Dollar is regaining some ground in Asian session today, as yesterday’s selloff was relatively well contained so far. Sterling is also recovering, together with Euro, against others. On the other hand, Australian Dollar turns softer after uneventful RBA rate decision. Other commodity currencies are also weak. Overall markets will turn to ISM services for guidance on next move.

Technically, there is no overwhelming indication of a near term bearish reversal in Dollar. EUR/USD is holding below 1.1682 minor resistance, AUD/USD below 0.7315 minor resistance, USD/CHF above 0.9214 support, USD/JPY above 110.44 support. GBP/USD’s break of 1.3608 resistance is also not clean. As long as these levels hold, Dollar buying is more likely to come back in the near term than not.

In Asia, at the time of writing, Nikkei is down -2.32%. Hong Kong HSI is up 0.32%. Singapore Strait Times is down -0.77%. Japan 10-year JGB yield is up 0.0046 at 0.056. China is still on holiday. Overnight, DOW dropped -0.94%. S&P 500 dropped -1.30%. NASDAQ dropped -2.14%. 10-year yield rose 0.016 to 1.481.

RBA keeps rate at 0.10%, continue QE until at least Feb 2022

RBA left monetary policy unchanged as widely expected. Cash rate is kept at 0.10%. Target for April 2024 Australian Government bond yield is also held at 0.10%. The asset purchase program will continue at AUD 4B per week until at least mid February 2022. RBA also maintained that the condition for rate hike “will not be met before 2024”.

It maintained that the set back to economy expansion by the Delta outbreak is “expected to be only temporary”. In the central scenario, the economy will be growing again in Q4, and is expected to be “back around its pre-Delta path in the second half of next year”.

On labor market, RBA said it’s business liaison and job vacancies data suggest that “many firms are seeking to hire workers ahead of the expected reopening in October and November.” Wage and price pressures remain “subdued” and disruption to global supply chains on overall inflation “remains limited”.

Australia trade surplus swelled to another record in Aug

Australia goods and services exports rose AUD 1923m or 4% mom to AUD 48.52B in August. The surge in exports was led by LNG, hard coking coal and thermal coal, on both higher prices and volumes. Goods and services imports dropped AUD -506m or 1% mom to AUD 33.44B. Trade surplus rose from AUD 12.65B to AUD 15.08B, above expectation of AUD 10.10B, and hit another record high.

Also released, retail sales dropped -1.7% mom, -0.7% yoy in August. Ben James, Director of Quarterly Economy Wide Surveys, said: “Retail turnover continues to be negatively impacted by lockdown restrictions, with each of the eastern mainland states experiencing falls in line with their respective level of restrictions. In direct contrast, states with no lockdowns performed well with Western Australia and South Australia enjoying strong rises as physical stores were open for trade.”

AiG Performance of Construction Index rose sharply from 38.4 to 53.3 in September. Ai Group Head of Policy, Peter Burn, said: “The bounce in the Australian PCI in September was largely due to many fewer builders and constructors reporting further falls in activity after the clear majority saw activity slump in August… Looking ahead, the further easing of restrictions, and the resumption of work put on hold should see more decisive improvement in the sector in the months ahead”.

Japan PMI services composite finalized at 47.9, but firms optimist on eventual end to pandemic

Japan PMI Services was finalized at 47.8 in September, up from August’s 42.9. PMI Composite was finalized at 47.9, up from August’s 45.5. Markit said contractions in output and new business eased. Employment rose at quickest pace since April. Business optimism also strengthened to three-month high.

Usamah Bhatti, Economist at IHS Markit, said: “Overall private sector activity saw a sustained, albeit softer decline in September, led by a slower decline in the larger service sector. At the same time, manufacturing output and new orders were both in decline for the first time since late-2020.

“Businesses in the Japanese private sector also noted the strongest cost pressures for 13 years, as supply chain disruption continued to dampen domestic and global activity. Price rises were notably sharp for raw materials, staff and fuel. Regardless of this, firms were optimistic that an eventual end to the pandemic would occur within the coming 12 months, and provide a broad-based boost to demand and activity. As a result, IHS Markit expects the economy to grow 2.5% in 2021.”

Also from Japan, Tokyo CPI core rose to 0.1% yoy in September, up from 0.0% yoy, missed expectation of 0.2% yoy.

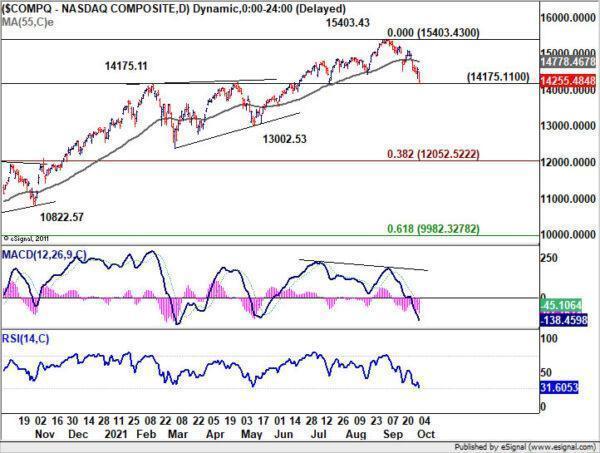

NASDAQ at a technical juncture after selloff

NASDAQ is now pressing key support level at 14175.11 after yesterday’s -2.41% decline, and it’s now at a technical juncture. Strong rebound from current level, followed by break of 55 day EMA (now at 14778.46) will maintain medium term bullishness. In this case, a break of 15403.43 record high is more likely before having a larger scale correction.

However, sustained break of 14175.11 will suggest that NASDAQ is already in correction to whole up trend from 6631.42. In this case, deeper fall would be seen to 55 week EMA (now at 134174.13), or even further to 38.2% retracement of 6631.42 to 15403.43 at 12052.52 before completing the correction. If happens, bearish sentiment would likely persist throughout Q4.

Looking ahead

France industrial output, Eurozone PMI services final and PPI, UK PMI services final will be released in European session. Later in the day, Canada and US will release trade balance. But main focus will be on ISM services.

AUD/USD Daily Report

Daily Pivots: (S1) 0.7259; (P) 0.7281; (R1) 0.7312; More…

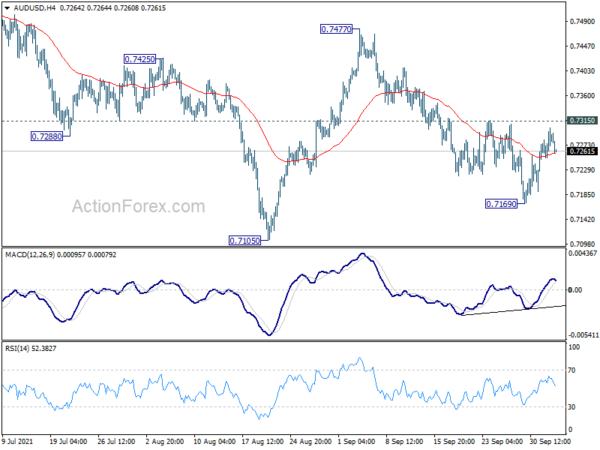

Intraday bias in AUD/USD remains neutral and further fall is mildly in favor with 0.7315 minor resistance intact. n the downside, below 0.7169 will target a test on 0.7105 low. Firm break there will resume whole decline from 0.8006 for 0.6991 support next. On the upside, above 0.7315 minor resistance will turn bias back to the upside for 0.7477 resistance instead.

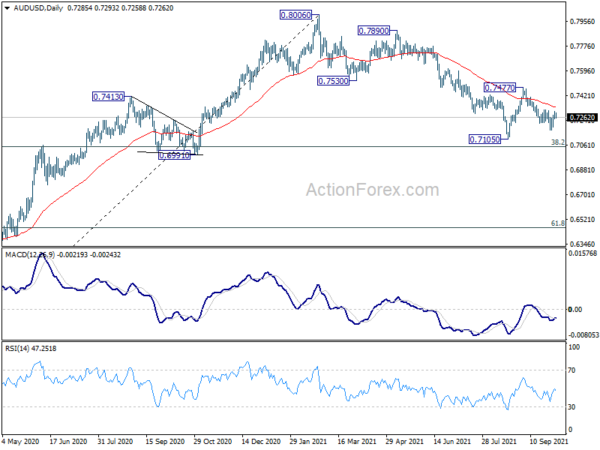

In the bigger picture, with 0.6991 cluster support (38.2% retracement of 0.5506 to 0.8006 at 0.7051) intact, we’re seeing price action from 0.8006 as a correction only. That is, up trend from 0.5506 low would resume after the correction completes. In that case, main focus will be 0.8135 key resistance (2018 high). Sustained break there will carry larger bullish implications. However, sustained break of 0.6991 will argue that the whole medium term trend has indeed reversed.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Construction Index Sep | 53.3 | 38.4 | ||

| 23:30 | JPY | Tokyo CPI Core Y/Y Sep | 0.10% | 0.20% | 0.00% | |

| 0:30 | AUD | Trade Balance (AUD) Aug | 15.08B | 10.10B | 12.12B | 12.69B |

| 3:30 | AUD | RBA Rate Decision | 0.10% | 0.10% | 0.10% | |

| 6:45 | EUR | France Industrial Output M/M Aug | 0.40% | 0.30% | ||

| 7:50 | EUR | France Services PMI Sep F | 56 | 56 | ||

| 7:55 | EUR | Germany Services PMI Sep F | 56 | 56 | ||

| 8:00 | EUR | Eurozone Services PMI Sep F | 56.3 | 56.3 | ||

| 8:30 | GBP | Services PMI Sep F | 54.6 | 54.6 | ||

| 9:00 | EUR | Eurozone PPI M/M Aug | 1.30% | 2.30% | ||

| 9:00 | EUR | Eurozone PPI Y/Y Aug | 13.50% | 12.10% | ||

| 12:30 | CAD | Trade Balance (CAD) Aug | 0.3B | 0.8B | ||

| 12:30 | USD | Trade Balance (USD) Aug | -70.5B | -70.1B | ||

| 13:45 | USD | Services PMI Sep F | 54.4 | 54.4 | ||

| 14:00 | USD | ISM Services PMI Sep | 59.8 | 61.7 | ||

| 14:00 | USD | ISM Services Employment Index Sep | 53.7 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals