Commodity currencies are turning weaker again in otherwise range trading markets. As for today, European majors are the stronger ones, as lead by Sterling. But there is no clear sign of follow through movements. Omicron seems to have slipped to the backstage. Traders are probably looking through to tomorrow’s non-farm payroll report to gauge how Fed would quicken its tapering.

Technically, Euro appears to be making some progress against Aussie and Canadian. Despite some unconvincing momentum, EUR/AUD is still on track to 1.6075 near term projection level. EUR/CAD’s rebound from 1.4162 short term bottom is also extending. Immediate focus will be on 1.4580 support turned resistance. Firm break there would bring stronger rise back to medium term falling trend line resistance at 1.4898.

In Europe, at the time of writing, FTSE is down -0.95%. DAX is down -1.76%. CAC is down -1.55%. Germany 10-year yield is down -0.0408 at -0.381. Earlier in Asia, Nikkei dropped -0.65%. Hong Kong HSI rose 0.55%. China Shanghai SSE dropped -0.09%. Singapore Strait Times dropped -0.20%. Japan 10-year JGB yield dropped -0.075 to 0.059.

US initial jobless claims rose to 222k, continuing claims dropped to 1.96m

US initial jobless claims rose 28k to 222k in the week ending November 27, better than expectation of 250k. Four-week moving average of initial claims dropped -12k to 239k, lowest since March 14, 2020.

Continuing claims dropped -107k to 1956k in the week ending November 20, lowest since March 14, 2020. Four-week moving average of continuing claims dropped -36k to 2084k, lowest since March 21, 2020.

Eurozone PPI at 5.4% mom, 21.9% yoy in October, well above expectations

Eurozone PPI came in at 5.4% mom, 21.9% yoy in October, well above expectation of 3.2% mom, 19.0% yoy. For the month, industrial producer prices increased by 16.8% mom in the energy sector, by 1.4% mom for intermediate goods, by 0.5% mom for durable and for non-durable consumer goods and by 0.4% mom for capital goods. Prices in total industry excluding energy increased by 0.8% mom.

EU PPI rose 5.0% mom, 21.7% yoy. The highest monthly increases in industrial producer prices were recorded in Belgium (+11.2%), Italy (+9.4%) and Romania (+8.6%), while the only decreases were observed in Estonia (-2.1%), Luxembourg (-0.3%) and Sweden (-0.2%).

Eurozone unemployment rate dropped to 7.3% in Oct, EU unchanged at 6.7%

Eurozone unemployment rate dropped to 7.3% in October, down from 7.4%, matched expectations. EU unemployment rate was unchanged at 6.7%.

Eurostat estimates that 14.312 million men and women in the EU, of whom 12.045 million in Eurozone, were unemployed in October 2021.

BoJ Suzuki: Effective and sustainable monetary easing to persistently continue

BoJ board member Hitoshi Suzuki said in a speech, “to achieve the price stability target of 2 percent, the Bank is expected — even after COVID-19 subsides — to persistently continue with further effective and sustainable monetary easing”.

However, it’s also necessary to “pay attention to the possibility that credit costs will increase due to a delay in economic recovery at home and abroad”. Also, “downward pressure on financial institutions’ core profitability is likely to persist as a trend even after COVID-19 subsides”.

“My view is that the Bank should pay due attention to the fact that side effects of monetary easing will accumulate over time,” he added. “The Bank will continue to conduct monetary policy in an appropriate manner so as to fulfill the two missions of achieving price stability and ensuring the stability of the financial system.”

From Japan too, monetary base rose 9.3% yoy in November, below expectation of 10.3% yoy.

Australia trade surplus narrowed to AUD 11.22B in Oct

Australia exports of goods and services dropped -3% mom to AUD 43.05B in October, driven by falls in iron ore prices. Goods and services imports dropped -3% mom to AUD 31.83B, by fall in imports of capital goods. Trade surplus narrowed to AUD 11.22B, slightly higher than expectation of AUD 11.00B.

Retail sales rose 4.9% mom, 5.9% yoy to AUD 31.13B.

USD/JPY Mid-Day Outlook

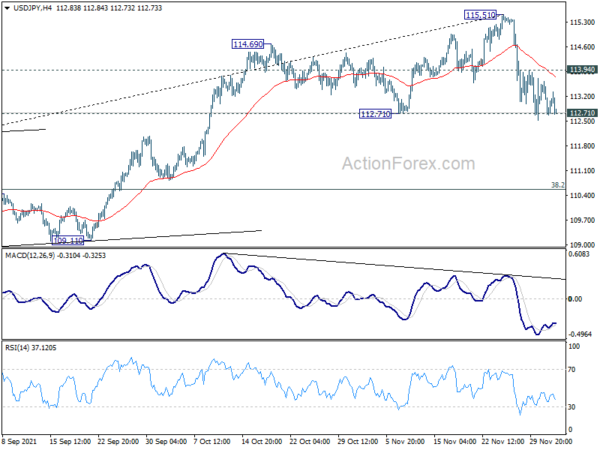

Daily Pivots: (S1) 112.43; (P) 113.03; (R1) 113.39; More…

Intraday bias in USD/JPY remains neutral for the moment. On the downside, sustained break of 112.71 structural support will argue that fall from 115.51 is already correcting whole rise from 102.58. Deeper decline would then be seen to 38.2% retracement of 102.58 to 115.51 at 110.57. On the upside, break of 113.94 minor resistance will turn bias back to the upside for retesting 115.51 high instead.

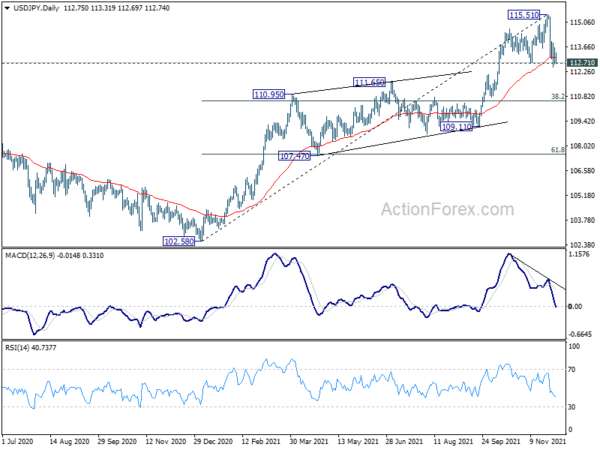

In the bigger picture, no change in the view that rise from 102.58 is the third leg of the up trend from 101.18 (2020 low). Such rally should target a test on 118.65 (2016 high) on resumption. However, firm break of 109.11 structural support will argue that the trend might have reversed and bring deeper fall to 107.47 support and possibly below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Terms of Trade Index Q3 | 0.70% | 2.10% | 3.30% | 3.20% |

| 23:50 | JPY | Monetary Base Y/Y Nov | 9.30% | 10.30% | 9.90% | |

| 00:30 | AUD | Trade Balance (AUD) Oct | 11.22B | 11.00B | 12.24B | 11.82B |

| 05:00 | JPY | Consumer Confidence Nov | 39.2 | 40.3 | 39.2 | |

| 07:30 | CHF | Real Retail Sales Y/Y Oct | 1.20% | 2.20% | 2.50% | 2.60% |

| 10:00 | EUR | Eurozone Unemployment Rate Oct | 7.30% | 7.30% | 7.40% | |

| 10:00 | EUR | Eurozone PPI M/M Oct | 5.40% | 3.20% | 2.70% | 2.80% |

| 10:00 | EUR | Eurozone PPI Y/Y Oct | 21.90% | 19.00% | 16.00% | 16.10% |

| 12:30 | USD | Challenger Job Cuts Y/Y Nov | -77.00% | -71.70% | ||

| 13:30 | USD | Initial Jobless Claims (Nov 26) | 222K | 250K | 199K | 194K |

| 15:30 | USD | Natural Gas Storage | -59B | -21B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals