Sterling drops sharply after BoE stands pat, disappointing those who expected a hike. Euro is currently following as the second weakest for the day. On the other hand, Yen and Swiss Franc rise broadly, supported by falling benchmark yields in Germany and UK. Dollar is also firm as general investor sentiment is cautious, awaiting tomorrow’s non-farm payroll report.

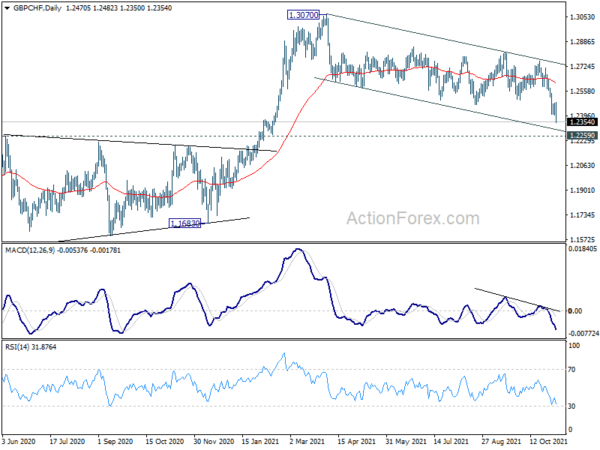

Technically, GBP/CHF extends recent decline and hits as low as 1.2350 so far. Choppy fall from 1.3070 is seen as a corrective move. Hence, we’d expect strong support from 1.2259 to contain downside to bring rebound. However, firm break of 1.2259 would argue that medium term trend has already reversed. If that happens, medium term bearishness of the Pound would be confirmed if EUR/GBP also breaks 0.8656 resistance.

In Europe, at the time of writing, FTSE is up 0.43%. DAX is up 0.54%. CAC is up 0.39%. Germany 10-year yield is down -0.022 at -0.189. Earlier in Asia, Nikkei rose 0.93%. Hong Kong HSI rose 0.80%. China Shanghai SSE rose 0.81%. Japan 10-year JGB yield dropped -0.0021 to 0.082.

US initial jobless claims dropped to 269, continuing claims down to 2.1m

US initial jobless claims dropped -14k to 269k in the week ending October 30, better than expectation of 277k. That’s the lowest level since March 14, 2020. Four-week moving average of initial claims dropped -15k to 285k, lowest since March 14, 2020 too. Continuing claims dropped -134k to 2105k in the week ending October 23, lowest since March 14, 2020. Four-week moving average of continuing claims dropped -156k to 2357k, lowest since March 21, 2020.

Also released, US trade deficit widened to USD -80.9B in September, versus expectation of USD -74.5B. Non-farm productivity dropped -5.0% in Q3 versus expectation of -1.5%. Unit labor costs rose 8.3% versus expectation of 5.2%. From Canada, trade surplus came in at CAD 1.9B in September, below expectation of CAD 2.3B.

BoE stands pat, but sees it’s necessary to hike in coming months

BoE kept Bank Rate unchanged at 0.10% by 7-2 vote today. Known hawks Dave Ramsden and Michael Saunders voted for a hike to 0.25%. The MPC also voted by 6-3 to continue with government bond purchase with GBP 875B. Catherine Mann, Dave Ramsdan and Michael Saunders voted to cut bond purchases by GBP 20B.

In the forward guidance, BoE said if incoming data, particularly on the labor market, are inline withe central projections in the Monetary Policy Report, it will be “necessary over coming months to increase Bank Rate in order to return CPI inflation sustainably to the 2% target.”

UK PMI construction rose to 54.6 in Oct, worst supply crunch may have passed

UK PMI Construction rose to 54.6 in October, up from 52.6, slightly above expectation of 54.0. Construction recovery accelerated from September’s eight-month low. House building regained its place as the best-performing category. But severe shortages of staff and materials continued.

Tim Moore, Director at IHS Markit said: “UK construction companies achieved a faster expansion of output volumes in October, despite headwinds from severe supply constraints and escalating costs…. “However, the volatile price and supply environment added to business uncertainty and continued to impede contract negotiations… There were widespread reports that shortages of materials and staff had disrupted work on site, while rising fuel and energy prices added to pressure on costs.

“Nonetheless, the worst phase of the supply crunch may have passed, as the number of construction firms citing supplier delays fell to 54% in October, down from 63% in September. Similarly, reports of rising purchasing costs continued to recede from the record highs seen this summer.”

Eurozone PPI rose 2.7% mom , 16.0% yoy in Sep, well above expectations

Eurozone PPI rose 2.7% mom, 16.0 yoy in September, above expectation of 1.9% mom, 15.2% yoy. For the month, Industrial producer prices, increased by 7.7% in the energy sector, by 1.0% for intermediate goods, by 0.5% for capital goods, by 0.4% for durable consumer goods and by 0.3% for non-durable consumer goods. Prices in total industry excluding energy increased by 0.6%.

EU PPI rose 2.7% mom, 16.2% yoy. The industrial producer prices increased in all Member States, with the highest monthly increases being registered in Ireland (+23.2%), Denmark (+8.4%) and Greece (+5.8%).

Eurozone PMI composite finalized at 54.2, still consistent with 0.5% quarterly GDP growth

Eurozone PMI Services was finalized at 54.6 in October, down from September’s 56.4. PMI Composite was finalized at 54.2, down from September’s 56.2. Looking at some member states, Ireland PMI composite rose to 2-month high at 62.5. Spain dropped to 6-month low at 56.2. France dropped to 6-month low at 54.7. Italy dropped to 6-month low at 54.2. Germany dropped to 8-month low at 52.0.

Chris Williamson, Chief Business Economist at IHS Markit said: “Eurozone growth has slowed sharply at the start of the fourth quarter, with manufacturing hamstrung by supply constraints and services losing momentum as the rebound from lockdowns fades.

“Despite the slowdown, the rate of expansion remains consistent with quarterly GDP growth of 0.5%, but there’s a worrying lack of clarity on the direction of travel in coming months.

“With supply shortages getting worse rather than better in October, manufacturing growth is likely to remain subdued for some time to come. That would leave the economy reliant on the service sector to drive growth, and there are already signs that rising virus case numbers are dampening activity in many service sector businesses, notably – but by no means exclusively – in Germany.

“Ongoing supply shortages meanwhile suggest that high price pressures will persist into next year, but as yet there are no signs of persistent strong wage growth, which would be the bigger concern for the longer-term inflation outlook.”

Australia retail sales rose 1.3% mom in Sep, down a record -4.4% qoq in Q3

Australia retail sales rose 1.3% mom, 1.7% yoy in September. For the quarter, sales dropped a record -4.4% qoq.

Ben James, Director of Quarterly Economy Wide Statistics said: “The Delta outbreak from late June led to protracted lockdowns in many mainland jurisdictions, with the restrictions causing many retailers to close their physical stores throughout the September quarter. This resulted in the largest quarterly fall in national sales volumes ever recorded.”

Also released, goods and services exports dropped -6% mom to AUD 44.97B in September. Goods and services imports dropped -2% mom to AUD 32.73B. Trade surplus came in at AUD 12.24B, versus expectation of AUD 12.22B.

BoJ Kuroda: YCC to continue even after the pandemic

BoJ Governor Haruhiko Kuroda said his met with new Japanese Prime Minister Fumio Kishida today, and discussed Japan, global economies and financial markets .

Kuroda said he explained BoJ’s monetary policy to Kishida, and reiterated the aim to achieve 2% inflation target. When asked about Fed’s tapering, he explained that BoJ is in different situation from western central banks.

Also, Kuroda said that yield curve control will continue even after the pandemic is contained.

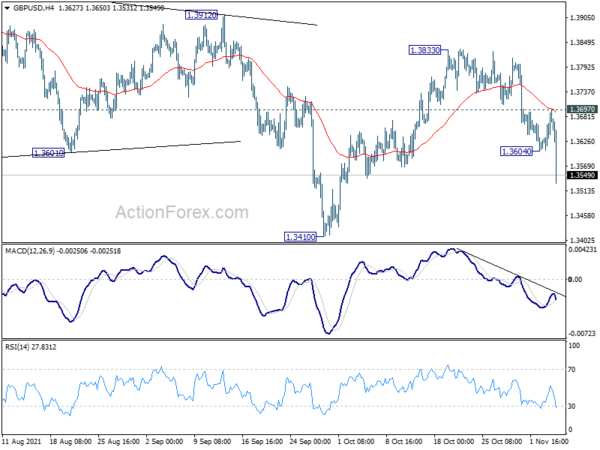

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.3632; (P) 1.3662; (R1) 1.3717; More…

GBP/USD’s fall from 1.3833 resumes after brief consolidation and hits as low as 1.3531 so far. Intraday bias is back on the downside for retesting 1.3410 low. Firm break there will resume larger fall from 1.4280 to 1.3164 medium term fibonacci level. On the upside, break of 1.3697 will turn intraday bias to the upside for 1.3833 resistance instead.

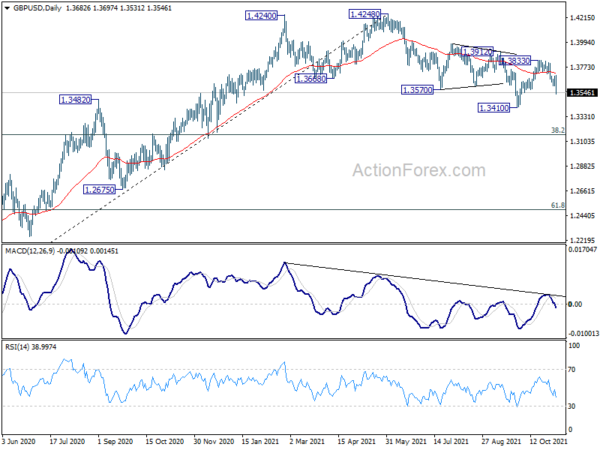

In the bigger picture, the structure of the fall from 1.4248 suggests that it’s a correction to the up trend from 1.1409 (2020 low) only. While deeper fall cannot be ruled out yet, downside should be contained by 38.2% retracement of 1.1409 to 1.4248 at 1.3164, at least on first attempt, to bring rebound. On the upside, firm break of 1.4376 key resistance (2018 high) will add to the case of long term bullish reversal. However, sustained trading below 1.3164 will revive some medium term bearishness and target 61.8% retracement at 1.2493.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:00 | NZD | ANZ Commodity Price Oct | 2.10% | 1.00% | 1.50% | |

| 00:30 | AUD | Trade Balance (AUD) Sep | 12.24B | 12.22B | 15.08B | 14.74B |

| 07:00 | EUR | Germany Factory Orders M/M Sep | 1.30% | 2.00% | -7.70% | |

| 08:00 | CHF | SECO Consumer Climate Q4 | 4 | 5 | 8 | |

| 08:45 | EUR | Italy Services PMI Oct | 52.4 | 54.5 | 55.5 | |

| 08:50 | EUR | France Services PMI Oct F | 56.6 | 56.6 | 56.6 | |

| 08:55 | EUR | Germany Services PMI Oct F | 52.4 | 52.4 | 52.4 | |

| 09:00 | EUR | Eurozone Services PMI Oct F | 54.6 | 54.7 | 54.7 | |

| 09:30 | GBP | Construction PMI Oct F | 54.6 | 54 | 52.6 | |

| 10:00 | EUR | Eurozone PPI M/M Sep | 2.70% | 1.90% | 1.10% | |

| 10:00 | EUR | Eurozone PPI Y/Y Sep | 16.00% | 15.20% | 13.40% | |

| 11:30 | USD | Challenger Job Cuts Y/Y Oct | -71.70% | -84.90% | ||

| 12:00 | GBP | BoE Rate Decision | 0.10% | 0.10% | 0.10% | |

| 12:00 | GBP | BoE Asset Purchase Facility | 875B | 875B | 875B | |

| 12:00 | GBP | MPC Official Bank Rate Votes | 2–0–7 | 0–0–9 | 0–0–9 | |

| 12:00 | GBP | MPC Asset Purchase Facility Votes | 0–3–6 | 0–2–7 | 0–2–7 | |

| 12:30 | CAD | Trade Balance (CAD) Sep | 1.9B | 2.3B | 1.9B | |

| 12:30 | USD | Initial Jobless Claims (Oct 29) | 269K | 277K | 281K | 283K |

| 12:30 | USD | Trade Balance (USD) Sep | -80.9B | -74.5B | -73.3B | -72.8B |

| 12:30 | USD | Nonfarm Productivity Q3 P | -5.00% | -1.50% | 2.10% | |

| 12:30 | USD | Unit Labor Costs Q3 P | 8.30% | 5.20% | 1.30% | |

| 14:30 | USD | Natural Gas Storage | 1.5B | 87B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals