Risk sentiment turns a bit weaker today in the stock markets. But benchmark European and US yields are staging a strong rally. In the currency markets, Aussie is sold off is in delayed reaction to RBA’s dovish tapering, but Canadian is follow closely with selloff in oil price. Sterling is also falling in European crosses, probably in reaction to the government’s plan to raise taxes. On the other hand, Dollar is trying to rebound, other with Euro and Swiss Franc.

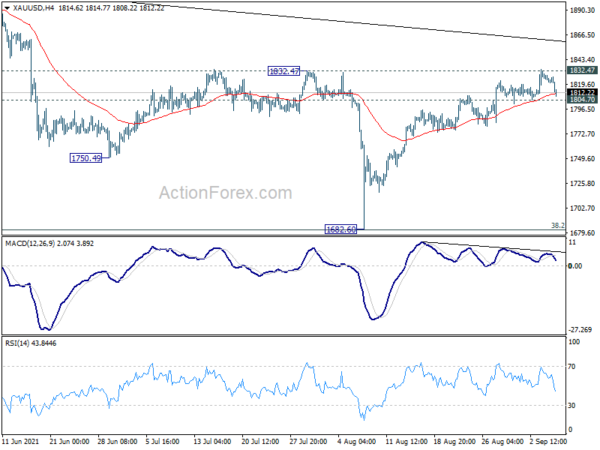

Technically, EUR/GBP’s break of 0.8601 resistance suggest resumption of rise from 0.8448 for 0.8668 resistance. We’ll keep an eye on 1.3730 support in GBP/USD and 151.32 support in GBP/JPY. Break of these levels would indicate more Sterling weakness to come. Meanwhile, we’d continue to pay attention 1804.70 support in Gold. Break there could sign a more sustainable rebound in the greenback.

In Europe, at the time of writing, FTSE is down -0.20%. DAX is down -0.11%. CAC is up 0.01%. Germany 10-yaer yield is up 0.0425 at -0.322. Earlier in Asia, Nikkei rose 0.86%. Hong Kong HSI rose 0.73%. China Shanghai SSE rose 1.51%. Singapore Strait Times rose 0.24%. Japan 10-year JGB yield dropped -0.0041 to 0.041.

Germany ZEW dropped sharply to 26.5, global chip shortage caused significant reduction in profit expectations

Germany ZEW Economic Sentiment dropped sharply from 40.4 to 26.5 in September, well below expectation of 30.2. It’s also the fourth consecutive decline. Germany Current Situation index improved form 29.3 to 31.9, below expectation of 33.1. Eurozone ZEW Economic Sentiment also tumbled from 42.7 to 31.3, below expectation of 35.3. Eurozone Current Situation index rose 7.9 pts to 22.5.

“Expectations fell markedly once more in September 2021. Although financial market experts expect further improvements of the economic situation over the next six months, the expected magnitude and the dynamics of the improvements have decreased considerably. Global chip shortage in the automobile sector and shortage of building material in the construction sector have caused a significant reduction in profit expectations for these sectors. This may have had a negative effect on economic expectations,” comments ZEW President Professor Achim Wambach.

Also from Germany, industrial production rose 1.0% mom in July, versus expectation of 0.7% mom.

Eurozone GDP grew 2.2% qoq in Q2, -2.5% below pre-pandemic level

Eurozone GDP grew 2.2% qoq in Q2, revised up from prior estimate of 2.0% qoq. Comparing with same quarter of previous year, GDP grew 14.3% yoy. GDP was -2.5% below the pre-pandemic level of Q4, 2019. Household final consumption expenditure rose 3.7% qoq. Government final consumption expenditure rose 1.2% qoq. Gross fixed capital formation rose 1.1% qoq. Exports rose 2.2% qoq. Imports rose 2.3% qoq.

EU GDP grew 2.1% qoq, 13.8% yoy. Ireland (+6.3%) recorded the sharpest increase of GDP compared to the previous quarter, followed by Portugal (+4.9%), Latvia (+4.4%) and Estonia (+4.3%). Declines were observed in Malta (-0.5%) and Croatia (-0.2%).

From Swiss, foreign currency reserves rose to CHF 929B in Aug. Unemployment rate dropped to 2.9%, matched expectations.

BoE Saunders concerned with continuing with asset purchases

BoE hawk Michael Saunders said he believed that the economy was now close to the pre-pandemic level. He’s worried that continuing with the asset purchase program would cause rise in medium-term expectation.

“I also worry that continuing with asset purchases, when CPI inflation is 4% and the output gap is closed – that is the likely situation later this year – might well cause medium-term inflation expectations to drift higher,” he said.

“Such an outcome could well require a more substantial tightening of monetary policy later, and might limit the committee’s scope to respond promptly the next time the economy needs more stimulus,” he added.

RBA tapers but extends QE, Delta to delay but not derail recovery

RBA kept with its tapering plan and announced to lower purchase of government securities at AUD 7B a week. But the program is extended until at least mid-February 2022, from mid November. At the same time, cash target rate is held at 0.10%. Target for April 2024 Australian government bond yield was also kept at 0.10%.

The central bank said the economy has been “interrupted by the Delta outbreak and the associated restrictions on activity”. GDP is expected to “decline materially” in Q3 with unemployment rate moving high over coming months. But the setback to economic expansion is “expected to be only temporary”. The Delta outbreak is expected to “delay, but not derail” the recovery. Economy will be growing again in Q4 and back to pre-Delta path in H2 of next year.

The decision to “extend” the asset purchases “reflects the delay in the economic recovery and the increased uncertainty associated with the Delta outbreak”. RBA pledged o continue to review on the program. Also, it maintained that the condition for rate hike “will not be met before 2024”.

Suggested reading on RBA:

Australia AiG services dropped to 56.6, outlook weak for another month or two

Australia AiG Performance of Services Index dropped sharply from 51.7 to 45.6 in August. That’s the lowest level since September 2020. Looking at some details, sales dropped -13.2 to 40.0. Employment rose 2.4 to 53.4. New orders dropped -9.3 to 47.4. Supplier deliveries dropped -1.3 to 44.0. Finished stocks dropped -9.3 to 37.7. Input prices dropped -2.6 to 71.5. Selling prices dropped -11.4 to 55.3.

Ai Group Chief Executive, Innes Willox, said: “Increased COVID-19 cases and the lockdowns aimed at constraining the spread of the virus saw the performance of the services sector slump in August… With lockdowns in Victoria, the ACT and NSW set to continue this month and with new orders down on previous levels, the immediate outlook is for another weak month or two. In the meantime, a lot hinges on the healthy supply of vaccines, success in overcoming hesitancy about vaccination and clear and convincing leadership from across the National Cabinet.”

China exports rose 25.6% yoy in Aug, imports up 33.1% yoy, trader surplus at USD 58.3B

In August, in USD term, China’s total trade rose 28.8% yoy to USD 530.3B. Exports rose 25.6% yoy to USD 294.3B. Imports rose 33.1% yoy to USD 236.0B. Trade surplus came in at USD 58.3B, above expectation of USD 52.3B.

Year-to-August, total trade rose 34.2% yoy to USD 3827.8B. Exports rose 33.7% yoy to USD 2095.1B. Imports rose 34.8% yoy to USD 1732.7B. Trade surplus came in at USD 362.5B.

From Japan, labor cash earnings rose 1.0% yoy in July, versus expectation of 0.8% yoy. Household spending rose 2.9% yoy, versus expectation of 2.9% yoy.

EUR/GBP Mid-Day Outlook

Daily Pivots: (S1) 0.8568; (P) 0.8577; (R1) 0.8587; More…

EUR/GBP’s break of 0.8601 resistance suggest resumption of rise from 0.8448. Intraday bias is back on the upside for 0.8668 resistance first. Firm break there will be a strong sign of near term bullish reversal at least. Next target is 0.8718 resistance. On the downside, break of 0.8561 support, however, would argue that the rebound has completed, and turn bias back to the downside for retesting 0.8448 low.

In the bigger picture, price actions from 0.9499 (2020 high) are still seen as developing into a corrective pattern. Deeper fall could be seen as long as 0.8668 resistance holds, towards long term support at 0.8276. However, firm break of 0.8668 resistance would argue that a medium term bottom was already formed. Stronger rise would be seen to 0.8861 support turned resistance to confirm completion of the corrective pattern.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Services Index Aug | 45.6 | 51.7 | ||

| 23:01 | GBP | BRC Like-For-Like Retail Sales Y/Y Aug | 1.50% | 3.20% | 4.70% | |

| 23:30 | JPY | Labor Cash Earnings Y/Y Jul | 1.00% | 0.80% | 0.10% | 0.10% |

| 23:30 | JPY | Household Spending Y/Y Jul | 0.70% | 2.90% | -5.10% | |

| 3:00 | CNY | Trade Balance (USD) Aug | 58.3B | 52.3B | 56.6B | |

| 3:00 | CNY | Exports (USD) Y/Y Aug | 25.60% | 17.10% | 19.30% | |

| 3:00 | CNY | Imports (USD) Y/Y Aug | 33.10% | 27.00% | 28.10% | |

| 3:00 | CNY | Trade Balance (CNY) Aug | 376B | 323B | 363B | |

| 3:00 | CNY | Exports (CNY) Y/Y Aug | 15.70% | 22.50% | 8.10% | |

| 3:00 | CNY | Imports (CNY) Y/Y Aug | 23.10% | 9.10% | 16.10% | |

| 4:30 | AUD | RBA Rate Decision | 0.10% | 0.10% | 0.10% | |

| 5:00 | JPY | Leading Economic Index Jul P | 104.1 | 103.5 | 104.1 | |

| 5:45 | CHF | Unemployment Rate M/M Aug | 2.90% | 2.90% | 3.00% | |

| 6:00 | EUR | Germany Industrial Production M/M Jul | 1.00% | 0.70% | -1.30% | -1.00% |

| 7:00 | CHF | Foreign Currency Reserves (CHF) Aug | 929B | 923B | 922B | |

| 9:00 | EUR | Eurozone GDP Q/Q Q2 | 2.20% | 2.00% | 2.00% | |

| 9:00 | EUR | Eurozone Employment Change Q/Q Q2 F | 0.70% | 0.50% | 0.50% | |

| 9:00 | EUR | Germany ZEW Economic Sentiment Sep | 26.5 | 30.2 | 40.4 | |

| 9:00 | EUR | Germany ZEW Current Situation Sep | 31.9 | 33.1 | 29.3 | |

| 9:00 | EUR | Eurozone ZEW Economic Sentiment Sep | 31.1 | 35.3 | 42.7 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals