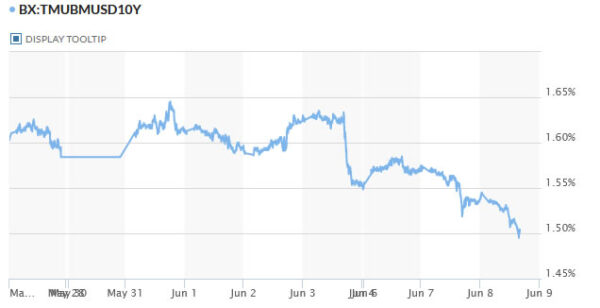

Major pairs and crosses are bounded inside yesterday’s range so far, as quiet trading continues. Dollar is mildly lower but loss is very limited, while Swiss Franc might be picking up some buying again. Stock markets are also treading water in very tight range. Nevertheless, notable weakness is seen in treasury yields. In particular, US 10-year yield is back pressing 1.5 handle entering into US session. In action to BoC, we’d also pay attention to market reactions to falling yields.

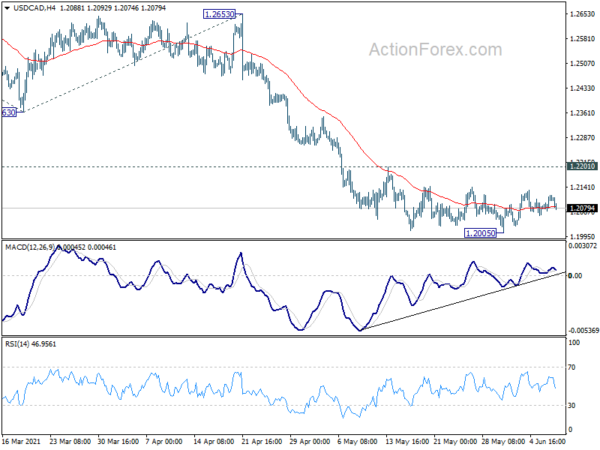

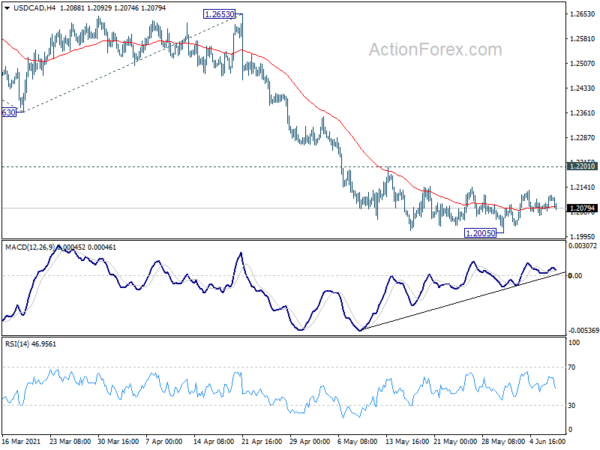

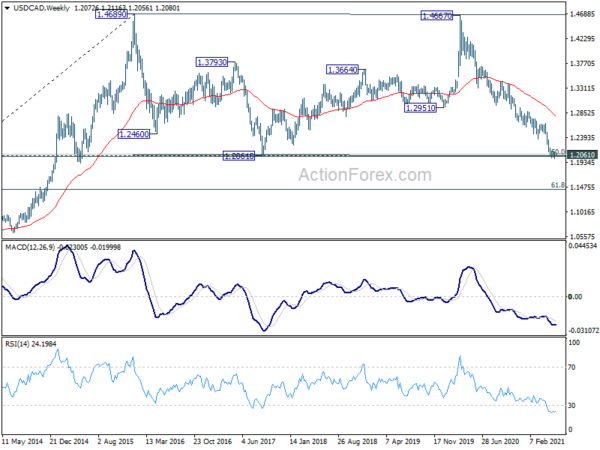

Technically, USD/CAD will be a focus today. As we mentioned in our technical outlook, the pair is pressing long term cluster support at 1.2061 (2017 low) and 50% retracement of 0.9406 to 1.4689 at 1.2048. We’d stay cautious on strong support from this level to bring reversal. Break of 1.2201 resistance will suggest short term bottoming and bring stronger, sustainable rebound.

In Europe, at the time of writing, FTSE is down -0.40%. DAX is down -0.49%. CAC is up 0.06%. Germany 10-year yield is down -0.028 at -0.249. Earlier in Asia, Nikkei dropped -0.35%. Hong Kong HSI dropped -0.13%. China Shanghai SSE rose 0.32%. Singapore Strait Times dropped -0.43%. Japan 10-year JGB yield dropped -0.0034 to 0.071. US 10-year yield at currently down -0.0406 at 1.503.

BoE Haldane: At some stage, we need to start turning off the tap

BoE Chief Economist Andy Haldane said the UK economy is “going gangbusters”, and it was “hard to find anything whose price isn’t going up at the moment”.

“It is the case that growth across the U.K. is picking up a real rate of knots, going gangbusters actually the economy just at the moment, and that’s a great thing to see,” he said.

Also, “that may mean at some stage, we need to start turning off the tap when it comes to the monetary policy support we’ve been providing.”

RBA Kent: There are good prospects for growth and increase in wages and inflation

RBA Assistant Governor Christopher Kent said in a speech that “the improvement in the economic outlook globally and in Australia has contributed to a rise in sovereign bond yields to around pre-pandemic levels.” There has been increase in inflation expectations to be “more in line with central banks’ targets”. Also expectations of short term interest rates have “increased a bit”.

But households and business continue to “benefit from record low interest rates” and their balance sheets are “in good shape”. The economy is “benefiting from supportive fiscal policy. He added, “there are good prospects for growth and an eventual increase in wages and inflation”. But the process will be “gradual” and inflation is unlikely to be sustainably within target rate “until 2024 at the earliest”.

Australia Westpac consumer confidence dropped -5.2% on concerns around Melbourne lockdown

Australia Westpac consumer confidence dropped -5.2% to 107.2 in June. The index has now fallen by -9.7% over the last two months. Westpac said the latest fall is “almost certainly due to concerns around the two-week lockdown in Melbourne.” There was a fall of -7.5% in Victoria, -4% in Queensland, -9% in Western Australia, and -10.9% in South Australia. New South Wales dropped only -1.1%.

Westpac expects RBA to decide against extending the Yield Curve Targeting from April 2024 bond to November 2024 bond. Also, RBA could announce a more flexible approach to QE, with a weekly target of AUD 5B.

New Zealand ANZ business confidence dropped to -0.4, inflation expectations rose further

In the preliminary read, New Zealand ANZ business confidence dropped to -0.4 in June, down from May’s 1.8. Own activity outlook rose from 27.1 to 29.1. Looking at some more details, export intentions rose from 12.2 to 13.9. Investment intentions rose from 18.9 to 25.3. Employment intentions dropped from 20.5 to 19.6. Pricing intentions rose from 57.4 to 62.8. Inflation expectations rose further from 2.22 to 2.33.

ANZ said: “Shipping disruptions, rising global commodity prices, the higher minimum wage, labour shortages due to both the closed border and uneven sector growth are creating a perfect storm for the supply side of the economy at the same time as demand is holding up much more than firms (or economists!) had anticipated.

“Headline inflation is set to jump over the next six months as a result, but it’s best to focus on wage growth and inflation expectations for clues regarding when the Reserve Bank might conclude they can no longer look through inflation pressure and simply wait for temporary pressures to subside, necessitating a higher OCR.”

Also released, manufacturing sales rose 2.1% in Q1.

USD/CHF Mid-Day Outlook

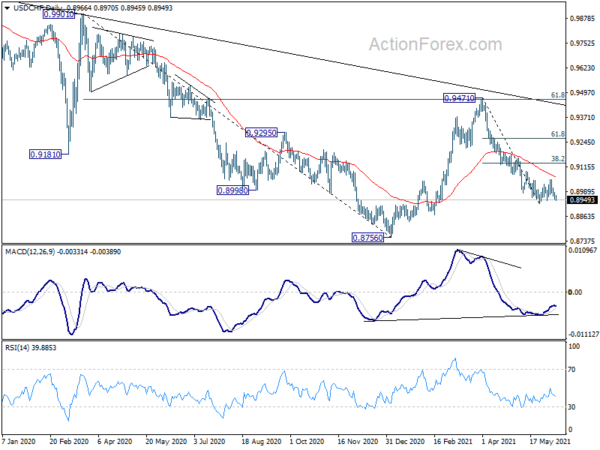

Daily Pivots: (S1) 0.8951; (P) 0.8970; (R1) 0.8988; More….

USD/CHF is still staying in sideway consolidation from 0.8929 and intraday bias remains neutral first. Outlook stays bearish for deeper decline. On the downside, break of 0.8929 will resume the fall from 0.9471 to retest 0.8756 low. However, firm break of 0.9052 will turn bias to the upside for stronger rebound, and target 38.2% retracement of 0.9471 to 0.8929 at 0.9136 first.

In the bigger picture, prior rejection by 61.8% retracement of 0.9901 to 0.8756 at 0.9464 argues that rebound from 0.8756 was probably just a corrective move. That is, larger down trend from 1.0237 might be still in progress. Medium term bearish is also affirmed as the pair is now far below falling 55 week EMA. Firm break of 0.8756 low will target 61.8% projection of 1.0237 to 0.8756 from 0.9471 at 0.8556 next.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Manufacturing Sales Q1 | 2.10% | -0.60% | -0.20% | |

| 23:50 | JPY | Money Supply M2+CD Y/Y May | 7.90% | 8.40% | 9.20% | |

| 0:30 | AUD | Westpac Consumer Confidence Jun | -5.20% | -4.80% | ||

| 1:00 | NZD | ANZ Business Confidence Jun P | -0.4 | 1.8 | ||

| 1:30 | CNY | CPI Y/Y May | 1.30% | 1.60% | 0.90% | |

| 1:30 | CNY | PPI Y/Y May | 9.00% | 8.50% | 6.80% | |

| 6:00 | EUR | Germany Trade Balance (EUR) Apr | 15.9B | 15.7B | 14.3B | |

| 14:00 | USD | Wholesale Inventories Apr | 0.80% | 0.80% | ||

| 14:00 | CAD | BoC Interest Rate Decision | 0.25% | 0.25% | ||

| 14:30 | USD | Crude Oil Inventories | -3.3M | -5.1M |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals