US CPI inflation readings for February will be out on Thursday at 12:30 GMT, likely generating more anxiety for Fed policymakers amid the Ukrainian geopolitical nightmare as price pressures are expected to have intensified further. The US dollar is trading in secure territory and another upbeat inflation report could strengthen calls for a faster monetary tightening once again, making the reserve currency shine brighter.

Powell previews March rate decision

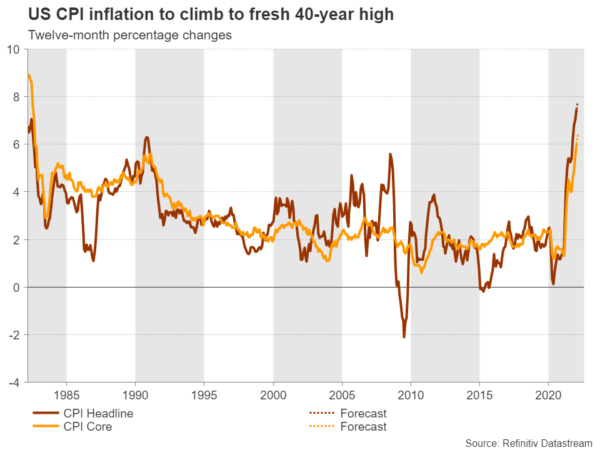

US consumer prices experienced their highest annual growth in 40 years in January, led by energy, electricity, and transportation costs. Other essential sectors such as food also posted considerable price increases, while the core CPI measure, which excludes volatile food and energy prices, surged to 6.0% y/y, flagging that what looked to be a pandemic-led price distortion is now developing to a broader inflation problem, which requires an immediate monetary action.

Indeed, speaking before a House panel, Fed chief Jerome Powell admitted he would propose a quarter-percentage point rate increase when the central bank’s voting committee meets next week, clearly revealing to investors how the policy gathering will play out. While that had initially curbed speculation for a more aggressive start to the tightening cycle, Powell kept that prospect open for the foreseeable future, indicating that the central bank would not hesitate to intervene drastically with non-traditional rate hikes even if such an action would sacrifice some economic growth.

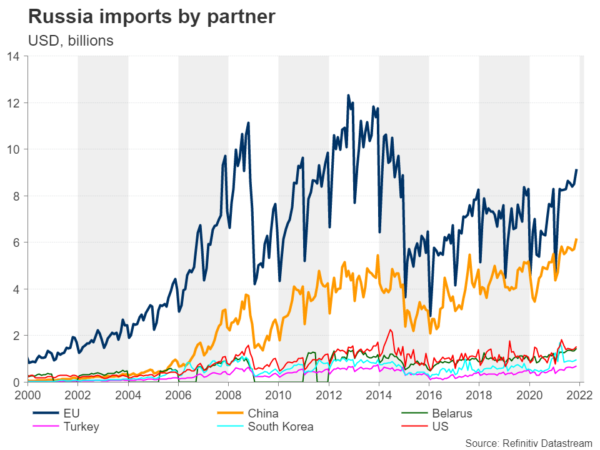

How exposed is the US to Russia?

It would not be a big surprise if Fed policymakers enter long debates over any tightening actions which could derail the economic expansion at a time when the tit-for-tat sanction war between Ukraine’s Western allies and Russia is moving from bad to worst, testing the interconnectedness of the global economy. That said, the US is less exposed to the Ukrainian crisis than its European rivals, given its small reliance on Russian exports and imports including the energy sector as well. Hence, the Fed could remain concentrated on cooling down inflation for now, and as long as the US economy keeps printing healthy data and the Ukrainian geopolitical crisis does not generate severe global economic shock waves.

US inflation to print fresh 40-year high

Hence, after February’s upbeat employment report, which revealed a stronger-than-expected hiring spree and an unemployment rate closer to pre-pandemic levels, the new CPI inflation report could raise again the stakes for a more aggressive Fed response. The headline measure is expected to edge up to a new 40-year high of 7.8% y/y and the gauge which excludes volatile food and energy prices is forecast to jump to 6.4% y/y, further deviating above the Fed’s 2.0% symmetrical price target.

How could the dollar react to another inflation spike?

As regards the dollar’s reaction, an upside surprise in the CPI data could bolster buying appetite for the world’s reserve currency, which is also extracting benefits from its safe-haven feature. Yet gains could appear moderate as investors are already aware that the sanction fight could make inflation stickier than analysts thought at the start of the year, and the Fed’s next policy decision is also well telegraphed. Moreover, futures markets are currently reflecting certainty for three additional 25 bps rate hikes by July, which makes February’s inflation data look less important but still a key indicator to influence rate expectations.

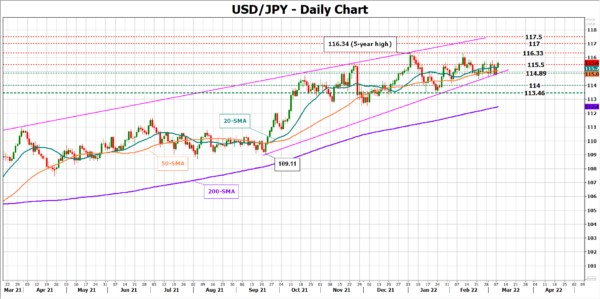

Looking at dollar/yen, the 115.50 level keeps balancing bullish moves for the second consecutive week. Should the CPI report push the pair above that boundary, traders may not rush to raise exposure to the market, unless the price climbs sustainably above the nearby ceiling of 116.33 and towards the 117.00 – 117.50 region.

In the case the CPI readings miss expectations, all attention will turn to the ascending trendline at 114.89, which has been supporting the market since September. Failure to bounce here could press the price towards the 114.00 level and January’s low of 113.46.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals