Dollar surges in early US session as boosted by stronger than expected inflation readings. Indeed, the core PCE inflation hit the highest level since 1991. With the current buying momentum, the greenback is likely to end the week on a high note, with prospect of closing as the strongest. On the other hand, commodity currencies are in rather steep decline, even the Kiwi. But Yen is more likely to end the week as the worst performer.

Technically, EUR/USD’s break of 1.2160 support indicates short term topping, deeper fall could now be seen back to 1.1985 support. Next focus will be 0.9046 resistance in USD/CHF and break there should confirm short term bottoming at 0.8929. Meanwhile, USD/JPY is on track to retest 110.95 high.

In Europe, at the time of writing, FTSE is up 0.28%. DAX is up 0.67%. CAC is up 0.68%. Germany 10-year yield is down -0.0109 at -0.179. Earlier in Asia, Nikkei rose 2.1%. Hong Kong HSI rose 0.04%. China Shanghai SSE dropped -0.22%. Singapore Strait Times rose 0.43%. Japan 10-year JGB yield rose 0.0094 to 0.085.

US PCE rose to 3.6% yoy, core PCE jumped to 3.1% yoy

US personal income dropped -13.1% mom, or USD 3.21T in April, slightly better than expectation of -14.0% mom. Personal spending rose 0.5% mom, or USD 80.3B, below expectation of 0.6% mom.

Headline PCE price index accelerated to 3.6% yoy, up from 2.4% yoy, above expectation of 2.2% yoy. Core PCE price index also jumped to 3.1% yoy, up from 1.9% yoy, above expectation of 3.0% yoy.

Also released, goods trade deficit narrowed to USD -85.2B in April, versus expectation of USD -92.0B.

ECB Schnabel: Rising yields a natural development at a turning point

ECB Executive Board member Isabel Schnabel “rising yields are a natural development at a turning point in the recovery – investors become more optimistic, inflation expectations rise and, as a result, nominal yields go up.” “This is precisely what we would expect and what we want to see,” she said. Also, “financing conditions remain favorable.”

“We always have to be willing to reduce or increase asset purchases in line with our promise to keep euro area financing conditions favorable,” she added. “The recovery still depends on continued policy support. A premature withdrawal of either fiscal or monetary support would be a great mistake,”

“It’s likely that when the PEPP ends, we will not have reached our (inflation target),” Schnabel said. “In that case, we will continue to run a highly accommodative monetary policy also after the PEPP.”

Eurozone economic sentiment rose to 114.5, close to Dec 2017 peak

Eurozone Economic Sentiment Indicator rose strongly to 114.5 in May, up from 110.5, above expectation of 112.1. The index scored markedly above its long-term average and pre-pandemic level. It was close to December 2017 peak. Employment Expectations Indicator rose 2.9 pts to 110.1.

Eurozone industry confidence rose from 10.9 to 11.5. Services confidence rose from 2.2 to 11.3. Consumer confidence rose from -8.1 to -5.1. Retail trade confidence rose from -3.0 to 0.4. Construction confidence rose from 3.0 to 4.9.

EU ESI rose 4 pts to 113.9. The ESI is well above its long-term average, and rose markedly in all of the six largest EU economies, mostly so in Italy (+11.0), followed by Poland (+5.1), France (+5.0), the Netherlands (+3.2), Germany (+2.8) and Spain (+2.3).

France household consumption dropped -8.3% mom in Apr

France household consumption expenditure dropped -8.3% mom in April. The decline was mainly due to manufactured goods purchases (–18.9%), during the third lockdown. Energy expenditure dropped slightly by -0.6%. Food consumption dropped -0.2%. Spending was -9.5% below its average level in Q4, 2019.

Also released, CPI came in at 0.3% mom, 1.8% yoy in May, matched expectations. GDP dropped slightly by -0.1% qoq in Q1. It stood -4.7% below prepandemic level in Q4 2019.

Swiss KOF rose to 143.2, very positive economic outlook for mid 2021

Swiss KOF economic barometer rose to 143.2 in May, up from 136.4. KOF said, “the outlook for the Swiss economy for the middle of 2021 can be regarded as very positive, provided that the containment of the virus continues to progress.”

KOF added: “The sharp increase is driven by bundles of indicators from the manufacturing sector and foreign demand. An additional positive signal is sent by indicators for accommodation and food service activities followed by indicators for the other services sector. By contrast, slight negative impulses are sent by private consumption.”

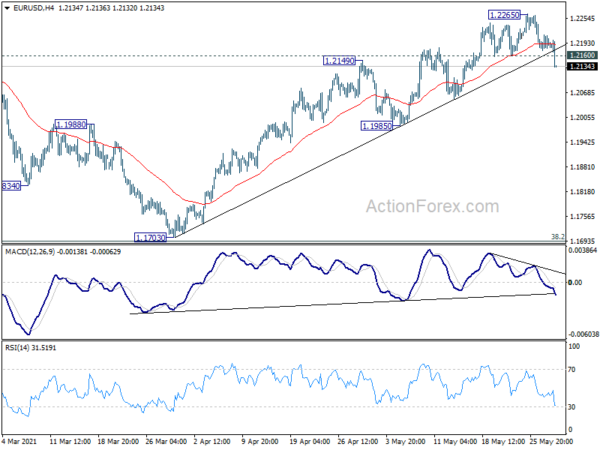

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2174; (P) 1.2194; (R1) 1.2214; More….

EUR/USD’s break of 1.2160 support indicates short term topping at 1.2265. Intraday bias is back on the downside for 1.1985 support first. Consolidation pattern from 1.2348 is probably in its third leg already. Break of 1.1985 will target 1.1703 support next. On the upside, through, above 1.2265 will extend the rally from 1.1703 to retest 1.2348 high.

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. Reaction from 1.2555 should reveal underlying long term momentum in the pair.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Tokyo CPI Core Y/Y May | -0.20% | -0.20% | -0.20% | |

| 23:30 | JPY | Unemployment Rate Apr | 2.80% | 2.70% | 2.60% | |

| 06:00 | EUR | Germany Import Price Index M/M Apr | 1.40% | 1.00% | 1.80% | |

| 06:45 | EUR | France CPI M/M May P | 0.30% | 0.30% | 0.20% | 0.10% |

| 06:45 | EUR | France CPI Y/Y May P | 1.80% | 1.80% | 1.60% | |

| 06:45 | EUR | France Consumer Spending M/M Apr | -8.30% | -4.10% | -1.10% | -0.30% |

| 06:45 | EUR | France GDP Q/Q Q1 | -0.10% | 0.40% | 0.40% | |

| 07:00 | CHF | KOF Leading Indicator May | 143.2 | 134 | 136.4 | |

| 09:00 | EUR | Eurozone Economic Sentiment Indicator May | 114.5 | 112.1 | 110.3 | 110.5 |

| 09:00 | EUR | Eurozone Industrial Confidence May | 11.5 | 11 | 10.7 | 10.9 |

| 09:00 | EUR | Eurozone Services Sentiment May | 11.3 | 7 | 2.1 | 2.2 |

| 09:00 | EUR | Eurozone Consumer Confidence May F | -5.1 | -6 | -5.1 | -8.1 |

| 12:30 | USD | Personal Income M/M Apr | -13.10% | -14.00% | 21.10% | 20.90% |

| 12:30 | USD | Personal Spending Apr | 0.50% | 0.60% | 4.20% | 4.70% |

| 12:30 | USD | PCE Price Index M/M Apr | 0.60% | 0.20% | 0.50% | 0.60% |

| 12:30 | USD | PCE Price Index Y/Y Apr | 3.60% | 2.20% | 2.30% | 2.40% |

| 12:30 | USD | Core PCE Price Index M/M Apr | 0.60% | 0.70% | 0.40% | |

| 12:30 | USD | Core PCE Price Index Y/Y Apr | 3.10% | 3.00% | 1.80% | 1.90% |

| 12:30 | USD | Goods Trade Balance (USD) Apr P | -85.2B | -92.0B | -90.6B | |

| 12:30 | USD | Wholesale Inventories Apr P | 0.80% | 0.70% | 1.30% | |

| 13:45 | USD | Chicago PMI May | 70 | 72.1 | ||

| 14:00 | USD | Michigan Consumer Sentiment Index May F | 82.9 | 82.8 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals