Selloff in Yen continued as DOW was pushed to new record by risk-on sentiment, while US benchmark treasury yield also jumped. Dollar is also under some pressure together with Canadian and Euro. On the other hand, Sterling continues to be the outperformer, leading Aussie in the race. With easing fear on Omicron, the markets look set to end the year on a high note.

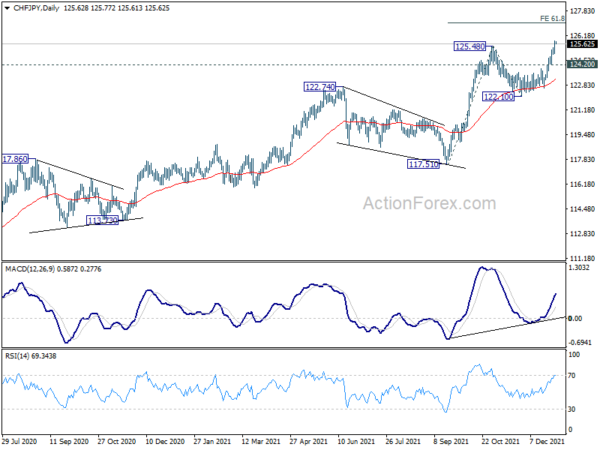

Technically, CHF/JPY’s up trend resumed by taking out 125.48 resistance. Near term outlook will now stay bullish as long as 124.20 minor support holds. Next target is 61.8% projection of 117.51 to 125.48 from 122.10 at 127.02. A question now is whether, or when, would USD/JPY follows to break through 115.51 high.

In Asia, at the time of writing, Nikkei is down -0.28%. Hong Kong HSI is up 0.09%. China Shanghai SSE is up 0.82%. Singapore Strait Times is down -0.31%. Japan 10-year JGB yield is up 0.0152 at 0.075. Overnight, DOW rose 0.25%. S&P 500 rose 0.14%. NASDAQ dropped -0.10%. 10-year yield rose 0.062 to 1.543.

DOW notched new record, 37129 projection level next

DOW finally caught up the S&P 500 and notched a new record close at 36488.63 overnight. Market sentiments remained positive despite record surge in daily Omicron cases. Investors are relieved by more and more evidence that Omicron is less severe than Delta.

From a medium term point of view, DOW is holding well above 55 week EMA, maintaining a healthy up trend. Weekly MACD also suggest that it might also be picking up momentum again. Nevertheless, a important test lies ahead at 100% projection of 18213.65 to 29199.35 from 26143.77 at 37129.47. Sustained break of 37129.47 could easily trigger more upside acceleration in Q1 towards 138.2% projection at 41326.00.

10-year yield setting stage for up trend resumption?

US 10-year yield jumped notably and closed up 0.062 at 1.543. With a strong break above 55 day EMA, it’s starting to suggest that consolidation pattern from 1.765 has completed with three waves to 1.343 already. TNX has also drew solid support from 55 week EMA again, keeping medium term bullishness well in place.

The focus could quickly be on 1.693 resistance when we come back from new year holiday. Firm break there should push TNX through 1.765 resistance to resume the up trend from 0.398. If this happens, we could easily see 10-year yield back at 2% level and above.

Looking ahead

Swiss KOF economic barometer is a feature in European session. US will release jobless claims and Chicago PMI.

USD/JPY Daily Outlook

Daily Pivots: (S1) 114.70; (P) 114.83; (R1) 114.94; More…

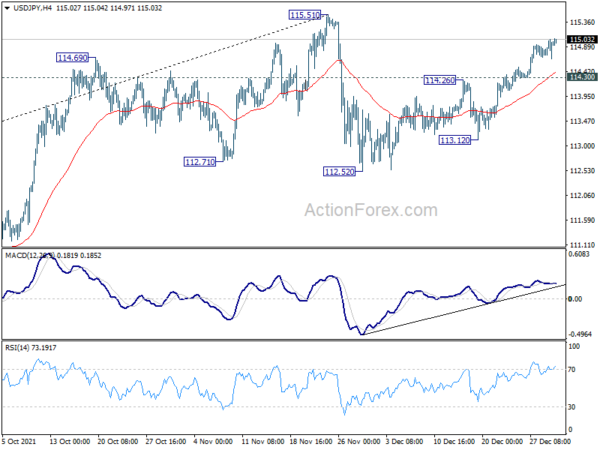

Intraday bias in USD/JPY remains on the upside at this point. Rise from 112.52 should target a test on 115.51 high first. Firm break there will resume larger up trend to 118.65 long term resistance next. On the downside, however, break of 114.30 will turn bias to the downside, and extend the corrective pattern from 115.51 with another falling leg back to 112.52 support.

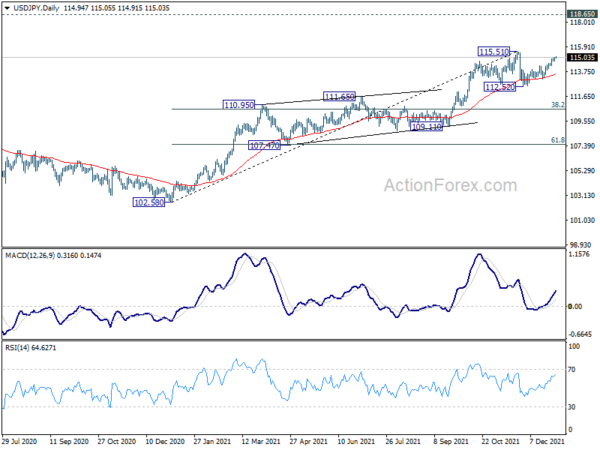

In the bigger picture, no change in the view that rise from 102.58 is the third leg of the up trend from 101.18 (2020 low). Such rally should target a test on 118.65 (2016 high) on resumption. However, firm break of 109.11 structural support will argue that the trend might have reversed and bring deeper fall to 107.47 support and possibly below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 08:00 | CHF | KOF Economic Barometer Dec | 106.4 | 108.5 | ||

| 13:30 | USD | Initial Jobless Claims (Dec 24) | 205K | 205K | ||

| 14:45 | USD | Chicago PMI Dec | 61.5 | 61.8 | ||

| 15:30 | USD | Natural Gas Storage | -55B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals