The forex markets are rather quiet in Asia, with major pairs and crosses stuck inside yesterday’s tight range. Risk sentiments are mixed. While US indexes extended the record runs overnight, Asian index are struggling, as dragged down by extended selloff in Hong Kong. Overall, European majors are generally firmer together with Yen. On the other hand, Dollar and commodity currencies are soft.

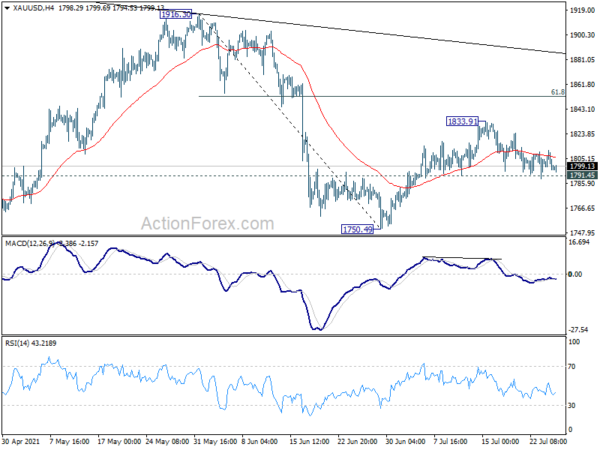

Technically, we’d pay attention to whether Dollar would turn weaker leading up to FOMC policy decision. In particular, break of 110.00 minor support in USD/JPY would suggest completion of rebound from 109.05. Break of 1.1880 resistance in EUR/USD would also indicate short term bottoming. At the same time, Gold is holding on to 1791.45 support with some resilience. Break of 1833.91 resistance will resume the rebound from 1750.49.

In Asia, at the time of writing, Nikkei is up 0.50%. Hong Kong HSI is down -1.03%. China Shanghai SSE is up 0.14%. Singapore Strait Times is up 0.53%. Japan 10-year JGB yield is up 0.0051 at 0.022. Overnight, DOW rose 0.24%. S&P 500 rose 0.24%. NASDAQ rose 0.03. 10-year yield dropped -0.010 to 1.276.

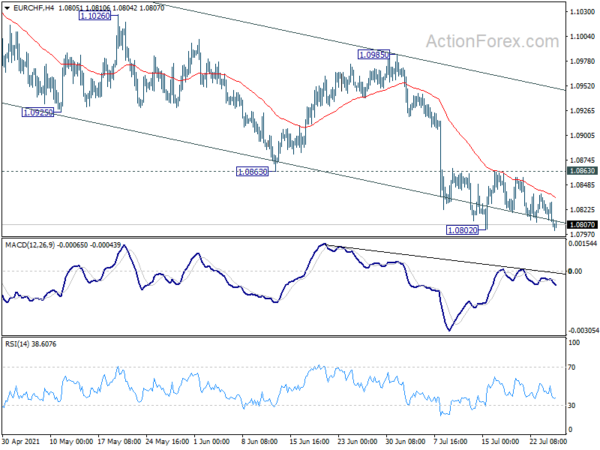

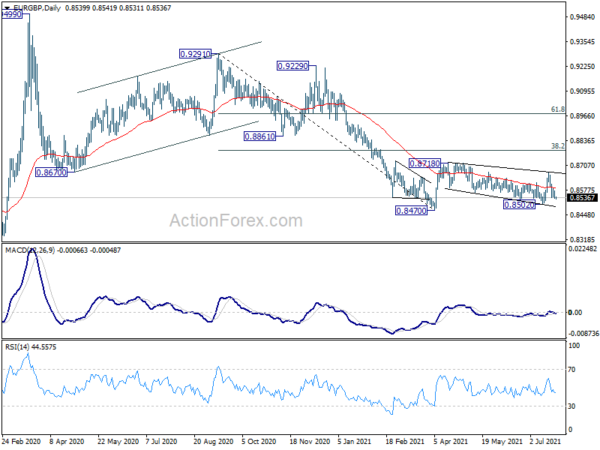

EUR/CHF breaking to downside, EUR/GBP soft

Euro has been trading as the relatively weaker European majors since ECB reaffirmed it dovish stance last week. The new forward guidance indicated that inflation must projected to be on target 12-18 months away before consideration of rate hike. At the same time, there is no sign of tapering the PEPP program yet and it’s going to last until March next year anyway.

EUR/CHF’s breach of 1.0802 temporary low suggests that recent decline is resuming. Rejection by 4 hour 55 EMA affirms near term bearishness too. Fall from 1.1149 is on track to 1.0737 cluster support (61.8% retracement of 1.0505 to 1.1149 at 1.0751). Downside momentum is so far capped by the medium term channel support. We’ll see if EUR/CHF could accelerate further. below the channel.

EUR/GBP also staged a sharp reversal after spiking to 0.8668 last week. The lack of deterioration in coronavirus infections and deaths was a good sign for the UK, after the so called “Freedom Day”. It’s now possible that corrective pattern from 0.8718 would take another take through 0.8502 support before completion. That is, Euro could continue to underperform Sterling for a little while.

AUD continues to under-perform NZD and CAD

Australian Dollar is continuing to under-perform New Zealand and Canadian Dollar. While Victoria’s lockdown is set to be eased by mid-night, it’s uncertain what the New South Wales government could do on restrictions after the end of the month as delta variant is still spreading quickly in the community. Whether RBA would taper asset purchase beyond September is now is question as renewed lockdowns are derailing recovery.

AUD/NZD edged lower today as fall from 1.0944 is still in force. Downside momentum weakened a little on oversold condition in daily RIS. But there is no sign of bottoming yet. With 1.0611 resistance intact, AUD/NZD is on track to 1.0415 support next.

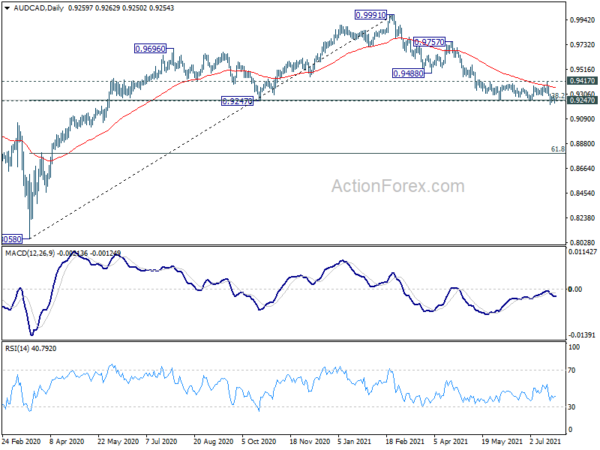

AUD/CAD’s decline from 0.9991 resumed after failing to sustain above 55 day EMA. It’s still trying to draw support from 0.9247 key support level but firm break of 0.9417 resistance is needed to indicate short term bottoming. Sustained trading below 0.9247 would open up further fall towards 61.8% retracement of 0.8058 to 0.9991 at 0.8796.

On the data front

Japan corporate service price rose 1.4% yoy in June, above expectation of 1.3% yoy. Eurozone M3 money supply will be released in European session. Later in the day, US will release durable goods orders, house price index and consumer confidence.

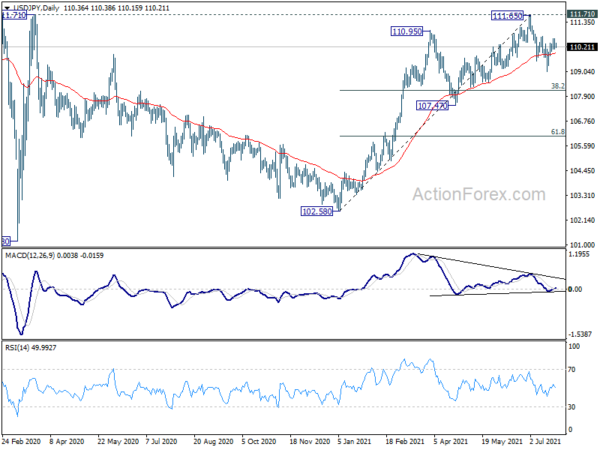

USD/JPY Daily Outlook

Daily Pivots: (S1) 110.23; (P) 110.41; (R1) 110.73; More…

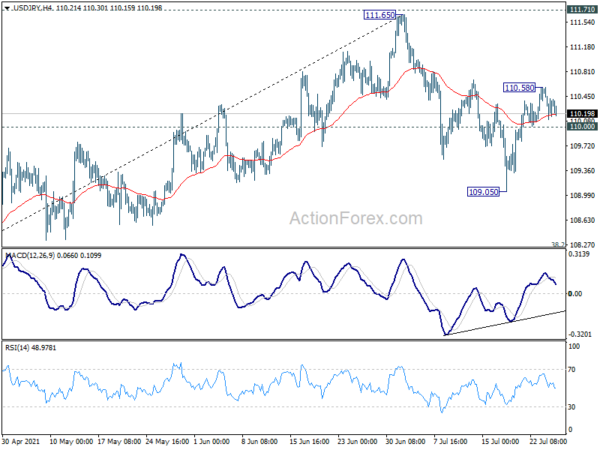

Intraday bias in USD/JPY remains neutral for the moment and outlook is unchanged. Another rise is in favor as long as 110.00 minor support holds. Above 110.58 will resume the rebound from 109.05 to retest 111.65 high. However, on the downside, break of 110.00 will turn bias back to the downside for 109.05. Break will resume the fall from 111.65 to 38.2% retracement of 102.58 to 111.65 at 108.18.

In the bigger picture, medium term outlook is staying neutral with 111.71 resistance intact. The pattern from 101.18 could still extend with another falling leg. Sustained trading below 55 day EMA will bring deeper fall to 107.47 support and below. For now, outlook won’t turn bullish as long as 111.71 resistance holds, even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Corporate Service Price Index Y/Y Jun | 1.40% | 1.30% | 1.50% | |

| 08:00 | EUR | Eurozone M3 Money Supply Y/Y Jun | 8.20% | 8.40% | ||

| 12:30 | USD | Durable Goods Orders Jun | 2.10% | 2.30% | ||

| 12:30 | USD | Durable Goods Orders ex Transportation Jun | 0.80% | 0.30% | ||

| 13:00 | USD | S&P/Case-Shiller Home Price Indices Y/Y May | 15.40% | 14.90% | ||

| 13:00 | USD | Housing Price Index M/M May | 1.80% | 1.80% | ||

| 14:00 | USD | Consumer Confidence Jul | 125.3 | 127.3 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals