Risk-on sentiment firms up slightly after better than expected jobless claims from the US. Dollar, Yen and Swiss Franc continue to trade as the weakest ones. On the other hand, New Zealand and Australian Dollars are the strongest. But the moves in risk markets are limited so far. Investors could turn cautious quickly again and stay calm before tomorrow’s non-farm payroll report.

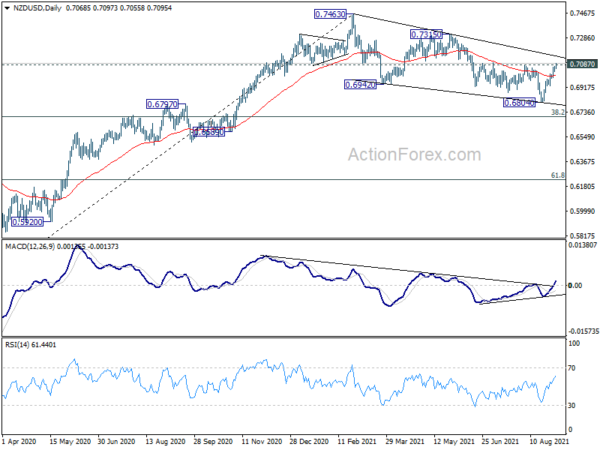

Technically, NZD/USD’s break of 0.7087 resistance suggests that corrective pattern from 0.7463 could have completed with three waves down to 0.6804 already. Stronger rise would be seen back to 0.7315 resistance. Break will likely resume larger up trend from 0.5467 through 0.7463 high. We’ll firstly see if NZD/USD’s move could extend into next week. Secondly, we’ll pay attention to whether AUD/USD would follow and break through 0.7425 resistance.

In Europe, at the time of writing, FTSE is up 0.01%. DAX is up 0.15%. CAC is up 0.13%. Germany 10-year yield is down -0.0203 at -0.390, staying above -0.4 handle. Earlier in Asia, Nikkei rose 0.33%. Hong Kong HSI rose 0.24%. China Shanghai SSE rose 0.84%. Singapore Strait Times rose 0.03%. Japan 10-year JGB yield rose 0.0039 to 0.035.

US initial jobless claims dropped to 340k, continuing claims dropped to 2.75m

US initial jobless claims dropped -14k to 340k in the week ending August 28, better than expectation of 351k. That’s the lowest level since march 14, 2020. Four-week moving average of initial claims dropped -12k to 355k, lowest since March 2020 too.

Continuing claims dropped -160k to 2748k in the week ending August 21, lowest since March 14, 2020. Four-week moving average of continuing claims dropped -58k to 2855k, lowest since March 21, 2020.

Also from US, trade deficit narrowed to USD -70.1B in July versus expectation of USD -74.5B. Non-farm productivity was revised to 2.1% in Q2, unit labor cost at 1.3%.

From Canada, building permits dropped -3.9% mom in July versus expectation of 1.5% mom. Trade surplus came in at CAD 0.8B versus expectation of CAD 1.7B.

Eurozone PPI at 2.3% mom, 12.1% yoy in Jul; EU up 2.2% mom, 12.2% yoy

Eurozone PPI came in at 2.3% mom, 12.1% yoy in July, well above expectation of 1.2% mom, 10.9% yoy. For the month, industrial producer prices increased by 5.7% in the energy sector, by 1.9% for intermediate goods, by 0.7% for durable consumer goods, by 0.5% for capital goods and by 0.1% for non-durable consumer goods. Prices in total industry excluding energy increased by 1.0%.

EU PPI came in at 2.2% mom, 12.2% yoy. For the month, industrial producer prices increased in all Member States except Malta, where they remained stable. The highest increases were recorded in Ireland (+20.6%), Estonia (+6.4%) and Belgium (+4.2%).

Swiss GDP grew 1.8% qoq in Q2, retail sales dropped -2.6% yoy in Jul

Swiss GDP grew 1.8% qoq in Q2, slightly below expectation of 1.9% qoq. Total GDP was only -0.5% below the pre-crisis level seen in Q4 2019. Looking at some details, from production approach, manufacturing grew 0.9%, trade rose 4.8%, accommodation and food rose 48.9%, arts, entertainment and recreation rose 52.9%. From expenditure approach, private consumption rose 4.1%, government consumption rose 5.5%.

Also from Swiss, real retail sales dropped -2.6% yoy in July, much worse than expectation of 0.2% yoy. CPI came in at 0.2% mom, 0.9% yoy in August, above expectation of 0.1% mom, 0.8% yoy.

Australia trade surplus hit record AUD 12.12B, as exports to China rose

Australia goods and services exports rose 5% mom in July to AUD 45.94B. The strong rise is exports was based on strong Asian demand for LNG and thermal coal, combined with sharply higher prices for iron ore. Exports to China also rose to record AUD 19.4B. Goods and services imports rose 3% mom to AUD 33.83B, due to sharp increase in parts and accessories for telecommunications equipment.

Trade surplus widened to AUD 12.12B, above expectation of AUD 10.1B., hitting a new record.

New Zealand terms of trade rose 3.3% in Q2 as export prices surged

New Zealand merchandise terms of trade rose 3.3% in Q2, well above expectation of 0.3%. Export prices for goods rose 8.3% while import prices rose 4.8%. Export volume for goods rose 2.9% while import volumes rose 4.4%. Export values rose 9.2% and import values rose 4.6%. Services terms of trade dropped -8.5%. Services export prices fell -1.6% while import prices rose 7.7%.

Terms of trade measures New Zealand’s purchasing power for import goods, based on the prices it receives for exports. An increase in terms of trade means that New Zealand can buy more import goods for the same quantity of exports.

BoJ Kataoka: BoJ must strengthen monetary easing

BoJ board member Goushi Kataoka, a known persistent dove, warned that the Japan economy remained in a “severe state”. The economy is heading toward recovery but “not fast enough.

He added that risks to the outlook are skewed to the downside. In particular, “risks to consumption are heightening” due to surge in Delta infections. “There’s a good chance the impact of the pandemic may last longer than expected,” he added.

Kataoka also continued his push for more aggressive monetary policy easing. “Personally, I believe the BoJ must strengthen monetary easing,” he said, as inflation would remain distant from the 2% target for years.

Looking ahead

Swiss retail sales, CPI and GDP will be released in European session while Eurozone will release PPI. Canada will release building permits and trade balance. US will release jobless claims, trade balance, factory orders and non-farm productivity.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1803; (P) 1.1830; (R1) 1.1866; More…

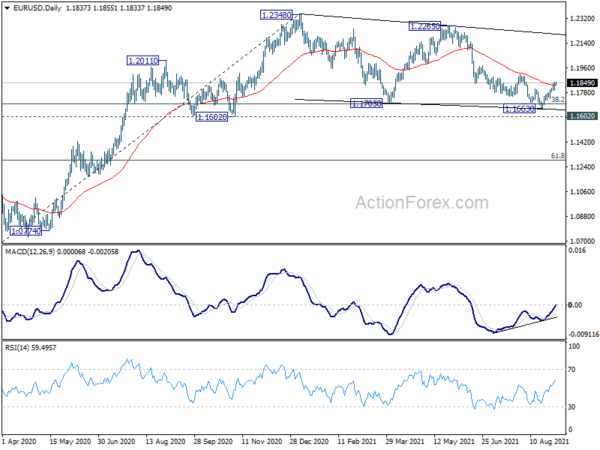

With 1.1778 minor support intact, intraday bias in EUR/USD remains mildly on the upside. Rise from 1.1663 short term bottom is on track to 1.1907 resistance first. Decisive break there will indicate that fall from 1.2265, as well as the consolidation pattern from 1.2348, have completed. Near term outlook will be turned bullish for 1.2265/2348 resistance. On the downside, break of 1.1778 resistance turned support will turn bias back to the downside for 1.1602/63 support zone instead.

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally remains in favors long as 1.1602 support holds, to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). However sustained break of 1.1602 will argue that the rise from 1.0635 is over, and turn medium term outlook bearish again. Deeper fall would be seen to 61.8% retracement of 1.0635 to 1.2348 at 1.1289 and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Terms of Trade Index Q2 | 3.30% | 0.30% | 0.10% | |

| 23:50 | JPY | Monetary Base Y/Y Aug | 14.90% | 16.20% | 15.40% | |

| 01:30 | AUD | Trade Balance (AUD) Jul | 12.12B | 10.10B | 10.50B | 11.11B |

| 06:30 | CHF | Real Retail Sales Y/Y Jul | -2.60% | 0.20% | 0.10% | |

| 06:30 | CHF | CPI M/M Aug | 0.20% | 0.10% | -0.10% | |

| 06:30 | CHF | CPI Y/Y Aug | 0.90% | 0.80% | 0.70% | |

| 07:00 | CHF | GDP Q/Q Q2 | 1.80% | 1.90% | -0.50% | -0.40% |

| 09:00 | EUR | Eurozone PPI M/M Jul | 2.30% | 1.20% | 1.40% | |

| 09:00 | EUR | Eurozone PPI Y/Y Jul | 12.10% | 10.90% | 10.20% | |

| 11:30 | USD | Challenger Job Cuts Y/Y Aug | -86.40% | -92.80% | ||

| 12:30 | CAD | Building Permits M/M Jul | -3.90% | 1.50% | 6.90% | |

| 12:30 | CAD | International Merchandise Trade (CAD) Jul | 0.8B | 1.7B | 3.2B | |

| 12:30 | USD | Initial Jobless Claims (Aug 27) | 340K | 351K | 353K | 354K |

| 12:30 | USD | Trade Balance (USD) Jul | -70.1B | -74.5B | -75.7B | -73.2B |

| 12:30 | USD | Nonfarm Productivity Q2 | 2.10% | 2.40% | 2.30% | |

| 12:30 | USD | Unit Labor Costs Q2 | 1.30% | 1.00% | 1.00% | |

| 14:00 | USD | Factory Orders M/M Jul | 0.40% | 1.50% | ||

| 14:30 | USD | Natural Gas Storage | 25B | 29B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals