Dollar and Yen rise following slightly negative risk sentiment. Major Asian indexes are generally lower, following the mild pull back in US overnight. Australian Dollar is leading commodity currencies lower. European majors are mixed with Euro trading a bit firmer than the others. Focuses will firstly turn to UK employment data and US PPI today. But there are main events of five central bank meetings ahead, starting with Fed tomorrow.

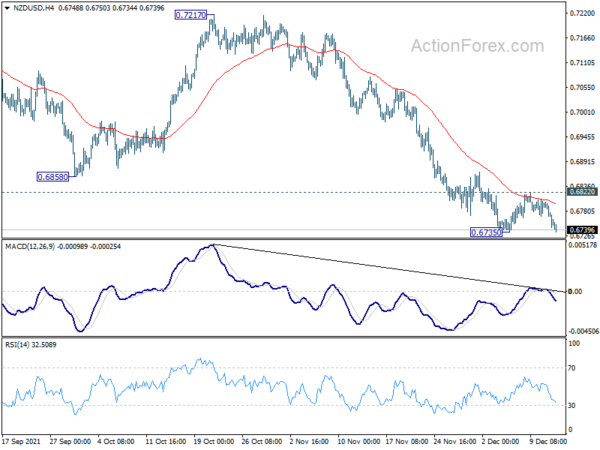

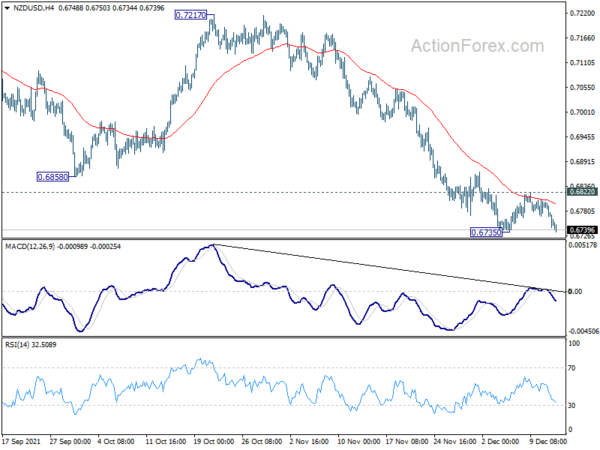

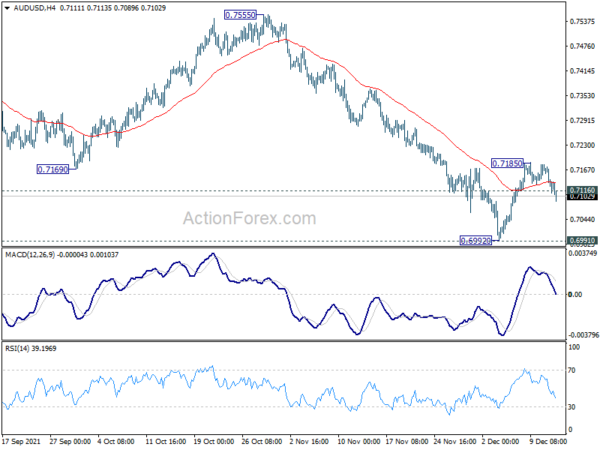

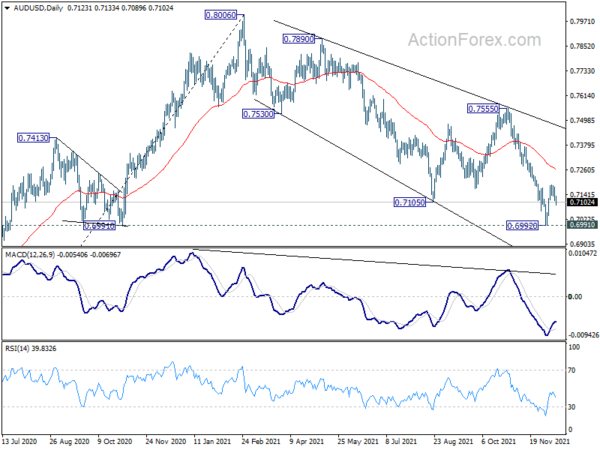

Technically, NZD/USD is making downside progress and is now eyeing 0.6735 minor support. Break there will resume the fall from 0.7217, as well as larger pattern from 0.7463 high. At the same time, we’ll also monitor USD/CAD and AUD/USD. Break of 1.2852 resistance in USD/CAD will resume the rise from 1.2286. AUD/USD is still far away from 0.6992 low, but break there will resume larger fall from 0.8006. These developments, if happen together, could signal a turn in overall market sentiments.

In Asia, at the time of writing, Nikkei is down -0.80%. Hong Kong HSI is down -1.26%. China Shanghai SSE is down -0.31%. Singapore Strait Times is up 0.12%. Japan 10-year JGB yield is down -0.0010 at 0.049. Overnight, DOW dropped -0.89%. S&P 500 dropped -0.91%. NASDAQ dropped -1.39%. 10-year yield dropped -.065 to 1.424.

BoC Macklem: Medium and longer-run inflation expectations well anchored on target

The Bank of Canada agreed with the federal government to keep the flexible inflation targeting framework the next five years. Also, monetary should continue to support maximum sustainable employment.

Governor Tiff Macklem said, “even as the complications of reopening the global economy have caused inflation in Canada and many other countries to rise, medium and longer-run inflation expectations in Canada have remained well anchored on the 2 percent target.”

“Keeping inflation expectations well anchored is key to completing the recovery and getting inflation back to target,” he noted.

Australia NAB business confidence dropped to 12, come back to earth

Australia NAB business confidence dropped from 20 to 12 in November. Business conditions improved from 10 to 12. Looking at some details, trading conditions rose from 15 to 16. Profitability conditions rose were unchanged at 8. Employment conditions rose from 6 to 11.

“Confidence remains high across states and industries, albeit it has come back to earth a little after the optimism associated with the end of lockdowns,” said NAB Chief Economist Alan Oster.

“Forward indicators are also very strong with a rise in capital expenditure a welcome sign that businesses are beginning to look towards a period of expansion. These results align with the strong rebound in activity that we believe is now underway, as well as a positive outlook for the coming months with vaccination rates now very high.”

Looking ahead

UK employment, Swiss PPI and Eurozone industrial production will be released in European session. US PPI is the main feature later in the day.

AUD/USD Daily Report

Daily Pivots: (S1) 0.7105; (P) 0.7141; (R1) 0.7170; More…

AUD/USD’s break of 0.7116 minor support suggests that rebound from 0.6992 has completed at 0.7185. Intraday bias is back on the downside for retesting 0.6992 low. Sustained break of 0.6991 key medium term structural support will carry larger bearish implication and resume the fall from 0.8006. On the upside, though, above 0.7185 will resume the rebound from 0.6992 to EMA (now at 0.7259).

In the bigger picture, sustained break of 0.6991 structural support will argue that the whole up trend from 0.5506 might be finished at 0.8006, after rejection by 0.8135 long term resistance. Deeper decline would then be seen back to 61.8% retracement of 0.5506 to 0.8006 at 0.6461). For now, medium term outlook will stay bearish as long as 0.7555 resistance holds, in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 0:30 | AUD | NAB Business Confidence Nov | 12 | 21 | 20 | |

| 0:30 | AUD | NAB Business Conditions Nov | 12 | 11 | ||

| 4:30 | JPY | Industrial Production M/M Oct F | 1.80% | 1.10% | 1.10% | |

| 7:00 | GBP | Claimant Count Change Nov | -14.9K | |||

| 7:00 | GBP | ILO Unemployment Rate 3M Oct | 4.20% | 4.30% | ||

| 7:00 | GBP | Average Earnings Including Bonus 3M/Y Oct | 4.50% | 5.80% | ||

| 7:00 | GBP | Average Earnings Excluding Bonus 3M/Y Oct | 4.00% | 4.90% | ||

| 7:30 | CHF | Producer and Import Prices M/M Nov | 0.50% | 0.60% | ||

| 7:30 | CHF | Producer and Import Prices Y/Y Nov | 4.90% | 5.10% | ||

| 10:00 | EUR | Eurozone Industrial Production M/M Oct | 1.50% | -0.20% | ||

| 11:00 | USD | NFIB Business Optimism Index Nov | 98.4 | 98.2 | ||

| 13:30 | USD | PPI M/M Nov | 0.60% | 0.60% | ||

| 13:30 | USD | PPI Y/Y Nov | 9.10% | 8.60% | ||

| 13:30 | USD | PPI Core M/M Nov | 0.40% | 0.40% | ||

| 13:30 | USD | PPI Core Y/Y Nov | 7.20% | 6.80% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals