Overall markets are mixed for now, except the clear strength in New Zealand Dollar this week. While Aussie is also trading higher against others, it’s lagging Kiwi by a mile. Dollar recovered overnight but once again lost momentum quickly. Canadian Dollar has also found some footing after yesterday’s pull back. In other markets, Asia markets are mixed in tight range, after US stocks tread water. Gold is now trying to defend 1900 handle while WTI oil struggles around 65.

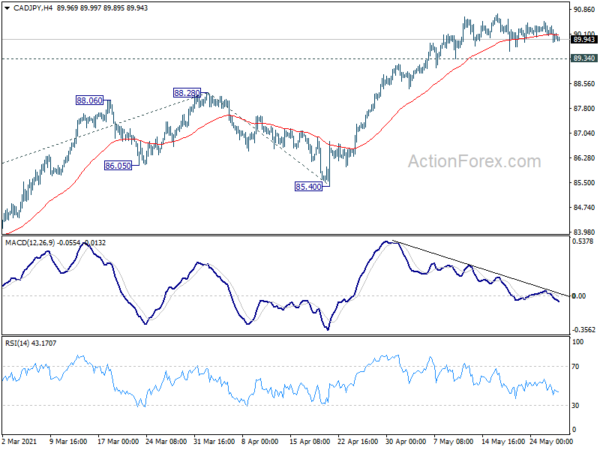

Technically, we’ll keep an eye on Canadian Dollar pairs for now. Near term support levels are still intact despite this week’s pull back. The levels to watch include 1.2201 resistance in USD/CAD, 1.4815 resistance in EUR/CAD, 1.7176 resistance in GBP/CAD, and 89.34 minor support in CAD/JPY. As long as these levels hold, Canadian Dollar is still in mild favor to resume recent rally next.

In Asia, at the time of writing, Nikkei is down -0.38%. Hong Kong HSI is down -0.25%. China Shanghai SSE is up 0.18%. Singapore Strait Times is up 0.39%. Japan 10-year JGB yield is down -0.001 at 0.074. Overnight, DOW rose 0.03%. S&P 500 rose 0.19%. NASDAQ rose 0.59%. 10-year yield rose 0.010 to 1.574.

RBNZ Orr in position to start normalizing monetary policy this time next year

RBNZ Governor Adrian Orr said at a parliamentary committee meeting, “in our projections, conditional to the economic outlook continuing to unfold as anticipated, about this time next year if not further on we see ourselves in a positive position of being able to start to normalize monetary conditions towards somewhat neutral position.”

As for the NZD 100B Large Scale Asset Purchase program, it will continue at the current rate through to June 2022. Any changes to the purchases will be driven by market functioning.

Fed Quarles: Could be important to discuss tapering at upcoming meetings

Fed Vice Chair Randal Quarles said in a speech that, “a significant portion of that recent boost to inflation will be transitory”, and it “will not interfere with the rapid growth driving progress toward the Fed’s maximum-employment goal.” He expected “strong recovery will keep rolling forward”. Nevertheless, “uneven global recovery” and “supply bottlenecks” are two “potential headwinds” for the economy.

Quarles added that, “if my expectations about economic growth, employment, and inflation over the coming months are borne out, however, and especially if they come in stronger than I expect, then, as noted in the minutes of the last FOMC meeting, it will become important for the FOMC to begin discussing our plans to adjust the pace of asset purchases at upcoming meetings.”

However, “the time for discussing a change in the federal funds rate remains in the future. The guidance for the federal funds rate commits to maintain the current rate until labor market conditions are consistent with our goal of maximum employment and inflation not only has reached 2 percent, but also is on track to moderately exceed 2 percent for some time.”

USTR Tai briefed China on its worker-centered trade policy and raised issues of concerns

US Trade Representative Katherine Tai and Chinese Vice Premier Liu He held the first phone call in the Biden era. USTR said during their “candid exchange”, Tai “discussed the guiding principles of the Biden-Harris Administration’s worker-centered trade policy and her ongoing review of the U.S.-China trade relationship, while also raising issues of concern.”

On the Chinese side, it said that both parties had a “candid, pragmatic and constructive” conversation. But no details were revealed on any developments on trade and tariffs.

On the data front

Australia private capital expenditure rose 6.3% in Q1, above expectation of 2.2%. Germany Gfk consumer confidence and Swiss trade balance will be released in European session. US will release jobless claims, durable goods orders, pending home sales and GDP revision later in the day.

AUD/USD Daily Report

Daily Pivots: (S1) 0.7716; (P) 0.7756; (R1) 0.7781; More…

AUD/USD is still bounded in range of 0.7673/7890 and intraday bias remains neutral first. As long as 0.7673 support holds, another rise is mildly in favor. On the upside, break of 0.7890 resistance will resume the rally from 0.7530 to retest 0.8006 high. On the downside, break of 0.7673 will suggest that correction from 0.8006 is extending with another falling leg. Intraday bias will be turned back to the downside for 0.7530 support and possibly below.

In the bigger picture, whole down trend from 1.1079 (2001 high) should have completed at 0.5506 (2020 low) already. Rise from 0.5506 could either be the start of a long term up trend, or a corrective rise. Reactions to 0.8135 key resistance will reveal which case it is. But in any case, medium term rally is expected to continue as long as 0.7413 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | Private Capital Expenditure Q1 | 6.30% | 2.20% | 3.00% | 4.20% |

| 06:00 | EUR | Germany Gfk Consumer Confidence (Jun) | -5.3 | -8.8 | ||

| 06:00 | CHF | Trade Balance (CHF) Apr | 4.85B | 5.82B | ||

| 12:30 | USD | Initial Jobless Claims (May 21) | 430K | 444K | ||

| 12:30 | USD | GDP Annualized Q1 P | 6.50% | 6.40% | ||

| 12:30 | USD | GDP Price Index Q1 P | 4.10% | 4.10% | ||

| 12:30 | USD | Durable Goods Orders Apr | 0.80% | 1.00% | ||

| 12:30 | USD | Durable Goods Orders ex Transportation Apr | 0.70% | 2.30% | ||

| 14:00 | USD | Pending Home Sales M/M Apr | 0.60% | 1.90% | ||

| 14:30 | USD | Natural Gas Storage | 105B | 71B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals