Overall sentiments in the financial markets remain rather fragile today, despite some stabilization. Major European indexes are trading slight up while DOW futures also gains over 150 pts at the time of writing. But there appears to be little support for treasury yield, with Germany 10-year yield below -0.4 handle at -0.42. US 10-year yield is also extending freefall, appearing to be targeting 1% handle eventually. In the currency markets, Dollar overtakes Yen as the strongest today. New Zealand Dollar is currently the weakest, catching up with others, Sterling is also rather weak, as selloff intensifies in crosses too.

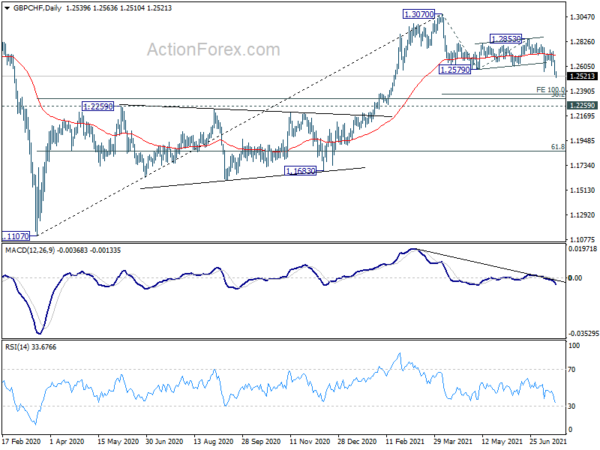

Technically, we’d pay some attention to European-Sterling crosses for the rest of the week. EUR/GBP’s rally is accelerating and break of 0.8670 resistance will solidify that case that it’s resuming whole rebound from 0.8470. That is, we could see further upside acceleration through 0.8718 resistance quickly. Meanwhile, GBP/CHF also broke out to the downside this week, resuming the fall from 1.3070. Such decline could also accelerate down to 100% projection of 1.3070 to 1.2579 from 1.2853 at 1.2362 before finding a bottom that.

In Europe, at the time of writing, FTSE is up 0.34%. DAX is up 0.15%. CAC is up 0.66%. Germany 10-year yield is down -0.050 at -0.433. Earlier in Asia, Nikkei dropped -0.96%. Hong Kong HSI dropped -0.84%. China Shanghai SSE dropped -0.07%. Japan 10-year JGB yield dropped -0.0033 to 0.014.

US building permits dropped to 1.598m in June, housing starts rose to 1.643m

US building permits dropped -5.1% mom to 1.598m annualized rate in June, below expectation of 1.690m. It’s nonetheless 23.3% above June 2020 rate of 1.296m. Housing starts rose 6.3% mom to 1.643m annualized rate, above expectation of 1.590m. It’s also 29.1% above June 2020 level of 1.273m.

Eurozone current account surplus at EUR 12B in May

Eurozone current account recorded EUR 12B surplus in May, down from April’s EUR 22B. In the 12 months to May, current account surplus amounted to EUR 310B (2.7% of Eurozone GDP), up from EUR 228B (2.0%) one year earlier.

In the financial account, Eurozone residents’ net acquisition of non-euro area portfolio investment securities totalled EUR 950B, in the 12 months to May. Non-residents’ net acquisitions of Eurozone area portfolio investment securities totalled EUR 187B.

Germany PPI rose 1.3% mom, 8.5% yoy in June, versus expectation of 1.2% mom, 8.5% yoy. Swiss Trade surplus widened to CHF 5.53B versus expectation of EUR 5.12B.

RBA Minutes: Conditions for rate hike won’t be met until 2024

In the minutes of July 5 meeting, RBA reiterated that the “central scenario implied that the conditions for an increase in the cash rate would not be met until 2024”. However, “fast-than expected” recovery over the course of 2021 had “widened the range of alternative plausible scenarios for the economic outlook”, and thus, “the cash rate over the period to November 2024”. Hence, it decided to retain April 2024 bond as the target bond, rather than extending the horizon to November 2024 bonds.

On the decision on the size of weekly bond purchases, it noted that “the economic outcomes had been materially better than earlier expected and the outlook had improved”. And, “in light of these improvements and the agreed decision-making framework, members decided to adjust the weekly purchases from $5 billion to $4 billion and agreed to review the rate of purchases at the November 2021 meeting.”

NZD/USD downside breakout, heading to 0.68 handle

NZD/USD finally follows other commodity currencies and breaks out to the downside today. Overall risk-off sentiments overwhelm speculations of RBNZ rate hike. Technically, fall from 0.7463 is seen as a correction to whole up trend from 0.5467. Outlook will stay bearish as long as 0.7104 resistance holds. Next target is 100% projection of 0.7463 to 0.6942 from 0.7315 at 0.6794 before completion.

For now, we’d look for strong support around 38.2% retracement of 0.5467 to 0.7463 at 0.6701 to complete the correction. But we’ll keep monitoring downside momentum, as well as development in the risk markets closely, to reassess the outlook.

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.3628; (P) 1.3703; (R1) 1.3752; More….

GBP/USD’s fall accelerates to as low as 1.3586 so far and intraday bias remains on the downside for 1.3482 key support. Decisive break there will indicate that it’s already correcting whole up trend from 1.1409. Next target will then be 38.2% retracement of 1.1409 to 1.4248 at 1.3164. On the upside, above 1.3688 minor resistance will turn intraday bias neutral first. But further fall will remain in favor as long as 1.3908 resistance holds.

In the bigger picture, as long as 1.3482 resistance turned support holds, up trend from 1.1409 should still continue. Decisive break of 1.4376 resistance will carry larger bullish implications. However, firm break of 1.3482 support will argue that the rise from 1.1409 has completed. GBP/USD would then be seen in another leg of long term range pattern between 1.1409 and 1.4376. Deeper fall could then be seen to 61.8% retracement of 1.1409 to 1.4248 at 1.2493, and even below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | National CPI Core Y/Y Jun | 0.20% | 0.20% | 0.10% | |

| 01:30 | AUD | RBA Minutes | ||||

| 06:00 | CHF | Trade Balance (CHF) Jun | 5.53B | 5.12B | 4.95B | 4.85B |

| 06:00 | EUR | Germany PPI M/M Jun | 1.30% | 1.20% | 1.50% | |

| 06:00 | EUR | Germany PPI Y/Y Jun | 8.50% | 8.50% | 7.20% | |

| 08:00 | EUR | Eurozone Current Account May | 11.7B | 24.3B | 22.8B | 22.1B |

| 12:30 | USD | Housing Starts Jun | 1.64M | 1.59M | 1.57M | 1.55M |

| 12:30 | USD | Building Permits Jun | 1.60M | 1.69M | 1.68M |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals