Sterling steals the show today breaking through key resistance levels the Japanese Yen, and a near term low against Euro too. Dollar is trying to strengthen against Euro and Swiss Franc on strong retail sales, but momentum is sluggish elsewhere. There is no change in the selloff in Yen, just some more accelerations. Aussie and Kiwi are firm and are both set to end the week as the best performers.

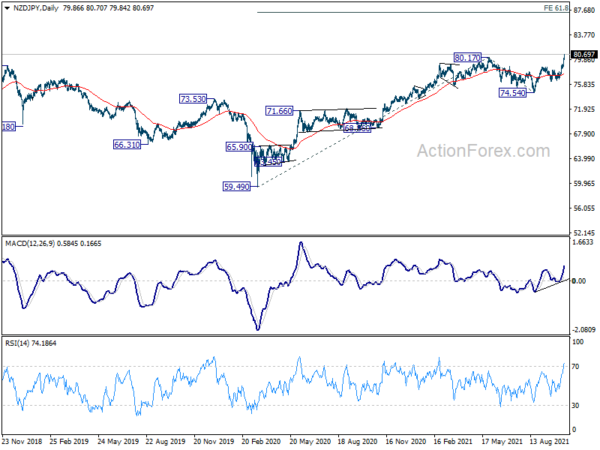

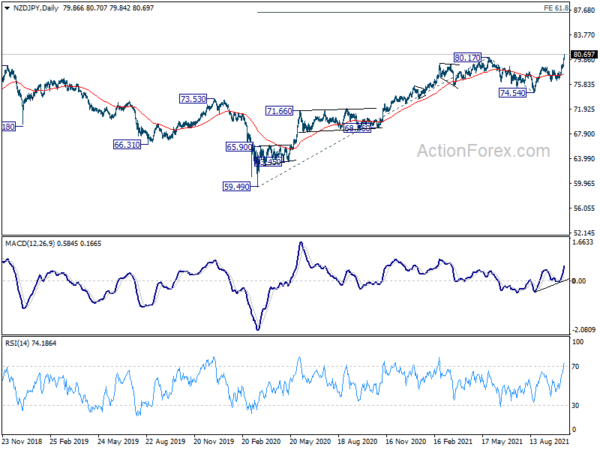

Technically, NZD/JPY has finally taken out 80.17 high to resume the up trend from 59.49. Next target is 61.8 projection of 59.49 to 80.17 from 74.54 at 87.32. We’d see when AUD/JPY would follow and break through 85.78 high eventually.

In Europe, at the time of writing, FTSE is up 0.28%. DAX is up 0.52%. CAC is up 0.42%. Germany 10-year yield is up 0.0293 at -0.157. Earlier in Asia, Nikkei rose 1.81%. Hong Kong HSI rose 1.48%. China Shanghai SSE rose 0.40%. Singapore Strait Times rose 0.29%. Japan 10-year JGB yield dropped -0.0048 to 0.081.

US retail sales rose 0.7% mom in Sep, ex-auto sales up 0.8% mom

US retail sales rose 0.7% mom to USD 625.4B in September, much better than expectation of -0.2% mom decline. Ex-auto sales rose 0.8% mom, above expectation of 0.4% mom. Ex-gasoline sales rose 0.6% mom. Ex-auto, ex-gasoline sales rose 0.7% mom.

Also released, import price index rose 0.4% mom in September, versus expectation of 0.5% mom. Empire State Manufacturing index dropped to 19.8 in October, down from 34.3, below expectation of 27.8.

Eurozone exports rose 18.2% yoy in Aug, imports rose 26.6% yoy

Eurozone exports of goods to the rest of the world rose 18.2% yoy to EUR 184.3B in August. Imports rose 26.6% to EUR 179.5B. Trade surplus came in at EUR 4.8B. Intra-Eurozone trade also rose 21.2% yoy to EUR 155.5B.

In seasonally adjusted term, Eurozone exports rose 0.3% mom to EUR 200.6B. Imports rose 1.6% mom to EUR 189.4B. Trade surplus narrowed to EUR 11.1B. Intra-Eurozone trade rose from 179.4B to 181.2B.

ECB Wunsch: We could afford some second-round effects, but not too much

ECB Governing Council member Pierre Wunsch told Bloomberg TV that the economy is ” on the right path. But medium term inflation goal is not met yet. “It seems that we are at some kind of inflection point,” Wunsch said. “We are below our objective, so we could afford some second-round effects, but not too much.”

Wunsch also said the central bank will maintain a “very supportive monetary policy,” even after the end of its emergency bond-buying program in March.

BoJ Amamiya urges vigilance to supply chain disruptions in Asia

BoJ Deputy Governor Masayoshi Amamiya reiterated that the economy is “picking up as a trend”, which will become clearer as pandemic impact subsides. He added that the price trends remains “solid” and the financial systems is “stable” as a whole.

But he also acknowledged that consumptions continues to “stagnate”. Exports and outputs are being affected by “supply constraints”. Ad emphasized that the central bank must be vigilant to the impact that of supply chain disruptions in Asia.

Japan Cabinet Office said exports increasing at a slower pace

In the October Monthly Economic Report, Japan’s Cabinet Office downgraded assessment on exports to “increasing at a slower pace”, from “continue to increase moderate”. That’s the first downgrade in seven months.

Overall, the economy is “picking up although the pace has weakened in a severe situation due to the Novel Coronavirus.” Private consumption “shows weakness further”. Business investment is “picking up”. Industrial production is “picking up”. Corporate profits are “picking up”. Employment situation “shows steady movements in some components”. Consumer prices show “steady movements”.

As the government lifted state emergency, it will “develop a new economic stimulus package” to address the issues of reopening. It expects BoJ to “pay careful attention to the economic impact of the infections and conduct appropriate monetary policy management”.

New Zealand BusinessNZ manufacturing rebounded to 51.4

New Zealand BusinessNZ Performance of Manufacturing rebounded strongly from 39.7 to 51.4 in September. Looking at some more details, production rose from 27.2 to 49.9. Employment ticked up from 54.3 to 54.5. New orders rose from 44.1 to 54.3. Finished stocks rose from 45.9 to 50.1. Deliveries also jumped from 33.1 to 47.8.

BNZ Senior Economist, Craig Ebert stated that “the rebound the PMI experienced in September was encouraging, although the survey is not without some still‐frayed parts. Credit where it’s due though, as the NZ PMI traced much less of a contraction, and quicker stabilisation, compared to what it went through during the initial outbreak of COVID‐19.”

GBP/JPY Mid-Day Outlook

Daily Pivots: (S1) 154.80; (P) 155.27; (R1) 155.91; More…

GBP/JPY accelerates up to as high as 157.16 so far today. The break of 156.05/59 key resistance zone confirms resumption of medium term up trend from 123.94. Intraday bias stays on the upside for 61.8% projection of 136.96 to 156.05 from 148.93 at 160.72. On the downside, below 155.32 minor support will turn intraday bias neutral and bring consolidations first, before staging another rally.

In the bigger picture, rise from 123.94 is seen as the third leg of the pattern from 122.75 (2016 low). Sustained break of 156.59 (2018 high) would affirm the case of long term bullish reversal, and pave the way to 61.8% retracement 195.86 (2015 high) to 122.75 at 167.93 next. For now, this will be the favored case as long as 148.93 structural support holds, even in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | BusinessNZ Manufacturing Index Sep | 51.4 | 40.1 | ||

| 04:30 | JPY | Tertiary Industry Index M/M Aug | -1.70% | -0.30% | -0.60% | |

| 09:00 | EUR | Eurozone Trade Balance (EUR) Aug | 11.1B | 15.3B | 13.4B | 13.5B |

| 12:30 | USD | Empire State Manufacturing Index Oct | 19.8 | 27.8 | 34.3 | |

| 12:30 | USD | Retail Sales M/M Sep | 0.70% | -0.20% | 0.70% | 0.90% |

| 12:30 | USD | Retail Sales ex Autos M/M Sep | 0.80% | 0.40% | 1.80% | 2.00% |

| 12:30 | USD | Import Price Index M/M Sep | 0.40% | 0.50% | -0.30% | |

| 14:00 | USD | Michigan Consumer Sentiment Index Oct F | 73.5 | 72.8 | ||

| 14:00 | USD | Business Inventories Aug | 0.70% | 0.50% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals