Dollar trades mildly lower entering into US session, after US FDA and CDC recommend pause of J&J COVID-19 vaccines on blood clot issue. DOW futures also turn south and point to slightly lower open. Meanwhile, UK Prime Minister Boris Johnson also warned that the fall in infections was due to lockdown, but not vaccinations. At the time of writing, Canadian is the weakest, followed by Sterling and Aussie. Yen is the strongest, followed by Euro and Swiss. Dollar is mixed despite slightly stronger than expected CPI.

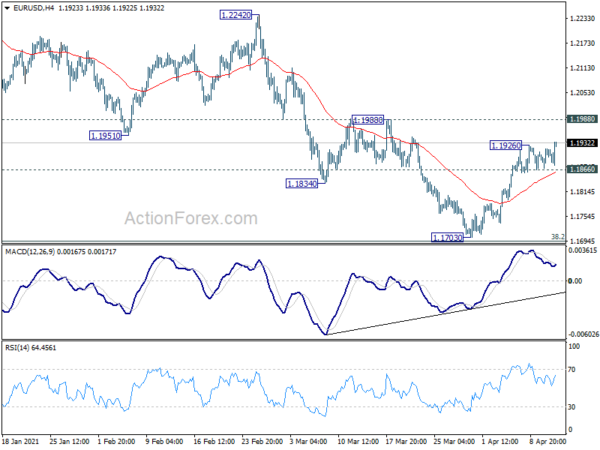

Technically, EUR/USD’s break of 1.1926 temporary top suggests resumption of rebound form 1.1703 towards 1.1988 resistance. Eyes are now on 0.8696 temporary top in EUR/GBP, and break will resume the rebound from 0.8696. EUR/JPY might also have another take on 130.65 resistance.

In Europe, currently, FTSE is down -0.10%. DAX is up 0.24%. CAC is up 0.30%. Germany 10-year yield is up 0.009 at -0.283. Earlier in Asia, Nikkei rose 0.72%. Hong Kong HSI rose 0.15%. China Shanghai SSE dropped -0.48%. Singapore Strait Times rose 0.44%. 10-year JGB yield dropped -0.0074 to 0.103.

US CPI accelerated to 2.6% yoy, core CPI up to 1.6% yoy

US CPI rose 0.6% mom in March, above expectation of 0.5% mom. That’s the highest 1-month increase since August 2012. Core CPI, all items less food and energy, rose 0.3% mom, above expectation of 0.2% mom.

Annually, headline CPI accelerated to 2.6% yoy, up from 1.7% yoy, above expectation of 2.5% yoy. Core CPI accelerated to 1.6% yoy, up from 1.3% yoy, matched expectations.

German ZEW economic sentiment dropped to 70.0, somewhat less euphoric

German ZEW Economic Sentiment dropped to 70.7 in April, down from 76.6, below expectation of 79.5. That’s the first decline since November. Current Situation index improved to -48.8, up from -61.0, above expectation of -52.0. Eurozone ZEW Economic Sentiment dropped to 66.3, down from 74.0, below expectation of 73.2. Current Situation index rose 4.3 pts to -65.5.

“The financial market experts are somewhat less euphoric than in the previous month. The ZEW Indicator of Economic Sentiment is, however, still at a very high level and the current situation is assessed much more positively than in March. Fears of a stricter lockdown have led to a decline in expectations for private consumption. Nevertheless, the outlook for exports is better than in the previous month,” ZEW President Professor Achim Wambach comments on the current expectations.

UK GDP grew 0.4% mom in Feb, still down -3.1% from Oct recovery peak

UK GDP grew 0.4% mom in February, below expectation of 0.6% mom. Service sector grew 0.2% mom. Production grew 1.0%, with manufacturing up 1.3% mom. Construction grew 1.6% mom.

Comparing to pre-pandemic level seen in February 2020, overall GDP was still down -7.8%. Services was down -8.8%. Production down -3.5%, with manufacturing down -4.2%. Construction was down -4.3%.

Comparing to initial recovery peak in October 2020, overall GDP was down -3.1%. Services was down -3.9%. Production was flat, with manufacturing down -0.3%. Construction was flat.

Also released, goods trade deficit widened to GBP -16.4B in February, larger than expectation of GBP -10.4B.

NIESR: UK GDP to grow 1.8% in March, 2.2% in April

NIESR said UK’s GDP is likely to have contracted by -1.5% qoq in Q1, with 1.8% mom growth in March. April is forecast to see GDP growth of 2.2% mom, driven by partial re-opening of pubs and restaurants. Assuming continuation of vaccination and re-opening, first estimate of Q2 GDP growth is 4.6% qoq, driven by pent-up demand and a return towards pre-Covid levels in the hospitality and retail sectors.

Rory Macqueen Principal Economist – Macroeconomic Modelling and Forecasting: “Despite little change in restrictions, a return to growth in February and upward revisions to January GDP mean that the contraction in the first quarter will be much smaller than anticipated….

“if the vaccine programme and lifting of restrictions continue on schedule this provides a firm basis for continuing growth in the second quarter and 2021 overall. The third wave in Europe and the success of other countries in vaccinating their populations will also have relevance for the recovery of the UK, as an open economy.”

BoJ Kuroda: There’s quite a lot of positives from a weak yen

BoJ Governor Haruhiko Kuroda told the parliament today that there’s “quite a lot of positives for Japan from a weak Yen”. Companies with overseas profit could have their yen-denominated value increase from a lower yen. Nevertheless, a weak Yen might not boost export as much as the part, because many manufacturers now produce goods locally in the overseas markets.

Though, Kuroda also emphasized the important for exchange rates to move at equilibrium levels. It’s “not as if the weaker the yen the better, or the stronger the better”.

China exports rose 30.6% yoy in Mar, imports rose 38.1%

In March, in USD term, China’s export grew 30.6% yoy to USD 241.1B. Imports rose 38.1% yoy to 227.3B. Trade surplus came in at USD 13.8B, well below expectation of USD 52.0B. From January to March, exports rose 49.0% yoy to USD 710.0B. Imports rose 28.0% yoy to USD 593.6B. Trade surplus was at USD 116.4B.

From January to March, exports to EU rose 56.7% yoy to USD 110.2B. Imports from EU rose 33.0% yoy to USD 73.4B. Exports to US rose 74.7% yoy to 119.2B. Imports from US rose 69.2% to 46.5B. Exports to Australia rose 50.5% yoy to USD 14.1B. Imports form AU rose 20.9% yoy to USD 33.7B.

Australia NAB business conditions rose to 25, record high

Australia NAB business conditions rose from 17 to 25 in March, hitting a record high. The rise was driven by strong increases in all sub-components. Looking at some details, trading condition rose from 23 to 35. Profitability condition rose from 18 to 26. Employment condition rose from 9 to 16. Forward orders rose from 10 to 17. Business confidence dropped to from 18 to 15, but remains well above its long-run average.

NAB said, “This is a very solid survey result. Businesses are telling us activity continues to increase at a very healthy rate as we have move past the rebound phase in activity with the earlier removal of pandemic-related restrictions. Overall, the recovery over the last year has been much more rapid than anyone could have forecast.”

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1882; (P) 1.1900; (R1) 1.1930; More….

EUR/USD’s break of 1.1926 temporary top suggests resumption of rebound from 1.1703. Intraday bias is back on the upside for 1.1988 resistance. Firm break there should affirm the case that correction from 1.2348 has completed at 1.1703. EUR/USD should then target 1.2242 key resistance for confirmation. On the downside, below 1.1866 minor support will turn bias back to the downside back to 38.2% retracement of 1.0635 to 1.2348 at 1.1694.

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. However, sustained break of 1.1602 will argue that whole rise from 1.10635 has completed. Deeper fall would be seen to 61.8% retracement of 1.0635 to 1.2348 at 1.1289.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:00 | NZD | NZIER Business Confidence Q1 | -13 | -6 | ||

| 23:01 | GBP | BRC Retail Sales Monitor Y/Y Mar | 20.30% | 11.90% | 9.50% | |

| 23:50 | JPY | Money Supply M2+CD Y/Y Mar | 9.50% | 9.60% | 9.60% | |

| 01:30 | AUD | NAB Business Confidence Mar | 15 | 16 | 18 | |

| 01:30 | AUD | NAB Business Conditions Mar | 25 | 15 | ||

| 03:00 | CNY | Trade Balance (USD) Mar | 13.8B | 52.0B | 103.3B | |

| 03:00 | CNY | Imports (USD) Y/Y Mar | 38.10% | 21.60% | 22.20% | |

| 03:00 | CNY | Exports (USD) Y/Y Mar | 30.60% | 32.70% | 60.60% | |

| 03:00 | CNY | Trade Balance (CNY) Mar | 88B | 330B | 676B | |

| 03:00 | CNY | Imports (CNY) Y/Y Mar | 27.70% | 10.30% | ||

| 03:00 | CNY | Exports (CNY) Y/Y Mar | 20.70% | 139.50% | ||

| 06:00 | EUR | Germany Wholesale Price Index M/M Mar | 1.70% | 0.60% | 1.40% | |

| 06:00 | GBP | GDP M/M Feb | 0.40% | 0.60% | -2.90% | -2.20% |

| 06:00 | GBP | Industrial Production M/M Feb | 1.00% | 0.50% | -1.50% | -1.80% |

| 06:00 | GBP | Industrial Production Y/Y Feb | -3.50% | -4.40% | -4.90% | -4.30% |

| 06:00 | GBP | Manufacturing Production M/M Feb | 1.30% | -0.80% | -2.30% | -1.80% |

| 06:00 | GBP | Manufacturing Production Y/Y Feb | -4.20% | -5.10% | -5.20% | -5.00% |

| 06:00 | GBP | Index of Services 3M/3M Feb | -1.90% | -2.30% | -2.40% | -1.90% |

| 06:00 | GBP | Goods Trade Balance (GBP) Feb | -16.4B | -10.4B | -9.8B | -12.6B |

| 08:00 | EUR | Italy Industrial Output M/M Feb | 0.20% | 0.60% | 1.00% | 1.10% |

| 09:00 | EUR | Germany ZEW Economic Sentiment Apr | 70.7 | 79.5 | 76.6 | |

| 09:00 | EUR | Germany ZEW Current Situation Apr | -48.8 | -52 | -61 | |

| 09:00 | EUR | Eurozone ZEW Economic Sentiment Apr | 66.3 | 73.2 | 74 | |

| 10:00 | USD | NFIB Business Optimism Index Mar | 98.2 | 98.2 | 95.8 | |

| 12:30 | USD | CPI M/M Mar | 0.60% | 0.50% | 0.40% | |

| 12:30 | USD | CPI Y/Y Mar | 2.60% | 2.50% | 1.70% | |

| 12:30 | USD | CPI Core M/M Mar | 0.30% | 0.20% | 0.10% | |

| 12:30 | USD | CPI Core Y/Y Mar | 1.60% | 1.60% | 1.30% | |

| 12:30 | GBP | NIESR GDP Estimate (3M) Mar | -1.50% | -2.00% | -1.60% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals