Dollar rebound strongly in early US session after much stronger than expected consumer inflation data. But Canadian Dollar is even stronger with help from extended rebound in oil price. Sterling is the third strongest, as supported by stronger than expected GDP. On the other hand, New Zealand and Australian Dollar are under most selling pressure as stock selloff is back. Euro and Yen are also weak.

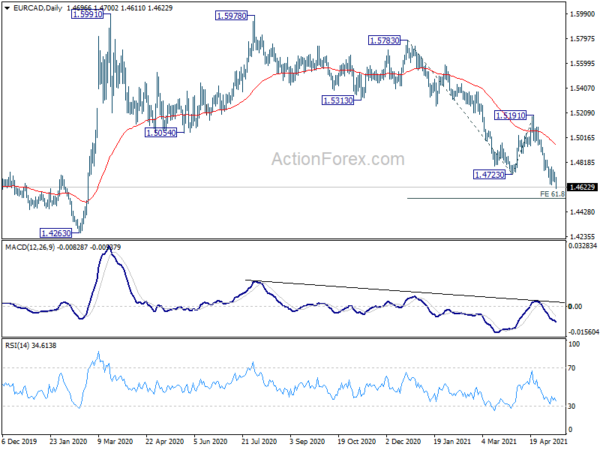

Technically, there is not follow through buying in Dollar after initial spike. We’d still prefer to see 4 hour 55 EMA in EUR/USD at 1.2094, and 4 hour 55 EMA in USD/CHF at 0.9073, taken out firmly before considering the sustainability of Dollar’s rebound. Meanwhile, Canadian Dollar’s strengthen continues to be impressive. EUR/CAD’s decline resumes today and should be targeting 61.8% projection of 1.5783 to 1.4723 from 1.5191 at 1.4536.

In Europe, at the time of writing, FTSE is up 0.32%. DAX is down -0.21%. CAC is down -0.40%. Germany 10-year yield is up 0.014 at -0.144. Earlier in Asia, Nikkei dropped -1.61%. Hong Kong HSI rose 0.78%. China Shanghai SSE rose 0.61%. Singapore Strait Times dropped -0.67%. 10-year JGB yield rose 0.036 to 0.080.

US CPI surged to 4.2% yoy, core CPI at 3.0% yoy

US CPI rose 0.8% mom in April, well above expectation of 0.2% mom. CPI core rose 0.9% mom, above expectation of 0.3% mom. Headline CPI accelerated to 4.2% yoy, up from 2.6% yoy, above expectation of 3.6% yoy, highest level since September 2008. CPI core accelerated to 3.0% yoy, up from 1.6% yoy, above expectation of 2.3% yoy. The’s well above Fed’s target of 2%.

EU upgrades 2021, 2021 growth forecast, shadow of COVID-19 beginning to lift

In the Spring 2021 Economic forecast of European Commission, Eurozone GDP forecast was upgraded up to 4.3% in 2021 (from 3.8), and 4.4% in 2022 (from 3.8%). Eurozone inflation is projected to jumped to 1.7% in 2021, but fall back to 1.3% in 2022. Eurozone unemployment rate is projected to rise to 8.4% in 2021, then fall back to 7.8% in 2022. EU GDP projection was upgraded to 4.2% in 2021 (from 3.7%), and 4.4% in 2022 (from 3.9%).

Valdis Dombrovskis, Executive Vice-President for an Economy that Works for People said: “While we are not yet out of the woods, Europe’s economic prospects are looking a lot brighter. As vaccination rates rise, restrictions ease and people’s lives slowly return to normal, we have upgraded forecasts for the EU and euro area economies for this year and next. The Recovery and Resilience Facility will help the recovery and will be a real game changer in 2022, when it will ramp up public investments to the highest level in over a decade. Much hard work still lies ahead, and many risks will hang over us as long as the pandemic does. Until we reach solid ground, we will continue to do all it takes to protect people and keep businesses afloat.”

Paolo Gentiloni, Commissioner for Economy said: “The shadow of COVID-19 is beginning to lift from Europe’s economy. After a weak start to the year, we project strong growth in both 2021 and 2022. Unprecedented fiscal support has been – and remains – essential in helping Europe’s workers and companies to weather the storm. The corresponding increase in deficits and debt is set to peak this year before beginning to decline. The impact of NextGenerationEU will begin to be felt this year and next, but we have much hard work ahead – in Brussels and national capitals – to make the most of this historic opportunity. And of course, maintaining the now strong pace of vaccinations in the EU will be crucial – for the health of our citizens as well as our economies. So let’s all roll up our sleeves.”

Eurozone industrial production rose only 0.1% mom in Mar, EU up 0.6% mom

Eurozone industrial production rose only 0.1% mom in March, well below expectation of 0.6% mom. Production of non-durable consumer goods rose by 1.9%, energy by 1.2% and intermediate goods by 0.6%, while production of capital goods fell by -1.0% and durable consumer goods by -1.2%

EU industrial production rose 0.6% mom. Among Member States for which data are available, the highest increases were registered in Denmark (+4.9%), Lithuania (+4.5%) and Bulgaria (+3.7%). The largest decreases were observed in Luxembourg (-4.4%), Belgium (-4.0%) and Finland (-2.1%).

From Germany, CPI was finalized at 0.7% mom, 2.0% yoy in March.

UK GDP grew 2.1% mom in March, still -5.9% below pre-pandemic level

UK GDP grew 2.1% mom in March, well above expectation of 1.3% mom. That’s the fastest monthly growth since August 2020. For the month, service sector grew 1.9% mom, production grew 1.8% mom, construction rose 5.8% mom. Still GDPP is -5.9% below the pre-pandemic level since in February 2020, and -1.1% below the initial recovery peak in October 2020.

For Q1, GDP contracted -1.5% qoq, versus expectation of -1.6% qoq. Household expenditure dropped -3.9% qoq. GFCF dropped -2.3% qoq. GDP per head dropped -1.6% qoq.

Also released, industrial production rose 1.8% mom, 3.6% yoy in March versus expectation of 1.0% mom, 2.8% yoy. Manufacturing production rose 2.1% mom, 4.8% yoy, versus expectation of 1.0% mom, 3.8% yoy. Goods trade deficit narrowed to GBP -11.7B, smaller than expectation of GBP -14.5B.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2120; (P) 1.2151; (R1) 1.2178; More….

Intraday bias in EUR/USD remains neutral first as consolidation from 1.2181 might extend further. Still, downside should be contained by 1.1985 support to bring another rise. On the upside, break of 1.2181 will resume the rally from 1.1703 for retesting 1.2242/2348 resistance zone. Decisive break there will resume larger up trend for 1.2555 key resistance zone next.

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. Reaction from 1.2555 should reveal underlying long term momentum in the pair.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 05:00 | JPY | Leading Economic Index Mar P | 103.2 | 98.7 | ||

| 06:00 | EUR | Germany CPI M/M Apr F | 0.70% | 0.70% | 0.70% | |

| 06:00 | EUR | Germany CPI Y/Y Apr F | 2.00% | 2.00% | 2.00% | |

| 06:00 | GBP | GDP M/M Mar | 2.10% | 1.30% | 0.40% | |

| 06:00 | GBP | GDP Q/Q Q1 P | -1.50% | -1.60% | 1.30% | |

| 06:00 | GBP | Industrial Production M/M Mar | 1.80% | 1.00% | 1.00% | |

| 06:00 | GBP | Industrial Production Y/Y Mar | 3.60% | 2.80% | -3.50% | |

| 06:00 | GBP | Manufacturing Production M/M Mar | 2.10% | 1.00% | 1.30% | |

| 06:00 | GBP | Manufacturing Production Y/Y Mar | 4.80% | 3.80% | -4.20% | |

| 06:00 | GBP | Goods Trade Balance (GBP) Mar | -11.7B | -14.5B | -16.4B | |

| 09:00 | EUR | Eurozone Industrial Production M/M Mar | 0.10% | 0.60% | -1.00% | -1.20% |

| 12:30 | USD | CPI M/M Apr | 0.80% | 0.20% | 0.60% | |

| 12:30 | USD | CPI Y/Y Apr | 4.20% | 3.60% | 2.60% | |

| 12:30 | USD | CPI Core M/M Apr | 0.90% | 0.30% | 0.30% | |

| 12:30 | USD | CPI Core Y/Y Apr | 3.00% | 2.30% | 1.60% | |

| 13:00 | GBP | NIESR GDP Estimate (3M) Apr | -1.80% | -1.50% | ||

| 14:30 | USD | Crude Oil Inventories | -2.1M | -8.0M |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals