Global financial markets are in full risk-on mode today. Major European indexes are trading higher while US futures indicates that record run is continuing. In the currency markets, Yen’s steep selloff continues and looks unstoppable. Dollar is performing well as supported by rally in treasury yields. Euro, on the other hand, is rather weak, in particular against Sterling and Swiss Franc. Commodity currencies are lacking a clear direction.

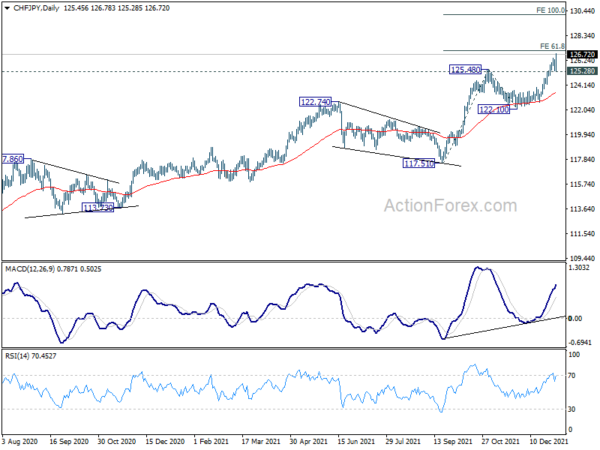

Technically, even CHF/JPY has also resumed its up trend and hit as high as 126.78 so far. A key focus is now on 61.8% projection of 117.51 to 125.48 from 122.10 at 127.02. Sustained break there could be an indication that Yen’s decline is further accelerating, and would set the stage for 100% projection at 130.07.

In Europe, at the time of writing, FTSE is up 1.46%. DAX is up 0.94%. CAC is up 1.43%. Germany 10-year yield is down -0.0188 at -0.139. Earlier in Asia, Nikkei rose 1.77%. Hong Kong HSI rose 0.06%. China Shanghai SSE dropped -0.20%. Singapore Strait Times rose 1.50%. Japan 10-year JGB yield rose 0.0168 to 0.089.

UK PMI manufacturing finalized at 57.9, upturn remains subdued

UK PMI Manufacturing was finalized at 57.9 in December, down slightly from November’s 58.1. The index has now remained above neutral 50 mark for 19 straight months. Markit noted that output, new orders and employment all rose. New export orders fell for the fourth month running. Selling price inflation hit fresh record high.

Rob Dobson, Director at IHS Markit, said: “While the uptick in growth is a positive step, the upturn remains subdued compared to the middle of the year, as supply chain constraints and weak export performance constrained attempts to raise production further. Manufacturers indicated that logistic issues, Brexit difficulties and the possibility of further COVID restrictions (at home and overseas) had all hit export demand at the end of the year.”

Also from UK, M4 money supply rose 0.7% mom in November versus expectation of 0.5% mom.

Swiss CPI at -0.1% mom, 1.5% yoy in Dec

Swiss CPI dropped -0.1% mom in December, matched expectations. the decline was due to several factors including falling prices for heating oil, fuel and air transport. For the 12-month period, CPI was unchanged at 1.5% yoy, below expectation of 1.6% yoy.

Average annual inflation in 2021 was at 0.6%. Prices for domestic products increased by 0.3% on average, those for imported products increased by 1.5%. Average annual inflation was –0.7% in 2020 and +0.4% in 2019.

From Germany, retail sales rose 0.6% mom in November versus expectation of -0.5% mom. Unemployment dropped -23k in December versus expectation of -15k.

China Caixin PMI manufacturing rose to 50.9, improving demand and supply

China Caixin PMI Manufacturing rose to 50.9 in December, up from November’s 49.9, above expectation of 50.0. The data signaled a renewed improvement in the sector with best reading since June. Caixin said rise in output was stronger amid renewed upturn in sales. Input cost inflation eased to 19-month low. Business confidence weakened amid pandemic and supply chain worries.

Wang Zhe, Senior Economist at Caixin Insight Group said: “To sum up, manufacturing demand and supply improved in December with easing inflationary pressure. But the job market was still under pressure and businesses were less optimistic, indicating unstable economic recovery. The repeated Covid-19 flare-ups and sluggish overseas demand were factors of instability.”

Japan PMI manufacturing finalized at 54.3 in Dec, confidence dipped

Japan PMI Manufacturing was finalized at 54.3 in December, slightly lower than November’s 54.5. But that was well above 2021’s average of 52.7. Markit said output and new orders increased at slower rates. Employment level rose at fastest pace in nearly four years. Business optimism eased to four-month low.

Usamah Bhatti, Economist at IHS Markit, said: “Domestic markets were buoyed by a gradual recovery from the COVID-19 pandemic however a sharp rise in cases, particularly in South Korea hindered international demand and continued to disrupt supply chains across the sector… Delivery delays and material shortages remained a dampener on production and sales… Average lead times across the final quarter of 2021 deteriorated further… Though still optimistic, Japanese goods producers were wary of the continued impact of the pandemic and supply chain disruption, which resulted in confidence dipping to the softest since August.”

GBP/JPY Mid-Day Outlook

Daily Pivots: (S1) 154.94; (P) 155.44; (R1) 155.97; More…

GBP/JPY’s rise from 148.94 resumed after brief retreat and intraday bias is back on the upside. As noted before, correction from 158.19 should have completed with three waves down to 148.94, after defending 148.93 key support. Further rally should be seen back to retest 158.19. Firm break there will resume larger up trend to 167.93 long term fibonacci level. On the downside, below 154.86 minor support will turn intraday bias neutral and bring consolidations first.

In the bigger picture, strong rebound from 148.93 key structural support will retain medium term bullishness. Firm break of 158.19 high will resume whole up trend from 123.94 (2020 low), to 61.8% retracement of 195.86 to 122.75 at 167.93. Nevertheless, firm break of 148.93 will bring deeper correction to 38.2% retracement of 123.94 to 158.19 at 145.10, and possibly further lower, as a correction to up trend from 123.94 at least

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:01 | GBP | BRC Shop Price Index Y/Y Nov | 0.80% | 0.30% | ||

| 00:30 | JPY | Manufacturing PMI Dec F | 54.3 | 54.2 | 54.2 | |

| 01:45 | CNY | Caixin Manufacturing PMI Dec | 50.9 | 50.5 | 49.9 | |

| 07:00 | EUR | Germany Retail Sales M/M Nov | 0.60% | -0.50% | -0.30% | |

| 07:30 | CHF | CPI M/M Dec | -0.10% | -0.10% | 0.00% | |

| 07:30 | CHF | CPI Y/Y Dec | 1.50% | 1.60% | 1.50% | |

| 08:55 | EUR | Germany Unemployment Change Dec | -23K | -15K | -34K | |

| 09:30 | GBP | Mortgage Approvals Nov | 67K | 66K | 67K | |

| 09:30 | GBP | M4 Money Supply M/M Nov | 0.70% | 0.50% | 0.60% | |

| 09:30 | GBP | Manufacturing PMI Dec F | 57.9 | 57.6 | 57.6 | |

| 13:30 | CAD | Industrial Product Price M/M Nov | 0.80% | 0.90% | 1.30% | |

| 13:30 | CAD | Raw Material Price Index Nov | -1.00% | 0.00% | 4.80% | |

| 14:30 | CAD | Manufacturing PMI Dec | 57.2 | |||

| 15:00 | USD | ISM Manufacturing PMI Dec | 60.2 | 61.1 | ||

| 15:00 | USD | ISM Manufacturing Prices Paid Dec | 79.5 | 82.4 | ||

| 15:00 | USD | ISM Manufacturing Employment Dec | 53.3 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals