Global stock markets are recovering slightly today, continuing to stabilize from Omicron worries for now. Major currency pairs are also bounded in consolidative trading in tight range. While Aussie is trying to lead commodity currencies higher, it’s lacking clear upside momentum. Swiss Franc and Yen are the softer ones followed by Euro and Dollar.

Technically, trading in Gold is also sluggish. Near term channel support appears to be providing a floor for now. Yet, there is no strength for a rebound. Gold’s decline from 1877.05 could re-accelerate if the support zone between 1757.84 and the channel support is taken out decisively. In the case, we might see a test on 1700 handle quickly. But a break of 1815 resistance will bring stronger rebound back towards 1877.05 resistance instead. The next move might be accompanied by a move in Dollar in the opposite direction.

In Europe, at the time of writing, FTSE is up 1.33%. DAX is up 1.87%. CAC is up 1.76%. Germany 10-year yield is up 0.025 at -0.324. Earlier in Asia, Nikkei rose 0.41%. Hong Kong HSI rose 0.78%. China Shanghai SSE rose 0.36%. Singapore Strait Times rose 1.87%. Japan 10-year JGB yield rose 0.0081 to 0.067.

US ADP jobs grew 534k in Dec, recovery continued to power through its challenges

US ADP private employment grew 534k in December, slightly above expectation of 525k. By company size, small businesses job grew 115k, medium businesses grew 142k, large businesses grew 277. By sector, goods-producing jobs grew 110k, service-providing jobs grew 424k.

“The labor market recovery continued to power through its challenges last month,” said Nela Richardson, chief economist, ADP. “November’s job gains bring the three month average to 543,000 monthly jobs added, a modest uptick from the job pace earlier this year. Job gains have eclipsed 15 million since the recovery began, though 5 million jobs short of pre-pandemic levels. Service providers, which are more vulnerable to the pandemic, have dominated job gains this year. It’s too early to tell if the Omicron variant could potentially slow the jobs recovery in coming months.”

UK PMI manufacturing finalized at 58.1 in Nov, but industry in a vulnerable position

UK PMI Manufacturing was finalized at 58.1 in November, up from October’s 57.8, hitting a 3-month high. Markit said output growth edged higher as domestic order intakes rose. New export business fell for the third straight month.

Rob Dobson, Director at IHS Markit, said: “The current mix of supply-side constraints, cost increases, skill shortages and rising demand for labour will add to the expectations of an imminent rate increase by the central bank, but the survey highlights how the subdued rate of manufacturing growth and export decline leaves industry in a vulnerable position to any new headwinds, not least the Omicron variant.”

Eurozone PMI manufacturing finalized at 58.4 in Nov, strong headline reading masks tough business conditions

Eurozone PMI Manufacturing was finalized at 58.4 in November, slightly up from October’s 58.3. Markit said stocks of purchases rose at strongest rate on record as firmed built safety buffers. Output price inflation hit fresh record while supplier performance deteriorated rapidly once again.

Looking as some member states, Italy PMI manufacturing rose to record high at 62.8. Others, except France at 55.9 (3-month high), dropped, but readings remained high, including the Netherlands at 60.7 (9-month low), Ireland at 59.9 (8-month low), Greece at 58.8 (2-month low), Austria at 58.1 (10-month low), Germany at 57.4 (10-month low), and Spain at 57.1 (8-month low).

Chris Williamson, Chief Business Economist at IHS Markit said: “A strong headline PMI reading masks just how tough business conditions are for manufacturers at the moment. Although demand remains strong, as witnessed by a further solid improvement in new order inflows, supply chains continue to deteriorate at a worrying rate. Shortages of inputs have restricted production growth so far in the fourth quarter to the weakest seen over the past year and a half…

“… Looking ahead, rising COVID-19 infection rates cast a darkening cloud over the near-term outlook, threatening to further disrupt supply chains while at the same time diverting spending from consumer services to consumer goods again, therefore worsening the imbalance of supply and demand.”

Germany PMI Manufacturing was finalized at 57.4 in November, down from October’s 57.8. Markit noted that input shortages held back output and, to a lesser extent, new orders. Rising energy costs helped drive new record increase in output prices. Business expectations improved for the first time in five months.

France PMI Manufacturing was finalized at 55.9 in November, up from October’s 53.6. That’s the first increase since May. Markit noted that output volumes were broadly unchanged during the month. Demand improved, but remained subdued amid supply-related constraints. Output price inflation reached new high.

Also released, Germany retail sales dropped -0.3% mom in October versus expectation of 1.0% mom. Swiss CPI jumped to 1.5% yoy in November, up from 1.2% yoy, above expectation of 1.4% yoy. Swiss SVME PMI dropped to 62.5, down from 65.4, below expectation of 64.5.

Australia GDP contracted -1.9% qoq in Q3, back below pre-pandemic level

Australia GDP contracted -1.9% qoq in Q3, better than expectation of -2.7% qoq. Through the year, GDP was up 3.9%.

Acting Head of National Accounts at the ABS, Sean Crick said: “Domestic demand drove the fall, with prolonged lockdowns across NSW, Victoria and the ACT resulting in a substantial decline in household spending.

“The fall in domestic demand was only partly offset by growth in net trade and public sector expenditure. GDP in the September quarter 2021 was 0.2 per cent below the December quarter 2019 pre-pandemic level.”

Australia AiG manufacturing rose to 54.8, grew more decisively

Australia AiG Performance of Manufacturing Index rose 4.4 pts to 54.8 in November. Looking at some details, production rose 4.7 to 52.5. Employment rose 2.0 to 50.0. New orders rose 1.0 to 59.3. Supplier deliveries rose 12.2 to 53.4. Input prices dropped -3.5 to 78.3. Selling prices rose 4.2 to 68.1. Average wages dropped -1.3 to 62.4.

Ai Group Chief Executive Innes Willox said: “The Australian manufacturing industry grew more decisively in November after a few flat months during which the south-east corner of the country was held back by the delta outbreaks and associated activity restrictions and while the states and territories tightened barriers to the movement of people.”

China Caixin PMI manufacturing dropped to 49.9, recovery not solid

China Caixin PMI Manufacturing dropped from 50.6 to 49.9 in November, below expectation of 50.5. Caixin added that output rose for the first time in four months as power supply issues unwound. But total new orders fell slightly. Inflationary pressures eased markedly.

Wang Zhe, Senior Economist at Caixin Insight Group said: “To sum up, the manufacturing sector remained stable overall in November. Increased downward pressure and easing inflationary pressure were prominent features of the economic situation…. After the shortage of power was alleviated, the supply side began to recover. But due to weak demand, the supply recovery was limited, and the foundation of the recovery was not solid.”

BoJ Adachi: Concern over spread of a new variant is increasing

BoJ board member Seiji Adachi said in a speech, the number of new coronavirus case in Japan is seeing “great improvement”, with weekly average decline to a “considerable extent recently”. However, “the situation warrants careful attention, as concern over the spread of a new variant is increasing at the moment.”

He added BoJ will “closely monitor the impact of COVID-19 and will not hesitate to take additional easing measures if necessary, with a view to supporting firms’ ability to sustain their businesses”,

“If the number of COVID- 19 cases resurges and it once again becomes inevitable to have public health measures in place, for example, it could become necessary to support corporate financing.”

“The role of the COVID-19 Special Operations largely depends on developments relative to the pandemic, so it is necessary to assess such developments and their impact on corporate financing when deliberating on the next steps.”

Japan PMI manufacturing finalized at 54.5 in Nov

Japan PMI Manufacturing was finalized at 54.5 in November, up from October’s 53.2. That’s the best reading since January 2018, and the 10th consecutive month of overall growth. Markit noted that output and new orders rose at faster rates. There was sharp rise in cost burdens amid sustained supply chain disruption. Businesses reported strong optimism regarding future output.

Also released, capital spending rose 1.2% in Q3 versus expectation of 2.7%.

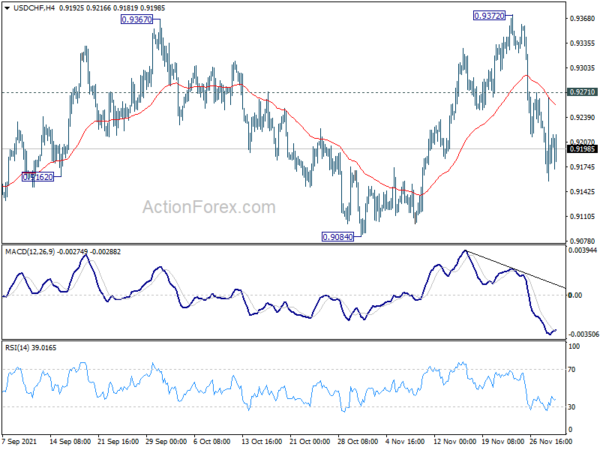

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9139; (P) 0.9203; (R1) 0.9248; More….

Further decline remains in favor in USD/CHF with 0.9271 minor resistance intact. Fall from 0.9372 would target 0.9084 support. Firm break there will argue that choppy rise from 0.8925 has completed, and fall from 0.9471 is resuming. Deeper decline would be seen through 0.8925. Nevertheless, break of 0.9271 will turn bias back to the upside for retesting 0.9372.

In the bigger picture, the corrective structure of the rebound from 0.8925 argues that fall from 0.9471 is not complete yet. It could either be the second leg of pattern from 0.8756 (2021 low), or resuming larger down trend from 1.0237 (2018 high). We’d pay attention to the downside momentum and assess the odds later. But for now, medium term outlook will be neutral at best as long as 0.9471 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Manufacturing Index Nov | 54.8 | 50.4 | ||

| 21:45 | NZD | Building Permits M/M Oct | -2.00% | -1.90% | -2.00% | |

| 23:50 | JPY | Capital Spending Q3 | 1.20% | 2.70% | 5.30% | |

| 00:01 | GBP | BRC Shop Price Index Y/Y Oct | 0.30% | -0.40% | ||

| 00:30 | AUD | GDP Q/Q Q3 | -1.90% | -2.70% | 0.70% | |

| 00:30 | JPY | Manufacturing PMI Nov F | 54.5 | 54.2 | 54.2 | |

| 01:45 | CNY | Caixin Manufacturing PMI Nov | 49.9 | 50.5 | 50.6 | |

| 07:00 | EUR | Germany Retail Sales M/M Oct | -0.30% | 1.00% | -2.50% | -1.90% |

| 07:30 | CHF | CPI M/M Nov | 0.00% | -0.10% | 0.30% | |

| 07:30 | CHF | CPI Y/Y Nov | 1.50% | 1.40% | 1.20% | |

| 08:30 | CHF | SVME PMI Nov | 62.5 | 64.5 | 65.4 | |

| 08:45 | EUR | Italy Manufacturing PMI Nov | 62.8 | 61 | 61.1 | |

| 08:50 | EUR | France Manufacturing PMI Nov F | 55.9 | 54.6 | 54.6 | |

| 08:55 | EUR | Germany Manufacturing PMI Nov F | 57.4 | 57.6 | 57.6 | |

| 09:00 | EUR | Eurozone Manufacturing PMI Nov F | 58.4 | 58.6 | 58.6 | |

| 09:30 | GBP | Manufacturing PMI Nov F | 58.1 | 58.2 | 58.2 | |

| 13:15 | USD | ADP Employment Change Nov | 534K | 525K | 571K | 570K |

| 13:30 | CAD | Building Permits M/M Oct | 1.30% | 0.10% | 4.30% | |

| 14:30 | CAD | Manufacturing PMI Nov | 57.7 | |||

| 14:45 | USD | Manufacturing PMI Nov F | 59.1 | 59.1 | ||

| 15:00 | USD | ISM Manufacturing PMI Nov | 61 | 60.8 | ||

| 15:00 | USD | ISM Manufacturing Prices Paid Nov | 86 | 85.7 | ||

| 15:00 | USD | ISM Manufacturing Employment Index Nov | 52 | |||

| 15:00 | USD | Construction Spending M/M Oct | 0.40% | -0.50% | ||

| 15:30 | USD | Crude Oil Inventories | -1.5M | 1.0M | ||

| 19:00 | USD | Fed’s Beige Book |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals