said “if you look at various indexes of financial conditions, what you’ll see is they generally do show financial conditions overall to be highly accommodative”. He just reiterated that “I would be concerned by disorderly conditions in markets or by persistent tightening of financial conditions that threaten the achievement of our goals.”

Some suggested readings on FOMC:

Australia employment rose 88.7k in Feb, back at pre-pandemic level

Australia employment rose 88.7k in February, well above expectation of 31.5k. Full-time jobs grew 89.1k while part-time jobs dropped -0.5k. Unemployment rate dropped -0.5% to 5.8%, much lower than expectation of 6.3%. Participation rate rose 0.1% to 66.1%. Monthly hours worked rose 102m hours to 1.665m.

Bjorn Jarvis, head of labour statistics at the ABS, said “The strong employment growth this month saw employment rise above 13 million people, and was 4,000 people higher than March 2020.”

New Zealand GDP contracted -1.0% qoq in Q4, a mixed picture at industry level

New Zealand GDP dropped -1.0% qoq in Q1, much worse than expectation of 0.1% qoq. Goods-producing industries dropped -3.2% qoq. Services industries rose a mere 0.1% qoq. Primary industries dropped -0.6% qoq. GDP per capital dropped -1.2% qoq. Over the year to December 2020, annual GDP declined -2.9%.

“Activity in the December quarter shows a mixed picture – some industries are down, but others have held up or risen, despite the ongoing impact of COVID,” national accounts senior manager Paul Pascoe said. At the industry level 7 out of 16 industries declined. The two largest contributors to the drop were construction, and retail trade and accommodation.

Awaits BoE view on recovery, yields and inflation

BoE is generally expected to keep bank rate unchanged at 0.10% today, and hold the QE target at GBP 875B. Both decisions should be by unanimous 9-0 votes. Governor Andrew Bailey sounded upbeat about economy economy in his comments earlier this week, even though that came with “a large dose of caution”. He’s also comfortable with the rise in real interest rates, as that was “consistent with the change in the economic outlook.”

On point to note was chief economist Andy Haldane’s warning on inflation last month. He said, there is a tangible risk inflation proves more difficult to tame, requiring monetary policymakers to act more assertively than is currently priced into financial markets…. the greater risk at present is of central bank complacency allowing the inflationary (big) cat out of the bag.”

We’d watch for clues on the overall views of the MPC on the issue of growth, yields and inflation. But the details might only be provided later in May’s monetary policy report.

Here are some suggested readings on BoE

Elsewhere

Swiss trade balance and PPI, Eurozone trade balance will be featured in European session. Later in the day, Canada will release ADP employment and new housing price index. US will release jobless claims and Philly Fed manufacturing.

AUD/USD Daily Report

Daily Pivots: (S1) 0.7729; (P) 0.7770; (R1) 0.7839; More…

Focus is now on 0.7837 minor resistance with today’s strong rise in AUD/USD. Firm break there will suggest that the correction from 0.8006 has completed. Intraday bias will be turned back to the upside for retesting this high. On the downside, below 0.7620 will target 0.7563 support. Firm break of 0.7563 will indicate that deeper correction is underway, back towards 0.7413 resistance turned support.

In the bigger picture, whole down trend from 1.1079 (2001 high) should have completed at 0.5506 (2020 low) already. Rise from 0.5506 could either be the start of a long term up trend, or a corrective rise. Reactions to 0.8135 key resistance will reveal which case it is. But in any case, medium term rally is expected to continue as long as 0.7413 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | GDP Q/Q Q4 | -1.00% | 0.10% | 14.00% | 13.90% |

| 0:30 | AUD | Employment Change Feb | 88.7K | 31.5K | 29.1K | 29.5K |

| 0:30 | AUD | Unemployment Rate Feb | 5.80% | 6.30% | 6.40% | 6.30% |

| 7:00 | CHF | Trade Balance (CHF) Feb | 4.10B | 5.05B | ||

| 7:30 | CHF | Producer and Import Prices M/M Feb | 0.30% | |||

| 7:30 | CHF | Producer and Import Prices Y/Y Feb | -2.10% | |||

| 10:00 | EUR | Eurozone Trade Balance (EUR) Jan | 28.3B | 27.5B | ||

| 12:00 | GBP | BoE Interest Rate Decision | 0.10% | 0.10% | ||

| 12:00 | GBP | BoE Asset Purchase Facility | 895B | 895B | ||

| 12:00 | GBP | MPC Official Bank Rate Votes | 0–0–9 | 0–0–9 | ||

| 12:00 | GBP | MPC Asset Purchase Facility Votes | 0–0–9 | 0–0–9 | ||

| 12:30 | CAD | ADP Employment Change Feb | -231.2K | |||

| 12:30 | CAD | New Housing Price Index M/M Feb | 0.50% | 0.70% | ||

| 12:30 | USD | Initial Jobless Claims (Mar 12) | 700K | 712K | ||

| 12:30 | USD | Philadelphia Fed Manufacturing Mar | 24.5 | 23.1 | ||

| 14:30 | USD | Natural Gas Storage | -52B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals