Euro is trading steadily in US session after ECB finally revealed it’s new forward guidance. Though, the common currency is notably weak against Sterling and commodity currencies. Meanwhile, Dollar and Swiss are also weak, together with Yen, as market sentiments are generally stable. We’d now see if US stocks could extend the strong rebounds in the past two days, to retest recently made record highs.

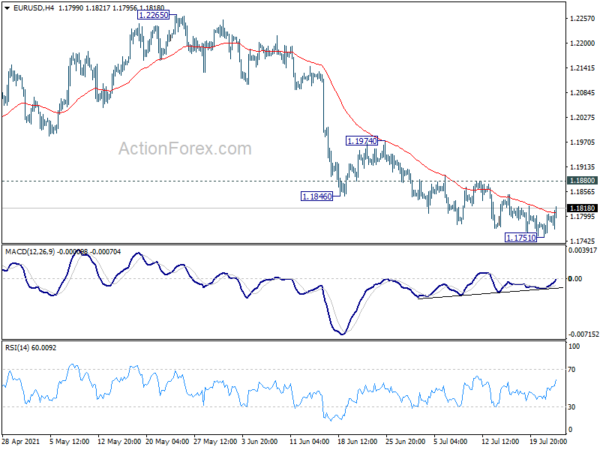

Technically, both EUR/USD and EUR/JPY are pressing 4 hour 55 EMA at this point. We’d see if the two pairs could stand firm above the EMAs to extend current recovery. Or, the would be dragged down by selloff in other crosses for retesting 1.1751 and 128.58 temporary lows.

In Europe, at the time of writing, FTSE is down -0.19%. DAX is up 0.66%. CAC is up 0.40%. Germany 10-year yield is down -0.008 at -0.400. Earlier in Asia, Hong Kong HSI rose 1.83%. China Shanghai SSE rose 0.34%. Singapore Strait Times rose 1.29%. Japan was on holiday.

US initial jobless claims rose to 419k, above expectation

US initial jobless claims rose 51k to 419k in the week ending July 17, worse than expectation of 350k. Four-week moving average of initial claims rose 750 to 385k.

Continuing claims dropped -29k to 3236k in the week ending July 10, lowest since March 21, 2020. Four-week moving average of continuing claims dropped -44k to 3338k, also the lowest since March 21, 2020.

ECB stands pat, issues new forward guidance

ECB keeps interest rate unchanged today, with main refinancing rate, marginal lending facility rate, and deposit facility rate at 0.0)%, 0.25%, and -0.50% respectively. Net purchase under APP will continue at monthly pace of EUR 20B. The EUR 1850PEPP will continue “until at least the end of March 2022”. Purchase pace remain at “significantly higher pace” than during first months of the year.

Also, ECB now expects key interest rates to “remain at their present or lower levels until it sees inflation reaching two per cent well ahead of the end of its projection horizon and durably for the rest of the projection horizon, and it judges that realised progress in underlying inflation is sufficiently advanced to be consistent with inflation stabilising at two per cent over the medium term.” It added that this may also imply “a transitory period in which inflation is moderately above target.”

BoE Broadbent: The appropriate policy response to current inflation is nothing

BoE Deputy Governor Ben Broadbent said in a speech, “most of the overshoot relative to target in the latest CPI numbers… reflects unusually strong inflation in goods prices”. That would also be true of the “larger overshoot we’re going to see towards the end of this year”. “If this was only a story about global goods prices,” he added, then the appropriate policy response to the current inflation would be “nothing”.

Also, “while we know it’s going to go further over the next few months, I’m not convinced that the current inflation in retail goods prices should in and of itself mean higher inflation 18-24 months ahead, the horizon more relevant for monetary policy,” he added.

Australia goods exports rose to record 41.3B in Jun

Australia exports of goods rose 8% mom or AUD 2.9B to AUD 41.3B in June. Imports of goods rose 7% mom or AUD 2.1B to AUD 28.0B. Goods trade surplus widened to record AUD 13.3B, up slightly from AUD 12.5B. Exports to top five destinations rose, including China (8%), Japan (21%), South Korea (24%), Taiwan (9%), USA (7%).

Head of International Statistics at the ABS Andrew Tomadini said: “June 2021 recorded a monthly export value above $40 billion. Exports increased 8 per cent to $41.3 billion, with significant increases in metalliferous ores, coal, non-monetary gold, and gas”.

Australia NAB business confidence dropped to 17 in Q2, but condition rose sharply to 32

Australia NAB business confidence dropped from 19 to 17 in Q2. Current business condition rose from 20 to 32. Business conditions for the next 3 months rose from 28 to 36. Business conditions for the next 12 months rose from 31 to 33. Capex plans for the next 12 months rose from 34 to 37.

Looking at some more details, trading conditions rose from 26 to 38. Profitability rose from 22 to 32. Employment rose from 13 to 23. Forward orders rose from 14 to 23. Stocks rose from 5 to 11. Exports also improved from -1 to 0.

According to Alan Oster, NAB Group Chief Economist “Business conditions were still in negative territory in Q3 2020, and now, three quarters later, they were at a record high, a testament to how rapid the recovery has been from last year’s recession”.

“A pleasing aspect of the survey is how broad-based the strength in conditions and confidence was – whether you look by industry or by state they are all above average, and in many cases well above.”

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1762; (P) 1.1784; (R1) 1.1815; More…

EUR/USD is still losing downside momentum, as displayed in 4 hour MACD. Nevertheless, further decline is expected with 1.1880 resistance intact. Current fall from from 1.2265, as the third leg of correction from 1.2348, would target 1.1703 support. On the upside, though, break of 1.1880 will indicate short term bottoming and turn bias back to the upside for stronger rebound to 1.1974 resistance first.

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. Reaction from 1.2555 should reveal underlying long term momentum in the pair. However sustained break of 1.1602 will argue that the rise from 1.0635 is over, and turn medium term outlook bearish again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | NAB Business Confidence Q2 | 17 | 17 | 19 | |

| 11:45 | EUR | Eurozone ECB Interest Rate Decision | 0.00% | 0.00% | 0.00% | |

| 12:30 | EUR | ECB Press Conference | ||||

| 12:30 | USD | Initial Jobless Claims (Jul 16) | 419K | 350K | 360K | 368K |

| 14:00 | USD | Existing Home Sales Jun | 5.95M | 5.80M | ||

| 14:00 | EUR | Eurozone Consumer Confidence Jul P | -3 | -3 | ||

| 14:30 | USD | Natural Gas Storage | 42B | 55B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals