Sterling was lifted very briefly after BoE policy decision, but there was again no follow through buying. Dollar also pays little attention to jobless claims. Overall, the markets are staying in consolidative mode, and would probably stay so before tomorrow’s non-farm payrolls report. As of now, Kiwi is the strongest one for the week followed by Aussie. Canadian is the weakest, followed by Euro.

Technically, we’d continue to pay attention to Dollar pairs. In particular, breaks of 110.58 resistance in USD/JPY and 0.9116 support turned resistance in USD/CHF are needed to confirm a Dollar come back. Otherwise, selling of the greenback could still come back any time. Meanwhile, break of 1.0907 resistance in EUR/USD would suggest that the Dollar selloff is taking off.

In Europe, at the time of writing, FTSE is down -0.10%. DAX is up 0.14%. CAC is up 0.39%. Germany 10-year yield is down -0.0133 at -0.508, staying below -0.5 handle. Earlier in Asia, Nikkei rose 0.52%. Hong Kong HSI dropped -0.84%. China Shanghai SSE dropped -0.31%. Singapore Strait Times dropped -0.25%. Japan 10-year JGB yield rose 0.0078 to 0.013.

US initial jobless claims dropped to 385k, continuing claims dropped to 2.9m

US initial jobless claims dropped -14k to 385k in the week ending July 31, slightly above expectation of 382k. Four-week moving average of initial claims dropped -250 to 394k.

Continuing claims dropped -366k to 2930k in the week ending July 24. That’s the lowest level since March 14, 2020. Four-week moving average dropped -109k to 3188k, lowest since March 21, 2020.

Also released, US trade deficit widened to USD -75.7B in June, versus expectation of USD -72.5B.

Canada trade balance reported CAD 3.2B surplus in June, versus expectation of CAD 0.4B.

BoE stands pat, won’t put undue weight on capacity pressures

BoE left Bank rate unchanged at 0.10% by unanimous vote. Asset purchase target was held at GBP 895B, by 701 vote. Michael Saunders was the only MPC member who voted for tapering to GBP 850B. BoE noted that the Committee will focus on “medium-term prospects for inflation”, but “will not put undue weight on capacity pressures that are frictional in nature and likely to be temporary.” Though, there remain “two-sided risk” around central path for medium term inflation and risk management considerations “continue to have some force”.

BoE also said that GDP is expected to grow by around 3% in Q3, with just a “small negative impact from recent developments in the pandemic”. GDP is projected to “recover further over the remainder of the year”, and reaches its prepandemic level in 2021 Q4. CPI inflation is projected to “temporarily” rise to 4% in Q4, but that falls back to close to the 2% target.

ECB bulletin: On track for strong Q3 with strong manufacturing and vigorous bounce-back services

In the Monthly Economic Bulletin, ECB said Eurozone economy is “on track for strong growth” in Q3. Manufacturing is expected to “perform strongly” despite supply bottlenecks. Reopening is supporting a “vigorous bounce-back” in services sector. However, Delta variant “could dampen this recovery in services, especially in tourism and hospitality.”

Economic activity is expected to return to pre-crisis level in Q1 next year. But there is “still a long way to go” before the damage is offset. Thus, “significant policy support remains essential”. It added, “an ambitious and coordinated fiscal policy should continue to complement monetary policy in underpinning confidence and supporting spending”.

UK PMI construction dropped to 58.7, widespread supply shortages and constrained capacity

UK PMI Construction dropped to 58.7 in July, down sharply from June’s 24-year high of 66.3. House building remained best-performing category. Supply shortages led to another rapid rise in input prices.

Also released, Germany factory orders rose 4.1% mom in June, above expectation of 1.5% mom. France industrial output rose 0.5% mom in June, matched expectations.

Australia trade surplus widened to AUD 10.2B in Jun

Australia exports of goods and services rose AUD 1489m (4% mom) to AUD 43.34B in June. Imports of goods and services rose AUD 261 m (1% mom) to AUD 32.84B. Trade surplus widened to AUD 10.50B, from AUD 9.27B, slightly above expectation of AUD 10.20B.

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.3865; (P) 1.3911; (R1) 1.3937; More…

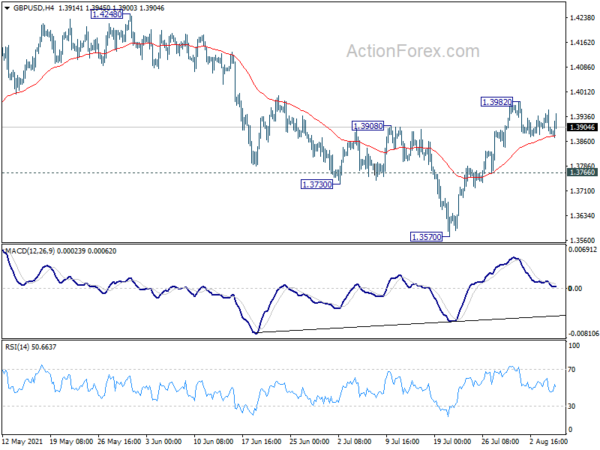

GBP/USD recovered after touching 4 hour 55 EMA, but stays below 1.3982. Intraday bias remains neutral for some more consolidations. Outlook is unchanged that corrective pattern from 1.4240 could have completed with three waves down to 1.3570. Further rise is expected as long as 1.3766 support holds. On the upside, break of 1.3982 will resume the rise from 1.3570 to retest 1.4248 high. However, break of 1.3766 support will dampen this bullish view and bring retest of 1.3570.

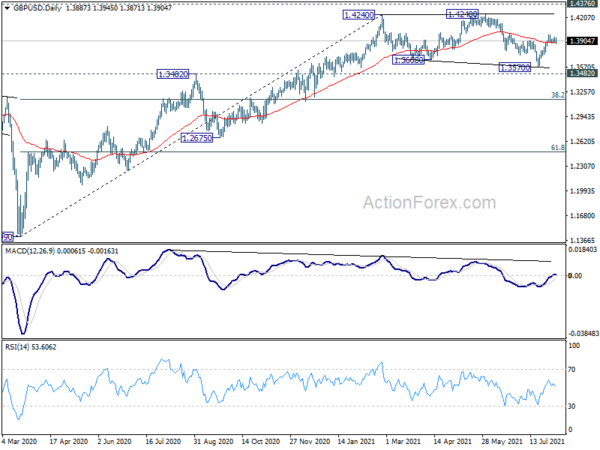

In the bigger picture, as long as 1.3482 resistance turned support holds, up trend from 1.1409 should still continue. Decisive break of 1.4376 resistance will carry larger bullish implications. However, firm break of 1.3482 support will argue that the rise from 1.1409 has completed. GBP/USD would then be seen in another leg of long term range pattern between 1.1409 and 1.4376. Deeper fall could then be seen to 61.8% retracement of 1.1409 to 1.4248 at 1.2493, and even below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | Trade Balance (AUD) Jun | 10.50B | 10.20B | 9.68B | 9.27B |

| 06:00 | EUR | Germany Factory Orders M/M Jun | 4.10% | 1.50% | -3.70% | -3.20% |

| 06:45 | EUR | France Industrial Output M/M Jun | 0.50% | 0.50% | -0.30% | -0.40% |

| 08:00 | EUR | ECB Economic Bulletin | ||||

| 08:30 | GBP | Construction PMI Jul | 58.7 | 63.8 | 66.3 | |

| 11:00 | GBP | BoE Rate Decision | 0.10% | 0.10% | 0.10% | |

| 11:00 | GBP | BoE Asset Purchase Facility | 895B | 895B | 895B | |

| 11:00 | GBP | MPC Official Bank Rate Votes | 0–0–8 | 0–0–9 | 0–0–9 | |

| 11:00 | GBP | MPC Asset Purchase Facility Votes | 0–1–7 | 0–1–8 | 0–1–8 | |

| 11:30 | USD | Challenger Job Cuts Y/Y Jul | -92.80% | -88.00% | ||

| 12:30 | CAD | International Merchandise Trade (CAD) Jun | 3.2B | 0.4B | -1.4B | -1.6B |

| 12:30 | USD | Trade Balance (USD) Jun | -75.7B | -72.5B | -71.2B | -71.0B |

| 12:30 | USD | Initial Jobless Claims (Jul 30) | 385K | 382K | 400K | 299K |

| 14:30 | USD | Natural Gas Storage | 19B | 36B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals