Dollar, Swiss Franc and Yen are taking turns to be the strongest, with the greenback having a little upper hand. But they’re kept in range against each other. Commodity currencies remain the weakest, with Aussie additionally pressured by strict lockdowns, while Loonie is dragged down by falling oil prices. Euro and Sterling are mixed in the middle. Stock traders appear to be relatively indecisive though, in particular in the US. S&P 500 and NASDAQ managed to reverse all initial decline to closed up. However, major Asian indexes are rather weak, especially in Hong Kong and China.

Technically, the overwhelming rally in Dollar this week is, to a certain extent, not overwhelming enough. Gold is just stuck in range around 1780 for now. Considering that it’s close to 55 day EMA (now at 1979.58), it’s actually rather resilient. To confirm more sustainable rise in the greenback, especially against the equally strong Swiss Franc and Yen, we’d prefer to see firm break of 1770.68 support in Gold to indicate rejection by 1800 handle. Otherwise, we’d maintain a bit of cautiousness in USD/CHF and USD/JPY, as well as EUR/USD.

In Asia, at the time of writing, Nikkei is down -0.70%. Hong Kong HSI is down -2.28%. China Shanghai SSE is down -1.66%. Singapore Strait Times is up 0.77%. Japan 10-year JGB yield is down -0.002 at 0.015. Overnight, DOW dropped -0.19%. S&P 500 rose 0.13%. NASDSAQ rose 0.11%. 10-year yield dropped -0.031 to 1.242.

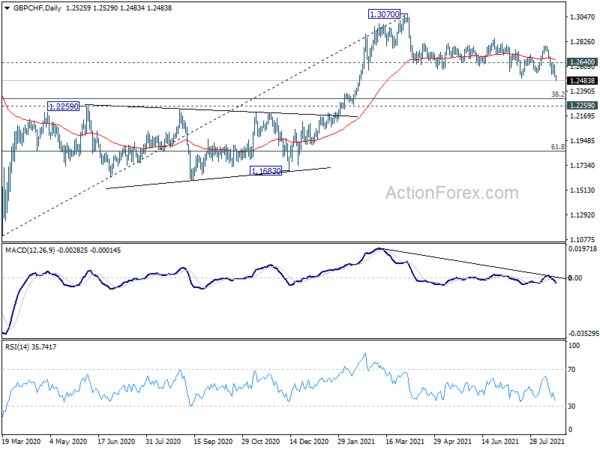

UK Gfk consumer confidence dropped to -8, GBP/CHF breaks near term support

UK Gfk consumer confidence dropped slightly from -7 to -8 in August, below expectation of -6. “Against a backdrop of cooling headline inflation and soaring house prices, the U.K. consumer confidence index is stable at minus 8 this August,” Joe Staton, GfK’s client strategy director, said.

“Expectations for our personal financial situation for the coming 12 months are holding up and this positivity bodes well for the economy going forward this year and next,” Staton said. The index measuring changes in personal finances over the past 12 months is up one point at 0.

Sterling is the weakest European major for the week, and is trading just better than commodity currencies. GBP/CHF drops through 1.2498 support to resume the choppy fall from 1.3070. Deeper decline is now expected as long as 1.2640 resistance holds. Such decline is seen as a correction to up trend from 1.1107. Next target is 38.2% retracement of 1.1107 to 1.3070 at 1.2320. Nevertheless, we’d look for strong support 1.2259 resistance turned support to bring rebound, at least on first attempt.

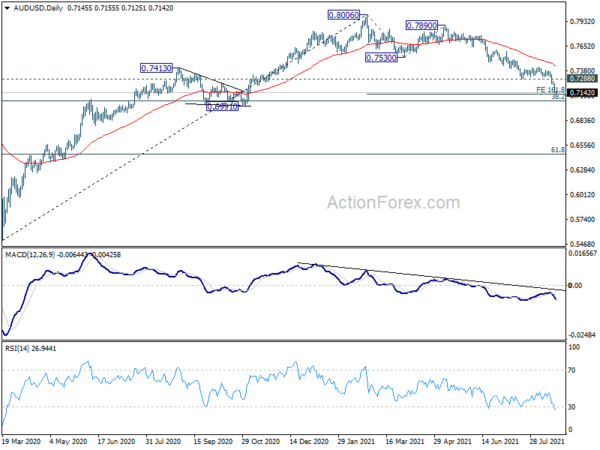

AUD/USD to draw strong support from 0.7 on next fall

Australian Dollar remains broadly pressured today. New South Wales reported another 644 new coronavirus infections and 4 deaths. Greater Sydney’s lockdown will be extended until the end of September. That is, the lockdown, which has already lasted for 8 weeks, will run for at least 13 weeks. Also, a curfew will be introduced for 12 local government areas of Sydney, as people there must stay stop between 9pm and 5am.

While more downside is still in favor in AUD/USD for the immediate future, we’d start to looking for bottoming sign on next move. Oversold condition in daily MACD could start to slow the decline. 161.8% projection of 0.8006 to 0.7530 from 0.7890 at 0.7120 will be met. Additionally, AUD/USD should then enter a key support zone around 0.7 psychological level, 0.6991 support, and 38.2% retracement of 0.5506 to 0.8006 at 0.7051. Let’s see if AUD/USD would at least turn into sideway trading.

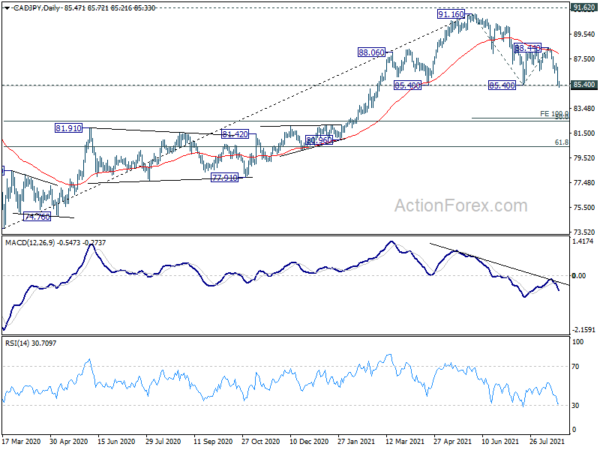

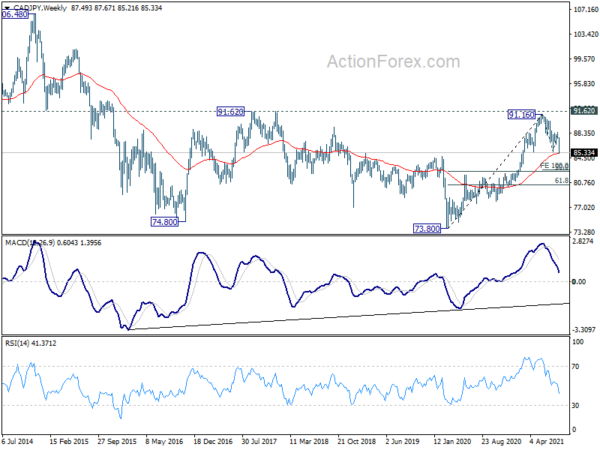

CAD/JPY pressing 85.40 key support, completing head and shoulder top?

CAD/JPY is now pressing 85.40 key support level after this week’s steep decline. Sustained break of this support would carry rather bearish medium term implications. Firstly, that would complete a head and shoulder top reversal pattern (ls: 88.06, h: 91.16, rs: 88.44). Secondly, 55 week EMA (now at 85.24) would be firmly taken out. Thirdly, that could also confirm completion of whole rise from 73.80 (2020 low) at 91.16, as a leg in the sideway pattern that started at 74.80 (2016 low), after rejection by 91.62 key resistance (2017 high).

Sustained break of 85.40 would push CAD/JPY to 100% projection of 91.16 to 85.40 from 88.44 at 82.68. That is close to 50 % retracement of 73.80 to 91.16 at 82.48.

Elsewhere

Japan CPI core dropped back to negative -0.20% yoy in July, down from 0.2% yoy, but beat expectation of -0.4% yoy. UK retail sales and public sector net borrowing will be released in European session. Germany will release PPI. Later in the day, Canada new housing price index and retail sales will be featured.

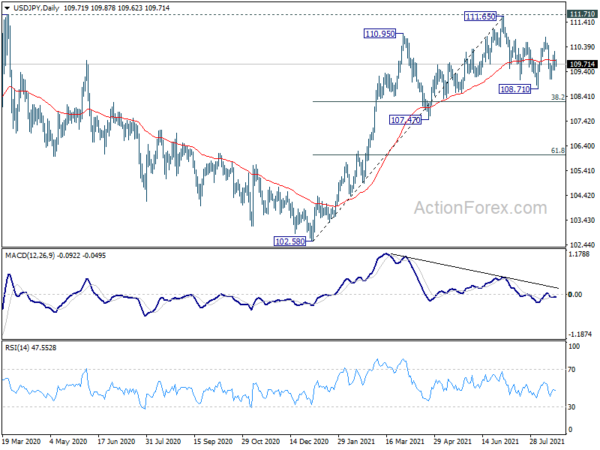

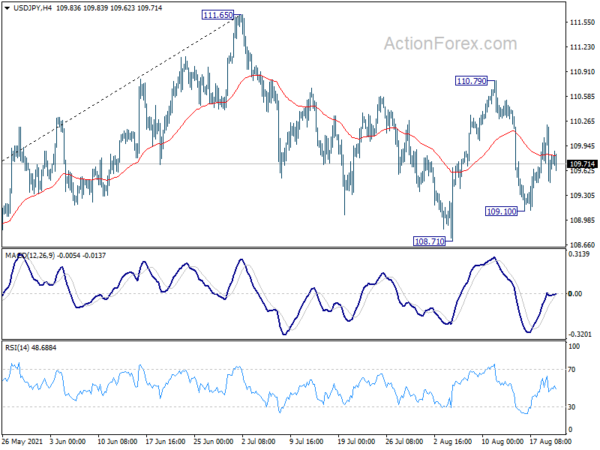

USD/JPY Daily Outlook

Daily Pivots: (S1) 109.43; (P) 109.83; (R1) 110.17; More…

Intraday bias in USD/JPY remains neutral and outlook is unchanged. On the upside, break of 110.79 will resume the rebound from 108.71 to retest 111.65 high. On the downside, break of 109.10 will target 108.71 support first. Firm break there will resume the decline from 111.65 and target 38.2% retracement of 102.58 to 111.65 at 108.18 next.

In the bigger picture, medium term outlook is staying neutral with 111.71 resistance intact. The pattern from 101.18 could still extend with another falling leg. Sustained trading below 55 day EMA will bring deeper fall to 107.47 support and below. Nevertheless, strong break of 111.71 resistance will confirm completion of the corrective decline from 118.65 (2016 high). Further rise should then be seen to 114.54 and then 118.65 resistance.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | GfK Consumer Confidence Aug | -8 | -6 | -7 | |

| 23:30 | JPY | National CPI Core Y/Y Jul | -0.20% | -0.40% | 0.20% | |

| 06:00 | GBP | Retail Sales M/M Jul | 0.40% | 0.50% | ||

| 06:00 | GBP | Retail Sales Y/Y Jul | 6.40% | 9.70% | ||

| 06:00 | GBP | Retail Sales ex-Fuel M/M Jul | 0.30% | |||

| 06:00 | GBP | Retail Sales ex-Fuel Y/Y Jul | 7.40% | |||

| 06:00 | EUR | Germany PPI M/M Jul | 0.80% | 1.30% | ||

| 06:00 | EUR | Germany PPI Y/Y Jul | 8.40% | 8.50% | ||

| 06:00 | GBP | Public Sector Net Borrowing (GBP) Jul | 23.2B | 22.0B | ||

| 12:30 | CAD | New Housing Price Index M/M Jul | 1.30% | 0.60% | ||

| 12:30 | CAD | Retail Sales M/M Jun | 5.00% | -2.10% | ||

| 12:30 | CAD | Retail Sales ex Autos M/M Jun | 4.90% | -2.00% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals