Return of risk-appetite pushed DOW to new record overnight while Asian markets also firm up. Dollar was under some selling pressure, but it’s still kept in range against except versus Swiss Franc and Canadian Dollar. Focus will turn to non-farm payroll report from today. A strong set of data would prompt more risk-on sentiments and give additional pressure to the greenback. On the other hand, commodity currencies would look into overall sentiments to help secure their positions as the best performers for the week.

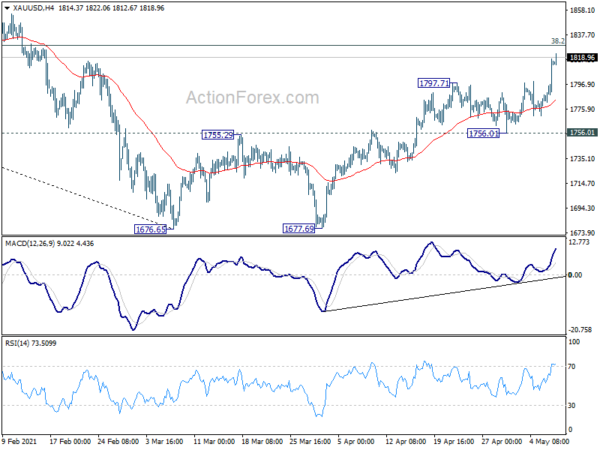

Technically, USD/CHF’s break of 0.9079 temporary low suggests down trend resumption. USD/CAD is also extending recent decline to as low as 1.2140. Break of 1.2075 minor resistance in EUR/USD would argue that up trend is ready to resume through 1.2149 resistance. That might spillover to other Dollar pairs, in particular GBP/USD and AUD/USD. Meanwhile, Gold has already taken out 1797.71 resistance, accompanying Dollar’s selloff. Focus will now turn to 1828 fibonacci level.

In Asia, at the time of writing, Nikkei is up 0.19%. Hong Kong HSI is up 0.52%. China Shanghai SSE is up 0.42%. Singapore Strait Times is up 0.68%. Japan 10-year JGB yield is down -0.0001 at 0.090. Overnight, DOW rose 0.93%. S&P 500 rose 0.82%. NASDAQ rose 0.37%. 10-year yield dropped -0.023 to 1.561.

RBA discussed upside and downside scenarios in SoMP

In the Statement on Monetary Policy, RBA reiterated that it’s “committed to maintaining highly supportive monetary conditions to support a return to full employment in Australia and inflation consistent with the target”. The conditions for raising the cast rate is unlikely to be met “until 2024 at the earliest”.

RBA also discussed both an upside and a downside scenario. In the upside scenario, stronger household consumption and reduced uncertainty about the outlook would “underpin faster growth in business investment and employment” and “puts additional downward pressure on the unemployment rate”. Unemployment would fall below 4%, and inflation back within target range by mid-2023.

On the other hand, in the downside scenario, household prefer to continue strengthening their balance sheets. Lower consumption growth would weigh on business income, and prompting delay in investment, as well as slower employment growth. Unemployment rate will remain at around 5.25-5.50%, while underlying inflation will remain below 2%.

Also from Australia, AiG Performance of Services index rose 2.3 pts to 61.0 in April. That’s the highest reading since October 2003. All five of the services sectors available in the Australian PSI in April indicated expansion, with results above 50 points (trend). All five activity indicators – sales, new orders, employment, stocks and deliveries – showed positive and improving results in the month (results above 50 points and rising from last month, seasonally adjusted).

China Caixin PMI services rose to 56.3, composite rose to 54.7

China Caixin PMI Services rose to 56.3 in April, up from 54.3, above expectation of 54.2. There was steeper increase in activity amid strongest upturn in sales for five months. Quicker rise in employment helped easing capacity pressures. Optimism towards the year ahead remained historically sharp. PMI Composite rose to 54.7, up from 53.1.

Wang Zhe, Senior Economist at Caixin Insight Group said: “To sum up, the post-epidemic manufacturing and services recovery accelerated as both supply and demand expanded. Business confidence was high amid strong overseas demand and improved employment. Services recovered faster than manufacturing. Inflation will be a focus in the future. Inflationary pressure was evident as input costs and output prices in manufacturing and services have continued to increase for several months.”

China exports rose 32.3% yoy in Apr, imports up 43.1% yoy, surplus swelled to USD 42.9B

In USD term, in April, China’s total trade rose 37.0% yoy to USD 485B. Exports rose 32.3% yoy to USD 264B. Imports rose 43.1% yoy to USD 221B. Trade surplus came in at USD 42.9B, up from March’s 13.8B, well above expectation of USD 28.0B.

Year to date in April, total trade rose 38.2% yoy to USD 1789B. Exports rose 44.0% yoy to 974B. Imports rose 31.9% yoy to 816B. Trade surplus came in at USD 158B.

- YTD with EU, total trade rose 38.2% yoy to USD 250B. Exports rose 46.6% to USD 150B. Imports rose 35.7% to USD 100B.

- YTD with US, total trade rose 61.8% yoy to USD 222B. Exports rose 60.8% yoy to USD 161B. Imports rose 64.7% yoy to USD 60B.

- YTD with Australia, total trade rose 32.0% yoy to USD 68.1B. Exports rose 40.9% yoy to USD 19.3B. Imports rose 28.7% yoy to USD 48.8B.

DOW hits new record as focus turns to non-farm payrolls

US non-farm payroll report will be a main focus today. Markets are expecting strong 950k growth in April, with unemployment rate down from 6.0% to 5.7%. Average hourly earnings are expected to rise 0.1% mom. Looking at related data, ISM manufacturing dropped from 59.6 to 55.1, but stayed well in expansion. ISM services employment rose from 57.2 to 58.8. ADP employment showed 742k growth. Four-week moving average of initial claims dropped to 560k. Overall, it’s just a matter of how strong the job market rebound had been.

DOW outperformed other major US indices and surged 0.93% to new record high at 34548.53 overnight. The strong close suggests that up trend is maintaining solid momentum. We’d expect current rise to target 100% projection of 18213.65 to 29199.35 from 26143.77 at 37129.47 next. In any case, outlook will stay bullish as long as 33687.01 support holds.

Elsewhere

Japan labor cash earnings rose 0.2% yoy in March versus expectation of -0.5% yoy. Monetary base rose 24.3% yoy in April versus expectation of 21.9% yoy.

Swiss unemployment rate and foreign currency reserves, Germany industrial production and trade balance, France industrial output and trade balance, Italy retail sales, and UK construction PMI will be released in European session.

Later in the day, in addition to US NFP, Canada will also release employment data and Ivey PMI.

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.2099; (P) 1.2193; (R1) 1.2245; More…

USD/CAD’s decline extends to as low as 1.2140 so far, just inch above 100% projection of 1.2880 to 1.2363 from 1.2653 at 1.2136. Intraday bias stays on the downside for the moment. Next target is long term cluster support at 1.2061. We’d be cautious on strong support from there to bring reversal. On the upside, break of 1.2265 minor resistance will turn bias to the upside to for rebound back to 55 day EMA (now at 1.2510). However, sustained break of 1.2061 will carry larger bearish implications. Next near term target will be 161.8% projection at 1.1816.

In the bigger picture, fall from 1.4667 is seen as the third leg of the corrective pattern from 1.4689 (2016 high). Further decline should be seen back to 1.2061 (2017 low). We’d look for strong support from there to bring rebound. Nevertheless, sustained break of 1.2653 resistance is needed to be the first sign of medium term bottoming. Otherwise, outlook will remain bearish in case of strong rebound. Also, sustained break of 1.2061 will pave the way to 61.8% retracement of 0.9406 to 1.4689 at 1.1424.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Services Index Apr | 61 | 58.7 | ||

| 23:30 | JPY | Labor Cash Earnings Y/Y Mar | 0.20% | -0.50% | -0.40% | |

| 23:50 | JPY | Monetary Base Y/Y Apr | 24.30% | 21.90% | 20.80% | |

| 01:30 | AUD | RBA Monetary Policy Statement | ||||

| 01:45 | CNY | Caixin Services PMI Apr | 56.3 | 54.2 | 54.3 | |

| 03:00 | NZD | RBNZ Inflation Expectations Q/Q Q2 | 2.05% | 1.89% | ||

| 03:03 | CNY | Trade Balance (USD) Apr | 42.9B | 28.0B | 13.8B | |

| 03:03 | CNY | Imports (USD) Y/Y Apr | 43.10% | 23.30% | 38.10% | |

| 03:03 | CNY | Exports (USD) Y/Y Apr | 32.30% | 35.50% | 30.60% | |

| 03:03 | CNY | Trade Balance (CNY) Apr | 276.5B | 88B | ||

| 03:03 | CNY | Imports (CNY) Y/Y Apr | 32.20% | 12.60% | 27.70% | |

| 03:03 | CNY | Exports (CNY) Y/Y Apr | 22.20% | 30.70% | 20.70% | |

| 05:45 | CHF | Unemployment Rate M/M Apr | 3.60% | 3.30% | ||

| 06:00 | EUR | Germany Industrial Production M/M Mar | 2.00% | -1.60% | ||

| 06:00 | EUR | Germany Trade Balance (EUR) Mar | 22.3B | 19.1B | ||

| 06:45 | EUR | France Trade Balance (EUR) Mar | -5.4B | -5.2B | ||

| 06:45 | EUR | France Industrial Output M/M Mar | 2.00% | -4.70% | ||

| 07:00 | CHF | Foreign Currency Reserves (CHF) Apr | 930B | |||

| 08:00 | EUR | Italy Retail Sales M/M Mar | -1.50% | 6.60% | ||

| 08:30 | GBP | Construction PMI Apr | 62.5 | 61.7 | ||

| 12:30 | CAD | Net Change in Employment Apr | -160.5K | 303.1K | ||

| 12:30 | CAD | Unemployment Rate Apr | 7.80% | 7.50% | ||

| 12:30 | USD | Nonfarm Payrolls Apr | 950K | 916K | ||

| 12:30 | USD | Unemployment Rate Apr | 5.70% | 6.00% | ||

| 12:30 | USD | Average Hourly Earnings M/M Apr | 0.10% | -0.10% | ||

| 14:00 | USD | Wholesale Inventories Mar F | 1.40% | 1.40% | ||

| 14:00 | CAD | Ivey PMI Apr | 67 | 72.9 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals