Markets sentiment took another dive on reports of Russia’s attack on a nuclear complex in Ukraine. Euro is extending recent decline, together will steep selloff in Asian stocks. Meanwhile, Australian Dollar is solidifying upside momentum, taking New Zealand Dollar higher too. Dollar remains mixed and will look into non-farm payroll report from the US. But the data would likely be overwhelmed by any developments in Russia’s invasion of Ukraine.

Technically, EUR/CAD took out initial target of 61.8% projection of 1.5096 to 1.4162 from 1.4633 at 1.4056, without much hesitation. Deeper fall should be seen to 100% projection at 1.3699. EUR/AUD broke 100% projection of 1.6343 to 1.5354 from 1.6223 at 1.5143, and it’s on track to 161.8% projection at 1.4476. EUR/CHF is also on the way to 100% projection of 1.0936 to 1.0298 from 1.0610 at 0.9972. Things are not looking good for the common currency.

In Asia, Nikkei closed down -2.32%. Hong Kong HSI is down -2.38%. China Shanghai SSE is down -0.96%. Singapore Strait Times is down -0.14%. Japan 10-year JGB yield is down -0.0148 at 0.154. Overnight, DOW dropped -0.29%. S&P 500 dropped -0.53%. NASDAQ dropped -1.56%. 10-year yield dropped -0.021 to 1.844.

BoC Macklem not fulling out a 50bps hike if needed

BoC Governor Tiff Macklem said in a speech yesterday, “tighter monetary policy is necessary to lower the parts of inflation that are driven by domestic demand. And that is critical to bringing price increases back in line with our 2% inflation target.”

BoC will also be considering when to move to quantitative tightening, or QT. “The timing and pace of further increases in the policy rate, and the start of QT, will be guided by the Bank’s ongoing assessment of the economy and its commitment to achieving the 2% inflation target,” he added.

In the Q&A session, Macklem said, there is certainly considerable space to raise interest rates over the course of the year”. “If we have to move more quickly, we are prepared to do that,” he added. “I am not going to rule out a 50-basis-point move in the future.”

Fed Williams: Higher oil prices not a stagflation issue

New York Fed President John Williams said the higher oil prices stemming from Russia invasion of Ukraine may act like a “tax” on American consumers. But, “the economy is coming into this with a lot of forward momentum. It’s definitely not a stagflation issue.”

Williams expect inflation to come down later this year but stays “well above” 2% target. He emphasized Fed has the “ability to adjust interest rates higher if inflation ends up being much more persistent or staying much higher than we expect or want”.

New Zealand ANZ consumer confidence dropped to record low

New Zealand ANZ-Roy Morgan consumer confidence dropped -16 pts to 81.7 in February, hitting a record low since data began in 2004. Inflation expectations were little changed at 5.6% while house price inflation expectations eased from 5.3% to 4.8%.

ANZ said: “This month’s data looks grim, but there are undoubtedly some temporary impacts in there. Time will tell what the other side looks like, but we do know that Omicron is fast and furious, and will blow through relatively quickly.

Australia retail sales rose 1.8% mom in Jan

Australia retail sales rose 1.8% mom to AUD 32.49B in January. Comparing to the same month a year ago, sales rose 6.4% yoy.

“The emergence of the Omicron variant and rising COVID-19 case numbers, combined with an absence of mandated lockdowns has resulted in a range of different consumer behaviours. We have seen the type of spending previously associated with lockdowns occurring simultaneously with those associated with the easing of lockdown conditions,” Director of Quarterly Economy Wide Statistics, Ben James said.

“This had led to variations across the industries with Food retailing recording a rise in sales consistent with previous COVID-19 outbreaks as consumers exercise caution amidst surging case numbers. However, the absence of lockdowns meant that other discretionary industries which would usually see a fall during the pandemic have recorded mixed results.”

Looking ahead

Germany trade balance, France industrial output, UK PMI construction, and Eurozone retail sales will be released in European session. Later in the day, US will release non-farm payrolls. Canada will release building permits and Ivey PMI.

EUR/CHF Daily Outlook

Daily Pivots: (S1) 1.0125; (P) 1.0183; (R1) 1.0211; More….

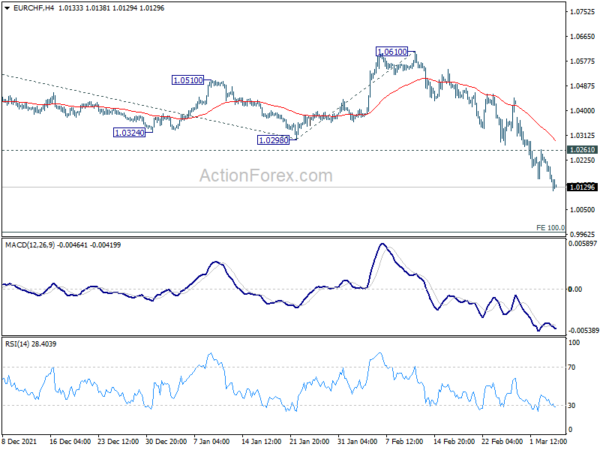

EUR/CHF drops further to as low as 1.0115 so far and intraday bias remains on the downside. Current fall is part of the down trend from 1.1149, and should target 100% projection of 1.0936 to 1.0298 from 1.0610 at 0.9972. On the upside, break of 1.0251 minor resistance will turn intraday bias neutral and bring consolidations first, before staging another decline.

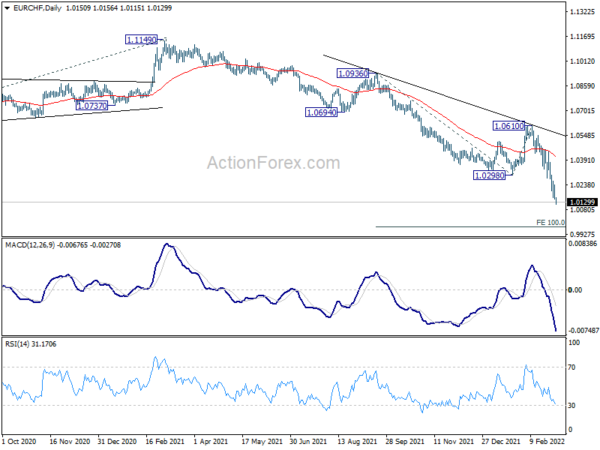

In the bigger picture, long term down trend from 1.2004 (2018 high) is still in progress. Next target is 100% projection of 1.2004 to 1.0505 to 1.1149 at 0.9650. In any case, break of 1.0610 resistance is needed to be the first sign of medium term bottoming. Otherwise, outlook will remain bearish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Unemployment Rate Jan | 2.80% | 2.70% | 2.70% | |

| 07:00 | EUR | Germany Trade Balance (EUR) Jan | 7.5B | 6.8B | ||

| 07:45 | EUR | France Industrial Output M/M Jan | 0.40% | -0.20% | ||

| 09:30 | GBP | Construction PMI Feb | 57.4 | 56.3 | ||

| 10:00 | EUR | Eurozone Retail Sales M/M Jan | 1.50% | -3.00% | ||

| 13:30 | CAD | Labor Productivity Q/Q Q4 | -0.20% | -1.50% | ||

| 13:30 | USD | Nonfarm Payrolls Feb | 438K | 467K | ||

| 13:30 | USD | Unemployment Rate Feb | 3.90% | 4.00% | ||

| 13:30 | USD | Average Hourly Earnings M/M Feb | 0.60% | 0.70% | ||

| 13:30 | CAD | Building Permits M/M Jan | 0.10% | -1.90% | ||

| 15:00 | CAD | Ivey PMI Feb | 54.2 | 57.4 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals