Canadian Dollar jumps broadly in early US session, with help from much better than expected job data. Dollar is following as second strongest for today, paring some of this week’s losses. On the other hand, Yen and Euro, turn weaker, other with Aussie. Overall, it appears that traders are generally taking profits from prior moves in the week, avoiding to commit to the positing through the weekend.

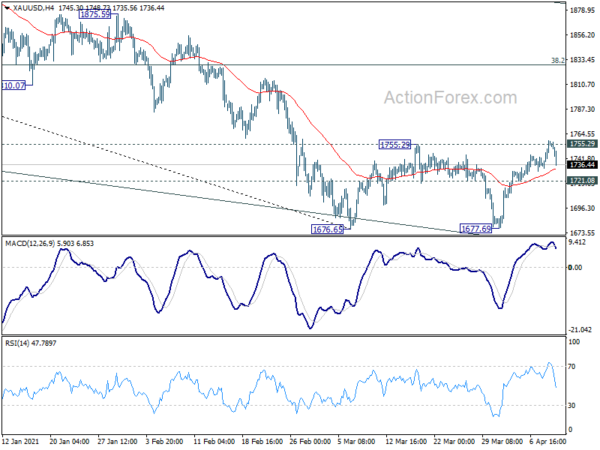

Technically, USD/JPY’s break of 109.93 minor resistance in USD/JPY suggests that pull back from 110.05 has completed at 108.99. Eyes will be on corresponding level of 1.1821 minor support in EUR/USD. and 0.9350 minor resistance in USD/CHF. Gold appears to have failed 1755.29 neckline resistance as well as the double bottom pattern. Break of 1721.08 minor support will retain near term bearishness, and bring retest of 1676.65 low.

In Europe, currently, FTSE is down -0.16%. DAX is up 0.13%. CAC is up 0.27%. Germany 10-year yield is up 0.0469 at -0.286, back above -0.3 handle. Earlier in Asia, Nikkei rose 0.20%. Hong Kong HSI dropped -1.07%. China Shanghai SSE dropped -0.92%. Singapore Strait Times dropped -0.06%.

Canada employment grew 303k in Mar, unemployment rate dropped to 7.5%

Canada employment grew 303k, or 1.6% mom in March, well above expectation of 90k. Full time employment rose 175k while part-time employment rose 128k. Employment was then within 1.5% of its prepandemic level in February 2020. Unemployment rate dropped sharply by -0.7% to 7.5%, below expectation of 8.0%. That’s also the lowest level since February 2020.

Fed Clarida: Most of early rise in inflation will revert by year-end

Fed Vice Chair Richard Clarida said in a Bloomberg TV interview that there is a lot of “pent-demand” as well as “pent-up supply” in the economy. Both supply and demand will be in play as the year progresses. The “baseline expectation” is that most of the early rise in inflation this year will “revert by year-end”.

“If inflation at the end of the year has not declined from where it is at the middle of the year might be ‘good evidence’ of inflation that is not transitory,” he added.

Also, Clarida reiterated that “substantial progress is actual progress.” Fed will inform the public about the progresses “as we go through the year”. “We will have ample opportunities as data comes in to inform Fed observers on our progress”, he said.

ECB Schnabel: It’s a economic disaster if EU pandemic recovery fund is delayed

ECB Executive Board member Isabel Schnabel warned in a Der Spiegel interview, “it would be an economic disaster for Europe if the disbursement of the funds were to be delayed indefinitely.” She referred to the EUR 750B EU pandemic response stimulus. The ratification of the measures is temporarily blocked in Germany. “If that were the case, Europe would have to think about alternative solutions, but that could take some time.”

Regarding surging stocks and real-estate markets, Schnabel also warned, “the risks of a correction are increasing, especially if the economic recovery falls short of expectation.”

Separately, Vice President Luis De Guindos said he saw the risk of “negative feedback loop between companies, banks and sovereigns.” He warned that withdrawal of stimulus must be “careful”.

Released in European session, Italy retail sales rose 6.6% mom in February, above expectation of 2.0% mom. France industrial output dropped -4.7% mom in February, below expectation of 0.5% mom. Germany industrial production dropped -1.6% mom in February, versus expectation of 1.5% mom. Germany trade surplus narrowed to EUR 19.1B, below expectation of EUR 23.4B. Swiss unemployment rate dropped to 3.3% mom in March, down from 3.6%, better than expectation of 3.6%.

Australia AiG services rose to 58.7 in Mar, highest since Jun 2018

Australia Performance of Services Index rose 2.9 pts to 58.7 in March. That’s the highest monthly result since June 2018. All five services sectors indicated “strong rates of recovery”. Four activity indicators – sales, new orders, stocks and deliveries – showed “robust recovery”. However, Employment index indicated “stably or mildly decreasing employment”.

Ai Group Chief Executive, Innes Willox, said: “While areas of vulnerability clearly remain, the strong lift in new orders is an encouraging sign that the services sector as a whole is well positioned to work through the winding down of fiscal stimulus in the next few months.”

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 108.87; (P) 109.39; (R1) 109.77; More…

USD/JPY’s breach of 109.93 minor resistance suggests that corrective pull back from 110.95 has completed at 108.99. Intraday bias is back on the upside for retesting 110.95 high first. On the downside, break of 108.99 will extend the correction to 108.40 support and possibly below. But downside should be contained by 38.2% retracement of 102.58 to 110.95 at 107.75 to bring rebound.

In the bigger picture, current development suggests that the corrective down trend from 118.65 (Dec 2016) has completed at 101.18. Firm break of 112.22 resistance should confirms this bullish case. A medium term up trend could then has started for 100% projection of 101.18 to 111.71 from 102.58 at 113.11 and then 161.8% projection at 119.61. However, rejection by 111.71, followed by sustained trading below 55 day EMA (now at 107.67), will dampen the bullish view and keep medium term outlook neutral first.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Services Index Mar | 58.7 | 55.8 | ||

| 01:30 | CNY | CPI Y/Y Mar | 0.40% | 0.30% | -0.20% | |

| 01:30 | CNY | PPI Y/Y Mar | 4.40% | 3.50% | 1.70% | |

| 05:45 | CHF | Unemployment Rate Mar | 3.30% | 3.60% | 3.60% | |

| 06:00 | EUR | Germany Industrial Production M/M Feb | -1.60% | 1.50% | -2.50% | |

| 06:00 | EUR | Germany Trade Balance (EUR) Feb | 19.1B | 23.4B | 22.2B | |

| 06:45 | EUR | France Industrial Output M/M Feb | -4.70% | 0.50% | 3.30% | 3.20% |

| 08:00 | EUR | Italy Retail Sales M/M Feb | 6.60% | 2.00% | -3.00% | -2.70% |

| 11:00 | GBP | BoE Quarterly Bulletin | ||||

| 12:30 | USD | PPI M/M Mar | 1.00% | 0.50% | 0.50% | |

| 12:30 | USD | PPI Y/Y Mar | 4.20% | 3.80% | 2.80% | |

| 12:30 | USD | PPI Core M/M Mar | 0.70% | 0.20% | 0.20% | |

| 12:30 | USD | PPI Core Y/Y Mar | 3.10% | 2.70% | 2.50% | |

| 12:30 | CAD | Net Change in Employment Mar | 303.1K | 90.0K | 259.2K | |

| 12:30 | CAD | Unemployment Rate Mar | 7.50% | 8.00% | 8.20% | |

| 14:00 | USD | Wholesale Inventories Feb F | 0.50% | 0.50% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals