Dollar drops notably in early US session after consumer inflation data. Headline CPI was steady while core CPI slowed a little. At least, inflation hasn’t been worsening from Fed’s “transitory rhetoric”. US stock futures also jump, probably on reduced concerns over monetary tightening. New Zealand and Australian Dollars are currently the strongest, followed by Swiss Franc.

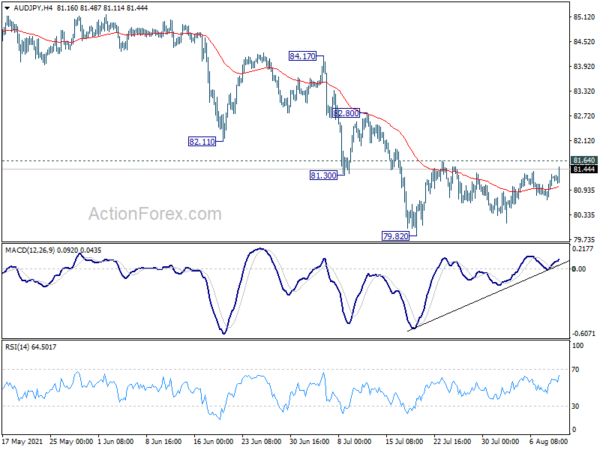

Technically, as discussed in prior reports, Dollar’s prior rally were mainly against Euro, Swiss Franc and Yen. Indeed, GBP/USD, AUD/USD and USD/CAD are all holding in familiar range. Focus will now turns to 1.3982 resistance, 0.7443 resistance and 1.2421 support, respectively, as Dollar is turning soft. Additionally, we’ll keep an eye on 81.64 resistance in AUD/JPY. Break will resume the rebound from 79.82, and signal a comeback in the Aussie.

In Europe, at the time of writing, FTSE is up 0.46%. DAX is down -0.02%. CAC is up 0.26%. Germany 10-year yield is down -0.0063 at -0.460. Earlier in Asia, Nikkei rose 0.65%. Hong Kong HSI rose 0.20%. China Shanghai SSE rose 0.08%. Singapore Strait Times dropped -0.85%. Japan 10-year JGB yield rose 0.0171 to 0.042.

US CPI unchanged at 5.4% yoy in Jul, CPI core slowed to 4.3% yoy

US CPI rose 0.5% mom in July, matched expectations. Over the last 12 months, CPI rose 5.4% yoy, unchanged from June’s reading, above expectation of 5.3% yoy.

Core CPI, excluding food and energy, rose 0.3% mom, below expectation of 0.4% mom. Over the past 12 months, CPI core slowed to 4.3% yoy, down from 4.5% yoy, matched expectation.

Fed Barkin: We’ll get there to taper in the next few months

Richmond Fed President Thomas Barkin said “we’re closing in” and he’s “very support of tapering and moving back toward a normal environment”. However, it’s credible to think “we will get there in the next few months” and he didn’t want to commit to a timetable yet.

“I would like to be at a normal level of participation in the asset markets and a normal level of rates,” Barkin said. But “I also think that as a committee, when you put out forward guidance you think about it carefully and then do your best to live to that.”

“On the employment side you have a hypothesis that you are going to bring a lot more back in. On inflation you have a hypothesis that these things are transitory,” he said. “I need to test both of these.”

Australia Westpac consumer sentiment dropped -4.4%, still reasonably confident

Australia Westpac-MI consumer sentiment dropped -4.4% to 104.1 in August, down from July’s 108.8. It’s now at the lowest point in a year, but was well above the pandemic trough, and even above the levels over the twelve months prior to the pandemic.

Westpac said: “The virus situation locally is clearly troubling, but consumers appear reasonably confident that it will come back under control, and that once it does, the economy will see a return to robust growth.”

Westpac expects RBA to leave policy unchanged at next meeting on September 7. It added, “given its decision to sit pat in August despite a sharp deterioration to the near-term outlook, the hurdle for RBA action looks to be very high”. It also maintain the forecast that RBA would start raising the case rate in Q1 of 2023.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1706; (P) 1.1724; (R1) 1.1739; More…

Intraday bias in EUR/USD is turned neutral with 4 hour MACD crossed above signal line. We’d continue to look for strong support from 1.1602/1703 support zone to bring rebound. On the upside, above 1.1768 minor resistance will turn bias back to the upside for 1.1907 resistance first. However, sustained break of 1.1602 will argue that it’s already reversing the trend from 1.1603, and target 61.8% retracement of 1.1603 to 1.2348 at 1.1289.

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. Reaction from 1.2555 should reveal underlying long term momentum in the pair. However sustained break of 1.1602 will argue that the rise from 1.0635 is over, and turn medium term outlook bearish again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Money Supply M2+CD Y/Y Jul | 5.20% | 5.60% | 5.90% | 5.80% |

| 00:30 | AUD | Westpac Consumer Confidence Aug | -4.40% | 1.50% | ||

| 06:00 | EUR | Germany CPI M/M Jul F | 0.90% | 0.90% | 0.90% | |

| 06:00 | EUR | Germany CPI Y/Y Jul F | 3.80% | 3.80% | 3.80% | |

| 12:30 | USD | CPI M/M Jul | 0.50% | 0.50% | 0.90% | |

| 12:30 | USD | CPI Y/Y Jul | 5.40% | 5.30% | 5.40% | |

| 12:30 | USD | CPI Core M/M Jul | 0.30% | 0.40% | 0.90% | |

| 12:30 | USD | CPI Core Y/Y Jul | 4.30% | 4.30% | 4.50% | |

| 14:30 | USD | Crude Oil Inventories | -0.8M | 3.6M |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals