Australian Dollar tumbles broadly in Asian session after weaker than expected CPI data. Sterling is following as the second weakest , and then New Zealand Dollar. Dollar firms up mildly as traders await FOMC rate decision, but the rebound is mainly centered against Yen and Aussie. Indeed, Yen was under some notable selling pressure overnight as US treasury yields rebounded.

Technically, EUR/JPY’s break of 130.95 resistance indicates resumption of larger up trend from 114.42. USD/JPY’s break of 108.53 minor resistance also indicates short term bottoming at 107.47. Stronger rebound would be seen back towards 109.95 resistance. CAD/JPY, the relatively stronger one, is also now in focus as it’s heading back to retest 88.28 high. Firm break there will resume larger rise from 77.91.

In Asia, at the time of writing, Nikkei is up 0.31%. Hong Kong HSI is up 0.13%. China Shanghai SSE is down -0.04%. Singapore Strait Times is down -0.08%. Japan 10-year JGB yield is up 0.0058 at 0.091. Overnight, DOW rose 0.01%. S&P 500 dropped -0.02%. NASDAQ dropped -0.34%. 10-year yield rose 0.052 to 1.622.

Australia CPI rose 0.6% qoq in Q1, missed expectations

Australia CPI rose 0.6% qoq in Q1, well below expectation of 0.9% qoq. Annually, CPI accelerated to 1.1% yoy, up from 0.9% yoy, but missed expectation of 1.4% yoy. At the all groups level, the CPI rose in all eight capital cities, ranging from 0.3% in Melbourne to 1.4% in Perth and 2.6% in Darwin.

Head of Prices Statistics at the ABS, Michelle Marquardt said: “Higher fuel prices, compared with the low prices seen in 2020, accounted for much of the rise in the March quarter CPI.”

Also released, goods exports rose 15% mom to AUD 36.2B in March. Goods imports rose 15% mom to AUD 27.8B. Goods trade surplus widened slightly to AUD 8.5B.

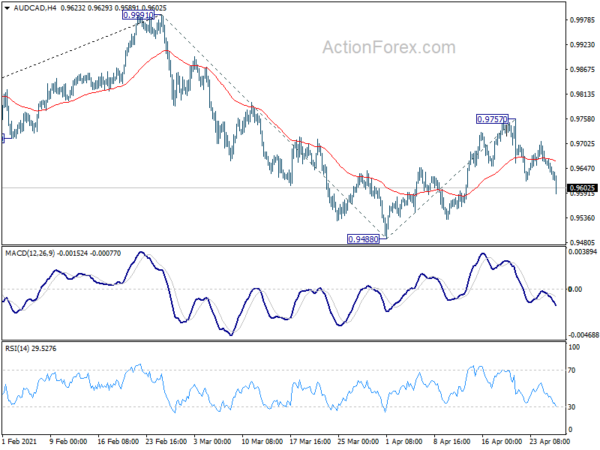

Aussie drops after CPI miss, AUD/CAD heading to 0.9488 support first

Australian Dollar dips notably after weaker than expected consumer inflation data. AUD/CAD’s recovery from 0.9488 could have already completed at 0.9757. Deeper fall could be seen back towards 0.9488 support. Break there will resume the whole decline from 0.9991.

But overall, the fall from 0.9991 is seen as a correction to the up trend from 0.8058 only. Hence, in case of downside extension, strong support should be seen from 0.9247 cluster support level to contain downside and bring rebound. This level coincides with 38.2% retracement of 0.8058 to 0.9991 at 0.9253, as well as 100% projection of 0.9991 to 0.9488 from 0.9757 at 0.9254.

BoC Macklem: Further QE adjustments will be gradual and deliberated

BoC Governor Tiff Macklem told the House of Commons Standing Committee on Finance that “the economy is making good progress”. But “a complete recovery will still take some time” with the third wave of coronavirus a new set back. BoC remains “steadfast in our commitment to support Canadian households and businesses through the full length of the recovery”.

With vaccinations progressing, he added, “we are expecting strong consumption-led growth in the second half of this year”. Inflation would increase over the next couple of months largely reflecting “base-year effects” and rise is gasoline prices. But inflation would only return to target as slack is absorbed in H2 of 2022.

The reduction of weekly QE purchase from CAD 4B to CAD 3B reflects the progress made toward economic recovery. Macklem noted, “further adjustments to the pace of net purchases will be guided by our ongoing assessment of the strength and durability of the economic recovery”. Also, “further adjustments to our QE program will be gradual, and we will be deliberate in both our assessment of incoming data and the communication of our analysis.”

FOMC to emphasize substantial actual progress before tapering

Fed is widely expected to keep monetary policy unchanged today. Fed funds rate target will be held at 0-0.25%. QE will continue with the same monthly pace at USD 80B in of treasury securities and USD 40B of MBS. FOMC statement will reiterate that QE will continue until “substantial further progress” has been made.

Fed Chair Jerome Powell could sound a bit more upbeat in the press conference. Though, he would reiterate that Fed is not even thinking about tapering for the moment. He would also emphasize that policymakers need to see improvement in economic actual data, rather than outlook, before removing stimulus.

Here are some previews:

Elsewhere

Japan retail sales rose 5.2% yoy in March, above expectation of 4.7% yoy. Germany will release Gfk consumer sentiment in European session, with Swiss Credit Suisse economic expectations. Canada will release retail sales later in the day. US will also release goods trade balance and oil inventories.

EUR/JPY Daily Outlook

Daily Pivots: (S1) 130.87; (P) 131.19; (R1) 131.80; More….

EUR/JPY’s break of 130.95 confirms up trend resumption. Intraday bias is now back on the upside. Rise form 114.42 should now target 100% projection of 114.42 to 127.07 from 121.63 at 134.28. On the downside, break of 129.57 support is needed to indicate short term topping. Otherwise, outlook will remain bullish in case of retreat.

In the bigger picture, rise from 114.42 is seen as a medium term rising leg inside a long term sideway pattern. Further rise is expected as long as 127.07 resistance turned support holds. Next target is 137.49 (2018 high). Decisive break there will open up the possibility that it’s indeed resuming the up trend from 94.11 (2012 low).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | BRC Shop Price Index Y/Y Mar | -1.30% | -2.40% | ||

| 23:50 | JPY | Retail Trade Y/Y Mar | 5.20% | 4.70% | -1.50% | |

| 01:30 | AUD | CPI Q/Q Q1 | 0.60% | 0.90% | 0.90% | |

| 01:30 | AUD | CPI Y/Y Q1 | 1.10% | 1.40% | 0.90% | |

| 01:30 | AUD | RBA Trimmed Mean CPI Q/Q Q1 | 0.30% | 0.50% | 0.40% | |

| 01:30 | AUD | RBA Trimmed Mean CPI Y/Y Q1 | 1.10% | 1.20% | 1.20% | |

| 06:00 | EUR | Germany Gfk Consumer Confidence May | -4.8 | -6.2 | ||

| 08:00 | CHF | Credit Suisse Economic Expectations Apr | 66.7 | |||

| 12:30 | CAD | Retail Sales M/M Feb | 4.00% | -1.10% | ||

| 12:30 | CAD | Retail Sales ex Autos M/M Feb | 3.50% | -1.20% | ||

| 12:30 | USD | Wholesale Inventories Mar P | 0.10% | 0.60% | ||

| 12:30 | USD | Goods Trade Balance (USD) Mar P | -87.5B | -86.7B | ||

| 14:30 | USD | Crude Oil Inventories | -0.9M | 0.6M | ||

| 18:00 | USD | Fed Rate Decision | 0.25% | 0.25% | ||

| 18:30 | USD | FOMC Press Conference |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals