Dollar and Yen recover some ground in mixed Asian session today. Stocks in Japan and Hong Kong are slightly down by China and Singapore are steady. Much weaker than expected services data from China triggered little reactions. Swiss Franc is retreating against other major currencies but losses are limited. Commodity currencies are softening somewhat. With US on holiday, main focus will be on Eurozone Sentix investor confidence.

Technically, we’d see that Euro is a bit vulnerable in crosses. With rebound from 1.0863 likely completed at 1.0985, EUR/CHF would be heading back to retest 1.0863. Such development could drag Euro lower, in particular against commodity currencies. Eyes will be on 1.4580 low in EUR/CAD first, and then 1.5699 support in EUR/AUD. Break of these levels will add to near term bearishness in Euro.

In Asia, at the time of writing, Nikkei is down -0.60%. Hong Kong HSI is down -0.22%. China Shanghai SSE is up 0.25%. Singapore Strait Times is up 0.22%. Japan 10-year JGB yield is down -0.0086 at 0.038.

China Caixin PMI services dropped to 50.3, PMI composite dropped to 50.6

China Caixin PMI Services dropped to 50.3 in June, down from 55.1, well below expectation of 55.7. There were the softest increase in activity and new work for 14-months. Staff numbers fell as capacity pressured eased. Rates of input cost and output charge inflation slowed notably. PMI Composite dropped to 50.6, down from 53.8, worst in 14-month.

Wang Zhe, Senior Economist at Caixin Insight Group said: “Overall, activity in both the manufacturing and services sector continued to expand. However, impacted by the resurgence of the virus in some regions in China, the services sector was weaker than the manufacturing sector, both in terms of market supply and demand or employment.”

Australia retail sales rose 0.4% mom in May, impacted by Victorian lockdown

Australia retail sales rose 0.4% mom, 7.7% yoy in May. That’s an upward revision to preliminary result of 0.1% mom rise.

Ben James, Director of Quarterly Economy Wide Surveys, said: “The main themes from the Retail Trade Preliminary release remain relevant for the Final release. Retail turnover in May was impacted by the Victorian lockdown from May 28 onwards, as well as those states recovering from restrictions in April.”

Australia AiG construction dropped to 55.5, facing capacity constraints

Australia AiG Performance of Construction dropped -2.8 pts to 55.5 in June. Current activity dropped -0.9 to 54.8. Employment dropped -6.1 to 58.3. New orders rose 0.9 to 56.1. Supplier deliveries dropped -8.5 to 50.9. Input prices rose 2.5 to 98.3. Selling prices rose 7.0 to 85.2. Average wages rose 5.4 to 70.4.

Ai Group Head of Policy, Peter Burn, said: “Australia’s construction industry continued its run of strong growth in June but the pace of expansion is slipping as it faces capacity constraints and rising input prices.”

Also released, building permits dropped -7.1% mom in May, versus expectation of -5.0% mom.

RBA rate decision to the highlight the week, with FOMC minutes

RBA rate decision is a highlight for the week. There are many questions to answer and they are somewhat inter-related. Firstly, RBA would announce whether to continue the current AUD 100B bond purchase program after expiry in September, and in what way. Secondly, RBA will tell us whether it will extend the maturity of the purchase from April 2024 bond to November 2024 bond. Thirdly, RBA should indicate whether it’s still expecting interest to be at current level until at least 2024. There are many parameters to play with for the monetary policy ahead.

FOMC minutes will be another highlight. The latest economic projections surprised the markets by showing that median projections were for rate to be hiked twice in 2023. There were also 7 participants who penciled in one hike or more in 2022. The in-depth discussions would be scrutinized for the chance of more hawkish shift in the committee. ECB minutes is another focus but it’s less likely to give any surprise.

As for economic data, main focuses will be on Germany ZEW economic sentiment, US ISM services; China CPI and PPI, UK GDP and Canada employment. Here are some highlights for the week:

- Monday: Australia AiG construction, MI inflation gauge, retail sales, building approvals; China Caixin PMI services; Eurozone PMI services final, Sentix investor confidence; UK PMI services final; BoC business outlook survey.

- Tuesday: Japan average cash earnings, household spending; RBA rate decision; Germany factory orders; UK Construction PMI; Germany ZEW economic sentiment, retail sales; US ISM services.

- Wednesday: Australia AiG services; Germany industrial production; France trade balance; Swiss foreign currency reserves; Canada Ivey PMI; FOM minutes.

- Thursday: Japan bank lending, current account, Eco watcher sentiment; Swiss unemployment rate; German trade balance; ECB meeting accounts; US jobless claims.

- Friday: China CPI, PPI; UK GDP, trade balance, production; France industrial production; Canada employment.

EUR/AUD Daily Outlook

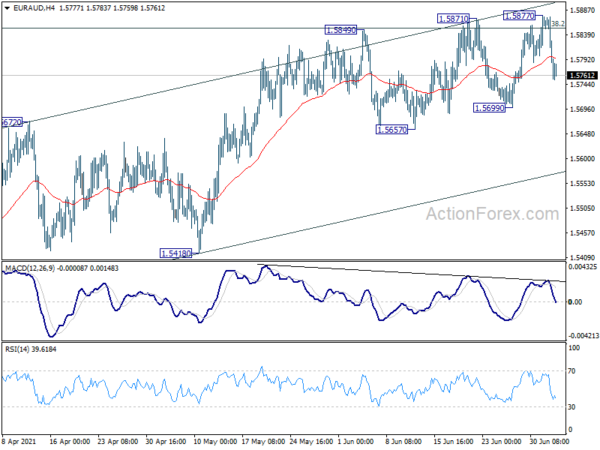

Daily Pivots: (S1) 1.5723; (P) 1.5800; (R1) 1.5842; More…

Intraday bias in EUR/AUD remains neutral for the moment. On the downside, break of 1.5699 support will suggest rejection by 38.2% retracement of 1.6827 to 1.5250 at 1.5852. Intraday bias will be turned back to the downside for 1.5418 support first. Break there should confirm completion of consolidation pattern from 1.5250. On the upside, break of 1.5877 will extend the near term rebound to 1.6033 key support turned resistance.

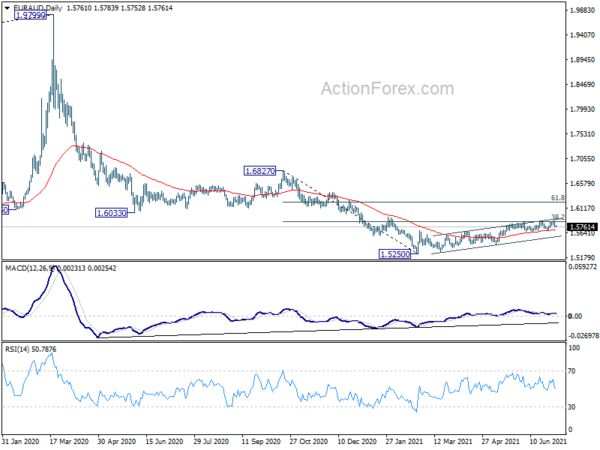

In the bigger picture, price actions from 1.9799 are developing into a deep correction, to long term up trend from 1.1602 (2012 low). Deeper fall would be seen to 61.8% retracement of 1.1602 to 1.9799 at 1.4733. Medium term outlook will remain bearish as long as 1.6033 support turned resistance holds, even in case of strong rebound. However, firm break of 1.6033 will argue that such decline has completed, and turn focus to 1.6827 structural resistance for confirmation.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Construction Index Jun | 55.5 | 58.3 | ||

| 01:30 | AUD | Retail Sales M/M May | 0.40% | 0.10% | 0.10% | |

| 01:30 | AUD | Building Permits M/M May | -7.10% | -5.00% | -8.60% | -5.70% |

| 01:45 | CNY | Caixin Services PMI Jun | 50.3 | 55.7 | 55.1 | |

| 07:45 | EUR | Italy Services PMI Jun | 56 | 53.1 | ||

| 07:50 | EUR | France Services PMI Jun F | 57.4 | 57.4 | ||

| 07:55 | EUR | Germany Services PMI Jun F | 58.1 | 58.1 | ||

| 08:00 | EUR | Eurozone Services PMI Jun F | 58 | 58 | ||

| 08:30 | EUR | Eurozone Sentix Investor Confidence Jul | 30.2 | 28.1 | ||

| 08:30 | GBP | Services PMI Jun F | 61.7 | 61.7 | ||

| 14:30 | CAD | BoC Business Outlook Survey |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals