The multi-decade high in US CPI reading appears to be failing trigger any move in Dollar. The greenback is staying in very tight range in general. Commodity currencies are indeed trying to regain upside momentum. Yen is set to end as the worst performing, followed by Swiss Franc and then Euro.

In Europe, at the time of writing, FTSE is down -0.06%. DAX is up 0.05%. CAC is down -0.06%. Germany 10-year yield is up 0.017 at -0.337. Earlier in Asia, Nikkei dropped -1.0%. Hong Kong HSI dropped -1.07%. China Shanghai SSE dropped -0.18%. Singapore Strait Times dropped -0.22%. Japan 10-year JGB yield rose 0.0059 to 0.056.

US CPI rose to 6.8% yoy, highest since 1982

US CPI rose 0.8% mom in November, above expectation of 0.7 % mom. For the 12-month period, CPI accelerated to 6.8% yoy, up from 6.2% yoy, matched expectations. That’s the highest rate since June 1982.

CPI core rose 0.5% mom, matched expectations. CPI core accelerated to 4.9% yoy, up from 4.6% yoy, matched expectations. Energy index rose 33.3% yoy. Both are highest level in at least 13 years.

NIESR forecast UK GDP to grow 0.6% mom in Nov, 1.0% qoq in Q4

NIESR forecast UK GDP growth to reach 0.6% mom in November, before significant concerns about transmission of Covid-19 began to return, falling to 0.3% in December. Overall for Q3, GDP growth is projected to be 1.0% qoq, following the 1.3% qoq in Q3.

NIESR added that “Omicron is expected to restrain growth in the coming months but not to cause economic disruption anywhere near the scale of 2020, with households and businesses having adapted economic behavior more with each wave.”

UK GDP grew 0.1% mom in Oct, Services back at pre-pandemic level

UK GDP grew 0.1% mom in October, below expectation of 0.3% mom. GDP remained -0.5% below pre-pandemic level in February 2020.

Services grew 0.4% mom, back at pre-pandemic level. Production dropped -0.6% mom, at -2.1% below pre-pandemic level. Manufacturing rose 0.0% mom, at -2.5% below pre-pandemic level. Construction dropped -1.8% mom, at -2.8% below pre-pandemic level.

Also released, industrial production came in at -0.6% mom, 1.4% yoy, versus expectation of 0.2% mom, 2.2% yoy. Manufacturing was at 0.0% mom, 1.3% yoy, versus expectation of 0.1% mom, 1.4% yoy. Goods trade deficit narrowed to GBP -13.9B, versus expectation of GBP -14.1B.

New Zealand BusinessNZ manufacturing dropped to 50.6, soft growth and rising inflation

New Zealand BusinessNZ Performance of Manufacturing index dropped from 54.3 to 50.6 in November. Looking at some details, production dropped from 53.2 to 52.2. Employment dropped from 51.7 to 48.2. New orders rose from 54.2 to 54.7. Finished stocks dropped from 54.6 to 48.3. Deliveries dropped from 59.9 to 42.9.

BNZ Senior Economist, Doug Steel stated that “the PMI implications for economic (and employment) growth seem clear – soft. But with obvious difficulties remaining on the supply side, we’d suggest that inflation is still rising.”

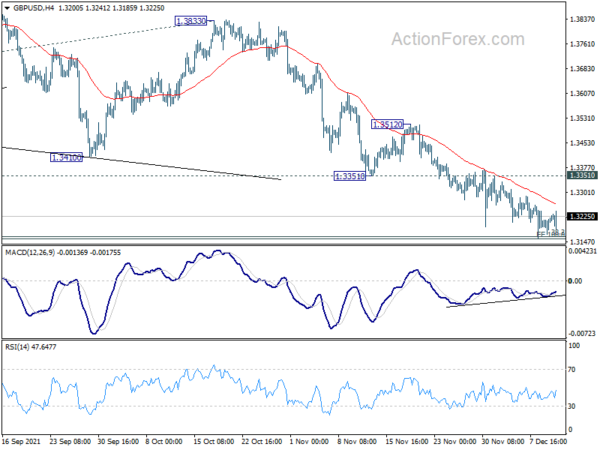

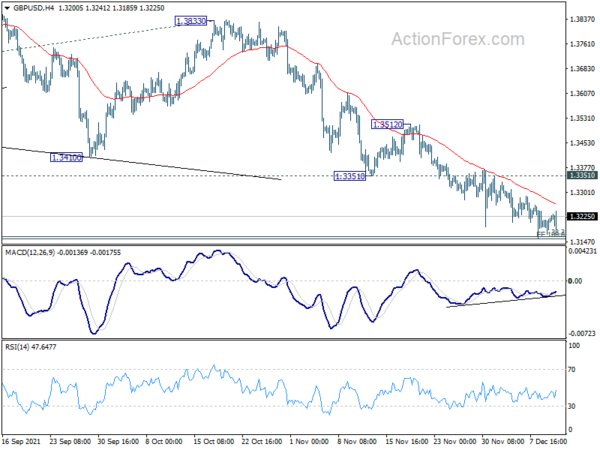

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.3153; (P) 1.3207; (R1) 1.3248; More…

Intraday bias in GBP/USD remains neutral and outlook is unchanged. On the downside, sustained break of 1.3164 medium term fibonacci level will carry larger bearish implication. Fall from 1.4248 should resume and target 161.8% projection of 1.4248 to 1.3570 from 1.3833 at 1.2736. On the upside, though, break of 1.3351 support turned resistance will indicate short term bottoming, and turn bias back to the upside for 1.3512 resistance next.

In the bigger picture, immediate focus is now on 38.2% retracement of 1.1409 to 1.4248 at 1.3164. Sustained break there will argue that whole rise from 1.1409 has completed at 1.4248, ahead rejection by 1.4376 long term resistance. That will revive some medium term bearishness and and target 61.8% retracement at 1.2493.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | NZD | Business NZ PMI Nov | 50.6 | 54.3 | ||

| 23:50 | JPY | PPI Y/Y Nov | 9.00% | 8.50% | 8.00% | |

| 07:00 | EUR | Germany CPI M/M Nov F | -0.20% | -0.20% | -0.20% | |

| 07:00 | EUR | Germany CPI Y/Y Nov F | 5.20% | 5.20% | 5.20% | |

| 07:00 | GBP | GDP M/M Oct | 0.10% | 0.30% | 0.60% | |

| 07:00 | GBP | Index of Services 3M/3M Oct | 1.10% | 1.20% | 1.60% | |

| 07:00 | GBP | Industrial Production M/M Oct | -0.60% | 0.20% | -0.40% | |

| 07:00 | GBP | Industrial Production Y/Y Oct | 1.40% | 2.20% | 2.90% | |

| 07:00 | GBP | Manufacturing Production M/M Oct | 0.00% | 0.10% | -0.10% | |

| 07:00 | GBP | Manufacturing Production Y/Y Oct | 1.30% | 1.40% | 2.80% | |

| 07:00 | GBP | Goods Trade Balance (GBP) Oct | -13.9B | -14.1B | -14.7B | |

| 09:00 | EUR | Italy Industrial Output M/M Oct | -0.60% | 0.40% | 0.10% | |

| 13:15 | GBP | NIESR GDP Estimate (3M) Nov | 0.90% | 1.30% | 1.00% | 0.90% |

| 13:30 | USD | CPI M/M Nov | 0.80% | 0.70% | 0.90% | |

| 13:30 | USD | CPI Y/Y Nov | 6.80% | 6.80% | 6.20% | |

| 13:30 | USD | CPI Core M/M Nov | 0.50% | 0.50% | 0.60% | |

| 13:30 | USD | CPI Core Y/Y Nov | 4.90% | 4.90% | 4.60% | |

| 13:30 | CAD | Capacity Utilization Q3 | 81.40% | 81.20% | 82.00% | |

| 15:00 | USD | Michigan Consumer Sentiment Index Dec P | 68.2 | 67.4 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals