Dollar tumbles broadly in early US session even though consumer inflation data hit multi-decade highs. The move could be seen as a result of clearing the risk of even worse inflation reading that could force Fed’s hand. For now, Canadian Dollar is the strongest one as boosted by rally in oil prices. Sterling and Aussie are following closely on broad risk-on sentiment. On the other hand, Yen is under some selling pressure.

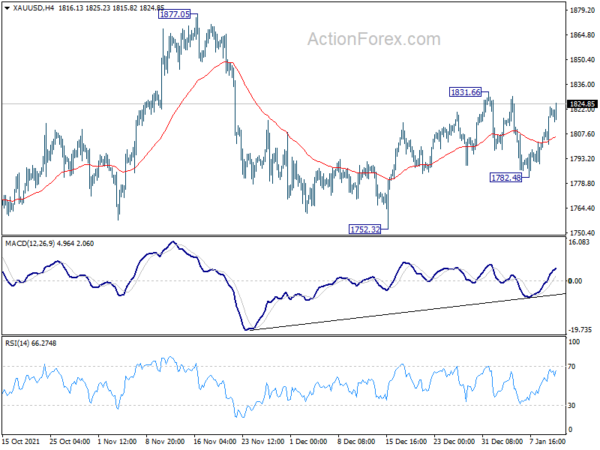

Technically, EUR/USD finally breaks out to the upside today, after staying in range for more than a month. We’ll now look at GBP/USD’s reaction to 1.3833 resistance and 0.7277 resistance in AUD/USD to further confirm Dollar’s weakness. Meanwhile, Gold could also follow by breaking 1831.66 resistance to resume the rebound from 1752.32.

In Europe, at the time of writing, FTSE is up 0.74%. DAX is up 0.37%. CAC is up 0.48%. Germany 10-year yield is down -0.044 at -0.067. Earlier in Asia, Nikkei rose 1.92%. Hong Kong HSI rose 2.79%. China Shanghai SSE rose 0.84%. Singapore Strait Times rose 0.27%. Japan 10-year JGB yield dropped -0.0255 to 0.129.

US CPI rose to 7.0% yoy in Dec, core CPI rose to 5.5% yoy

US all-item CPI accelerated from 6.8% yoy to 7.0% yoy in December, matched expectations. The annual rate was the largest increase since June 1982. Core CPI accelerated from 4.9% yoy to 5.5% yoy, above expectation of 5.4% yoy. That’s the highest level since February 1991. The energy index rose 29.3% yoy while food index rose 6.3% yoy.

Eurozone industrial production rose 2.3% mom in Nov, EU up 2.5% mom

Eurozone industrial production rose 2.3% mom in November, well above expectation of 0.6% mom. Production of non-durable consumer goods rose by 3.2%, capital goods by 1.5%, energy by 1.2% and intermediate goods by 0.9%, while production of durable consumer goods fell by -0.2%

EU industrial production rose 2.5% mom. Among Member States for which data are available, the largest monthly increases were registered in Ireland (+37.3%), Poland (+5.9%) and Czechia (+4.8%). The highest decreases were observed in Belgium (-4.4%), Malta (-3.7%) and Luxembourg (-2.3%).

BoJ Kuroda: Consumer inflation likely to gradually accelerate

In a speech to regional branch managers, BoJ Governor Haruhiko Kuroda said “Japan’s economy is picking up as a trend, although it remains in a severe state due to the impact of the coronavirus pandemic.” The economy is expected to recover ahead as coronavirus impact eases.

On prices, Kuroda said consumer inflation is “likely to gradually accelerate reflecting rising energy prices.” Also, “consumer inflation likely to gradually accelerate as a trend.”

BoJ upgrades economic assessments on all nine regions

In the latest regional Economic Report, BoJ upgraded assessment on all nine regions. All reported that their respective economies “had been picking up or had shown signs of a pick-up, with the impact of the novel coronavirus (COVID-19) waning somewhat, primarily in consumption of services.”

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1330; (P) 1.1352; (R1) 1.1392; More…

EUR/USD finally breaks out of established range today and hits as high as 1.1414 so far. Intraday bias is now on the upside, and rebound from 1.1185 would target 38.2% retracement of 1.2265 to 1.1185 at 1.1598. As we’re tentatively treating is as a corrective move, we’d look for strong resistance from 1.1598 to bring down trend resumption. On the downside, below 1.1284 support will bring retest of 1.1185 low. However, sustained break of 1.1598 will argue that the trend is reversing already.

In the bigger picture, there are various ways of interpreting the fall from 1.2348 (2021 high). It could be a correction to rise from 1.0635 (2020 low), the fourth leg of a sideway pattern from 1.0339 (2017 low), or resuming long term down trend. In any case, outlook will now stay bearish as long as 1.1703 support turned resistance holds. Sustained break of 61.8% retracement of 1.0635 to 1.2348 at 1.1289 would pave the way back to 1.0635.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Bank Lending Y/Y Dec | 0.60% | 0.60% | 0.60% | |

| 23:50 | JPY | Current Account (JPY) Nov | 1.37T | 1.05T | 1.03T | |

| 01:30 | CNY | CPI Y/Y Dec | 1.50% | 1.80% | 2.30% | |

| 01:30 | CNY | PPI Y/Y Dec | 10.30% | 11.10% | 12.90% | |

| 05:00 | JPY | Eco Watchers Survey: Current Dec | 56.4 | 56.2 | 56.3 | |

| 10:00 | EUR | Eurozone Industrial Production M/M Nov | 2.30% | 0.60% | 1.10% | -1.30% |

| 13:30 | USD | CPI M/M Dec | 0.50% | 0.40% | 0.80% | |

| 13:30 | USD | CPI Y/Y Dec | 7.00% | 7.00% | 6.80% | |

| 13:30 | USD | CPI Core M/M Dec | 0.60% | 0.50% | 0.50% | |

| 13:30 | USD | CPI Core Y/Y Dec | 5.50% | 5.40% | 4.90% | |

| 15:30 | USD | Crude Oil Inventories | -2.1M | -2.1M | ||

| 19:00 | USD | Fed’s Beige Book |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals