The forex markets are staying in consolidative mode today and could remain so before weekly close. Though, that would depend on whether US stocks would surge again with powerful buying. For the week, Dollar is currently the worst performing, followed by Canadian and Euro. Aussie is the strongest followed by Kiwi.

Technically, the retreats in Yen pairs are so far very shallow. We’d continue to monitor if 132.13 and 156.58 minor support levels in EUR/JPY and GBP/JPY would be broken. Or, near term up trend in Yen crosses would resume with help from stock and overall risk-on sentiments.

In Europe, at the time of writing, FTSE is up 0.52%. DAX s up 0.80%. CAC is up 0.93%. Germany 10-year yield is up 0.0144 at -0.085. Earlier in Asia, Nikkei rose 0.34%. Hong Kong HSI rose 0.42%. China Shanghai SSE dropped -0.34%. Singapore Strait Times rose 0.52%. Japan 10-year JGB yield rose 0.0081 to 0.098.

Canada retail sales rose 2.1% mom in Aug, to fall -1.9% mom in Sep

Canada retail sales rose 2.1% mom to CAD 57.2B in August, slightly above expectation of 2.0% mom. The gain was led by higher sales at food and beverage stores (+4.8%), gasoline stations (+3.8%), and clothing and clothing accessories stores (+3.9%). Sales increased in 9 of 11 subsectors. Based on preliminary data, sales has decreased -1.9% mom in September.

UK PMI composite rose to 56.8, picking up economy pouring fuel on inflation worries

UK PMI Manufacturing ticked up to 57.7 in October, from September’s 57.1, above expectation of 55.6. PMI Services rose to 58.0, up from 55.4, above expectation of 54.5. PMI Composite rose to 56.8, up from 54.9, highest in 3 months.

Chris Williamson, Chief Business Economist at IHS Markit, said: “The UK economy picked up speed again in October, but the expansion is looking increasingly dependent on the service sector, which in turn looks prone to a slowdown amid the recent rise in COVID-19 cases. Growth is also being accompanied by an unprecedented rise in inflationary pressures, which will inevitably feed through into higher consumer prices in coming months.

“The news comes at a time when the Bank of England is already leaning towards hiking interest rates to safeguard against inflationary expectations becoming entrenched. The record readings of the PMI survey’s price gauges will inevitably pour further fuel on these inflation worries and add to the case for higher interest rates.

UK retail sales dropped -0.2% mom, -1.3% yoy in Sep

UK retail sales dropped -0.2% mom, -1.3% yoy in September, below expectation of 0.7% mom, -0.4% yoy. Ex-fuel sales dropped -0.6% mom, -2.6% yoy, below expectation of 0.2% mom, -1.7% yoy.

ONS also noted: “Despite relaxation of COVID-19 restrictions in summer 2021, in-store retail sales remain subdued; the proportion of retail sales online rose to 28.1% in September 2021 from 27.9% in August, substantially higher than the 19.7% in February 2020 before the pandemic.”

Eurozone PMI composite dropped to 54.7, growth much weaker in Q4

Eurozone PMI Manufacturing dropped slightly to 58.5 in October, down from September’s 58.6, above expectation of 57.3. But that’s still the lowest level in 8 months. PMI Services dropped to 54.7, down from 56.4, below expectation of 55.4, and a 6-month low. PMI Composite dropped to 54.3, down from 56.2, a 6-month low.

Chris Williamson, Chief Business Economist at IHS Markit said: “A sharp slowdown in October means the eurozone starts the fourth quarter with the weakest growth momentum since April… The ongoing pandemic means supply chain delays remain a major concern, constraining production and driving prices ever higher, both in manufacturing and in the services sector. Average selling prices for goods and services are rising at a rate unprecedented in over two decades, which will inevitably feed through to higher consumer prices in the coming months.

“While the overall rate of economic growth remains above the long-run average for now, risks seem tilted to the downside for the near-term as the pandemic continues to disrupt economies and push prices higher. After strong second and third quarter expansions, GDP growth is looking much weaker by comparison in the fourth quarter.”

Germany PMI composite dropped to 52.0, beginning to plateau

Germany PMI Manufacturing dropped slightly to 58.2 in October, down from 58.4, better than expectation of 56.8. That’s still a 9-month low. PMI Services dropped notably to 52.4, down from 56.2, below expectation of 55.2, a 6-month low. PMI Composite dropped to 52.0, down from 55.5, an 8-month low.

Phil Smith, Associate Director at IHS Markit said: “October’s flash PMI data point to economic activity in Germany beginning to plateau at the start of the fourth quarter. Growth has slowed to a modest pace, with supply bottlenecks holding back manufacturing production and the rebound in services activity continuing to lose momentum, in part due to supply issues spilling over to the sector.”

France PMI composite dropped to 54.7, growth profile akin to a K

France PMI Manufacturing dropped to 53.3 in October, down from September’s 55.0, below expectation of 54.3. That’s also a 9-month low. PMI Services rose to 56.6, up from 56.2, above expectation of 55.3. PMI Composite dropped slightly to 54.7, down from 55.3, a 6-month low.

Joe Hayes, Senior Economist at IHS Markit said: “Responsibility for France’s economic recovery was placed firmly on the shoulders of the service sector in October, as latest PMI data showed manufacturing output falling for the first time since January. The overall rate of expansion slowed to a six-month low as the supply-side issues hurting manufacturers the most offset a faster expansion in services activity. Of the medley of letters that an economic recovery can look like, France’s growth profile is currently akin to a “K”.

Japan PMI manufacturing rose to 53.0, returned to growth

Japan PMI Manufacturing rose to 53.0 in October, up from September’s 51.5, above expectation of 51.6. PMI Services rose to 50.7, up from 47.8. PMI Composite rose to 50.7, up from 47.9.

Usamah Bhatti, Economist at IHS Markit, said: “Activity at Japanese private sector businesses returned to expansion territory at the start of the fourth quarter of 2021… Panel members commonly associated the slight recovery to a reduction in COVID-19 cases and looser pandemic restrictions.

“Private sector businesses also noted an increase in aggregate new business for the first time since April, assisted by a quicker rise in export orders. That said, firms continued to highlight sustained supply chain pressures and material shortages. As a result, input prices rose at the fastest rate in over 13 years. This contributed to the sharpest rise in output charges since July 2018.”

Also release, Japan all item CPI rose to 0.2% yoy in September, up from -0.4% yoy. CPI core (ex-food), rose to 0.1% yoy, up from 0.0% yoy. However, CPI core-core (ex-food, energy) was unchanged at -0.5% yoy.

Australia PMI composite rose sharply to 52.2, back in expansion

Australia PMI Manufacturing rose to 57.3 in October, up from September’s 56.8. PMI Services jumped sharply to 52.0, up from 45.5. PMI Composite rose to 52.2, up from 46.0. All are four-month highs.

Jingyi Pan, Economics Associate Director at IHS Markit, said: “Composite PMI indicated that the Australian economy is back in expansion in October as the easing of COVID-19 restrictions and plans for further opening up of the Australian economy restored confidence and rejuvenated economic activity…

“Higher demand however translated to greater strains on the supply chain… Meanwhile employment levels rose at a slower rate with reports of constraints when trying to hire staff. These are issues that may persist in the short- to medium- term for firms as they take their time to clear.”

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9168; (P) 0.9187; (R1) 0.9203; More….

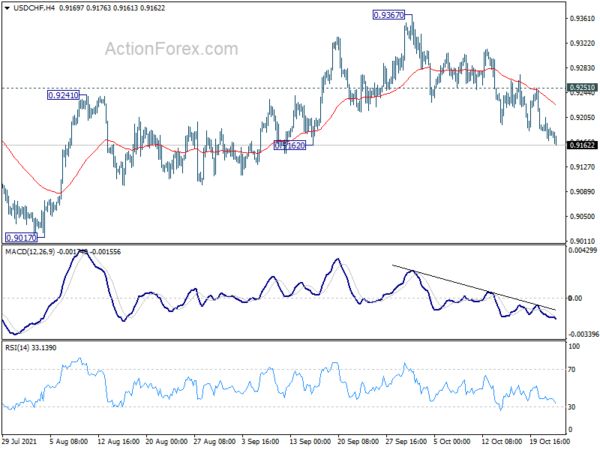

USD/CHF’s decline continues today and intraday bias remains on the downside. Considering bearish divergence condition in daily MACD, firm break of 0.9162 support will argue that whole rise from 0.8925 has completed. Deeper decline would be seen to 0.9017 support next. On the upside, break of 0.9251 minor resistance will turn bias back to the upside for retesting 0.9367 instead.

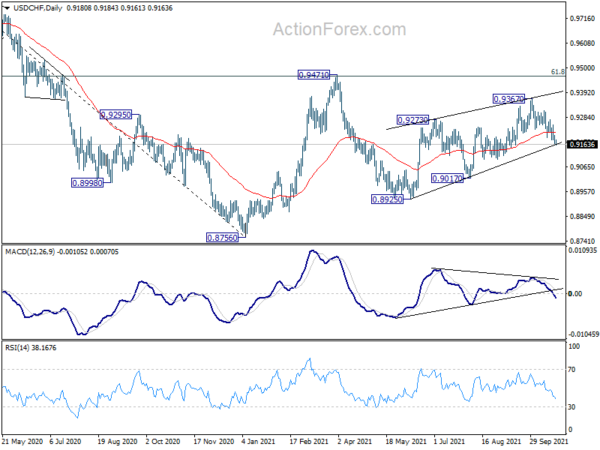

In the bigger picture, the corrective structure of the rebound from 0.8925 argues that fall from 0.9471 is not completed yet. It could either be the second leg of pattern from 0.8756 (2021 low), or resuming larger down trend from 1.0237 (2018 high). We’d pay attention to the downside momentum of assess the odds later. But for now, medium term outlook will be neutral at best as long as 0.9471 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:00 | AUD | Manufacturing PMI Oct P | 57.3 | 56.8 | ||

| 22:00 | AUD | Services PMI Oct P | 52 | 45.5 | ||

| 23:01 | GBP | GfK Consumer Confidence Oct | -17 | -16 | -13 | |

| 23:30 | JPY | National CPI Core Y/Y Sep | 0.10% | 0.10% | 0.00% | |

| 00:30 | JPY | Manufacturing PMI Oct P | 53 | 51.6 | 51.5 | |

| 06:00 | GBP | Retail Sales M/M Sep | -0.20% | 0.70% | -0.90% | -0.60% |

| 06:00 | GBP | Retail Sales Y/Y Sep | -1.30% | -0.40% | 0.00% | -0.20% |

| 06:00 | GBP | Retail Sales ex-Fuel M/M Sep | -0.60% | 0.20% | -1.20% | -0.70% |

| 06:00 | GBP | Retail Sales ex-Fuel Y/Y Sep | -2.60% | -1.70% | -0.90% | |

| 07:15 | EUR | France Manufacturing PMI Oct P | 53.5 | 54.3 | 55 | |

| 07:15 | EUR | France Services PMI Oct P | 56.6 | 55.3 | 56.2 | |

| 07:30 | EUR | Germany Manufacturing PMI Oct P | 58.2 | 56.8 | 58.4 | |

| 07:30 | EUR | Germany Services PMI Oct P | 52.4 | 55.2 | 56.2 | |

| 08:00 | EUR | Eurozone Manufacturing PMI Oct P | 58.5 | 57.3 | 58.6 | |

| 08:00 | EUR | Eurozone Services PMI Oct P | 54.7 | 55.4 | 56.4 | |

| 08:30 | GBP | Manufacturing PMI Oct P | 57.7 | 55.6 | 57.1 | |

| 08:30 | GBP | Services PMI Oct P | 58 | 54.5 | 55.4 | |

| 12:30 | CAD | Retail Sales M/M Aug | 2.10% | 2.00% | -0.60% | |

| 12:30 | CAD | Retail Sales ex Autos M/M Aug | 2.80% | 2.60% | -1% | |

| 13:45 | USD | Manufacturing PMI Oct P | 60.5 | 60.7 | ||

| 13:45 | USD | Services PMI Oct P | 55.3 | 54.9 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals