The markets are now reversing prior moves in the week, with Dollar, Yen and Swiss Franc trading generally lower. Canadian Dollar is supported by strong job data, while Aussie and Kiwi also recover. Major European indexes are trading slightly up as DOW futures is also up over 260 pts. US 10-year yield is back above 1.3 handle, while Germany 10-year yield is above -0.3. now, we’d see how much of the last moves of the week could reverse the prior ones.

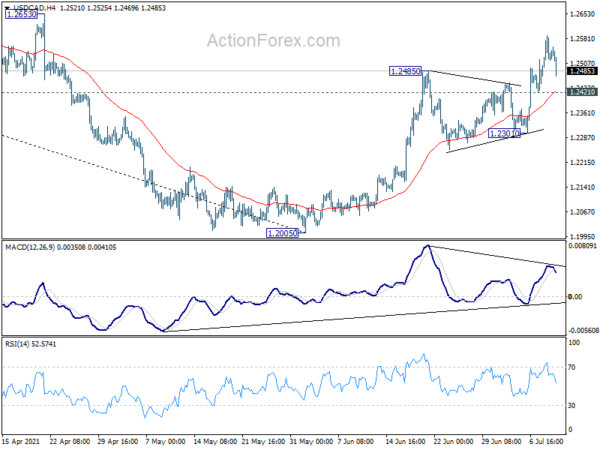

Technically, 1.1894 minor resistance in EUR/USD will be a focus before the weekend. Break there would indicate short term bottoming at 1.1780 and bring stronger rebound. At the same time, break of 1.241 minor support in USD/CAD could turn focus back to 1.2301 support. Bearish divergence on 4 hour MACD in USD/CAD would then raise the chance of short term topping.

In Europe, at the time of writing, FTSE is up 0.71%. DAX is up 0.91%. CAC is up 1.68%. Germany 10-year yield is up 0.013 at -0.292. Earlier in Asia, Nikkei dropped -0.63%. Hong Kong HSI rose 0.70%. China Shanghai SSE dropped -0.04%. Singapore Strait Times rose 0.77%. Japan 10-year JGB yield rose 0.0028 to 0.031.

Canada employment rose 230.7k in June, unemployment rate dropped to 7.8%

Canada employment grew 230.7k in June, above expectation of 172.5k. Statistics Canada noted, “employment growth in June was entirely in part-time work and concentrated among youth aged 15 to 24, primarily young women.”

Unemployment rate dropped to 7.8%, down from 8.2%, matched expectations. Labor force participation rate also rose 0.6% to 65.2%. The figure remained above post-pandemic low of 7.5% recorded in April this year, but was considerably lower than recent peak at 9.4% in January, and the record high of 13.7% in May 2020.

Bundesbank Weidmann: ECB not striving for either lower or higher inflation

Bundesbank President Jens Weidmann said ECB is “not striving for either lower or higher rates” of inflation with the new symmetric target. He added, the 2% medium term inflation goal is a “clear and easily understandable objective,” and that “temporary deviations from the target in either direction can occur.”

Separately, Governing Council member Olli Rehn said the “new inflation goal is unambiguous.” Clearly, the “medium-term core inflation forecast of 1.4% below new aim.”

Another Governing Council member Francois Villeroy de Galhau said ECB will still need to analyze the meaning of a “temporary” overshoot of inflation. “We didn’t discuss any duration, we didn’t discuss any numbers. It’s all about the context,” he said. “In monetary policy, you have to combine the direction with judgment. We set the direction very clearly.”

ECB accounts: PEPP to continue with significantly higher pace

In the accounts of June 9-10 meeting, ECB said, “it was stressed that the recovery was at an early stage and lacked robustness, as it depended heavily on policy support”. The projected path for the economy was ” was subject to significant uncertainties and risks”. An ” undue tightening of financing conditions at the current juncture could jeopardise the ongoing economic recovery and the outlook for inflation.”

Hence, “a noticeable slowing of the pace of purchases for the next quarter was therefore seen as inappropriate at the current juncture”. A remark was even made that, “in view of the persistent inflation shortfall projected in the June staff projections, even an increase in asset purchases as the main monetary policy instrument could be justified at present.”

Nevertheless, “in view of the better outlook for growth and inflation and the associated upside risks, it was, however, also argued that, to provide the same degree of accommodation, asset purchases should be scaled back somewhat.” Concerns were also expressed about potential side effects “if the highly accommodative monetary policy stance was maintained much longer.”

Overall, most members consent that net PEPP purchases should continue at a significantly higher pace in Q3. But the “reaction function” on purchases would “continue to rely on a joint assessment of financing conditions and the outlook for inflation over the medium term”.

UK GDP grew 0.8% mom in May, still -3.1% below pre-pandemic level

UK GDP grew 0.8% mom in May, well below expectation of 1.9% mom. That’s still the fourth consecutive month of growth. Service sector grew 0.9% mom. Production grew 0.8% mom, returned to growth. Manufacturing contracted -0.1% mom. Construction contracted for a second consecutive month, by -0.8% mom.

Overall GDP was still -3.1% below pre-pandemic level seen in February 2020. Services was -3.4% low, production -2.6% lower, while manufacturing was -3.0% lower. But construction was 0.3% above the pre-pandemic level.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1797; (P) 1.1833; (R1) 1.1881; More…

Intraday bias in EUR/USD remains neutral first. With 1.1894 minor resistance intact, another fall could still be seen. Below 1.1780 will extend the fall from 1.2265, as the third leg of the consolidation pattern from 1.2348, to 1.1703 key support next. On the upside, firm break of 1.1894 resistance will suggest short term bottoming, on bullish convergence condition in 4 hour MACD. Stronger rebound should then be seen to 1.1974 resistance and above.

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. Reaction from 1.2555 should reveal underlying long term momentum in the pair. However sustained break of 1.1602 will argue that the rise from 1.0635 is over, and turn medium term outlook bearish again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Money Supply M2+CD Y/Y Jun | 5.90% | 7.10% | 7.90% | |

| 01:30 | CNY | PPI Y/Y Jun | 8.80% | 8.80% | 9.00% | |

| 01:30 | CNY | CPI M/M Jun | -0.40% | 0.00% | -0.20% | |

| 01:30 | CNY | CPI Y/Y Jun | 1.10% | 1.40% | 1.30% | |

| 06:00 | GBP | GDP M/M May | 0.80% | 1.90% | 2.30% | 2.00% |

| 06:00 | GBP | Manufacturing Production M/M May | -0.10% | 1.00% | -0.30% | 0.00% |

| 06:00 | GBP | Manufacturing Production Y/Y May | 27.70% | 29.50% | 39.70% | 39.10% |

| 06:00 | GBP | Industrial Production M/M May | 0.80% | 1.50% | -1.30% | -1.00% |

| 06:00 | GBP | Industrial Production Y/Y May | 20.60% | 21.60% | 27.50% | 27.20% |

| 06:00 | GBP | Index of Services 3M/3M May | 3.90% | 4.30% | 1.40% | |

| 11:00 | GBP | Goods Trade Balance (GBP) May | -8.5B | -10.8B | -11.0B | -10.9B |

| 12:30 | CAD | Net Change in Employment Jun | 230.7K | 172.5K | -68K | |

| 12:30 | CAD | Unemployment Rate Jun | 7.80% | 7.80% | 8.20% | |

| 13:00 | GBP | NIESR GDP Estimate Jun | 3.80% | |||

| 14:00 | USD | Wholesale Inventories May | 1.10% | 1.10% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals