Markets are generally mixed as FOMC minutes overnight delivered basically what have be told. Asian stocks are mixed, following the US session. Gold and oil are both stuck in range. In the currency markets, Euro and Swiss Franc are paring some gains. But both stay as the best performer for the week so far. Sterling remains as the weakest, followed by Canadian. Focus will turn to ECB meeting accounts, but that’s also unlikely to trigger much reactions.

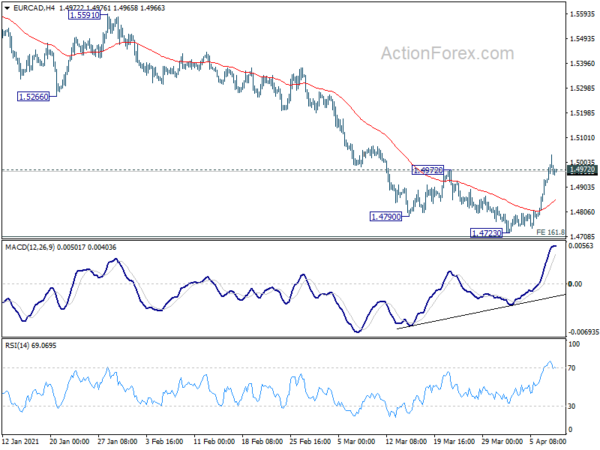

Technically, Euro’s rally is making some progress, as EUR/CAD broke 1.4972 resistance that confirms short term bottoming at 1.4723. EUR/GBP did breached 0.8644 resistance too, but fails to sustain above there so far. Eyes will also be on 1.5605 resistance in EUR/AUD, as well as 130.65 resistance in EUR/JPY. Euro will have to break through these levels to solidify the turnaround.

In Asia, currently, Nikkei is down -0.37%. Hong Kong HSI is up 0.87%. China Shanghai SSE is up 0.19%. Singapore Strait Times is down -0.01%. Japan 10-year JGB yield is down -0.001 at 0.100. Overnight, DOW rose 0.05%. S&P 500 rose 0.15%. NASDAQ dropped -0.07%. 10-year yield dropped -0.003 to 1.653.

Fed minutes: Some time until substantial further progress made

Minutes of March 16-17 FOMC meeting reiterated the assessment that it will take “some time” until “substantial further progress” is made towards Fed’s targets. The asset purchases will continue “at least at the current pace” until then. Also, if there would be any changes in the QE program, they would be communicated to the public “well in advance of time”.

“Participants noted that it would likely be some time until substantial further progress toward the Committee’s maximum-employment and price-stability goals would be realized and that, consistent with the Committee’s outcome-based guidance, asset purchases would continue at least at the current pace until then,” the minutes said.

Additionally, “a number of participants highlighted the importance of the Committee clearly communicating its assessment of progress toward its longer-run goals well in advance of the time when it could be judged substantial enough to warrant a change in the pace of asset purchases.”

“The timing of such communications would depend on the evolution of the economy and the pace of progress toward the Committee’s goals.”

Fed Brainard: Our policy guidance is premised on outcomes, not outlook

Fed Governor Lael Brainard told CNBC that “our monetary policy forward guidance is premised on outcomes not the outlook” Hence, “it is going to be some time before both employment and inflation have achieved the kinds of outcomes that are in that forward guidance.”

She acknowledged that the latest economic forecast is “considerably better outcomes both on growth as well as on employment and inflation.” But she reiterated, “that’s an outlook. We’re going to have to actually see that in the data. When you look at the data, we are still far from our maximum employment goal.”

Brainard also said it’s “really important to recognize” the rise in inflation is “transitory”. “And following those transitory pressures associated with reopening, it’s more likely that the entrenched dynamics that we’ve seen for well over a decade will take over.”

Fed Evans: We have to be patient and bolder on inflation

Chicago Fed President Charles Evans said, “we are going to have to go months and months into the higher inflation experience before I’m going to even have an opinion on whether or not this is sustainable or not, and that’s going to be uncomfortable.”

“We really have to be patient and be willing to be bolder than most conservative central bankers would choose to be if we are going to actually get inflation expectations to move up in a sustainable fashion,” he added.

New Zealand ANZ business confidence dropped to -8.4, stresses and strains starting to show

New Zealand ANZ Business confidence dropped to -8.4 in April, down from -4.1. Own activity outlook dropped slightly to 16.4, down from 16.6. Looking at more details, export intensions rose from 4.5 to 6.6. Investment intentions rose form 11.9 to 12.4. Cost expectations rose from 73.3 to 75.1. Employment intentions dropped slightly from 14.4 to 14.1. Profit expectations dropped notably from -0.6 to -4.3.

ANZ said: “The stresses and strains in the New Zealand economy are starting to show…. rising costs are an economy-wide issue…. It’s inflationary, but not growth-friendly, so the RBNZ will look through it as long as it appears transitory.”

Looking ahead

Germany factory orders, France trade balance, Swiss foreign currency reserves, UK PMI construction and Eurozone PPI will be released in European session. But main focus will likely be on ECB meeting accounts. Later in the day, US will release jobless claims.

AUD/USD Daily Report

Daily Pivots: (S1) 0.7584; (P) 0.7630; (R1) 0.7660; More…

Intraday bias in AUD/USD is turned neutral as it retreated after hitting 0.7667. Another rise is mildly in favor as long as 0.7590 minor support holds. Above 0.7676 will resume the rebound from 0.7530 short term bottom to 0.7848 resistance. Break there should confirm completion of the correction from 0.8006, and bring retest of this high. However, break of 0.7590 minor support will turn bias to the downside for 0.7530 and below, to extend the correction from 0.8006.

In the bigger picture, whole down trend from 1.1079 (2001 high) should have completed at 0.5506 (2020 low) already. Rise from 0.5506 could either be the start of a long term up trend, or a corrective rise. Reactions to 0.8135 key resistance will reveal which case it is. But in any case, medium term rally is expected to continue as long as 0.7413 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | RICS Housing Price Balance Mar | 59.00% | 53.90% | 52.00% | 54.00% |

| 23:50 | JPY | Current Account (JPY) Feb | 1.79T | 1.02T | 1.50T | |

| 1:00 | NZD | ANZ Business Confidence Apr P | -8.4 | 0 | -4.1 | |

| 5:00 | JPY | Eco Watchers Survey: Current Mar | 41.3 | |||

| 5:00 | JPY | Consumer Confidence Index Mar | 35.6 | 33.8 | ||

| 6:00 | EUR | Germany Factory Orders M/M Feb | 1.00% | 1.40% | ||

| 6:45 | EUR | France Trade Balance (EUR) Feb | -3.8B | -3.9B | ||

| 7:00 | CHF | Foreign Currency Reserves (CHF) Mar | 914B | |||

| 8:30 | GBP | Construction PMI Mar | 55 | 53.3 | ||

| 9:00 | EUR | Eurozone PPI M/M Feb | 1.20% | 1.40% | ||

| 9:00 | EUR | Eurozone PPI Y/Y Feb | 0.00% | |||

| 11:30 | EUR | ECB Monetary Policy Meeting Accounts | ||||

| 12:30 | USD | Initial Jobless Claims (Apr 2) | 650K | 719K | ||

| 14:30 | USD | Natural Gas Storage | 14B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals