The forex markets appear to be turning into a consolidative phase for now. Yen is trading broadly lower as European indexes and US futures rebound further. Canadian Dollar is the strongest one with WTI crude oil reclaiming 68 handle. Aussie and Sterling are following as the next strongest for the day. But after all, there is not much change in the weekly picture, as Dollar and Yen are still the strongest while commodity currencies are the weakest.

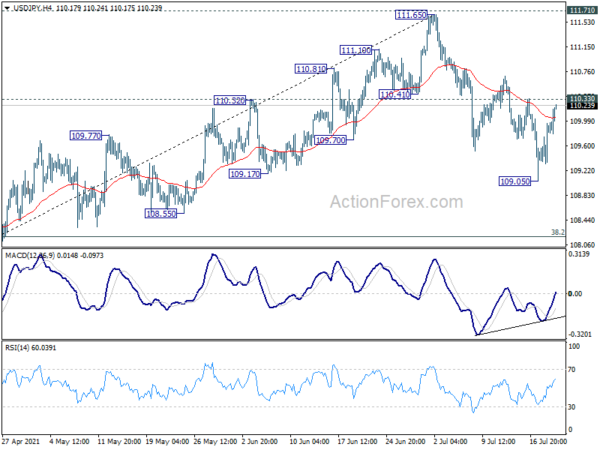

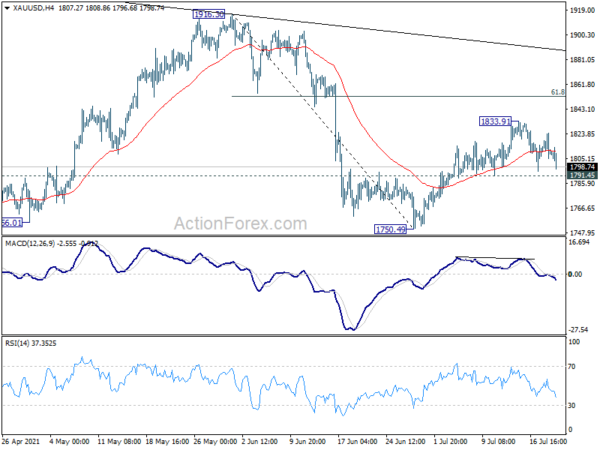

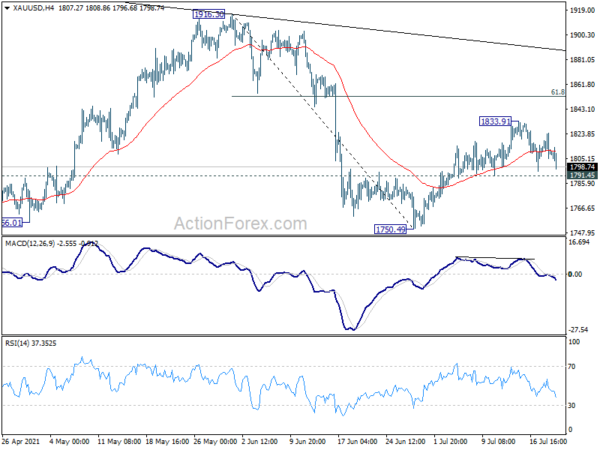

Technically, USD/JPY’s strong rebound is worth a note. Eyes are now on 110.33 resistance. Break there will argue that corrective fall from 111.65 has completed at 109.05. Stronger rise would then be seen back to retest 111.65 high. At the same time, Gold is back below 1800 handle, with eyes on 1791.45 support. Break will indicate completion of rebound from 1750.49, and bring retest of this support. Both developments, if happen together, could indicate stronger rally in Dollar elsewhere.

In Europe, at the time of writing, FTSE is up 1.52%. DAX is up 0.85%. CAC is up 1.37%. Germany 10-year yield is down -0.002 at -0.410. Earlier in Asia, Nikkei rose 0.58%. Hong Kong HSI dropped -0.13%. China Shanghai SSE rose 0.73%. Singapore Strait Times rose 0.25%.

Gold back below 1800, but staying in range

Gold drops notably again today, and it’s back below 1800 handle at the time of writing. Though down is still contained above 1791.45 support. Focus will remain on this support level. As long as 1791.45 support, rebound from 1750.49 is still in favor to resume. Break of 1833.91 will target 61.8% retracement of 1916.30 to 1750.49 at 1852.96.

However, firm break of 1791.45 would likely resume the decline from 1916.30. Further break of 1750.49 would confirm this bearish case and target 1676.65 support again.

BoJ Masayoshi: Inflation sluggish and powerful easing necessary

BoJ Deputy Governor Amamiya Masayoshi said speech, an uptrend in private consumption is expected to “become evident” as the impact of COVID-19 wanes gradually and employee income increases”. The “virtuous cycle” in the “corporate sector” will spread to the “household sector”, and “intensifying the cycle in the overall economy.” Nevertheless, the baseline scenario entails “high uncertainties” with risks “skewed to the downside” on the spread of variants. But activity could improve more than expected as vaccine rollout accelerates.

Masayoshi also said that it will “take time” to achieve price stability target of 2% inflation. He added, “while the inflation rate has risen clearly of late in the United States and other countries, it has been sluggish in Japan.” Giver this, “it is necessary for the Bank to persistently continue to conduct powerful monetary easing with a view to achieving the price stability target.”

Japan exports rose 48.6% yoy in Jun, 4th month of double-digit growth

Japan’s exports rose 48.6% yoy to JPY 7220B in June. That;s the fourth straight month of double-digit growth, even though it’s largely exaggerated by the pandemic plunge last year. By destination, exports to China jumped 27.7% yoy, led by demand for chip-making equipment, raw materials and plastic. Exports to US also rose 85.5% yoy, driven by cars, auto parts and motors. Imports rose 32.7% yoy to JPY 6837B. Trade surplus came in at JPY 383B.

In seasonally adjusted terms, exports rose 2.4% mom to JPY 7040B. Imports rose 4.0% mom to JPY 7130B. Trade balance turned into deficit of JPY 0.09T, versus expectation of JPY 0.02T surplus.

Australia retail sales dropped -1.8% mom in Jun on return to restrictions

According to preliminary estimate, Australia retail sales dropped -1.8% or AUD -515.1m in June 2021. Comparing to June 2020, sales rose 2.9% yoy. Victoria (-3.5 per cent) led the state falls in June, with the impact of the state’s fourth lockdown more pronounced in June than May (-0.9 per cent). New South Wales (-2.0 per cent) and Queensland (-1.5 per cent) also fell due to stay-at-home restrictions and reduced interstate mobility.

Ben James, Director of Quarterly Economy Wide Surveys, said: “June’s fall in turnover was due to the impact of coronavirus restrictions across multiple states. Victoria saw restrictions from the start of the month, which were gradually eased from the 11th of June. New South Wales, in particular Greater Sydney, saw stay-at-home orders issued towards the end of the month. Other states and territories saw interrupted trade due to mini-lockdowns, as well as reduced mobility between states with the tightening of border restrictions.”

Australia Westpac leading index dropped to 1.34, RBA to use flexibility in asset purchases

Australia Westpac leading index slowed from 1.68% to 1.34% in June. The index peaked at 5% back in November last year and then gradually fallen back. It’s still comfortably above zero and signals outlook for above trend growth. Still, Westpac expected -3.1% contraction in GDP in Q3 in New South Wales and -0.1% in Victoria due to renewed lockdowns.

Westpac added that RBA would be advised of significant downward revisions for Q3 growth at the meeting on August 3. It said it’s an “appropriate time” for RBA to use the “flexibility” on asset purchases. At the least it could announce to defer the tapering from AUD 5B to AUD 4B a week, which is scheduled to start in September. Further, “a decision to immediately lift purchases to $6 billion per week would certainly send the right signal that the Bank is responsive to economic developments and is prepared to use its new flexible policy tool accordingly.”

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 109.47; (P) 109.72; (R1) 110.10; More…

Intraday bias in USD/JPY remains neutral at this point. Further fall will remain in favor as long as 110.33 resistance intact. On the downside, break of 109.05 will target 38.2% retracement of 102.58 to 111.65 at 108.18. However, on the upside, break of 110.33 will argue that the choppy fall from 111.65 has completed, and turn bias back to the upside for retesting this high.

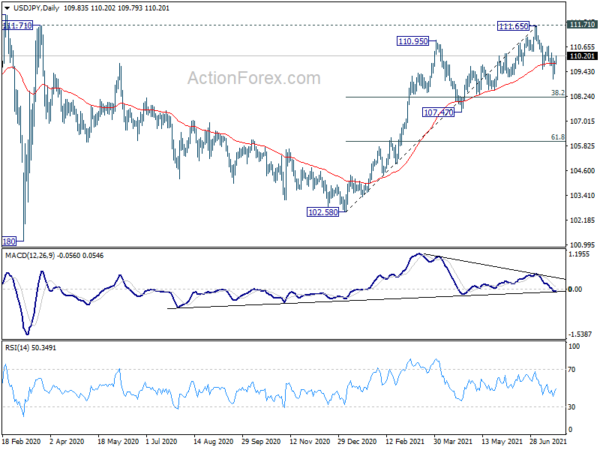

In the bigger picture, medium term outlook is staying neutral with 111.71 resistance intact. Sustained trading below 55 day EMA would argue that the pattern from 101.18 is starting another falling leg, that could head back to 102.58 support and below. For now, outlook won’t turn bullish as long as 111.71 resistance holds, even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Trade Balance (JPY) Jun | -0.09T | 0.02T | 0.04T | 0.02T |

| 23:50 | JPY | BoJ Minutes | ||||

| 0:30 | AUD | Westpac Leading Index M/M Jun | -0.10% | -0.10% | 0.10% | |

| 1:30 | AUD | Retail Sales M/M Jun P | -1.80% | -0.50% | 0.40% | |

| 6:00 | GBP | Public Sector Net Borrowing (GBP) Jun | 22.0B | 21.5B | 23.6B | 19.9B |

| 12:30 | CAD | New Housing Price Index M/M Jun | 0.60% | 1.10% | 1.40% | |

| 14:30 | USD | Crude Oil Inventories | -7.9M |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals