Dollar rebounds strongly in early US session after much stronger than expected CPI inflation reading. The headline reading has indeed been trend up every month since January and showed no sign of slowing yet. Yen also rebounds following the greenback. Meanwhile Sterling and Canadian Dollar are the weakest ones for today for the moment.

Technically, focus will now be on near term resistance for the greenback. In particular, levels to watch include 1.1780 support in EUR/USD, 1.3730 support in GBP/USD, 0.7480 support in AUD/USD, and 1.2589 resistance in USD/CAD. Dollar will need to overcome these levels to confirm that it’s resuming near term rally. Otherwise, the moves are just seen as another leg inside range patterns.

In Europe, at the time of writing, FTSE is up 0.09%. DAX is down -0.01%. CAC is down -0.09%. Germany 10-year yield is down -0.002 at -0.295. Earlier in Asia, Nikkei rose 0.52%. Hong Kong HSI rose 1.63%. China Shanghai SSE rose 0.53%. Singapore Strait Times rose 0.63%. Japan 10-year JGB yield dropped -0.0043 to 0.025.

US CPI surged to 5.4% yoy in June, core CPI jumped to 4.5% yoy

US CPI rose 0.9% mom in June, well above expectation of 0.5% mom. That’s the largest monthly rise since June 2008. CPI core rose 0.9% mom, also above expectation of 0.5% mom.

Over the last 12 months, headline CPI accelerated to 5.4% yoy, up from 4.0% yoy, above expectation of 4.9% yoy. That’s the highest annual rate since August 2008. CPI core jumped to 4.5% yoy, up from 3.8% yoy, above expectation of 4.0% yoy.

Fed Bullard: The time is right to pull back emergency measures

St. Louis Fed President James Bullard said in a WSJ interview, “I think with the economy growing at 7% and the pandemic coming under better and better control, I think the time is right to pull back emergency measures.”

But he added, “we do want to do it gently and carefully” on tapering asset purchases. “But I think we’re in a very good position to start a taper. I don’t need to get going tomorrow, but I think we’re—I think we’re in very good shape for this”.

Bullard also said recent fall in bond yields was a “bullish” development. He’s “comfortable with the idea that the economy will continue to grow very robustly through the second half of this year, and go through the first half of 2022, and all of 2022.”

ECB Lagarde: It’s now a simple, solid, symmetric 2% inflation target

In an FT interview, ECB President Christine Lagarde said the old inflation target of “below, but close to, two per cent” was “vaguely ambiguous and a little bit complex”. The target with the new strategy was a “simple, solid, symmetric two per cent target”

The 2% target now is “solid because it gives us space to manoeuvre our monetary policy, it is a well-accepted measurement of price stability around the world and it limits the welfare cost of too high inflation.”

She added that the third “s” of symmetry is really important, because “we affirm very clearly that there may be deviations up or down… we know that it’s not going to be a straight two per cent linearly forever once we reach the target and we’ll recognise that it will oscillate around two per cent. ”

Lagarde also said ECB’s policy rebound will be especially forceful or persistent”, intending to signal that” we will not prematurely tighten”.

Released in European session, Germany CPI was finalized at 0.4% mom, 2.3% yoy in June. France CPI was finalized at 0.2% mom, 1.9% yoy in June. Swiss PPI came in at 0.3% mom, 2.9% yoy in June.

Australia NAB business confidence dropped to 11, conditions dropped to 24

Australia NAB Business Confidence dropped from 20 to 11 in June. Business Conditions dropped from 36 to 24. Trading conditions dropped from 45 to 35. Profitability conditions dropped from 39 to 25. Employment conditions dropped from 25 to 17.

“After reaching a record high last month, business conditions pulled back in the month. The decline in conditions was broad-based across states but led by a significant decline in Victoria coming off the back of the lockdown that started in late May but was eased, in a series of steps, over June” said NAB.

“Confidence took a hit in the month with the survey undertaken in the week of the NSW lockdown and with some overlap to brief shutdowns in the smaller capitals. The threat of closing borders also appears to have weighed everywhere”.

China exports rose 32.2% yoy in June, imports rose 23.1% yoy, trade surplus widened to USD 51.5B

In USD terms, China’s total trade rose 34.2% yoy to USD 511.3B in June. Exports rose 32.2% yoy to USD 281.4B, versus expectation of 23.1% yoy. Imports rose 36.7% yoy to USD 229.9B, versus expectation of 30.0% yoy. Trade surplus widened to USD 51.5B, above expectation of USD 44.4B.

Year-to-June, total trade with EU rose 37.0% yoy to USD 388.2B. Exports to EU rose 35.9% yoy to USD 233.0B. Imports from EU rose 38.8% yoy to USD 155.2B. Trade surplus came in at USD 78B.

Year-to-June, total trade with US rose 45.7% yoy to USD 340.8B. Exports to US rose 42.6% yoy to 252.9B. Imports from US rose 55.5% yoy to USD 87.9B. Trade surplus came in at USD 165B.

Year-to-June, total trade with Australia rose 35.0% yoy to USD 107.4B. Exports to AU rose 30.0% yoy to 29.7B. Imports from AU rose 37.0% yoy to AUD 77.7B. Trade deficit came in at USD -48B.

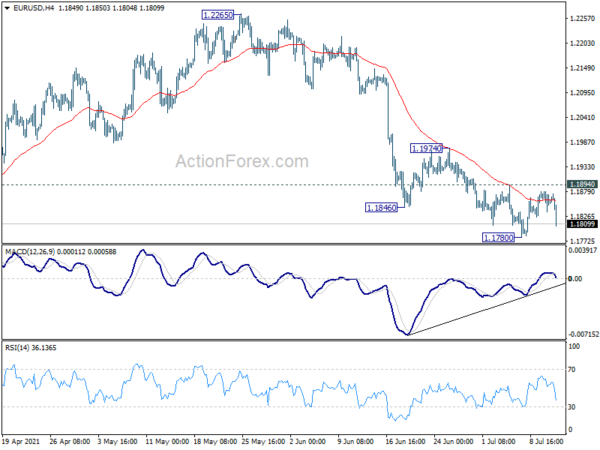

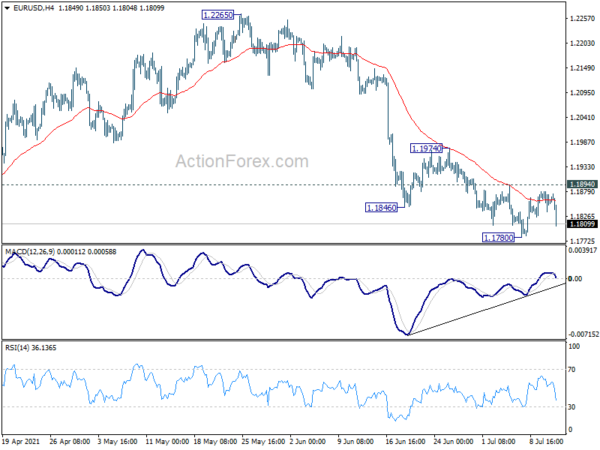

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1838; (P) 1.1859; (R1) 1.1882; More…

EUR/USD dips notably in early US session, but stays above 1.1780 temporary low. Intraday bias remains neutral first. Considering bullish convergence condition in 4 hour MACD, beak of 1.1894 minor resistance will indicate short term bottoming at 1.1780. Corrective pattern from 1.2348 might have completed too. Intraday bias will be turned back to the upside for 1.1974 resistance for confirmation. Sustained break there will pave the way back to 1.2265/2348 resistance zone. On the downside, break of 1.1780 will extend the correction to retest 1.1703 support instead.

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. Reaction from 1.2555 should reveal underlying long term momentum in the pair. However sustained break of 1.1602 will argue that the rise from 1.0635 is over, and turn medium term outlook bearish again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | BRC Like-For-Like Retail Sales Y/Y Jun | 6.70% | 18.50% | ||

| 01:30 | AUD | NAB Business Confidence Jun | 11 | 20 | ||

| 01:30 | AUD | NAB Business Conditions Jun | 24 | 37 | ||

| 03:00 | CNY | Trade Balance (USD) Jun | 51.5B | 44.4B | 45.5B | |

| 03:00 | CNY | Exports (USD) Y/Y Jun | 32.20% | 23.10% | 27.90% | |

| 03:00 | CNY | Imports (USD) Y/Y Jun | 36.70% | 30.00% | 51.10% | |

| 03:00 | CNY | Trade Balance (CNY) Jun | 333B | 271B | 296B | |

| 03:00 | CNY | Exports (CNY) Y/Y Jun | 20.20% | 29.60% | 18.10% | |

| 03:00 | CNY | Imports (CNY) Y/Y Jun | 24.20% | 32.30% | 39.50% | |

| 06:00 | EUR | Germany CPI M/M Jun F | 0.40% | 0.40% | 0.40% | |

| 06:00 | EUR | Germany CPI Y/Y Jun F | 2.30% | 2.30% | 2.30% | |

| 06:30 | CHF | Producer and Import Prices M/M Jun | 0.30% | 0.40% | 0.80% | |

| 06:30 | CHF | Producer and Import Prices Y/Y Jun | 2.90% | 3.20% | ||

| 06:45 | EUR | France CPI M/M Jun F | 0.20% | 0.20% | 0.20% | |

| 06:45 | EUR | France CPI Y/Y Jun F | 1.90% | 1.90% | 1.90% | |

| 10:00 | USD | NFIB Business Optimism Index Jun | 102.5 | 99.5 | 99.6 | |

| 12:30 | USD | CPI M/M Jun | 0.90% | 0.50% | 0.60% | |

| 12:30 | USD | CPI Y/Y Jun | 5.40% | 4.90% | 5.00% | |

| 12:30 | USD | CPI Core M/M Jun | 0.90% | 0.50% | 0.70% | |

| 12:30 | USD | CPI Core Y/Y Jun | 4.50% | 4.00% | 3.80% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals