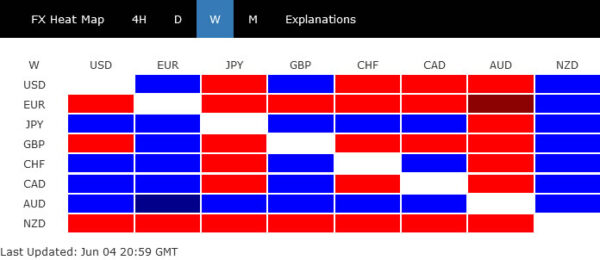

Dollar was in a pole position to end as the strong one but was the unfortunately knocked down by solid, but disappointing non-farm payroll report. The data did nothing to alter the base position of Fed officials that, it’s only time to talk about talking about tapering for now. Some more time is still needed for the impact of vaccination and inflation dynamics to fully play out.

Nevertheless, New Zealand Dollar actually as the as the worst performing one, paring some of recent gains. Euro was the second worst despite some solid data. But there is prospect for some upside in Euro, at least against Dollar and Yen, should ECB indicates that tis’ ready to scale back some the pace of asset purchases this week. Australian Dollar was surprisingly the strongest, and has technically the potential to outperform further ahead.

Dollar index failed below 55 day EMA, more downside still in favor

Dollar index’s rebound once again faltered last week and couldn’t even touch 55 day EMA (now at 90.71). With 90.90 resistance intact, near term outlook stay mildly bearish as fall from 93.43 could extend to retest 89.20 low. At this point, downside momentum in daily MACD doesn’t warrant a strong break there yet. Another rise and break through 90.90 resistance will extend the consolidation pattern from 89.20 with another rise, back towards 93.43. However, firm break of 89.20 will resume the down trend from 102.99 to 88.25 long term support and below.

Gold stays bullish after Dollar assisted rebound

Gold dipped to 1855.30 last week but quickly rebounded on Dollar’s reversal. As it’s now back above 1882.07 support turned resistance, the pull back is considered completed, at least temporarily. Outlook also stays bullish as it’s hold comfortably well above 55 day EMA (now at 1824.96), which is close to 38.2% retracement of 1676.65 to 1916.06.

We’re, thus, holding on to the bullish view that correction from 2075.18 has completed with three waves down to 1676.65. Break of 1916.06 should extend the rise from 1676.65 through 1959.16 resistance, to retest 2075.18 high.

Aussie’s late rebound suggests it might be turning around

Australian Dollar surprisingly ended as the strongest one, with help from the very late rebound. Technically, there is prospect that the Aussie is turning around the weakness that lasted for around three months.

In particular, it now looks as if AUD/USD’s pull back from 0.7890 has completed at 0.7644. Initial focus is back on 0.7772 resistance this week. Firm break there will confirm this bullish case and bring stronger rally through 0.7890 resistance. Sustained break of 0.7890 will in turn argue that larger rise up trend from 0.5506 is resume to resume through 0.8006 high.

EUR/AUD’s break of 1.5723 support also suggests short term topping at 1.5849. That’s the first sign that consolidation pattern from 1.5250 has completed, after just missing 38.2% retracement of 1.6827 to 1.5250 at 1.5852. Deeper fall is now in favor to 55 day EMA (now at 1.5637). Sustained break there will solidify the bearish case that larger down trend from 1.979 is ready to resume through 1.5250 low.

AUD/CAD also rebounded notably after hitting 0.9258, just ahead of 0.9247 cluster support, which coincides with 38.2 retracement of 0.8058 to 0.9991 at 0.9253, and 100% projection of 0.9991 to 0.9488 from 0.9757 at 0.9254. Immediate focus will be on 0.9407 resistance this week. Firm break of 0.9407 resistance will argue that corrective decline from 0.9991 has completed, and bring stronger rebound back to 0.9488 support turned resistance for confirmation.

Finally, AUD/NZD extended the rebound from 1.0597, and break of 1.0702 support turned resistance suggests that decline from 1.0944 has completed. Further rise is now in favor back to 1.0805 resistance this week. Firm break there should confirm this case. More importantly, that would also raise the chance that consolidation pattern from 1.1042 has completed, and up trend from 0.9992 is ready to resume. Further rise should be seen back to 1.0944 resistance first.

USD/JPY rose to 110.32 last week but dropped sharply since then. Initial bias remains neutral this week first, with immediate focus on 109.32 support. Break there will argue that choppy rebound from 107.47 has completed. Intraday bias will be turned back to the downside for 108.55 support, and then 107.47. On the upside, above 110.32 will resume the rebound to retest 110.95 high instead.

In the bigger picture, medium term outlook is staying neutral with 111.71 resistance intact. Though, as notable support was seen from 55 day EMA, rise from 102.58 is mildly in favor to extend higher. Decisive break of 111.71/112.22 resistance will suggest medium term bullish reversal. Rise from 101.18 could then target 118.65 resistance (Dec 2016) and above.

In the long term picture, the rise from 75.56 (2011 low) long term bottom to 125.85 (2015 high) is viewed as an impulsive move, no change in this view. Price actions from 125.85 are seen as a corrective pattern which could still extend. In case of deeper fall, downside should be contained by 61.8% retracement of 75.56 to 125.85 at 94.77. Up trend from 75.56 is expected to resume at a later stage for above 135.20/147.68 resistance zone.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals