Trading the the forex markets remain rather subdued in Asian session. Aussie basically shrugs off RBA’s decision to taper, but extend QE. Dollar is trading slightly softer, as yesterday’s recovery lost momentum. European majors are currently the slightly firmer ones. But overall, traders are staying in wait-and-see mode. Risk sentiment elsewhere is firm, however, with Nikkei extending the powerful rally, and 30k handle is just half-step away.

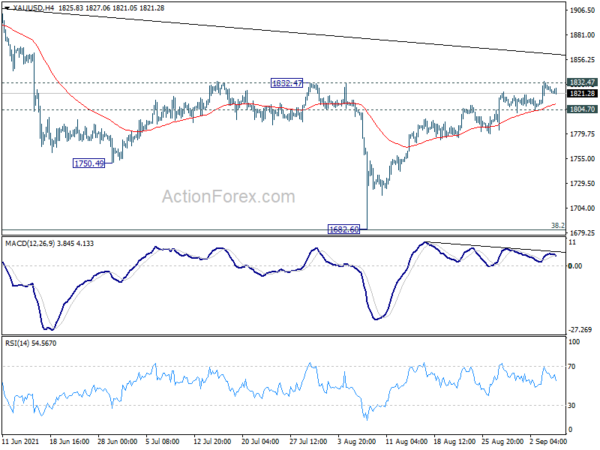

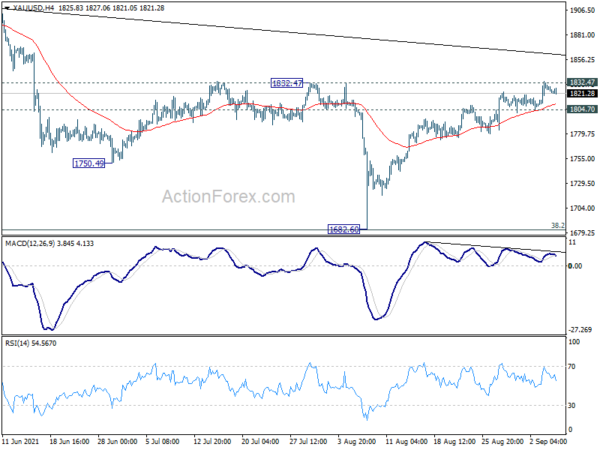

Technically, the next move in Dollar would remain a major focus. EUR/USD will need to forcefully break through 1.1907 resistance to confirm near term bearish reversal in the greenback. However, rejection from there, followed by 1.1792 minor support will argue that EUR/USD’s rebound from 1.1663 has completed, and revive Dollar buying. At the same time, we will apply slightly tighter condition for Gold, a break of 1804.07 support will suggest rejection by 1832.47 resistance, at least on first attempt. Deeper pull back could be seen back and that, if happens, could come with a stronger rebound in Dollar.

In Asia, at the time of writing, Nikkei is up 0.91% at 29928. Hong Kong HSI is up 0.61%. China Shanghai SSE is up 0.77%. Singapore Strait Times is down -0.14%. Japan 10-year JGB yield is down -0.0079 at 0.037.

RBA tapers but extends QE, Delta to delay but not derail recovery

RBA kept with its tapering plan and announced to lower purchase of government securities at AUD 7B a week. But the program is extended until at least mid-February 2022, from mid November. At the same time, cash target rate is held at 0.10%. Target for April 2024 Australian government bond yield was also kept at 0.10%.

The central bank said the economy has been “interrupted by the Delta outbreak and the associated restrictions on activity”. GDP is expected to “decline materially” in Q3 with unemployment rate moving high over coming months. But the setback to economic expansion is “expected to be only temporary”. The Delta outbreak is expected to “delay, but not derail” the recovery. Economy will be growing again in Q4 and back to pre-Delta path in H2 of next year.

The decision to “extend” the asset purchases “reflects the delay in the economic recovery and the increased uncertainty associated with the Delta outbreak”. RBA pledged o continue to review on the program. Also, it maintained that the condition for rate hike “will not be met before 2024”.

Australia AiG services dropped to 56.6, outlook weak for another month or two

Australia AiG Performance of Services Index dropped sharply from 51.7 to 45.6 in August. That’s the lowest level since September 2020. Looking at some details, sales dropped -13.2 to 40.0. Employment rose 2.4 to 53.4. New orders dropped -9.3 to 47.4. Supplier deliveries dropped -1.3 to 44.0. Finished stocks dropped -9.3 to 37.7. Input prices dropped -2.6 to 71.5. Selling prices dropped -11.4 to 55.3.

Ai Group Chief Executive, Innes Willox, said: “Increased COVID-19 cases and the lockdowns aimed at constraining the spread of the virus saw the performance of the services sector slump in August… With lockdowns in Victoria, the ACT and NSW set to continue this month and with new orders down on previous levels, the immediate outlook is for another weak month or two. In the meantime, a lot hinges on the healthy supply of vaccines, success in overcoming hesitancy about vaccination and clear and convincing leadership from across the National Cabinet.”

China exports rose 25.6% yoy in Aug, imports up 33.1% yoy, trader surplus at USD 58.3B

In August, in USD term, China’s total trade rose 28.8% yoy to USD 530.3B. Exports rose 25.6% yoy to USD 294.3B. Imports rose 33.1% yoy to USD 236.0B. Trade surplus came in at USD 58.3B, above expectation of USD 52.3B.

Year-to-August, total trade rose 34.2% yoy to USD 3827.8B. Exports rose 33.7% yoy to USD 2095.1B. Imports rose 34.8% yoy to USD 1732.7B. Trade surplus came in at USD 362.5B.

From Japan, labor cash earnings rose 1.0% yoy in July, versus expectation of 0.8% yoy. Household spending rose 2.9% yoy, versus expectation of 2.9% yoy.

Looking ahead

Swiss unemployment rate and foreign currency reserves will be released in European session. Eurozone will release GDP revision. Germany will release industrial production and ZEW economic sentiment.

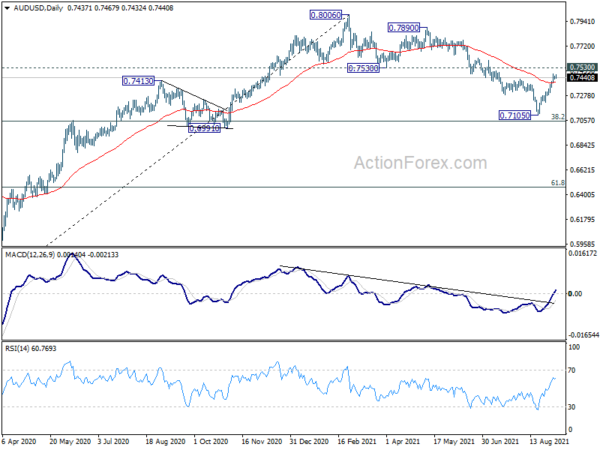

AUD/USD Daily Report

Daily Pivots: (S1) 0.7422; (P) 0.7442; (R1) 0.7457; More…

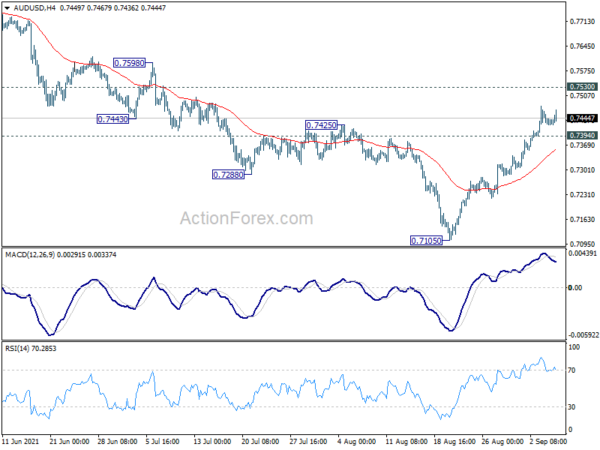

Despite some loss of upside momentum, with 0.7394 minor support intact, intraday bias stays on the upside for 0.7503 support turned resistance. Correction from 0.8006 should have completed at 0.7105 already. Sustained break of 0.7530 will pave the way to retest 0.8006 high. On the downside, break of 0.7394 minor support will turn intraday bias neutral and bring consolidations first.

In the bigger picture, with 0.6991 cluster support (38.2% retracement of 0.5506 to 0.8006 at 0.7051) intact, we’re seeing price action form 0.8006 as a correction only. That is, up trend from 0.5506 low would resume after the correction completes. In that case, main focus will be 0.8135 key resistance (2018 high). Sustained break there will carry larger bullish implications. However, sustained break of 0.6991 will argue that the whole medium term trend has indeed reversed.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Services Index Aug | 45.6 | 51.7 | ||

| 23:01 | GBP | BRC Like-For-Like Retail Sales Y/Y Aug | 1.50% | 3.20% | 4.70% | |

| 23:30 | JPY | Labor Cash Earnings Y/Y Jul | 1.00% | 0.80% | 0.10% | 0.10% |

| 23:30 | JPY | Household Spending Y/Y Jul | 0.70% | 2.90% | -5.10% | |

| 3:00 | CNY | Trade Balance (USD) Aug | 58.3B | 52.3B | 56.6B | |

| 3:00 | CNY | Exports (USD) Y/Y Aug | 25.60% | 17.10% | 19.30% | |

| 3:00 | CNY | Imports (USD) Y/Y Aug | 33.10% | 27.00% | 28.10% | |

| 3:00 | CNY | Trade Balance (CNY) Aug | 376B | 323B | 363B | |

| 3:00 | CNY | Exports (CNY) Y/Y Aug | 15.70% | 22.50% | 8.10% | |

| 3:00 | CNY | Imports (CNY) Y/Y Aug | 23.10% | 9.10% | 16.10% | |

| 4:30 | AUD | RBA Rate Decision | 0.10% | 0.10% | 0.10% | |

| 5:00 | JPY | Leading Economic Index Jul P | 103.5 | 104.1 | ||

| 5:45 | CHF | Unemployment Rate M/M Aug | 2.90% | 3.00% | ||

| 6:00 | EUR | Germany Industrial Production M/M Jul | 0.70% | -1.30% | ||

| 7:00 | CHF | Foreign Currency Reserves (CHF) Aug | 923B | |||

| 9:00 | EUR | Eurozone GDP Q/Q Q2 | 2.00% | 2.00% | ||

| 9:00 | EUR | Eurozone Employment Change Q/Q Q2 F | 0.50% | 0.50% | ||

| 9:00 | EUR | Germany ZEW Economic Sentiment Sep | 30.2 | 40.4 | ||

| 9:00 | EUR | Germany ZEW Current Situation Sep | 33.1 | 29.3 | ||

| 9:00 | EUR | Eurozone ZEW Economic Sentiment Sep | 35.3 | 42.7 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals